Matthews™ measured investor insight in a recovering market. CRE investors remain optimistic, despite the current inflationary environment recent rate hikes. The four most significant challenges investors believe the CRE industry faces today are rising interest rates, the Federal Administration, change in demand of the workforce, and capital market risk.

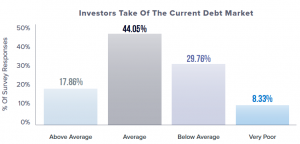

Nearly 70% of investors believe the current capital raising environment to be average to excellent, with majority (54.12%) keeping their real estate capital commitments the same compared to last year.

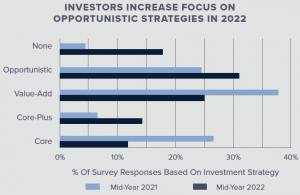

In response to rising rates, 56.57% of investors are holding onto their assets as they believe the biggest consequence to inflation is having less buying power. Nearly 99% of investors expect increased rates to affect cap rates and property values, with 90.59% being more selective with their investments compared to previous quarters.

For more information on the trends occurring in your market, please reach out to a Matthews™ specialized agent.