Manufactured Housing: The Fight to Maintain an Affordable Housing Market

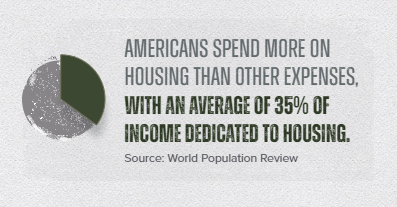

Over the past two years, the median home price has increased 36.5 percent. This significant increase, paired with the average 30-year mortgage rate jumping from 3.3 to nearly seven percent, has caused many Americans to press pause on house hunting, unable to match the income requirements of homeownership. According to the World Population Review, families in the U.S. earning the median household income can afford a mortgage of about $250,000. Since the average traditional home costs $344,000, families are finding themselves priced out of the market. Overall, current interest rates and inflation have caused Americans to rethink their buying decisions and look for affordable alternatives to achieve the American Dream of homeownership.

Rising Concerns

The annual inflation rate in the United States is 8.3 percent for the 12-month period ending in August 2022, after previously rising to 8.5 percent in July 2022, according to data from the U.S. Labor Department. With the median income across the country at $44,225 and consumer prices increasing every quarter, homeownership is not feasible for many families. The high costs have caused Americans to investigate more viable options until the market cools off.

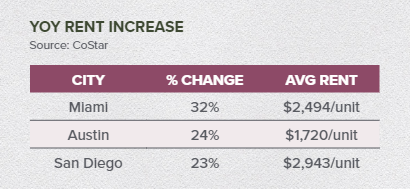

Although renting is always an option for those unable to purchase property, increased rent rates across the country have hindered consumers’ want and ability to rent. Some feel they would rather put high rent costs towards a mortgage, which gives a return on investment at sale. The rapid rent growth is also forcing some residents to downsize to smaller units that offer lower rates.

Growth in Manufactured Home Purchases

With consumers shying away from traditional residential homes, other housing opportunities have been introduced to help residents either achieve homeownership or find more affordable options. The increased need for more accessible housing is where manufactured housing communities come into play, drawing over 22 million Americans.

Manufactured homes are usually between 1,000 and 2,000 square feet and are sometimes referred to as prefabricated housing. These homes are built off-site and then assembled on a rectangular chassis. Manufactured homes are usually built as single or double-wide units. Thanks to upgraded technology and development, the overall quality and design of manufactured homes has greatly improved in recent years. Internal finishes, such as vaulted ceilings, working fireplaces, custom kitchens and baths, and more are common among these homes, appealing to homebuyers who may not have considered a manufactured home initially. Typically, there are eight to 15 homes per acre in a manufactured housing community, offering residents plenty of space, with some high-end communities offering valuable amenities.

Why Invest in Manufactured Housing Communities

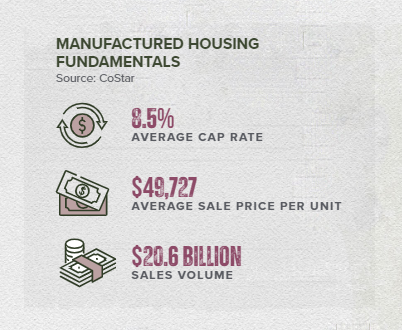

Manufactured housing communities make a strong investment option since they attract a buyer pool that encompasses most Americans. Owners of manufactured homes typically earn a median income of $34,700 to $50,000 per year, compared to the national average of $30,000 to $40,000 annually. As such, manufactured housing communities cater to a reliable and large demographic, preserving demand. Offering more space than an apartment and requiring less cash than a traditional home, manufactured communities are the perfect mix of homeownership and affordability. Here’s why investors should plant capital in manufactured housing communities:

1. Varying Ownership Options: Unlike conventional homes, the land on which a manufactured home is assembled is not owned by the resident of the home, but by the owner of the manufactured community. The owner then rents out plots of land to residents, charging for the land use. However, an investor can purchase the land and the physical housing units and rent both the land and home or sell off the units as needed. Converting the manufactured home into real property, meaning the home is affixed to the land, provides the most financial gain, according to the National Consumer Law Center. To note, owning both the home and land will translate to higher taxes.

2. Passive Income Opportunity: Owning a manufactured housing community doesn’t require the same management responsibilities as a typical multifamily investment. Because the homes are typically owned by the individual resident, owners are only responsible for common areas and any amenities the community offers, not the individual homes. This type of agreement is like a net lease agreement commonly used in retail transactions.

3. Attracts Long-Term Tenants: Unlike apartment buildings or condos, where the renter resides for an average of three years, manufactured homes have minimal turnover. Manufactured homeowners typically stay in their home for over 14 years, since the cost to physically move the home off the plot of land costs about $10,000. Due to the costly price tag of relocating, most families pass down their homes through generations.

4. Short Development Timeline: A manufactured home can be built in two to seven days, establishing a quick development pipeline. From there, the home can be delivered in about four months. In addition, builders don’t face weather-caused issues such as sun fading materials, mold, rot, and material theft as often as traditional housing builders, decreasing the production time astronomically. All in all, the start to finish process is more efficient than the conventional home building process, meaning communities can be brought to market in a few short months.

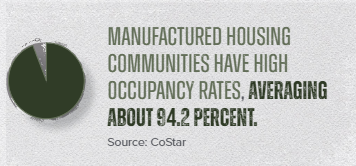

5. High Occupancy and Demand: Due to strong rent growth, sale prices for these types of communities have rapidly increased in the commercial real estate industry. In the past year, manufactured housing rent rose 4.6 percent. Unlike expensive metropolitan locations, manufactured housing tenants also tend to pay on time, resulting in fewer evictions and delinquency rates. As we enter a recession, demand for these assets will grow as consumers look for more affordable options, and manufactured homes serve as an inflationary hedge.

What’s Next?

The cost of living in the United States is becoming increasingly expensive, leading Americans to rethink their housing costs, but not taking away their hope of achieving the American Dream of homeownership. Manufactured housing allows middle-income residents to put capital into personal property or land for an affordable price instead of throwing away money on rent or gouging their bank accounts to pay mortgage payments. Inflation, high rents, and the risk of recession are not going anywhere, so demand for viable housing options will grow, encouraging investors to plant capital in the growing multifamily subsector.