The CRE Sector Everyone is Betting On

Industrial is the current darling of commercial real estate. But as the asset class grows in popularity, supply and demand become unbalanced. Tight market conditions, paired with rising land and construction costs, have hindered industrial development, especially in port cities. Across the U.S., industrial real estate is booming, combating challenges to stay on top.

The Uprising of Industrial Demand

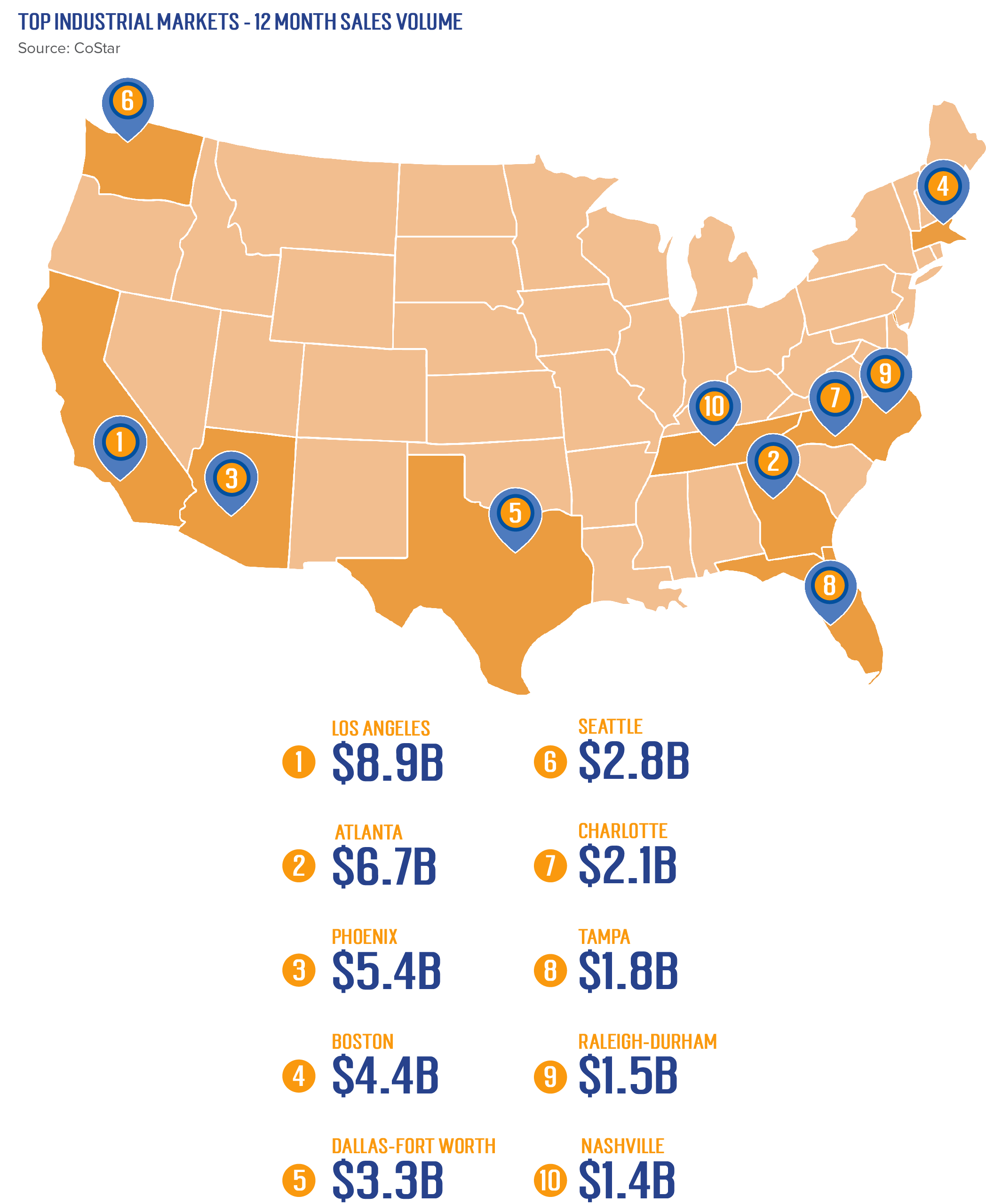

According to RCA, year-over-year sale prices for industrial assets climbed 28.5 percent in 2021, with demand still strengthening in early 2022. The start of the global pandemic sparked an immediate need for industrial space for various uses. E-commerce accelerated, and online retailers required more warehouse space to manufacture, store, and ship products. Consumers stopped dining out and began ordering groceries online to fully stock their freezer, fueling the need for cold storage facilities. As the internet grew in reach and power, logistic companies and data centers expanded their reach.

