Offices Undergoing an Upgrade

Medical office buildings (MOBs) have exhibited significant demand from investors over the past decade, buoyed by consistent occupancy and rent growth. With technology allowing advanced procedures to be performed outside of centralized facilities and the increased demand for outpatient services, many health systems are opening medical facilities outside of centralized campuses. In search of more space, affordability, and new patients, health entities have turned to unused traditional offices for MOBs. Existing office buildings save healthcare providers from building ground-up and are conveniently located in neighborhoods to serve families closer to home.

The State of the Medical Industry

Healthcare is a resilient industry, even during economic uncertainty, because the demand for health and wellness services is always present, as treatment is often necessary. However, the latest technologies have improved convenience and affordability, revolutionizing the industry.

With an aging population and expanding healthcare access, the demand for health services is expected to multiply in the U.S. in the next two to three decades.

Coinciding with this, the population of insured patients is expected to decrease from 1.2 percent within the next seven years to 89.4 percent in 2028. These statistics point to higher out-of-pocket expenses, as uninsured patients spend a higher portion of their income on healthcare than insured patients. The rapidly increasing senior citizen population has also fueled growth in the healthcare market. For a single physician visit, each millennial requires, a baby boomer requires almost six times the number of visits. Moreover, according to Pew Research, the 75 million baby boomer population records nearly 10,000 retirings every day. In a brief released by the United Health Foundation and Alliance for Aging Research, healthcare costs for retired couples are projected to range between $260,000 to $600,000, depending on the retirement age. These projections, paired with favorable demographic trends, indicate that healthcare will be very busy in the upcoming years – and investors have taken notice.

Patient Preference for Outpatient Facilities

The need for convenience has transitioned into the medical setting as patients seek a local one-stop destination for examinations, labs, and procedures. This has sparked a shift in medical office space away from their hospital campus to outpatient facilities.

Outpatient medical offices have continuously recorded strong performance metrics, drawing in the interest of institutional investors seeking long-term stability and passive income. Investors once viewed inpatient facilities (medical offices on or nearby hospital campuses) as lower-risk investments due to generating high-priced leases, retaining long-term tenants, and maintaining healthy rent increases. However, data from Revista, a medical real estate data platform, indicates that may not be the case.

When looking at outpatient medical offices under 35,000 square feet, these assets saw a 1.9 percent appreciation in rent year-over-year, compared to 1.7 percent of inpatient buildings. Although it may seem like a small percentage, there is a 65-basis point difference when looking at occupancy, and both trended over the top 50 market’s average of 91.4 percent in Q4 2020.

Traditional Office vs. Medical Office Building

While traditional offices emptied during the pandemic, office investors paused activity as several companies migrated to remote working. Alternatively, medical offices saw continued interest even as patients opted for video appointments over in-person visits. Healthcare providers are increasingly seeking to expand their reach to new customers and retain current ones, and the costs associated with developing an outpatient asset can be intimidating. One popular solution is retrofitting existing office buildings for medical purposes.

With medical providers increasingly targeting traditional offices for conversions, it’s important to weigh the strengths and weaknesses of the two different asset classes.

Traditional office space buildings can encompass various revolving businesses, while medical offices house long-term primary care physicians, plastic surgeons, dialysis centers, and more. The strong credit tenants in MOBs attract other medical-related credit-grade tenants who prefer to be near complimentary services. According to Revista, medical office landlords collected 95 percent of rents owed in 2020, compared to traditional office landlords who received less than 85 percent. MOBs have particular physical features, such as operating rooms and waiting rooms. Therefore, tenants will sign longer leases to avoid pricier build-outs and relocating costs.

According to Health Carousel, healthcare is one of the few sectors to see continued rapid growth. For this reason, investors view MOBs as a durable investment with quality tenants.

