An Update on Industrial Rents

The industrial real estate market in the United States is undergoing a remarkable transformation, driven by shifting trends and evolving dynamics. As we look ahead, it becomes clear that industrial real estate rents are poised for significant changes that will shape the sector’s future. This article will explore the latest expectations and trends in industrial real estate rents across the country.

Projections and Outlook

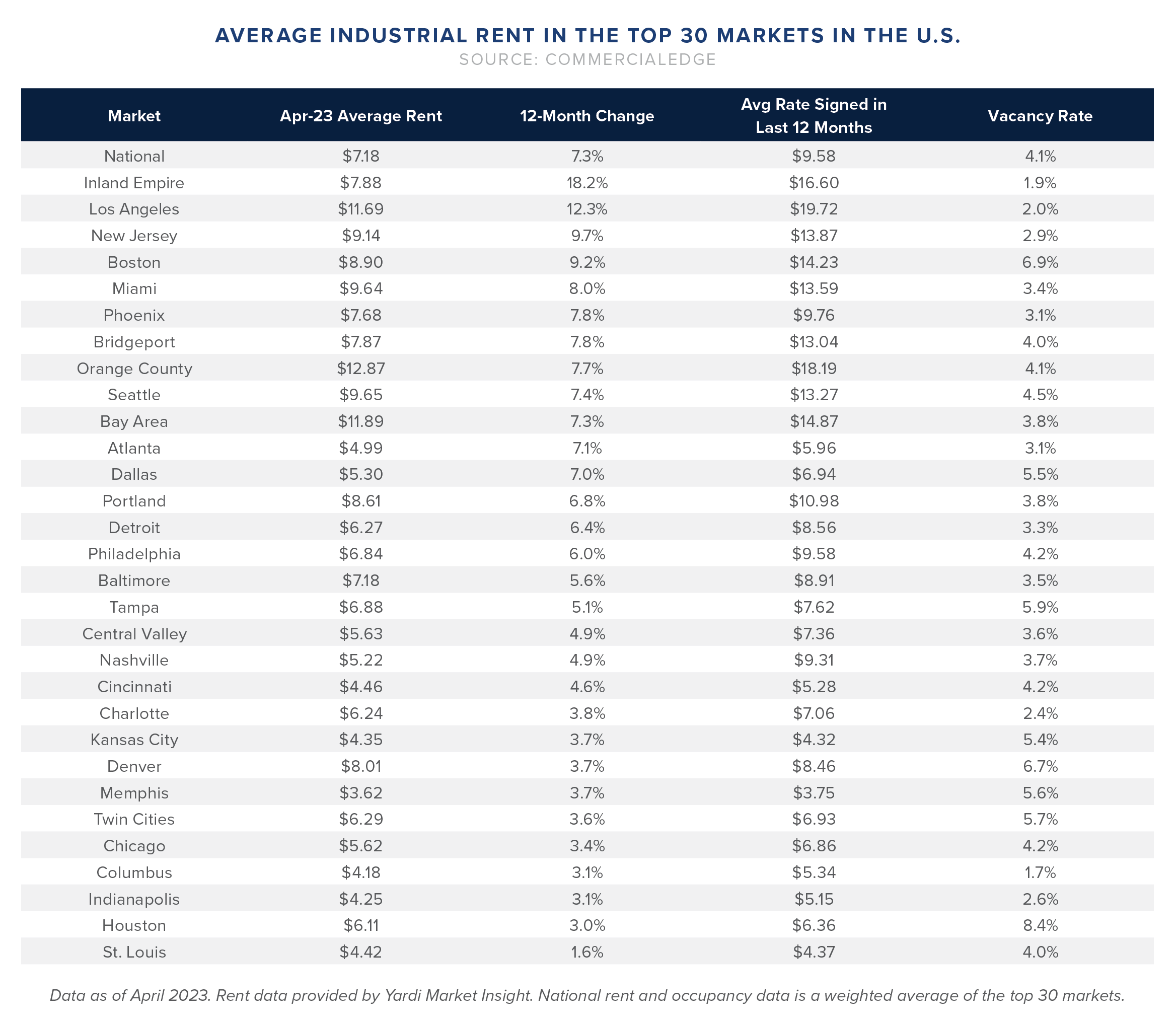

According to industry experts, industrial real estate rents are expected to experience a notable evolution in the coming years. While the previous year witnessed a staggering 30 percent surge in rents, primarily attributed to high inflation, a less substantial growth rate of 10 percent is anticipated for 2023. Additionally, a recent U.S. industrial market report by CommercialEdge reports that the average in-place rent for industrial space in April reached $7.18 per square foot, reflecting a three-cent increase from the previous month. Further, new leases signed in the past 12 months averaged $9.58 per square foot, surpassing in-place contracts by $2.40. These figures indicate a growing demand for industrial space and a willingness among tenants to pay higher rents for new leases.

Regional Variations and Hotspots:

Southern California, particularly the Inland Empire and Los Angeles, has consistently experienced the widest lease spreads between new and existing leases. Leases signed in the past year in these regions cost $8.72 and $8.03 more per square foot, respectively, compared to existing rents.

Other coastal markets also witnessed a notable increase in the average rate of new leases signed over the past year, with the Inland Empire recording an 18.2 percent increase, Los Angeles with 12.3 percent, New Jersey with 9.7 percent, and Boston with 9.2 percent. These growth rates indicate the robust demand for industrial space in these regions.

Factors Influencing Rent Growth

Several factors contribute to the projected evolution of industrial real estate rents. According to Prologis, one key driver is the persistent competition for prime logistics space, which has led to a 4.4 percent increase in rents during the first quarter of 2023. The demand for well-located warehouses and distribution centers remains robust, fueled by the continued growth of e-commerce and the need for efficient supply chain management.

- Growth of E-commerce and its Impact