The average rent for U.S. cold storage space increased about 15% from the first quarter through the end of 2021. Source: CoStar

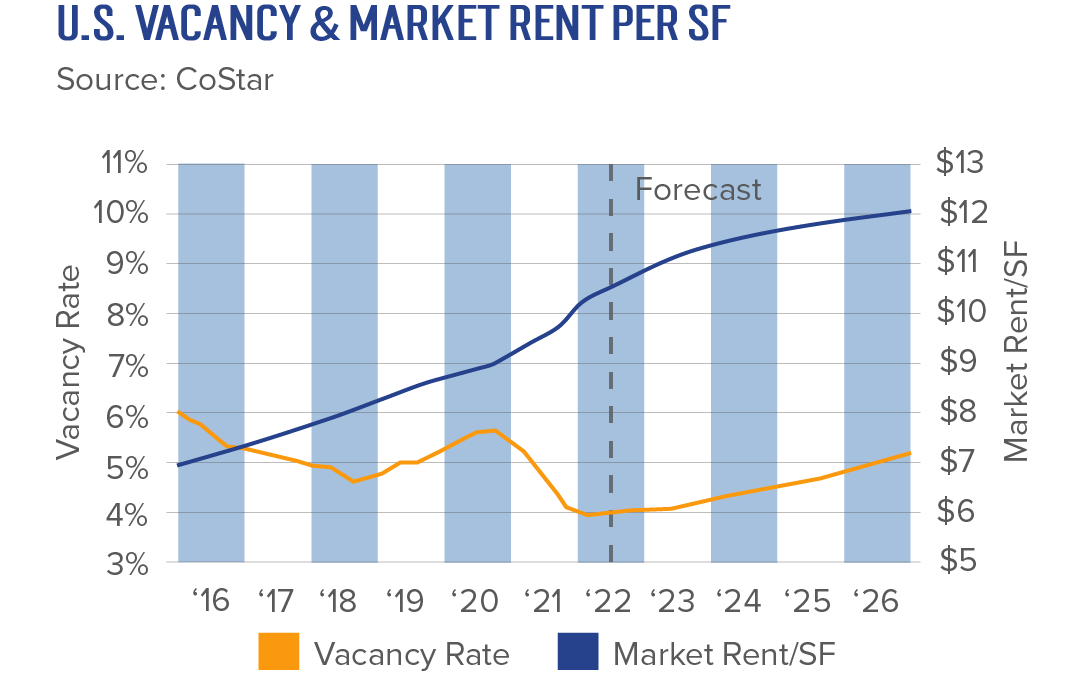

The initial effects created a surge in demand, as investors snatched up existing properties quickly and developers couldn’t build fast enough. According to CoStar, overall industrial leasing activity was up 65 percent from the average quarter reported three years before the pandemic. Demand expanded once more when global supply chains stalled due to shutdowns and slowed fulfillment and shipping. Manufacturers and retailers now look to produce at least six months’ worth of products ahead of time compared to pre-pandemic, when most retailers produced only three months of inventory. This strategy shifted to combat disrupted supply and demand. Industrial assets are experiencing the lowest vacancy rates in history while owners significantly increase rent rates to keep pace and balance ongoing disruptions.