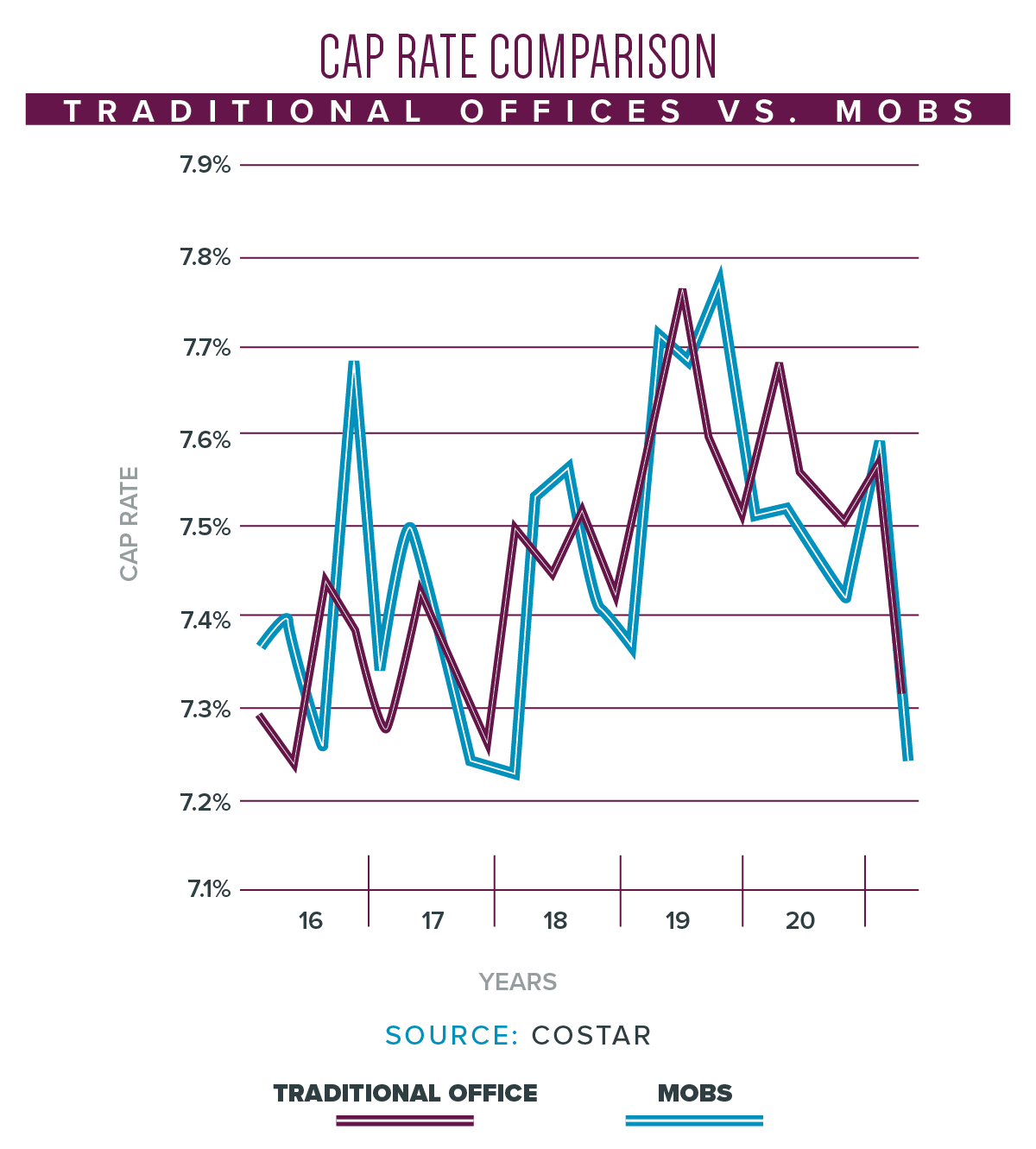

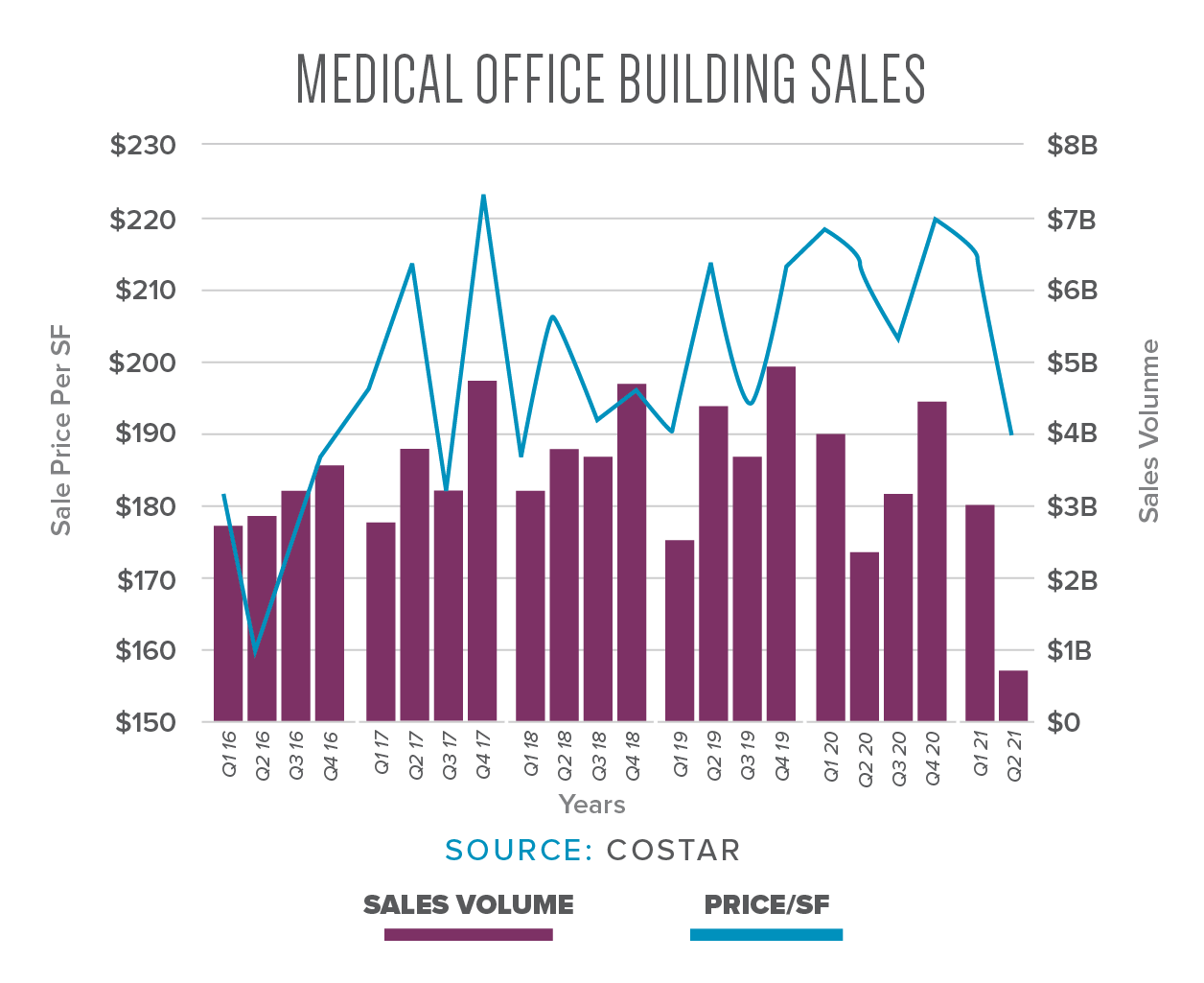

According to Revista, commercial real estate sales volume fell 32 percent in 2020, but investors still spent $11.2 billion on medical office buildings, compared to $12 billion in 2019. Office transactions fell roughly 44 percent in 2020, with more than $90.2 billion in trades, compared to $141.4 billion in 2019, according to CoStar data. The ongoing activity in medical offices has driven prices, with Revista reporting yields on acquisitions posting a median of 5.7 percent, compared to 6.2 percent in 2019.

