Where Casual Dining Currently Stands

The casual dining industry, otherwise known as full-service restaurants, has felt the same adverse effects of e-commerce as traditional brick-and-mortar retail, department stores, and suburban mall centers. According to Bloomberg, consumer tastes have strayed from the sit-down experience model, evidenced by the rise and relative out-performance of local restaurants, fast food chains, delivery-focused companies, and fast-casual concepts. Full-service restaurants are desperately rethinking their business models to pivot and adapt. In this article, Matthews™ reviews how COVID-19 and inflation have made lasting impacts on casual dining as well as the sector’s strengths and weaknesses.

The Casual Dining Landscape

Before COVID-19, investors were already looking at the casual dining sector more skeptically for not keeping up with consumers’ changing tastes. Many attributed this to millennials, who prefer to visit fast-casual restaurants (limited-service restaurants), such as Chipotle or Panera Bread. Fast-casual restaurants often use fresh and locally sourced ingredients to prepare the same or better-quality food than casual dining chains, only they provide the speed and price of a fast food chain. In many cases, limited service restaurants have successfully marketed “healthier” menu options. At full-service restaurants, slim or even negative margins on the sale of food items led operators to become fixated on selling high-margin items, such as alcohol. Meanwhile, technological advances in mobile ordering, delivery, or customer loyalty programs drew many to limited-service (fast-casual and fast food) restaurants. Delivery services, such as UberEats, Postmates, and DoorDash, make eating at home even more appealing, and these digital sales tend to favor limited-service restaurants. Furthermore, fast-casual meals hold much better in to-go containers for 20 minutes than more complex meals from casual dining chains, such as calamari or a Grand Slam breakfast

50% of customers say the availability of a customer loyalty reward program would make them choose one restaurant over another.

Takeout and delivery were the life rafts for all restaurants during the COVID-19-induced dine-in bans as consumers dined in their homes more frequently. In many ways, major casual dining brands had the edge over the smaller competitors thanks to broader resources and brand-name recognition that took customers back to a simpler time. This trend continued, but alone, these sales were not enough to keep a casual dining location afloat. Many restaurants saw dramatic same store sales decline during the height of COVID-19. According to Top Data, when the coronavirus pandemic began, casual dining restaurants saw 58% less traffic on average, compared to just a 30% decrease for fast food restaurants. As weeks went on, many restaurants that saw these declines began to see sequential improvements. However, same-store sales continued to decrease for casual dining brands, even as dining rooms were allowed to reopen. As a result, many casual dining brands reduced their footprint or consolidated locations outright, a trend that continues today well into 2023.

“Quick-service franchises such as McDonald’s, Taco Bell, and Dunkin’ rebounded quickly and are expected to bring in just as much revenue as last, if not more.” – Mark Wsilefsky, Head of TD Bank’s Restaurant Franchise Group

One would assume cost would be king during a pandemic; however, consumers’ definition of value during COVID-19 wasn’t all about the price. It was less about the deal and more about the food attributes. Growth in consumers taking advantage of BOGOs and digital discounts indicates that price was and is an important consideration. Now, casual dining brands are met with inflation, resulting in increased menu prices, lower cost ingredients, or reduced portion sizes. These changes will inadvertently influence customer’s decisions on where to dine out. Other drivers of consumer decisions include food quality, variety, and “treating myself.” (Source: NPD).

Rebranding the Sector

Casual dining restaurants are modifying their value offerings to attract consumers. Despite already having strong locations in many markets, the real variable of uncertainty was COVID-19’s impact on consumer behavior. Consumer expectations for casual dining have certainly changed; food should be high in novelty factor, healthy, and prepared fast. Ultimately, many established casual dining brands have invested in a fresh rebranding strategy. Casual dining investors have distinguished the safe harbor concepts, typically those located in profitable markets, in great locations, and tenants working towards revamping their brand.

Casual Dining Strengths

Brand

Restaurants with strong brands have navigated through shifting industry currents while attracting customers and retaining their loyalty. During the COVID-19 environment, casual dining restaurants pivoted to outdoor dining quickly and adjusted the brand experience in response to changing customer preferences and demands.

Location

Location influences consumers, from attracting the initial customer to being convenient to visit. Today, consumers are less likely to travel far from home for casual dining, so convenient locations are key. More often than not, a casual dining restaurant is located in a shopping center, and historically casual dining restaurants have synergistic relationships with shopping centers. These restaurants benefitted from increased foot traffic and shoppers prone to ordering higher margin items. Per a report released in July 2020 from William Blair analyst Sharon Zackafi, the restaurant concepts that have fared best during the pandemic are those with real estate footprints skewed to the suburbs.

Casual Dining Weaknesses

Price

Despite the prevalence of advertised deals, many consumers find casual dining entrée prices more expensive than other restaurant options. This, paired with the rapidly rising consumer price index on food away from home at 7.1.% as of H2 2023, some patrons have cut back on how often they dine out.

