Industrial Service Facilities

Due to various external factors that exist in the marketplace today, the U.S. industrial segment has grown to be one of the most sought-after product types among investors. The excess demand has caused interest to spill from traditional warehouse investments into niche industrial assets. One of which is industrial service facilities (ISFs), mission-critical properties used to store, maintain, or dispatch vehicles, equipment, and materials. To some investors, ISFs might not be as appealing as concrete construction Class A warehouses; however, these facilities provide must-have services for supply chains that support multiple industries. They are primarily occupied by companies engaged in the transportation, equipment rental, or service and repair industries. Net lease investors favor these facilities as a place to park capital amongst the ever-changing post-COVID-19 tenant landscape. ISFs are leased to many national credit tenants, including United Rentals, HERC Rentals, Sunbelt Rentals, and H&E Equipment Services. ISFs boast one of the lowest vacancy rates in the industrial subsector, housing mature and stable tenants, which benefit from e-commerce, but don’t depend on e-commerce-driven growth.

What are Industrial Service Facilities?

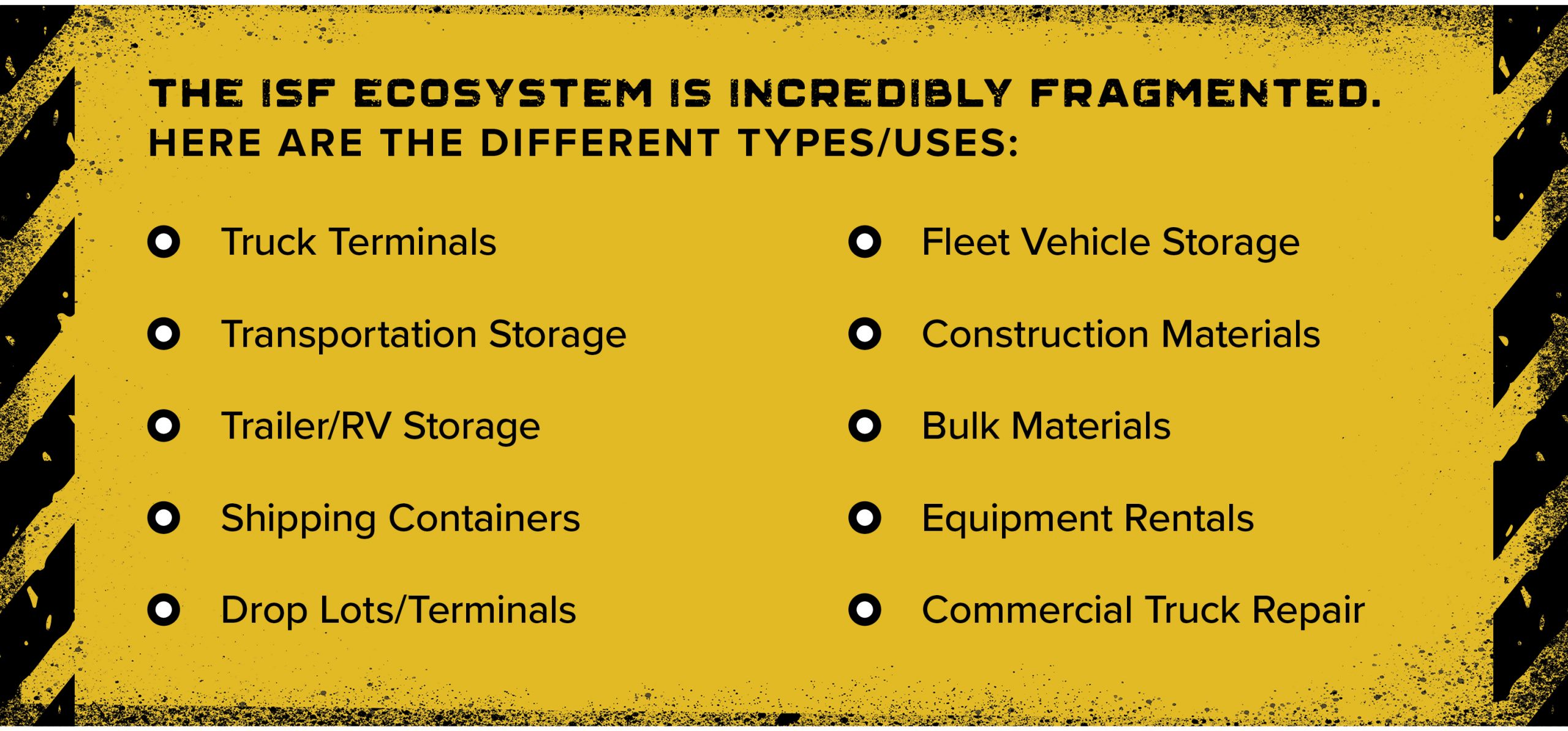

Industrial service facilities (ISFs), sometimes called outdoor storage facilities or industrial outdoor storage, serve numerous purposes ranging from storage and maintenance of rigs, trailers, containers, and chassis to housing bulk materials, such as roofing supplies, stone, or construction materials. Any firm with a large fleet, like utilities or companies with field technicians, may also use these sites.