The rise of e-commerce has revolutionized the retail landscape, leading to a higher demand for industrial spaces. Online retailers require warehouses and fulfillment centers strategically located near major population centers to ensure swift order fulfillment. As e-commerce continues to flourish, the need for well-equipped industrial properties grows, driving up rents. Even industry giants like Amazon have adjusted their expansion plans and decreased their industrial footprint.

- Supply Chain Optimization

Businesses are increasingly prioritizing supply chain optimization to enhance efficiency and reduce costs. This includes streamlining logistics operations, minimizing transportation time, and ensuring seamless inventory management. Industrial spaces serve as the backbone of these operations, acting as distribution hubs and providing storage for goods. The growing focus on supply chain optimization further intensifies the demand for industrial real estate, leading to rent escalation.

Third-Party Logistics Providers

The rise in industrial rents coincides with an increase in third-party logistics (3PL) providers occupying these facilities. Last year, 3PLs were responsible for 40.8 percent of all lease transactions involving big-box warehouses in North America, surpassing general retailers or wholesalers. As rental prices continue to climb, retail giants like Amazon and Walmart are actively seeking ways to cut fulfillment and delivery costs. This trend highlights the expanding role of industrial real estate in the logistics and retail sectors, with the global storage and warehouse leasing market projected to grow significantly in the coming years.

Business Sentiment & Prospects

While the industrial real estate market faces challenges such as increased construction costs and financing constraints, the overall outlook remains positive. Business sentiment, as measured by Prologis’ Industrial Business Indicator, indicates a rebound in expansionary readings after a temporary decline. The prospects for industrial real estate rents are promising, with expectations of continued growth and the potential for tighter market conditions.

Takeaway

The landscape of industrial real estate rents in the United States is experiencing a transformative phase. While a more conservative growth rate is projected for 2023, the sector continues to evolve in response to changing market dynamics. The expanding role in the retail sector and anticipated growth of the global storage and warehouse leasing market contribute to the exciting future of industrial real estate.