Sky-Rocketing Rent Growth

With rising mortgage-interest rates and more people opting to live alone, would-be homebuyers are forced to keep renting and increased interest rates are taking effect on property values. With high pressures on demand and ongoing affordability issues, rent growth will likely remain high.

The median monthly asking rent in the U.S. surpassed $2,000 for the first time in May 2022, rising 15 percent year-over-year to a record high of $2,002, which is on par with April’s annual increase of 15 percent, but a slowdown from March’s 17 percent gain.

The metro area with the highest rent growth year-over-year was Austin, TX, with the largest increase on record as asking rents surged 48 percent. Nashville, Seattle, and Cincinnati also saw asking rents increase over 30 percent from a year earlier. Rent growth in Portland, OR (24 percent) fell below 30 percent for the first time since the start of the year, removing them from the top 10 metro areas with the highest rent growth. The primary driver is demand, fueled by renters migrating from expensive metro areas to more affordable Sunbelt cities.

Strong vacancy compression and a robust single-family market also contribute to the market’s impressive rent growth. With several billion-dollar projects underway, Austin has strong prospects for sustained economic expansion.

Slow Transaction Activity

Rising concerns about gas prices and inflation have not impacted multifamily demand but are some of the main headwinds for the industry. The Federal Reserve raised policy rates to limit inflation, with the 10-year Treasury surpassing 3 percent for the first time since 2018 and priced to yield roughly 2.75 percent at the end of May, which is 125 basis points above January levels. The trend is anticipated to continue throughout the year and can be especially important within the commercial real estate industry, as it is financed with a substantial amount of debt, making it highly sensitive to interest rate hikes. Meanwhile, floating-rate debt is more expensive and acquisition yields are averaging 4.5 percent presently. This will surely rise if debt costs remain at higher levels and will contribute to a slowdown in transaction activity.

Moreover, with a combination of low supply and an increasing number of first-time tenants, multifamily should remain strong due to the increasing tenant population.

Foreign Investments Impacting the Multifamily Sector

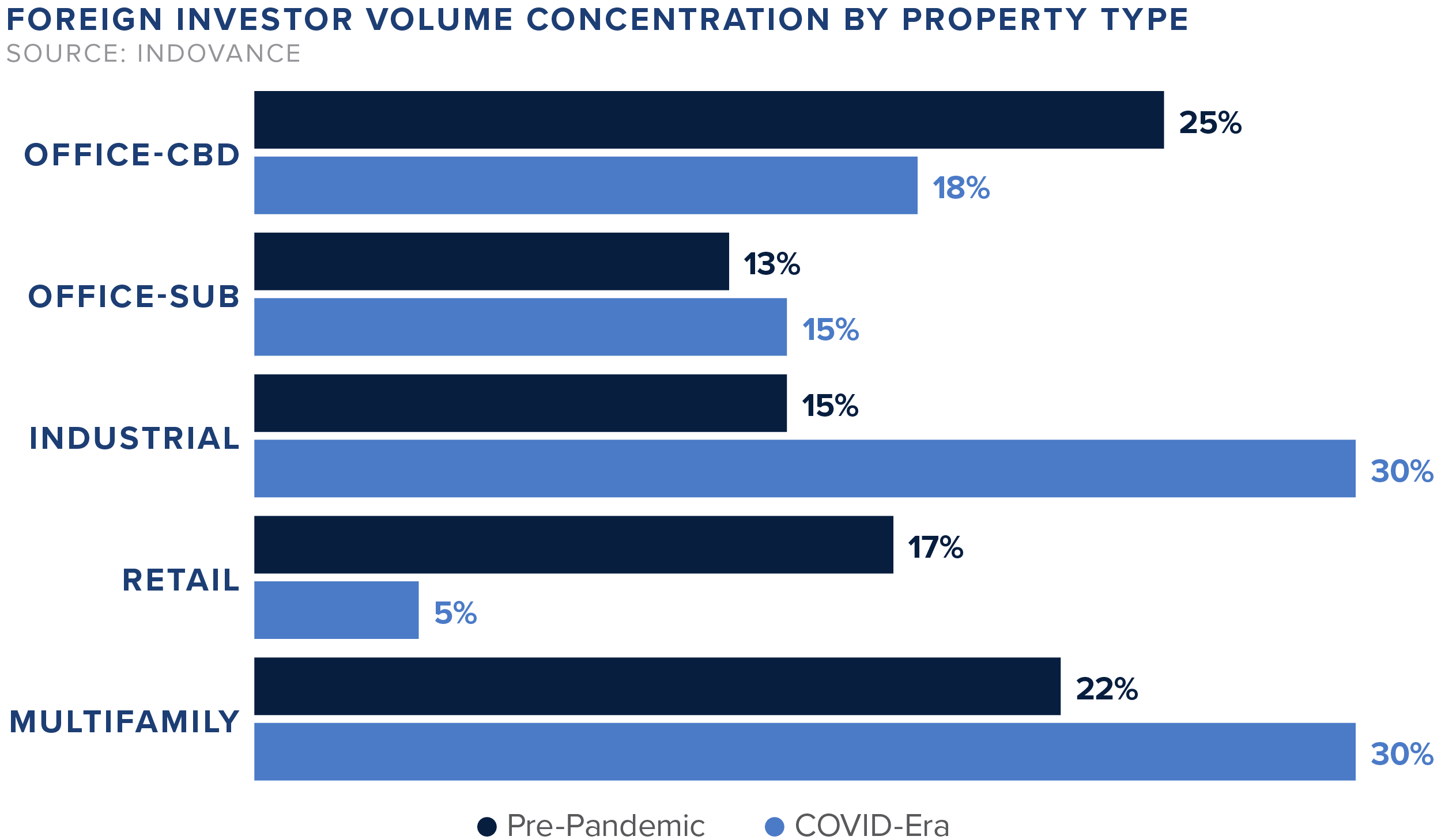

Foreign investments are continuing to increase in multifamily apartment buildings throughout the U.S. During the COVID-19 pandemic, foreign investors poured $21 billion into multifamily properties, shifting their focus away from key coastal cities to the Sunbelt and secondary markets. Student and senior housing are particularly popular with foreign investors.