Typically, this industrial segment is overlooked as investors focus on the heavily publicized warehouses and distribution centers. ISFs provide lucrative and more significant aggregated square footage and also capitalize on the surge in e-commerce activity. These assets have been around for years, and on average, house smaller structures that occupy between five percent and 20 percent of a parcel of land. ISFs are often found in infill industrial areas to facilitate storage near metropolitan centers. Additionally, location requirements typically include freeway, rail, or port access for quick and easy storage and access.

The Rise in Popularity

E-commerce sales are expected to settle back into pre-pandemic norms, with online sales growing 9.3% in 2023 to reach $1.137 trillion, according to Insider Intelligence. It is estimated that every $1 billion increment in e-commerce sales necessitates about 1.25 million square feet of additional warehouse space.

ISFs serving the warehouse and logistics sector will likely grow in demand as companies try to make their supply chains more flexible. This asset class could fit into the last-mile supply chain and contribute valuable resources depending on location and proximity to consumers, ports, or transportation hubs. As industrial users opt to store more inventory to avoid disruptions in the global supply chain, these versatile properties will grow in popularity among users, particularly with vacancy as low as it is among other last-mile properties. ISF assets are mission-critical to the speed and efficiency of the global supply chain, and the pandemic has only further underlined the critical role these assets serve.

On-Market Data

Price tags on these properties range drastically based on the size and proximity to trade areas, however, they are typically between $1 million to $10 million. Currently, there is about $117.6 billion in ISF properties nationwide, according to data from CoStar. This compares to $45 billion to $50 billion for Class A warehouse space. The ISF network has previously been ignored by some institutional capital because of the smaller average deal size and unique nature of these assets. As excess industrial land in urban centers has become increasingly hard to come by over the past decade, private and institutional investors are now re-examining the sector for opportunities.

Infill locations are important & the two main factors are zoning and the floor area ratio