Quality

For the price, the food quality at casual dining restaurants doesn’t match consumer expectations. These brands successfully lure a type of customer who may have previously avoided fast dining options altogether as they were considered unhealthy and opted for casual dining restaurants instead. As consumer expectations for fast-casual have risen, the casual dining market is now affected by the same rising tide.

Convenience

Consumers typically gravitate to quick-service restaurants, fast-casual, and drive-thrus compared to casual dining due to speed, taste, efficiency, and value. The average waiting time between a drive-thru and casual dining takeout differ dramatically, though savvy brands have since optimized menus and services for takeout.

Social Distancing

Most casual dining brands have built-in seating or booths, which hindered the ability to allow for flexible seating layouts during the COVID-19 environment. Further, many casual dining sale-leasebacks were set with a pre-COVID-19 rent factor, accounting for 100% use of the gross leasable area. Even just a minor decrease in revenue or seating capacity will hamper probability margins.

Current Market Conditions

COVID-19 undoubtedly accelerated the problems that the weaker brands had to a large extent. The COVID-19 shutdown drove the softening in casual dining, and now the sector is met with another threat: inflation. Over the last 12 months, the index for food away from home rose 7.1%, according to the Bureau of Labor Statistics. The index for limited service meals rose by 7.8% during the same time.

Already, major brands are feeling the effects of inflation, reporting reduced customer count or increased ordering of cheaper menu items. Customers are squeezed by increased prices, leaving casual dining operators to resort to three options: reduce portion sizes, use more affordable ingredients, or increase meal prices.

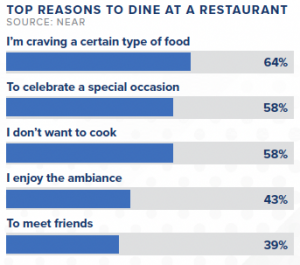

On a positive note, compared to pre-COVID-19 trends, dining out trends are positive. According to Near, a data intelligence company, diners are getting food from restaurants 9.1 times per month. Before COVID-19, diners reportedly would get takeout 2.5 times per month compared to three times currently, and delivery 1.6 times monthly compared to 1.8 times present day. The study revealed that 72% of customers enjoy the traditional waiter experience.

Lender & Financing

The lending markets for the restaurant and casual dining sectors have dramatically shifted. Already undercapitalized and with thin margins, restaurants cannot function profitably when foot traffic is down 50%, or even 35%, said Benjamin Sebraw, managing director for SMS Financial LLC. According to OpenTable, restaurant bookings in some states were down as much as 94% year-over-year at the end of Q2 and beginning of Q3 2020. Locations without $4 to $5 million in sales do not have the margins to entice lenders or restaurant operators in the current market.

Despite the recovered performance, a cycle of deteriorating liquidity and solvency, and the inability to secure additional financing, will lead the sector to face challenges in the coming years. The largest U.S. lenders have significantly reduced their exposure to restaurant lending deals. Restaurant loans are now seen as riskier than they were pre-pandemic, being a hard-hit industry by the coronavirus due to restrictions. The top 15 restaurant lenders are led by Fifth Third Bancorp, with $1.8 billion in loans, up from $1.6 billion in 2020. The runner-up lender is Pinnacle Financial Partners Inc., with $595 million in restaurant loans, a 12.3% increase compared to Q4 2020.

The Fed raised interest rates this year in July 2023 by a quarter point to 5.25%-5.5%, the highest level in 22 years. While it’s impossible to predict the impact rising rates will have on the restaurant industry, the investment activity in casual dining has been robust. After restaurant sales rebounded quickly from the March 2020 shutdown, consumers have illustrated their willingness to pay higher prices to get food away from home.

Casual Dining Outlook

As restaurants continue to embrace new technology and prioritize the customer experience, the casual dining segment will see sizeable demand in the market. Overall, the restaurant industry has seen a recovery as it emerges with creative innovations from the pandemic pivots. Thus far, the biggest trend is consolidation efforts as operators realize that smaller footprints help reduce costs, including rent and payroll. Moreover, virtual kitchens are a growing concept in the industry as well, further reducing costs and allowing brands to reach a new demographic in new ways.

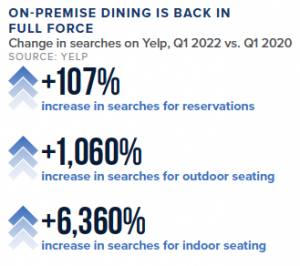

Restyling efforts have also played tribute to the comeback, and investors have seen their potential, as demonstrated by the accelerated investment activity in 2021. Overall restaurant spending was up 13% in March 2023 compared to a year earlier, showcasing that demand is much higher than pre-pandemic levels. Yelp data showed a 107% increase in searches for reservations in 2022 compared to two years prior, demonstrating the intense customer demand to dine out again.

Casual dining brands with ongoing business models that have taken advantage of increased curbside services offered during the COVID-19 period will continue to find success. Speed of service, convenience, and value are extremely important for consumers; therefore, it is encouraged that casual dining investors lookout for brands moving in this direction. Corporately guaranteed leases or large franchisees with strong financials will remain in the highest demand among private investors.

