IS IT BETTER TO LEASE OR OWN MEDICAL OFFICE BUILDINGS?

Physicians are navigating uncharted territory post-COVID-19, and practices are dealing with different challenges. Medical offices are a hot commodity given current demographic trends and performance during the most recent economic downturn. Due to this, physicians now have to compete with commercial investors to own medical space, begging the question – Is it better to lease or own the real estate? This article will discuss the variables to take into consideration when deciding to rent or own the real estate for a medical practice.

SCREENING YOUR REAL ESTATE

Patients are migrating away from large hospital facilities for their health services, opting for outpatient facilities closer to patients in primary retail trade areas. These markets experience solid performance metrics, long-term stability, and healthy appreciation. When determining if leasing or owning real estate is suitable for the practice, it’s important to consider a couple of things:

- Desired Time at Location: If planning on practicing at a specific location for an extended period, purchasing the real estate can be worthwhile. It would secure the location long-term, provide for the opportunity to structure a sale leaseback, and the opportunity to be a landlord if/when the practice is sold in exchange for a lease later on. Conversely, leasing a space provides a physician with the flexibility to move where the market or customers move and typically only requires short-term commitments.

- Stability of Practice: Buying real estate means that the physician is committing to a long-term responsibility. There is an opportunity for long-term appreciation, but not without a successful practice. A lease would be worthwhile if the physician is not confident in the business’s performance at this location.

CONSIDERATIONS TO OWNING

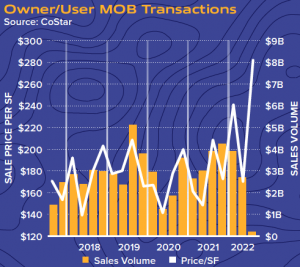

There are plenty of advantages to owning the practice’s real estate, including control over occupancy, short-term and long-term appreciation, and building equity. Additionally, physicians won’t have to worry about the inevitable rent increases attached to a lease. Before purchasing the property outright, a physician should consider the price of the real estate asset, which will vary by location and demographic trends. Going in hand with the purchase price, there are several responsibilities left to the owner, such as occupancy costs, maintenance/repairs, and renovations. All buildings age over time, so maintenance costs are necessary. For healthcare providers, relocation can be costly and complicated; therefore, the property may need renovations to optimize the business with additional amenities, equipment, or updated infrastructure.

Over 50% of respondents reported they had remodeled their office, added square footage, or changed locations in the last 2 years to stay relevant. Source: Medical Group Management Association Poll

The practice should assess its net worth to see if it can sustain a long-term commercial loan or purchase a property in cash. On the plus side, loan terms tend to favor physicians because of their long-term occupancy and credit history. If a physician owns a medical building and is nearing retirement, they can accomplish a steady income stream after stopping their practice if they lease the property to other physicians.

CONSIDERATIONS TO LEASING

Medical groups will find that leasing is a traditionally safer, more flexible, and cost-effective method in the short-term.

There are significantly fewer costs to lease a building as opposed to owning.

While owners are left to worry about the evolving market the building is situated in, healthcare providers could relocate to a more desirable area closer to the target patient’s neighborhood. If a catastrophic event were to occur, like COVID-19, the practice could exit the lease or wait out the remaining lease term. Purchasing real estate can take up to three months or longer to close, along with any necessary improvements needed to the property, whereas leasing provides instant access to the real estate.

Leasing allows primary care providers to invest in other opportunities with capital that would otherwise be tied up in the real estate they own.

Physicians should consider leasing their practice in medical parks, where several other complementing medical providers are in one location, optimizing patient convenience. Standalone practices can find it more difficult to attain new customers than medical parks, where they can see their dentist and physician in one visit and where customers are familiar with the location.

The most significant downfall to leasing would be the lack of equity.

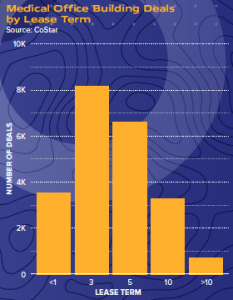

There is no direct ownership of the property through a lease. Another concern is the length of the lease, with the average medical office lease term between three to five years, according to CoStar. If a practice needs change during that time, they are stuck with the lease until expiration. At the end of the lease term, the medical group is exposed to any market fluctuations, like increased rents. Fluctuations, however, could be beneficial if the market declines during the lease term, a lower lease rate could be negotiated.

LEASING OUT REAL ESTATE

As a physician, owning a multi-tenant medical office building comes with its share of responsibilities. The physician would be responsible for the upkeep of their own suite, along with managing the entire building. Although the other suites would likely be on NNN leases, alleviating management concerns on a day-to-day basis, significant repairs can come up along with vacancies and leasing responsibilities. Vacancies, declining rates, and market downturns can lead to a loss in value, so being an involved owner would need to be a priority.

SALE LEASEBACK OPTION

Sale leasebacks are an excellent option for healthcare real estate owners looking to pay off debt or grow their business.

Through a sale leaseback, an owner-operator sells their real estate to a buyer and remains the occupant and operator of the business through a simultaneously executed lease.

Additionally, 100 percent of the property’s equity is unlocked, allowing the seller to reinvest the liquidated capital back into their business through financing renovations, operations, or expansions.

There are several benefits for the seller, including:

- Brand New Lease: As opposed to most properties on the market, a sale leaseback is a way of securing a new lease beginning the moment the transaction closes.

- Customizable Lease Terms: The process includes customization of the lease, ensuring the tenant the most affordable price and terms.

- Invest in an Expanding Enterprise: Structured as a financing tool, sale leasebacks can expand an enterprise, increase the practice’s ability to boost returns, and expand footprint. When an operator structures a sale leaseback to renovate current locations, the ultimate buyer is given confidence in the physician’s (who would now be the tenant) commitment to the location and overall practice.

Medical office development remains solid with over 20 million square feet having been started in the past year, held up by a strong finish in 2021. Source: Revista Med

While the question remains whether it is better to lease or own, it is entirely up to the medical practice. Owning can be highly beneficial for those seeking longer-term stays, and equity growth through ownership. Leasing a medical office provides more flexibility and avoids long-term deferred maintenance expenses, depending on the length and structure of the lease. While the global pandemic contributed to changing factors in real estate, the decision should be based on the overall goal of the healthcare provider and market indicators.