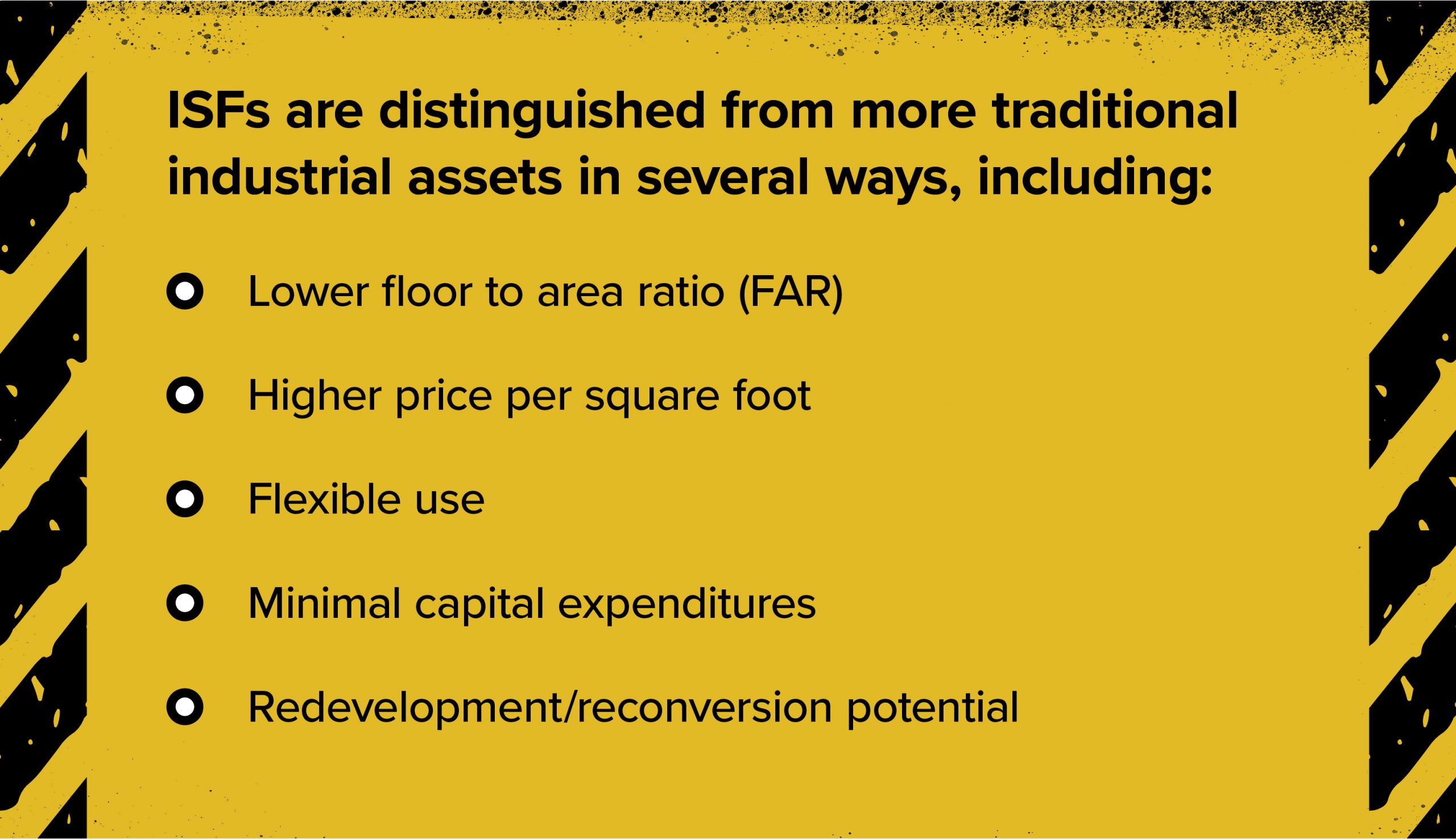

On the surface, ISFs look flexible enough to be considered the prime candidates for conversion into other uses; however, zoning restrictions limit redevelopment potential. There are high barriers to entry, such as limited utility infrastructure. Even though the tenants these facilities serve are relatively mature industries without rapid growth, they benefit from superb supply-demand fundamentals because of zoning restrictions. The floor area ratio (FAR) is a measurement of a building’s floor area in relation to the size of the lot/parcel that the building is located on. In this case, ISF FAR values typically range between 0 to 20 percent, whereas more traditional warehouses generally have FAR values between 20 and 60 percent. Essentially, ISFs are low-FAR assets that generate value from the land as opposed to the structure. Users of traditional industrial space are primarily interested in the property’s indoor storage capabilities, placing value on ceiling heights, column spacing, and distribution access through docks and drive-in doors. Users of ISFs, on the other hand, find value not only in the building itself but also in the storage capabilities of the ground the building sits on.

While rents may be consistently higher, cap rates can vary across the subsector

The tenants for these sites are typically long-term, with many being ten-year leases. As such, they often command higher rents per square foot than warehouse and distribution centers because tenants derive additional value from the storage capabilities and the building itself. The cap rates for these property types are dependent on the nature of the tenant’s credit profile, the length of the lease term, and the intrinsic real estate value. A well-located property leased to a national tenant with a long-term lease of ten years can more easily trade with a cap rate in a low to mid-six percent range. For non-credit and private-credit tenants, cap rates are 50 to 75 basis points higher, all else being equal. For properties without a credit tenant, the cap rate depends on lease terms, quality of the property, location, size of the outdoor storage component, and the ability to achieve replacement rents at or above the current rent level.

Industrial service facilities are in short supply, making them attractive to investors and tenants

In combination with the high rents, the impact transportation and logistics have on the real estate sector contribute to the low vacancy for the overall industrial market. The national vacancy rate for traditional industrial buildings is about five percent in major markets, while ISFs boast a tighter availability with an average of 2.9 percent national vacancy, according to CoStar.

Due to COVID-19, a slowdown in investment sales activity has come to fruition. However, the pandemic has not had a detrimental impact on pricing trends for ISF properties. There is a limited supply of this asset type which results in residual values being greater than traditional properties. The renewal rate for tenants in this property sector is high due largely to the constrained supply and higher-than-average replacement costs. As such, investor demand has increased for this unique asset class, and pricing has tightened as net lease investors have pulled away from non-essential retail assets and more capital flows into the industrial sector.

The Big Players

- United Rentals: 1,186+ locations

- HERC Rentals: 312+ locations

- Sunbelt Rentals: 700+ locations

- H&E Equipment Services: 106+ locations

- XPO Logisitics: 771+ locations

The activity occurring in the space demonstrates that this product type is desirable. ISFs rest on a solid foundation with well-occupied tenants. This niche market is not understood by many, as national industrial players build or invest in warehouse or distribution space instead. However, as single-tenant, triple net lease properties, ISFs have the potential to bolster any portfolio. The users are mature and stable, and the increasing performance of logistics-related real estate means that these property types will only trend upward.