Why is Healthcare a Favored Asset Class?

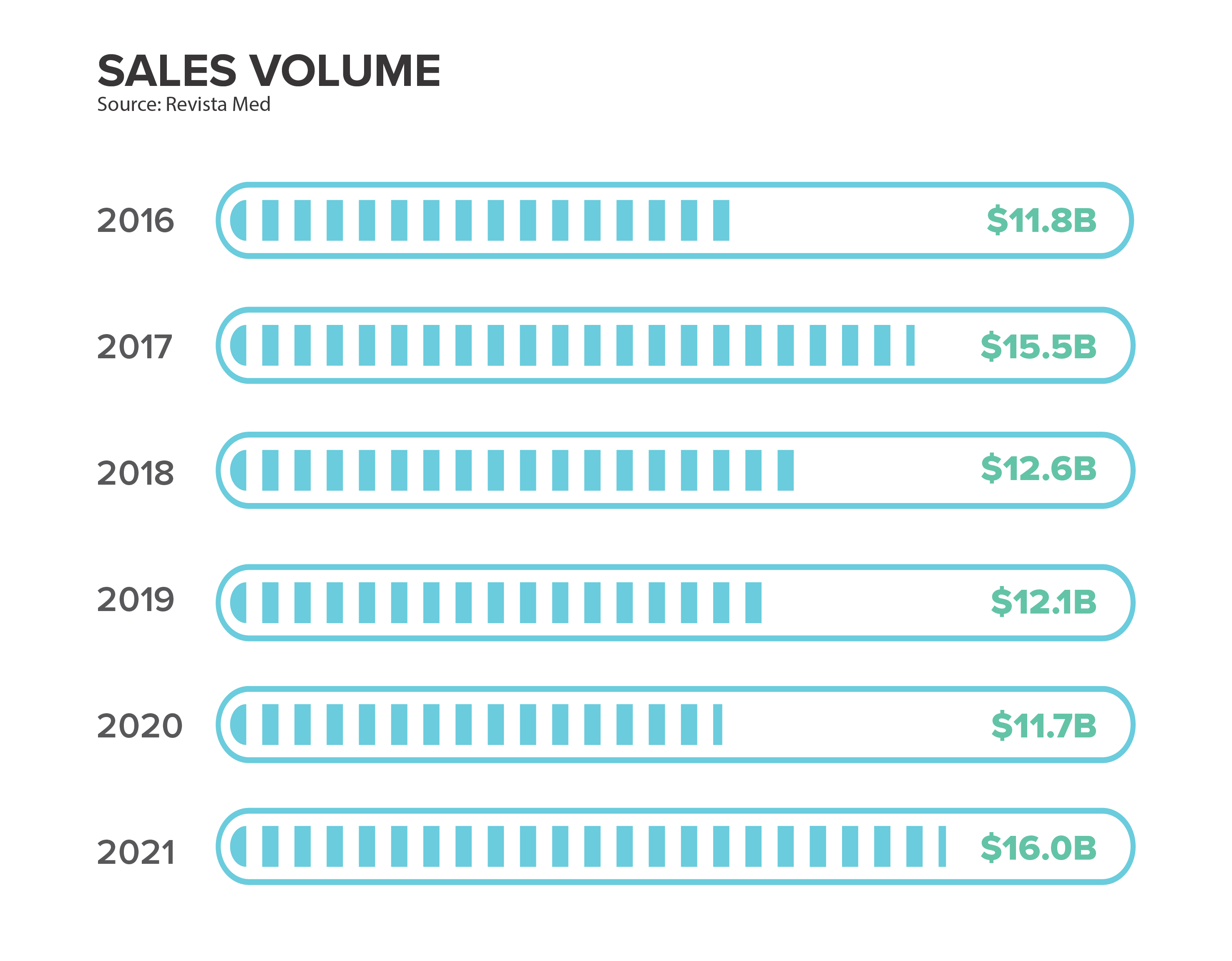

The healthcare industry can endure every economic cycle due to one basic fundamental – everyone needs healthcare. According to Medical News Today, investors are bullish on medical properties as they have proven durable and offer steady income, leading to healthcare investments more than tripling since 2015. From an investment standpoint, the attractiveness of healthcare assets sits within its essential nature, resiliency against e-commerce, and ability to perform well during recessions. In 2021, medical office sales topped $16 billion, up from $11.7 billion in 2020. According to Revista Med, private equity investors led in acquisitions, accounting for 63 percent of sales last year.

