Optimizing Investment Strategies in a Down Market

In a changing commercial real estate market, investors should reconsider their investment portfolio and strategic outlook, evaluating whether their current investment principles are best practice for the current economic climate. As valuations and market fundamentals shift, private and institutional investors look for the best ways to continue NOI growth.

To Sell or to Hold…

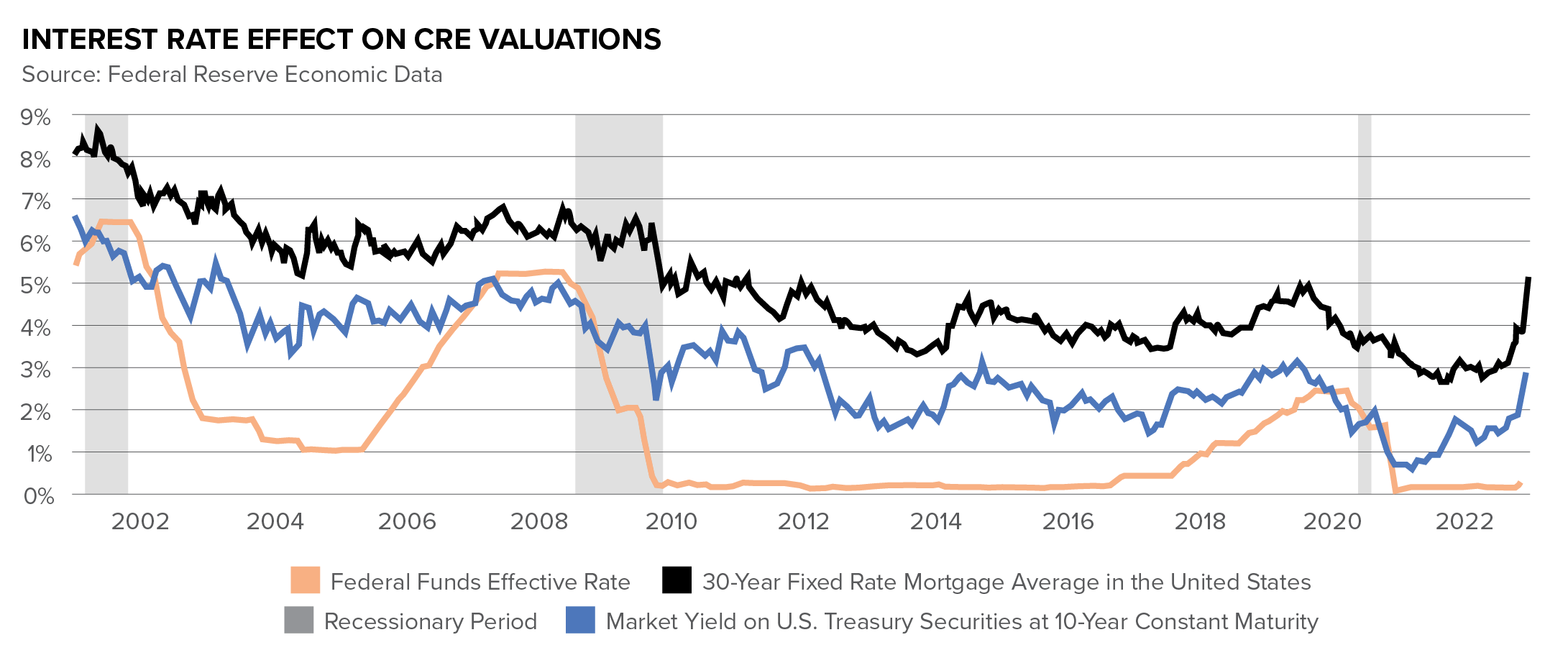

The decision to buy or sell commercial real estate in a down market depends on several factors, including investment goals, risk tolerance, and financial situation. The Fed’s consecutive rate hikes caused debt costs to rise, encouraging owners to tighten their buying criteria and target returns to protect downside risk. In addition, due to increased interest rates, property valuations of commercial assets have decreased as buyers are unwilling to pay the prices they once deemed acceptable in 2021 and early 2022, forcing sellers to reprice. Many REITs believe the first half of the year will remain slow from a transactional standpoint but will pick up in the second half of the year as the bid-ask spread narrows.

Real estate strategies like 1031 Exchanges can be especially profitable in volatile markets because owners can exchange out of a depreciating investment and into a property type that produces higher yields.