Markets Seeing Growth with Foreign Investment

Amid an easing of restrictions related to COVID-19 that has benefited foreign buyers seeking to expand their holdings, Germany-based Union Investment is now a key player in the multifamily sector, with a $227 million acquisition of a two-building complex in Fort Lauderdale late last year. Foreign investors are now less likely to invest in office buildings with long-term credit tenant leases, and instead looking into multifamily property’s low capitalization rate.

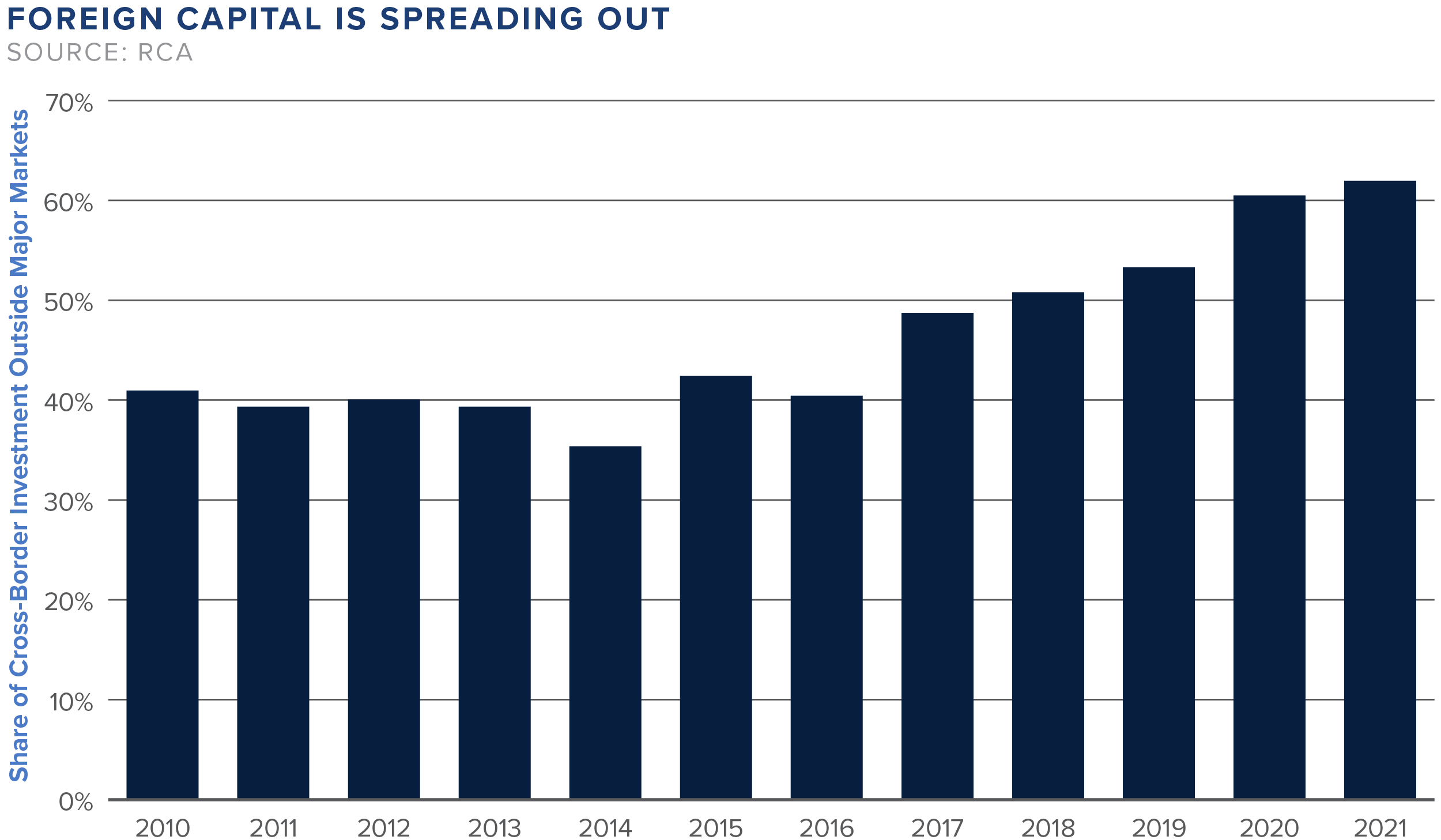

In the U.S. multifamily market, 62 percent of cross-border investment was outside major markets last year, up from averages of 40 percent in non-major markets from 2011 to 2017 — with Atlanta, Phoenix and Dallas leading. Other high-growth markets with low taxes and increasing population that are seeing a surge in foreign investment include:

- Charlotte

- Nashville

- Denver

- Austin

- Orlando

- Tampa