Benefits of Having Healthcare Tenants

Landlords find comfort in leasing a location to a healthcare tenant as they front more of the investment due to the extensive build-outs. These tenant types require special features like exam rooms, surgery capabilities, and various other aspects. Medical offices are increasingly leasing for three, five, or seven-year periods. For tenants, signing a long-term lease can have benefits, such as rent abatement, tenant improvement allowance, and stability. For landlords, long-term leases guarantee stability, security, and rental increases that are established during the negotiation process. With a longer lease, landlords have fewer concerns and risk of vacancies.

The increased buyer appetite for medical office properties has resulted in price surges, creating a very competitive market. However, not all healthcare investments are considered equal, and there is a broad range of different operators and tenants guaranteeing the leases of these buildings. In today’s market, it’s essential to understand what makes a good lease guaranty and what to look for when evaluating investment opportunities.

What is the Main Function of a Lease Guaranty?

A lease guaranty is an official contract signed by the landlord, tenant, and lease guarantor (typically a party related to the tenant), who agrees to meet the monetary requirements of the lease. A guaranty is a valuable part of any deal as it provides additional security through the financial backing of a lease. Most guaranties can be categorized as personal, corporate, subsidiary, or burn-off.

Personal Guaranty

A personal guaranty requires the personal guarantor to financially back the tenant’s obligations and put their personal holdings on the line should the tenant go bankrupt or default under the lease. These are typically found in leases for smaller healthcare operators, new operators, or an operator whose corporate financials aren’t strong enough to support rental obligations moving forward.

Corporate Guaranty

A corporate guaranty is often signed by an institution or a developed, affiliated company that financially backs the tenant’s obligations with their corporate financial holdings. Landlords typically favor these as they usually offer substantial comfort and financial protection should the tenant default. Mid to large healthcare operators often incorporate these guaranties into their leases.

Subsidiary Guaranty

A subsidiary guaranty, also known as an upstream guaranty, is when the subsidiary guarantees its parent company’s debt or obligation, backed by one or more of its subsidiaries. They can be used to leverage buyouts when the parent company owns insufficient assets to back the buyout syndicate’s debt-financed purchase.

Burn-Off Guaranty

While not its own guaranty and more of a modification to a personal or corporate guaranty, a burn-off guaranty essentially burns off the financial backing of the lease for a landlord or investor. Burn-off guaranties do not last the entire term of the lease, usually one, three, or five years. They add a level of risk to a deal as they limit the tenant’s liability to satisfy its lease obligations until the burn-off window expires.

How does the Guaranty Affect the Property Value?

It’s never certain if a business will succeed, presenting risks for any lender or buyer. As such, buyers can ask for a legally binding personal guaranty to safeguard their chances of being repaid. Personal guaranties improve real estate values for smaller operations, whereas those without a personal guaranty can be seen as riskier investments.

The credit of a corporation can also affect value. The guaranty will be stronger with a higher credit rating as it indicates a safe investment. There are globally three main entities referenced for corporate credit ratings: Moody’s, Standard & Poor’s (S&P), and Fitch Ratings. Each rating system helps investors determine the risk associated with investing in a specific company. If a tenant does not meet a landlord’s credit requirements, the landlord can propose a lease guaranty that would be mutually beneficial for the landlord and tenant.

Guaranties Relating to Sale Leasebacks

In terms of sale leasebacks, the lease is usually assignable to prepare for the potential sale of the practice so that any potential buyer that acquired the practice (and thus the lease) would have a larger and stronger guaranty. If a sale leaseback features a personal guaranty, in most situations, that guaranty would become void once a practice is sold to a larger group. It’s imperative to understand both as a buyer and as a seller what the tenant’s obligations and requirements are in the short and long-term when signing a lease.

Options When a Guaranty is Weak?

If a landlord is considering terminating a lease early due to a weak guaranty, they should always consult with their accountant and attorney for the specifics of that process. Landlords can include language in the lease that allows them to review a practice’s financials to gauge its performance, enabling them to monitor the potential risk of a weak guaranty. Landlords can also discover if a tenant plans to bring in more physicians or sell to a larger group or private equity firm, in turn, providing a stronger guaranty. Additionally, the lessee can obtain a turnkey insurance policy

to cover the remaining balance on a lease if terminated early.

Any commercial lease, including healthcare leases, has some type of guaranty, whether corporate, personal, or subsidiary. Large guaranties can make the difference between hundreds of thousands if not millions of dollars in value on a single transaction. Healthcare operators who currently own their real estate should take into account the risks and considerations when negotiating any contract or lease.