Building to Balance

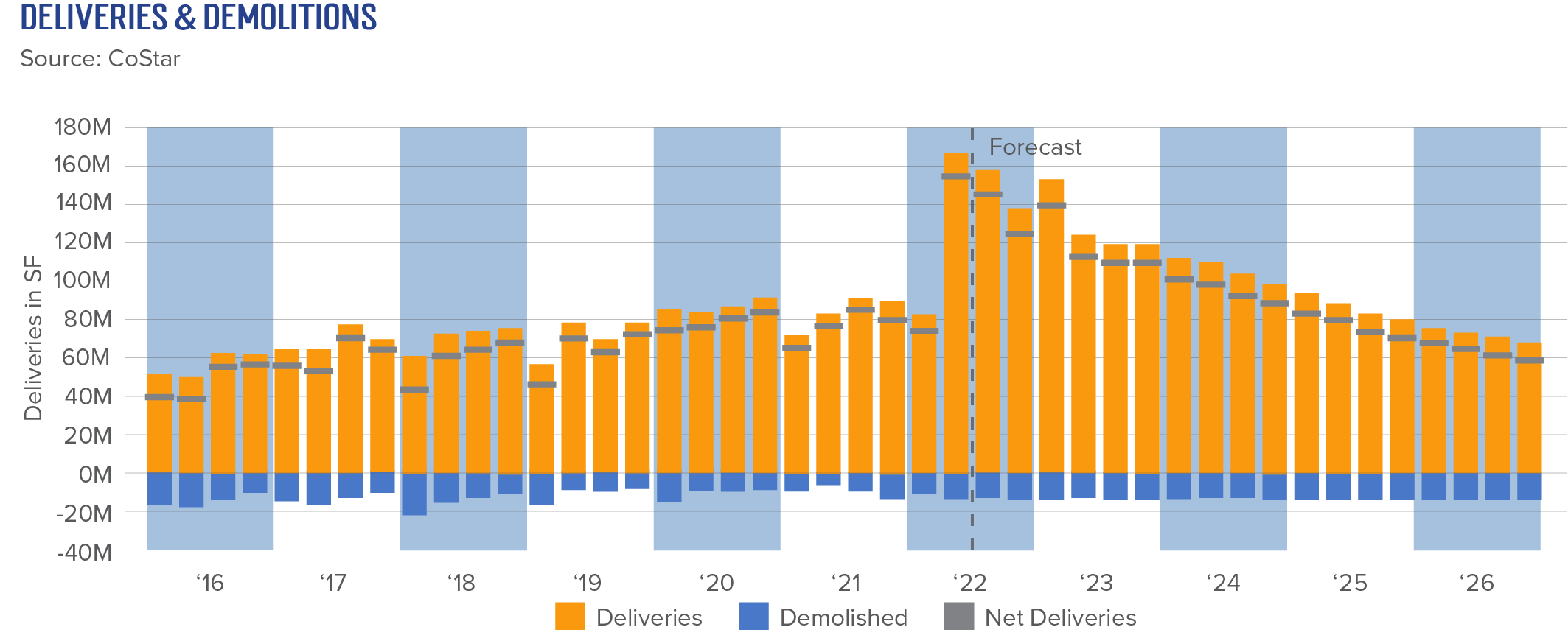

Developers are breaking ground on industrial assets at a record pace. Since the onset of the pandemic, construction is up 64 percent, with 816 million square feet in the pipeline across the U.S., according to CoStar. An extremely hefty supply pipeline often causes investors to worry about increased vacancy rates due to the chances of new supply entering the market without absorption. This is not the case for industrial assets, at least for the foreseeable future, because the need for buildings is only increasing as e-commerce continues to grow.