A Look at 10 Casual Dining Brands

The Cheesecake Factory

Cheesecake Factory’s total revenue for Q1 2023 was $866.17 million, an increase compared to $793.7 million in Q1 2022. Restaurant sales increased 5.7% year-over-year. Cheesecake Factory executives were pleased with the earnings report as they face near-term inflationary headwinds. With measurably higher costs for ingredients, the company remains committed to returning margins to pre-pandemic levels. The Cheesecake Factory Inc. is seeing promising activity and plans to open 20 to 22 new restaurants in 2023, including six Cheesecake Factory restaurants, four or five North Italia restaurants, and ten Fox Restaurant Concepts (FRC).

Olive Garden

Olive Garden is recovering from the COVID-19 pandemic, reporting a 12.3% year-over-year increase in same-store sales in Q1 2023. The chain restaurant ranked 20 in Technomic’s Top 500 Chain Restaurant Report for 2021. According to its parent company, Darden Restaurants, 2023 earnings report, the Italian restaurant achieved $3.6 billion in the last 12 months. Olive Garden accounts for nearly half of Darden’s revenue. Darden is projected to reach $10.5 billion in revenue by the end of 2023.

BJ’s Restaurant & Brewhouse

At BJ’s Restaurants, total revenues increased 18.2% year-over-year to $344.2 million, according to the company’s earnings report released in February 2023. In a statement, Greg Levin, Chief Executive Officer and President said, “Our second quarter sales performance highlights the powerful guest affinity to the BJ’s brand and the success of our initiatives to rebuild restaurant staffing, as we hired more than 6,000 new team members and increased our team member count by 8.0% from the end of the first quarter, which enabled us to serve more guests.”

Bloomin’ Brands

(Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, Fleming’s Prime Steakhouse & Wine Bar, Aussie Grill)

Combined same-stores sales for Bloomin’ Brands’ four restaurant chains were up 5.1% in the first quarter. The company cited inflation, higher operating expenses, increased labor costs, and more expensive advertising as the reasons for decreased restaurant-level operating margins. Bloomin’ Brands reported $1.24 billion of revenue in Q1 2023, a growth of 9.1% compared to Q1 2022.

IHOP & Applebee’s

In the first quarter of 2023, Business Wire saw same-store sales increase 6.1% at Applebee’s and 8.7% at IHOP. The strong financial results have shown continued improvement in the brand’s business as they pivot to an asset-light model. The company is focusing on aggressive approaches to innovation and investments in technology, new restaurant formats, and developing incremental growth channels, according to the CEO of Dine Brands Global.

Denny’s

Denny’s reported a 10.04% year-over-year increase in revenues during June 2023 to $472.69 million. The chain opened ten franchised restaurants, including four international kitchens. The company has also signed an agreement to acquire Florida-based Keke’s Breakfast Café, adding 52 restaurants to its portfolio.

Red Robin

Reb Robin Gourmet Burgers reported a total revenue of $298.6 million in Q2 2023, an increase of $4.6 million from Q2 2022. The casual dining chain continues to focus on off-premise enhancements and offerings after recognizing the value in the channel. To stay ahead of the competition, Red Robin added Donatos pizzas to half their restaurants and generated over $7 million in pizza sales. Additionally, the burger chain has redesigned its website and launched its first app to create a seamless digital ecosystem for its customers. Red Robin’s growing loyalty program, Red Robin Royalty, allows the brand to effectively communicate with more than 11 million of its members, helping yield customer engagement and personalized offers.

Brinker International

(Chili’s Grill & Bar, Maggiano’s Little Italy)

In the quarter that ended June 28th 2023, Brinker International reported sales of $1.07 billion, compared to $1.02 billion at the same time last year. Chili’s saw a 6.3% increase in comparable restaurant sales, while Maggiano’s saw an increase of 9.1%. The brand attributes Chili’s increased sales to higher traffic, price increases, and the acquisition of 66 franchise-operated restaurants. Maggiano’s increased sales are credited to the higher dining room and banquet sales.

Buffalo Wild Wings

Buffalo Wild Wings ranked 23rd in Technomic’s 2022 Top 500 Chain Restaurant Report among the highest-grossing brands in the U.S. According to the report, the chicken wing chain achieved $3.718 billion in sales and operated 1,212 locations. The restaurant launched its GO concept in 2020, rolling out takeout and delivery-focused initiatives. The smaller format store has found success and Buffalo Wild Wings opened its 50th GO location in April 2023. The chain is also experimenting with robotics to craft chicken wings in a partnership with Miso Robotics to cut costs on labor amid the labor shortage.

While the outlook for casual dining was initially meager immediately following the outbreak, brands within the industry have found success in a postCOVID-19 world. By leveraging technology, optimizing off-premise experiences, and building stronger relationships with customers through loyalty programs, there is light at the end of the tunnel for the casual dining sector. Brands that have a focus on said initiatives will continue to find success in 2023 and beyond as they provide customers with a modernized and safe dining experience.