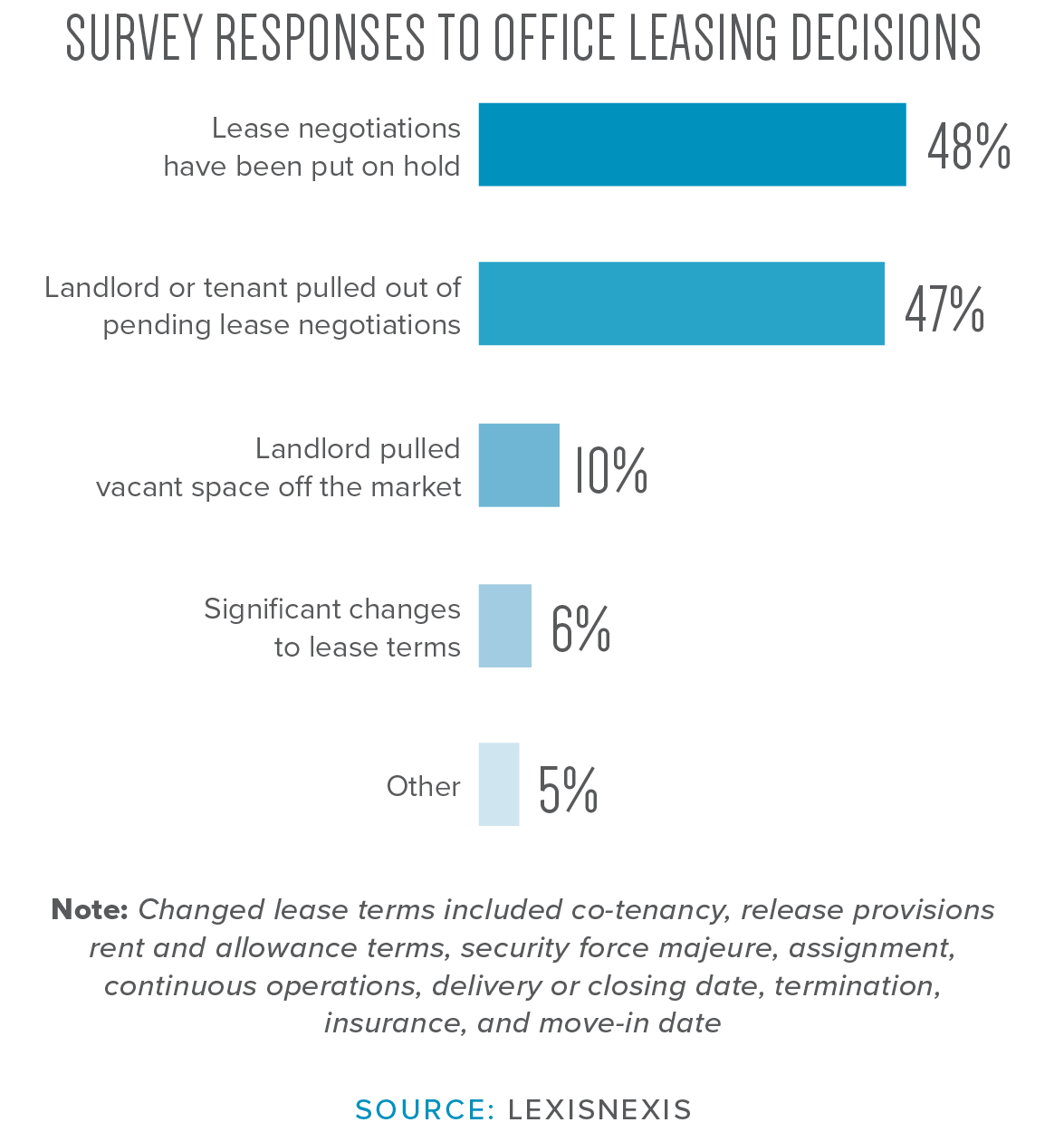

Most office tenants opted to modify or cancel their lease agreement during the wake of COVID-19, including Google, Facebook, and more. As a result, offices saw a wave of sublet space flood the market. This led investors to a bearish outlook on the industry, resulting in rent cuts as steep as 20 percent, according to CoStar. In Q1 2021, office vacancies reached 15 percent, and Moody’s Analytics expects that figure to increase to 19.4 percent in 2021. Given this background, office landlords have been inspired to reconsider their space needs beyond the traditional business tenants and shift towards medical providers.

