The Life Sciences Boom

The Life Science sector is a break-out commercial real estate asset type taking the market by storm. Both private equity and public funding are pouring billions of dollars into the industry, reaching $39 billion in 2021, according to JP Morgan Chase. Yet life sciences was an expanding asset class long before the covid-19-induced investment surge.

Will the Growth Last?

One primary concern regarding life sciences’ growth is the lack of available professionals with specialized skills to work in the facilities. This has resulted in experts projecting a disruption in the future. It’s not all bad news, though, with most life sciences hubs near universities offering access to an educated talent pool.

Despite the expensive buildouts, the funding environment for life science is flourishing, fueled by venture capital and the National Institutes of Health. It may be one of the fastest-growing industries, but life science is here to stay.

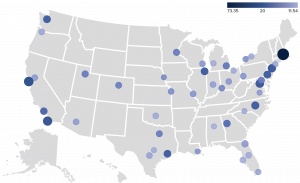

According to Commercial Café, the top 20 U.S. Metros for Life Sciences Companies in 2022 are

- Boston

- San Francisco

- San Diego

- New York

- Washington, D.C.

- Chicago

- Philadelphia

- Raleigh

- Seattle

- Houston

- Los Angeles

- Atlanta

- Detroit

- Baltimore

- Sale Lake City

- Dallas-Fort Worth

- Minneapolis-St. Paul

- Denver

- Cincinnati

- Kansas City

2022 Top U.S. Metros for Life Science Companies

Source: U.S. Census Bureau, Commercial Edge

These markets are ranked as the best life sciences nodes for their local talent pool and office market. The list takes into consideration the life sciences employment and educational attainment. These markets either have existing or under construction life sciences buildings.

The demand for new research, innovation, and vaccines will breathe life into life science facilities for years, indicating that the niche sector will continue to grow. Recent development and investor interest bode well for the future of labs.