Sellers must consider their balance sheets and ensure they are well-positioned to weather a moderate downturn. Furthermore, those that are highly leveraged may be forced to sell due to upcoming debt maturities.

Owners without capital to backfill or redevelop vacant space may decide to sell in the current market.

Despite the sticky market conditions, buyers that have capital to deploy are in search of opportunities at discounted pricing. Additionally, investors looking to diversify their portfolios have negotiation leverage and seek assets located within high-performing markets. In hot real estate markets, sellers are often strictly motivated by profit, expect top-of-the-market pricing, and resist negotiating. Whereas in slowing markets, sellers are motivated more out of necessity to dispose of an investment. The difference in motivation gives the buyer an upper hand, and sellers typically will accept reasonable pricing and are more likely to accept looser terms.

The increasing cost of debt causes hesitation among buyers, but if the market allows, the property can be acquired for a better price under more favorable terms. This is especially true for asset types such as multifamily, healthcare, and industrial, which have all performed well in times of economic stress throughout the past few years. The saying “It’s not timing the market, it’s time in the market” rings true. If an investor plans to hold an investment long-term, the rental income acquired over time will outweigh the heavy short-term costs of interest.

Strategies to Consider

For those looking to capitalize on the current market, there are plenty of strategies to consider.

Look For Value-Add Properties

There are typically more value-add properties available for purchase in a down market. Investors should consider near-term mark-to-market opportunities. By improving the operational efficiency of a building, renovating, or rebranding assets, owners can improve cash flow and increase occupancy, establishing long-term profits.

1031 Exchanges

Property values are declining, making it more difficult for investors to sell their properties for a profit. By using a 1031 Exchange, investors can sell their investments and use the proceeds to purchase higher-yield assets without paying capital gains taxes on the sale. 1031 Exchanges help investors preserve their capital, maintain their purchasing power, and strategically shift portfolios to better align with their long-term goals and objectives.

Of the 50 largest MSAS tracked by Cred IQ, 34 of those markets exhibited comparatively higher levels of distress in commercial real estate loans than one month prior. The average month-over-month increase in distressed rates for these 34 markets was approximately 21 basis points. * As of March 2023

Look For Opportunities in Secondary Markets

While prices may be falling in some areas, there may be secondary markets that are poised for growth. Investors who do their research and identify these areas can purchase properties at lower prices and see their value increase as the market expands. Midwest markets such as Indianapolis and Cincinnati are reporting strong annual multifamily rent growth, hitting 6.6 percent and 6.1 percent, respectively, as of February 2023. Northern New Jersey boasts one of the nation’s strongest retail markets, offering high average income translating to enormous purchasing power. For industrial, Salt Lake City has been gaining popularity, featuring a low vacancy rate of 4.2 percent, a 13.9 percent year-over-year rent growth, and six million square feet under construction.

Focus on Cash Flow

It’s important for investors to focus on cash flow. They should ensure that their investment properties are generating positive cash flow and that they have sufficient reserves to cover any unexpected expenses. Owners should negotiate strong lease terms when signing new tenants to include higher percentage rent increases to match industry averages and inflation.

Consider Creative Financing

Investors should consider alternative financing options such as private lenders, bridge loans, hard money loans, or seller financing. Private lenders are bridge lenders/hard money lenders. An investor can benefit from these loans because they can increase leverage by sizing to a supported proforma rather than in-place operations. While these products are generally higher in pricing, an investor can benefit by appreciating leverage, full-term interest-only payments, and usually non-recourse. Seller financing is another unique method to acquire commercial real estate. Seller financing terms are usually more competitive than what the wider market can provide. However, there is a risk with trusting an asset with a seller that may or may not be credible or reliable. Only consider seller financing if they are institutional in nature or if there is an established relationship. Another interesting method to solving for leverage is exercising mezzanine, preferred, or JV equity participation. The structures of these options vary by product but are generally good to provide 10 to 20 percent of the full capital stack as long as the subject commercial opportunity is in line with the private equity placements’ investment criteria.

Takeaways

If there’s one thing an investor needs to remember in a down market, real estate is cyclical. There will be more robust markets for sellers and stronger markets for buyers, each with its own unique set of opportunities and challenges. The current real estate cycle is set to last 12 to 24 months. Sellers can capitalize by collecting passive income from secure investments or look into different real estate strategies like 1031 Exchanges to shift their portfolios. On the other hand, buyers can capitalize in the down market by evaluating their investment goals, taking advantage of value-add opportunities, and increasing the cash flow of current assets.