The Medical Office Inventory

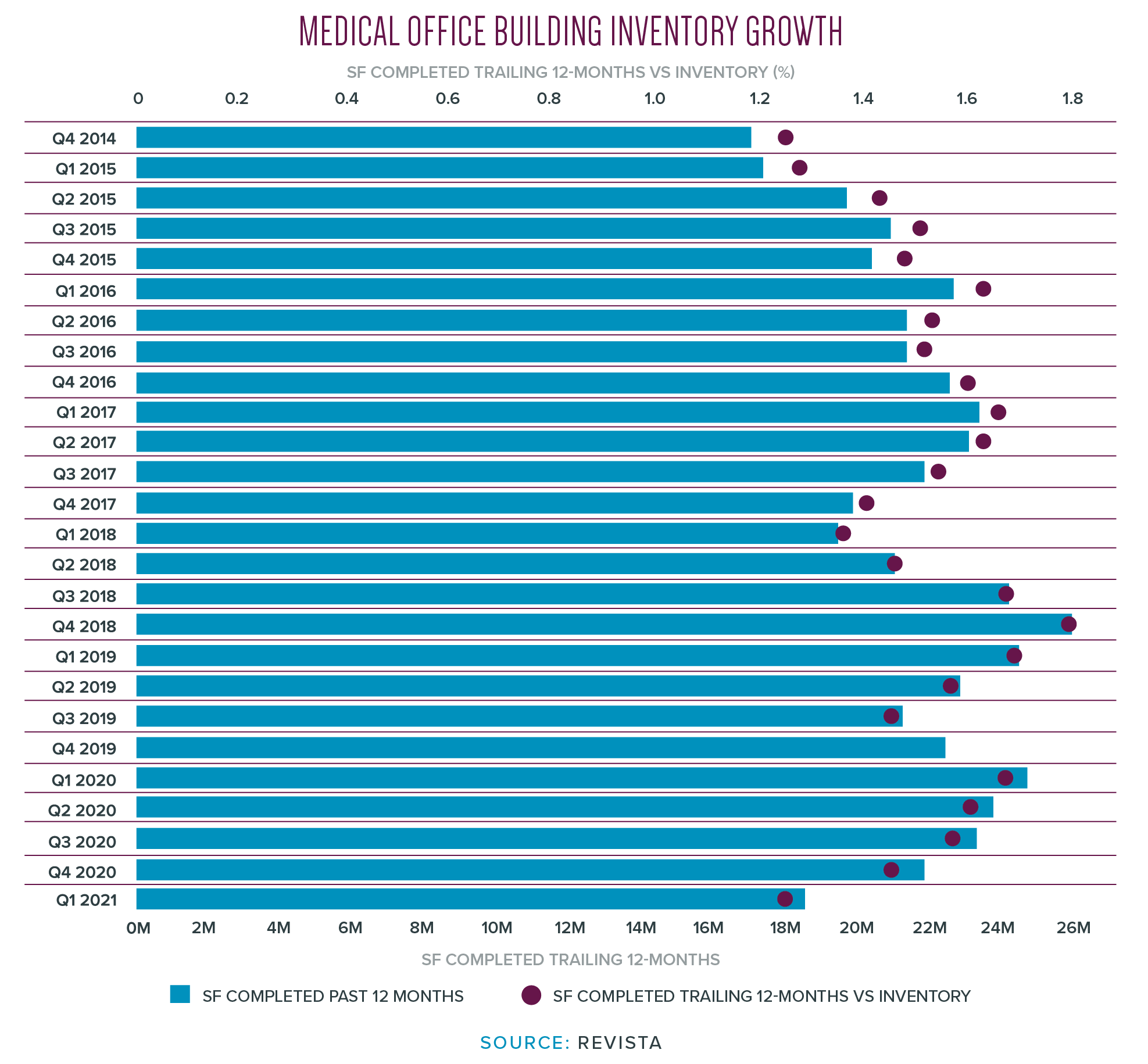

Even with the use of inpatient facilities declining, the healthcare industry is booming with a plethora of new and different types of facilities. This necessitates more MOB space to house the growing variety of services. Subsequently, investors are buying up any and all available medical offices, and on-market supply is dwindling. Moreover, healthcare development reached a multi-year low in Q1 2021, completing 18.6 million square feet compared to 24.8 million square feet in Q1 2020.