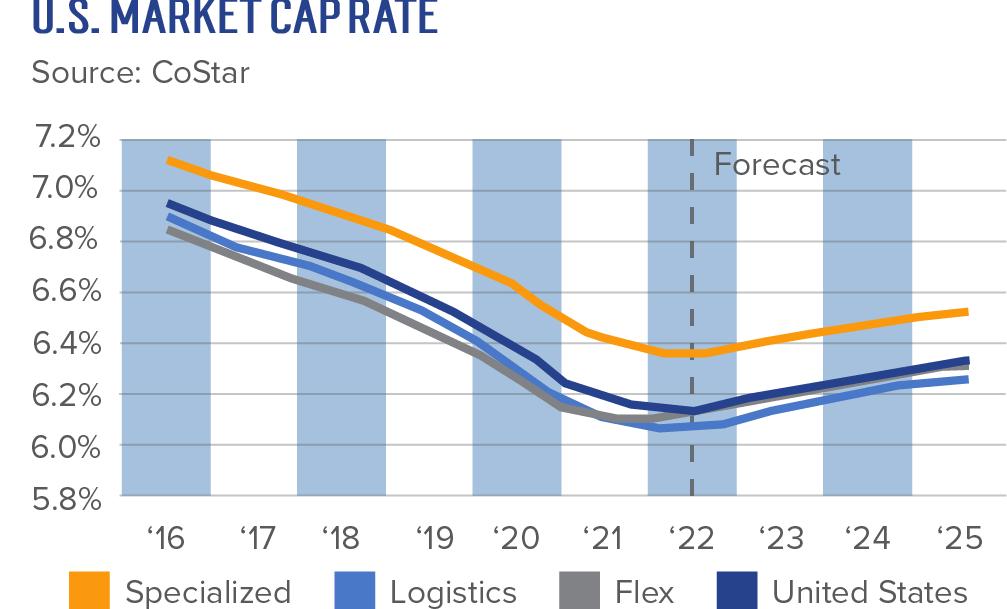

High construction costs, wage increases, a tight labor market, and a limited supply of materials all affect the speed and profitability of industrial development. It’s getting harder to build properties for a reasonable price, which in turn is raising sales prices and compressing cap rates. Industrial-grade properties located in prime markets witness more cap rate compression, with the average falling below 3.5 percent.

Prime port markets where industrial-zoned land is scarce is facing long-term supply shortages. In Los Angeles, Miami, Seattle, & Baltimore, for example, the current tally of available modern inventory amounts to what the market typically absorbs in less than 12 months. Source: CoStar

The shortage of land is another threat builders are facing. Developable land is scarce in markets that have traditionally been the best picks for industrial construction. Owners and developers have started exiting the traditional markets and expanding to more rural regions such as the Southeast and Southwest. Phoenix, Dallas, and Tampa are all reporting heightened construction activity.

Top Markets

According to Costar, 44 out of 50 logistic-heavy markets in the U.S. now have rent growth surpassing eight percent year-over-year. Land-constrained port cities are experiencing the highest rent growth. Miami, Northern New Jersey, and Los Angeles are leading the pack with year-over-year rent growth ranging between 14 and 21 percent.

On a percentage basis, the industrial transaction activity seen was the most rapid acceleration in investment recorded among all four major property types in the U.S. coming out of the pandemic.

Future Challenges

The future of industrial real estate is reliant on several factors, some of which will force landlords, tenants, and investors to pivot business plans and adapt to the market. Recruiting and retaining warehouse workers is becoming harder as the workforce decreases. The labor market is tight, and operators will need to increase benefits, safety, and pay to compete with large businesses.

In August 2021, Walmart launched several incentives to encourage their warehouse employees to stay on the job and work more hours. Some warehouse workers received $1,000 over four weeks for attending all their scheduled shifts, while some received pay raises until January 2022. Source: Insider

Energy costs are also increasing, as new warehouses’ enhanced technology and infrastructure use more electric and alternative fuels than before, bolstering operating costs and the property’s burden on the environment. As industrial buildings’ environmental impact grows, local and federal governments will be more inclined to place restrictions and regulations on warehouse development.

For tenants, rapidly rising rent is an uphill battle as landlords look to capitalize on demand and shorten lease terms. Substantial rent growth may encourage owners and landlords to look for new tenants since they can continue to inflate rates and negotiate the lease terms.

An analysis of 101 metros by Moody’s Analytics shows that from 2017 to 2019, the average lease term for warehouse and distribution space changed around the 36-month mark. Source: Bisnow

The average lease term fell 20% to 29 months, and the last two quarters of 2021 saw lease terms decline by an average of 4% per quarter. Source: Bisnow

Even though the industrial sector has some hurdles to overcome, it shows no sign of decelerating. Experts predict there will be a gradual decrease in leasing activity, absorption will pick up, and the expeditious increase in rent growth will slow. Supply will be needed as consumers actively grow the dominance of e-commerce retail and companies expand to emerging markets. Profit, growth, and demand are pillars of industrial real estate and investors are eager to capitalize on CRE’s best-performing asset class.