Cap Rate for Investment Properties

Cap rates are an excellent tool for assessing a property’s overall profitability. Although it may be difficult to pinpoint a perfect cap rate, there are ways investors can determine if the cap rate of a property meets their individual investment goals. Read on to see how investors can make the most out of their investments using cap rate calculations.

What Is a Cap Rate?

Cap rates can provide helpful information about any property by estimating the expected rate of return on commercial or residential real estate. They are estimates of the rates of return on numerous commercial or residential real estate properties. These rates are computed by dividing the property’s net operating income (NOI) by the asset value of the property.

Cap Rate = NOI / Current Market Value

A property’s cap rate is defined by its potential revenue and risk level compared to other properties. It is important to note that the cap rate will not provide a complete return on investment. It will instead offer an approximation of how long it will take to recover the initial investment in the property.

The most widely used benchmark for comparing investment properties is the cap rate.

Good vs. Bad Cap Rates

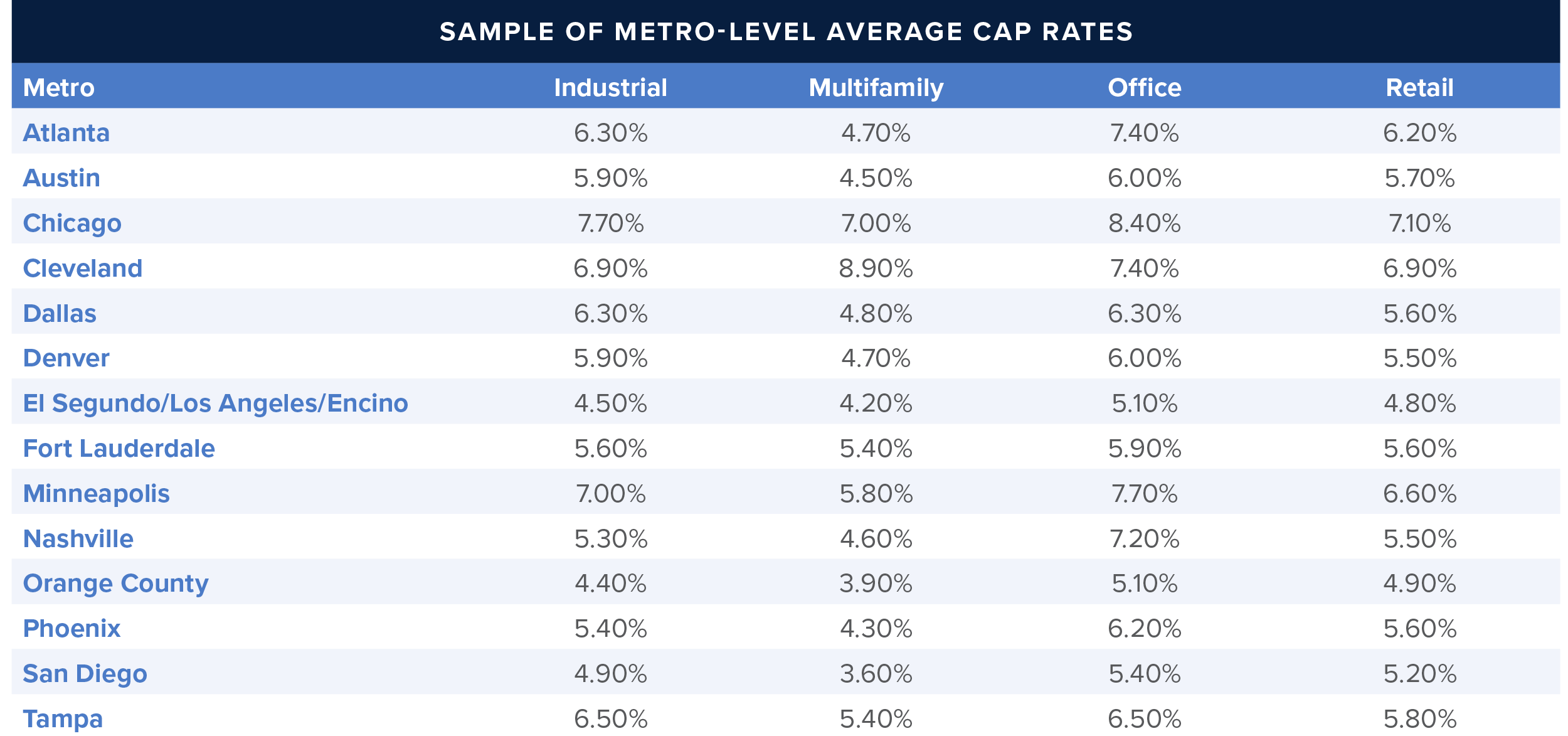

A “good” cap rate varies depending on the investor and the property. Generally, the higher the cap rate, the higher the risk and return. Market analysts say an ideal cap rate is between five and 10 percent; the exact number will depend on the property type and location. In comparison, a cap rate lower than five percent denotes lesser risk but a more extended period to recover an investment.

Investors should spend some time thinking about a reasonable cap rate for the properties in their portfolio. Utilizing the cap rate formula can help investors immediately eliminate properties that don’t fit their risk threshold by having a desired rate in mind.

What Affects a Property’s Cap Rate?

According to J.P. Morgan Investment Banking, Cap rates usually reflect more prominent economic factors. These factors include:

- Interest rates – High inflation and the ensuing increases in interest rates can impact commercial real estate cap rates; when interest rates rise, cap rates quickly follow suit.

- Rent growth – When there is a prevalent expectation of higher rents and NOI, this can lead to a noticeable increase in interest rates. A declining economy can also put pressure on cap rates to rise and halt rent growth.

- GDP and unemployment – GDP and unemployment both indicate the state of the economy. Commercial real estate investments tend to have lower cap rates when GDP is high and unemployment is low. Investment properties carry a higher risk when GDP is low and unemployment is high.

- Location – Cap rates are influenced by the location’s vicinity to highways, public transportation, popular city locations, etc. Properties in a stable location in an area with high demand typically have lower cap rates.

How to Utilize Tools To Value Property

The cap rate of a property is not the only metric used to assess a real estate investment. Investors should examine the return on investment (ROI), internal rate of return (IRR), and gross rent multiplier (GRM), as well as several other considerations, such as the property’s unique attributes and location.

What Is Cap Rate Compression?

Cap rate compression refers to growing market prices for investments concerning the income generated by the investment. In summary, cap rates are inversely connected to market pricing; hence, when cap rates are compressed, prices rise without a corresponding increase in rental income. According to supply and demand rules, cap rate compression may come from excessive investor demand or a general lack of quality inventory, resulting in higher pricing for the same assets.

Cap rate compression is largely indicative of market recovery. Location, sector shift, and economic environment are three factors that have historically driven cap rate compression.

Takeaway

Cap rates are forward-looking, and each transaction is influenced by a building’s potential, the investor’s perspective regarding the property, and the current economic conditions and expectations.