Office Conversion Considerations

As the pandemic accelerated telework trends and offices were left vacant, an opportunity was presented for healthcare providers looking for cheaper real estate. Despite the challenges that traditionally come with a repurposing project, selecting the right property can significantly improve the process by decreasing the development timeframe, bringing services to the community quicker, and saving on construction costs. Adaptive reuse projects are a cost-effective strategy for healthcare providers to enter the market before the competition. There are several economic benefits when utilizing an unused building to support communities.

Before deciding if an office conversion is suitable, consider the following pros & cons:

PROS:

- DEVELOPMENT COSTS – Starting with the most apparent advantage, renovating a once-occupied office building to a medical office can save on ground-up development costs. With a waiting lobby and offices already in place, healthcare tenants can delegate their savings onto patient care or other technologies.

- ACCESSIBILITY – Whether the office building is in an urban or suburban location, they often already have access to main roads or transportation networks. This allows healthcare providers to access patients more efficiently.

- LOCATION – If the building is located in a shopping center, medical offices have the advantage of referral clientele from neighboring tenants that are likely not viewed as competitors. This benefits the neighbors as the providers will have strong patient retention.

- ESTABLISHED TENANT-BASE – Repurposing a building has the added benefit of being recognized as a community destination. This also provides the opportunity to serve communities close to home.

CONS:

- PLUMBING/ELECTRICAL – While the development costs aren’t cause for concern, other costs come into play. Medical offices usually require more robust plumbing and electrical systems compared to traditional office real estate.

- HEALTHCARE CODES – When repurposing an existing space, there are specific healthcare codes the property must meet to support clinical practices effectively. Consider the building’s height, structural capacity, and electrical systems before buying an unoccupied office building.

- ZONING LAWS – The location of traditional offices may conflict with the zoning laws required for medical office buildings. It’s essential to be knowledgeable of local zoning laws before starting renovations.

- PARKING – Another consideration is the amount of parking available. A traditional office only requires four parking spots per 1,000 square feet of real estate; some medical offices require five to six spaces per 1,000 square feet.

Telehealth Trends & the Influence on Real Estate Decisions

Technology has played a vital role in revolutionizing the healthcare industry. As in-person visits and elective procedures were put on hold, video conferencing and drive-up appointments were introduced. The widespread adoption of telehealth has allowed practitioners to expand their clientele to more rural communities often unreached. However, that’s not to say that telehealth will substitute for in-person appointments, as procedures and treatments beyond pharmaceuticals require a patient’s physical presence. By expanding healthcare to underserved rural communities, telehealth has driven the demand for increased healthcare services.

Moreover, the newly found point-of-entry to millions of Americans increases patient commitment and retention, thus in-person visits. Before the pandemic, only 11 percent of patients used telemedicine. Since the arrival of COVID-19, that figure has jumped to 46 percent.

Healthcare has never been more accessible in the United States, according to the New York Times. The demand for conveniently accessible medical office buildings throughout the United States will inherently increase. The ongoing debate surrounding telemedicine regards the effect it will have on healthcare real estate’s footprint. Some experts argue that telehealth will result in increased office acquisitions with less square footage. Conversely, others believe it could drive square footage because telehealth appointments lead to in-person visits. Yet, as more providers incorporate telehealth into their practices, exam rooms could be retrofitted for telehealth purposes, keeping square footage the same. With the telehealth sector projected to grow ten to 15 percent annually, we will evidently see the role telehealth plays in the industry.

The medical office market is going through significant strides as investors continue to target the niche sector, and technology is increasingly utilized from setting the appointment to performing the procedure. Capitalizing on the movement of services to outpatient settings, health systems will become more involved in overall community healthcare services. By repurposing an office building, healthcare providers use less capital, become operational quicker than with new construction, and can potentially reinvigorate a neighborhood by bringing care closer to home.