The American Families Plan is the second part of President Joe Biden’s 10-year initiative, the counterpart to a $2.3 trillion infrastructure and jobs package, dubbed the American Jobs Plan. It is a $1.8 trillion economic proposal to support childcare, education, family leave, among other initiatives. It will be paid for by tax hikes on capital gains and individual income. The plan is currently speculative and will be a challenge to pass in Congress, but the proposed tax increases are cause for concern in the commercial real estate industry.

Key Points for CRE Investors

The plan adjusts or eliminates some of CRE’s key policies – tax breaks on capital gains, and property passed down to heirs, as well as 1031 Exchanges.

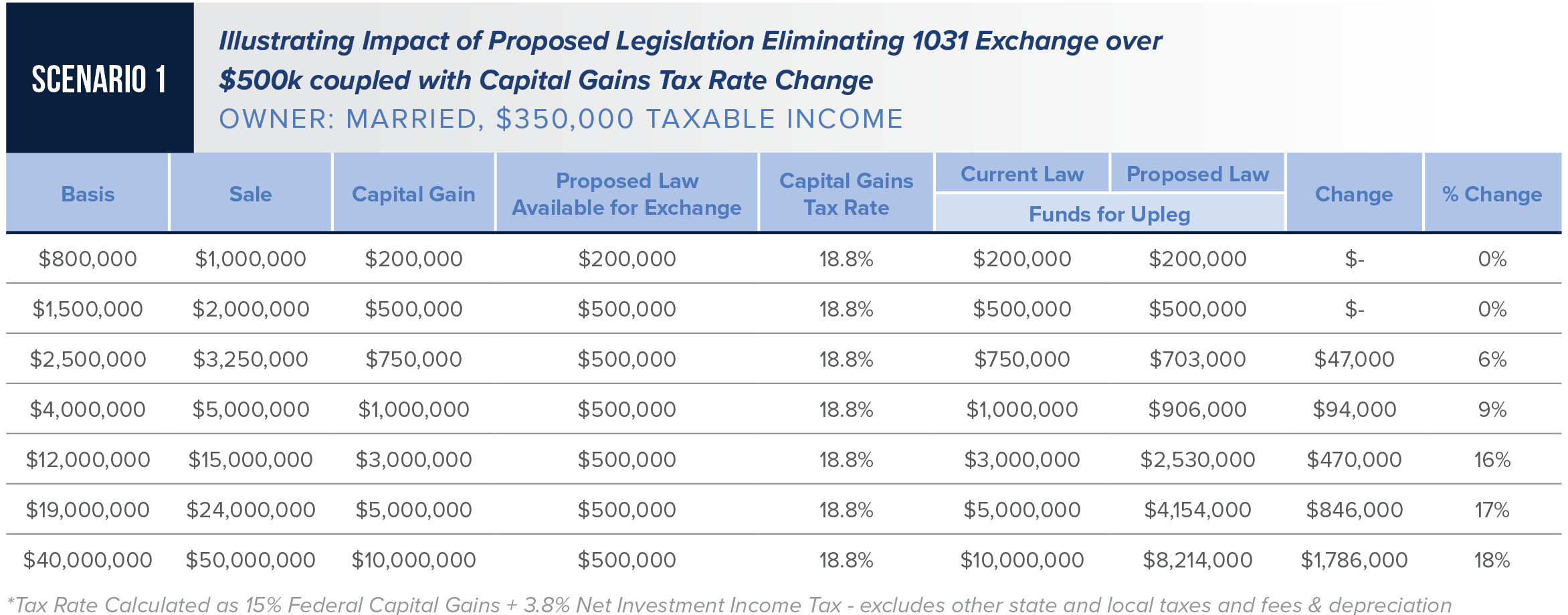

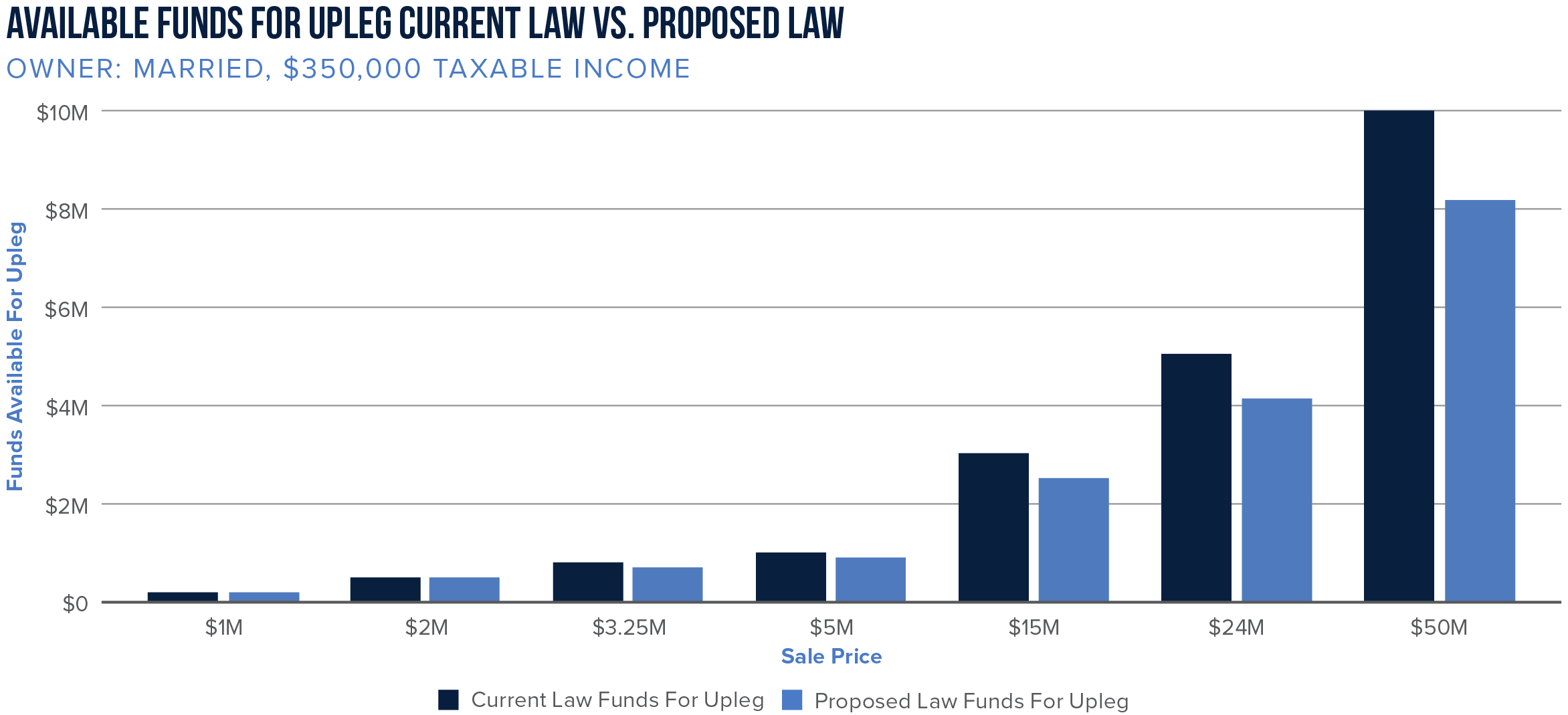

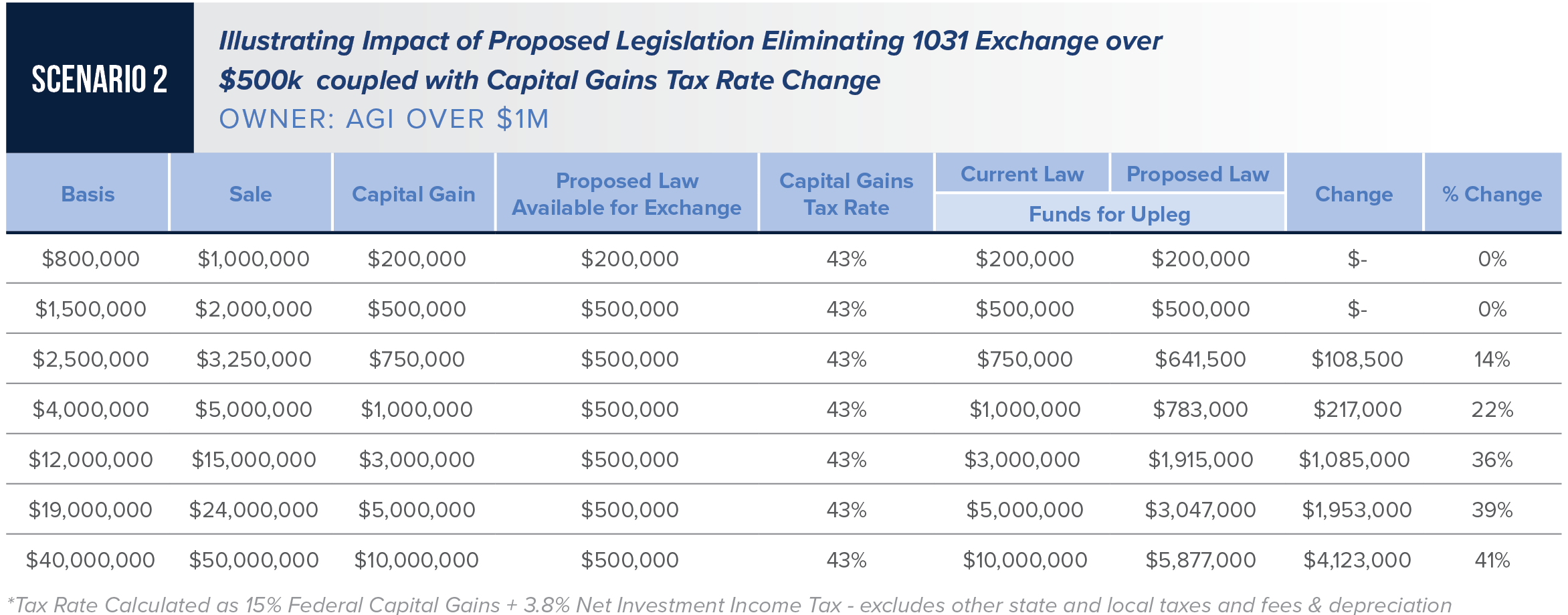

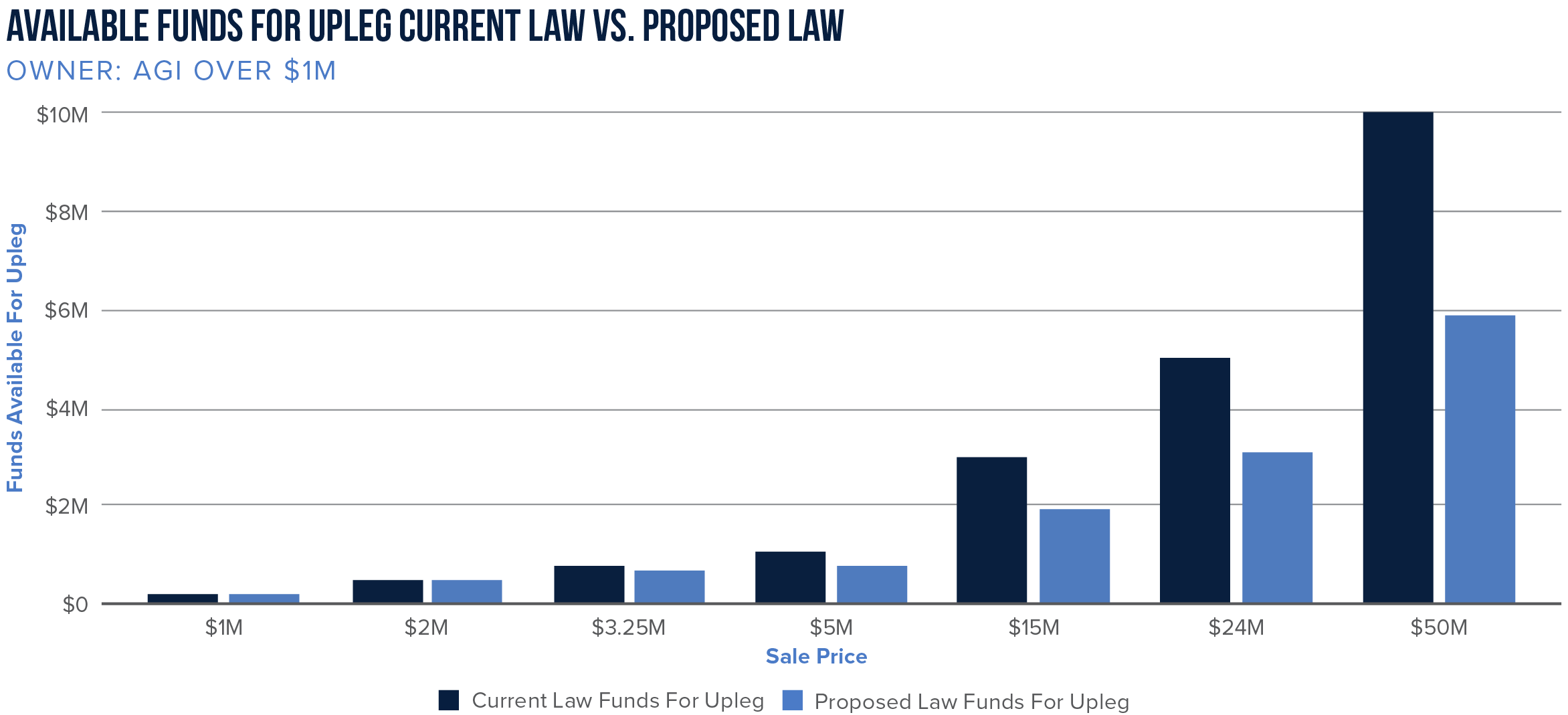

- 1031 Exchange Tax: President Joe Biden plans to “end the special real estate tax break” when completing a 1031 Exchange for gains larger than $500,000. Under Section 1031, investors defer capital gains taxation when a property is sold in exchange for a like-kind asset in a short period of time. This could result in significantly different strategies, create less turnover, and decrease supply and demand.

- Capital Gains: The plan would nearly double the capital gains to 39.6% on assets held longer than a year or investors making over $1 million a year. Currently, the capital gains tax sits at 20% for individuals making more than $445,850.

- Stepped-Up Basis: The plan calls for the elimination of a stepped-up basis for gains of $1 million or more ($2.5 million or more for a married couple) when “combined with real estate exemptions.” Property donated to charity wouldn’t be taxed. Family-owned businesses and farms wouldn’t be subject to capital gains tax either if the heirs continued to run the business.

- Income Tax: The American Families Plan would raise the personal income tax to 39.6% on individuals making more than $400,000, an increase of about 3% from the 2017 tax plan.

- Corporate Tax: Under the Infrastructure and Jobs Plan, the corporate tax rate would jump from 21% to 28%.