How COVID-19 Accelerated the Adoption of Telehealth

The healthcare sector is booming and growth is not expected to slow down any time soon. Businesses in this sector have been deemed essential by the U.S. government, resulting in investors allocating 57 percent more capital toward healthcare real estate for 2022, according to TheRealDeal. The resilience in healthcare during recessions provides stability; no matter the economic climate, people will always need to see a doctor, purchase a prescription, or schedule an operation.

The pandemic called for improved government reimbursement in this sector because space, supplies, and workers were limited during a time of dire need. As a result, the federal government is increasing funding, resulting in more healthcare facilities being built, and current facilities being expanded. With more than 100,00 Americans turning 65 every day, the need for care centers and medical office buildings is only expanding. With its various properties and services, healthcare real estate allows for investors to have a well-rounded portfolio active in multiple segments.

Best Places to Plant Capital in Healthcare

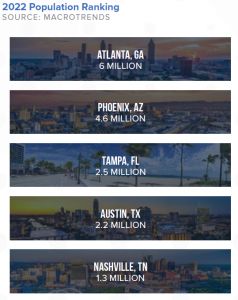

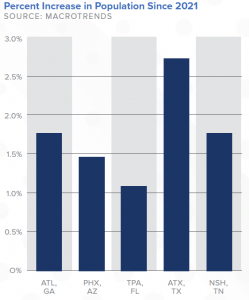

Healthcare real estate is dominating major cities, and continuous growth is anticipated in the coming years. Healthcare hotspots include Phoenix, Atlanta, Nashville, Austin, and Tampa. These cities are thriving in numbers because of their climate, culture-packed neighborhoods, proximity to major airports, and expanding job market and opportunities.

Rapid investment growth in these five major markets for healthcare real estate is attributed to an increase in foreign investors, recession-resilient numbers, constant consumer demand, and long-term investment appeal with high ROI. The healthcare sector has proven to weather a pandemic economy, making it an in-demand investment. It also allows investors the opportunity to invest in a modern sector actively adapting and innovating new technologies to meet the needs of consumers. Examples of this vary from contactless drive-thru pharmacy pick-up locations to rapid-covid testing facilities to “medtail” office buildings taking over vacant retail spaces in metropolitan areas.

Top Medical Properties to Invest In

The myriad of property types in healthcare make for a well-rounded investor portfolio. The top-performing properties since 2020 have been ambulatory centers, pharmacies, medical office buildings, life science space, and hospitals. The pandemic highlighted a need for medical facilities nationwide, provoking developers and current owners to build and expand upon their properties. Additionally, the increase in vacant retail space has pushed medical offices to take over, thus creating “medtail” facilities. These coveted offices are located in heavily populated cities and neighborhoods, and are primarily occupied by dermatologists, alternative medicine, and veterinary offices.

Ambulatory Centers

Since 2021, ambulatory centers have seen a 17 percent growth rate. These centers were few and far between during the pandemic with limited hospital beds and ventilators for patients, pushing for an increase in properties. In 2020, the ambulatory surgical center market size was $34.73 billion, and is projected to grow to $58.85 billion by 2028. The space for these centers is highly desirable, and the average center is about 20,000 square feet.

Medical Office Buildings

Medical office buildings have hit record numbers in recent years. Strong rent collections in this asset type have exceeded 95 percent, even during the most challenging economic times of the pandemic. Additionally, the country’s aging population calls for more healthcare and doctor visits. There has been a growing need for medical buildings and workers around the country, putting investors in a well-positioned opportunity to get ahead.

Life Science

The life science sector of healthcare is growing, and the need for lab space is at an all-time high. With that, many lab spaces are being converted from office spaces as new facilities are being built. This niche market increased by 11 percent in lab space in 2021 and is expected to be valued globally at $727 billion by 2025.

Pharmacies

Pharmacies are a highly desirable asset as they offer a stable cash flow and shelter capital gain. Since people will always need prescriptions, medical tools, and daily supplies, these

asset types are here to stay. Additionally, the innovative technology pushing for drive-thru pharmacy pick-up, contactless check-out, and digital order pick-up meets consumers’ need for convenience and staying healthy. Furthermore, pharmacies offer health services, including physicals, medical testing, and shots, ensuring all health needs can be met in one place.

Hospitals

Naturally, as a result of COVID-19, hospitals all over the country are being developed and expanded. These long-lived assets add notoriety to an investment portfolio. Hospitals will always be a coveted healthcare property, and with the never-ending need for medical practices, healthcare real estate makes for a great investment opportunity.

Healthcare real estate appeals to many due to its variety in property types, ability to weather any economic climate, and multitude of hotspot locations. Investing in this sector adds notoriety and diversity to an investor’s portfolio. In the future, it is expected for healthcare properties to continue expansion, cementing their footprint and dominance in the commercial real estate industry.