Congress Battles as U.S. Hits Debt Ceiling

On Thursday, January 19, U.S. Secretary of the Treasury Janet L. Yellen sent a letter to all members of Congressional leadership stating the U.S. has reached its debt ceiling, prompting the Treasure department to take extraordinary measures to meet obligations without falling into default. Economists say another default presents a huge risk to markets as there’s enough uncertainty for a potential recession.

Measures the Treasury will take include:

- Redeeming existing and suspending new investments in the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund

- Suspending reinvestment of the Government Securities Investment Fund of the Federal Employees Retirement System Thrift Savings Plan

What Is the Debt Ceiling?

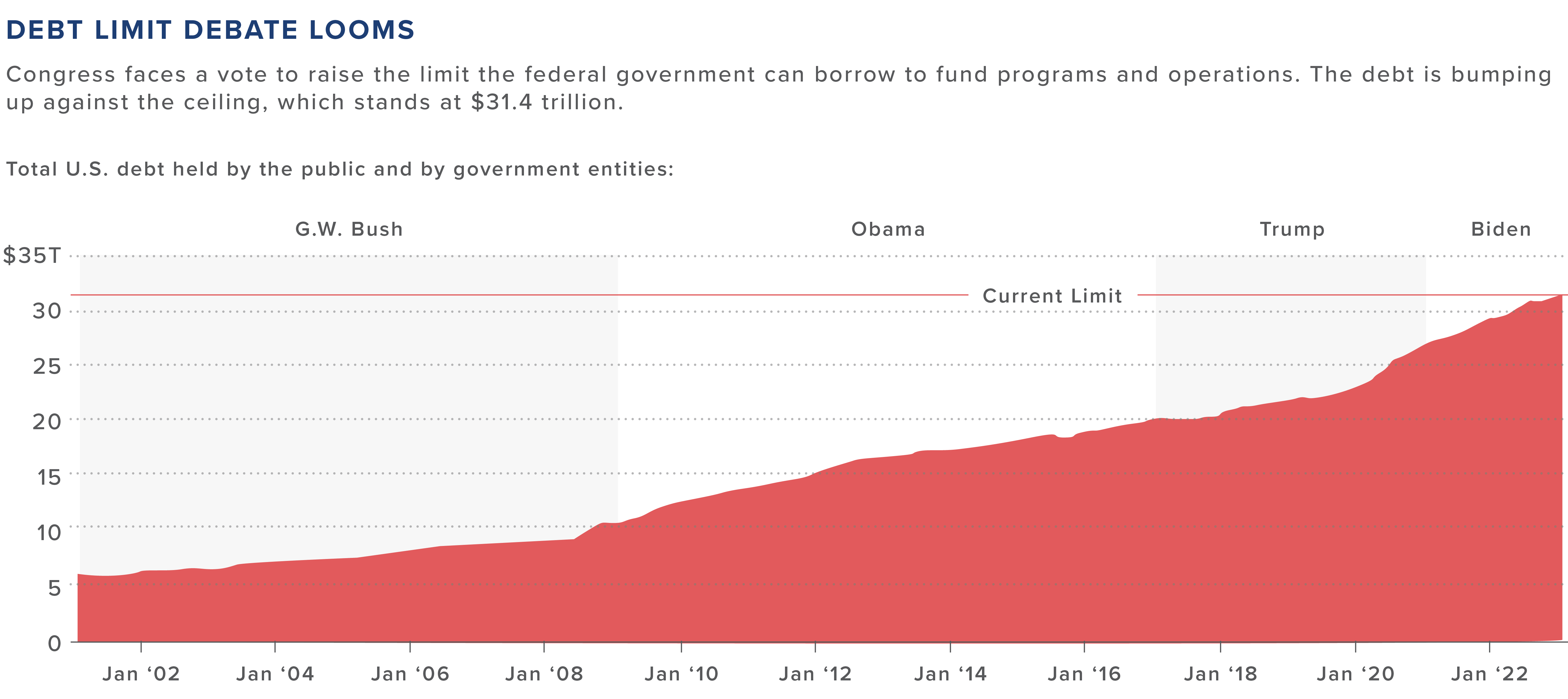

The debt ceiling is the amount of money the U.S. Treasury is authorized to borrow to pay its bills. Those obligations include Social Security and Medicare benefits, tax refunds, military salaries, and interest payments on outstanding national debt.

The milestone of reaching the $31.4 trillion debt cap is a product of decades of tax cuts and increased government spending by both Republicans and Democrats. This could impact finances over the next coming months and cause major ramifications for consumers. Investors are already hedging their bets and pricing in the impending crisis, as the Dow has fallen by 1,000 points over the past two days. The S&P 500 and Nasdaq Composite also dropped significantly, and steeper declines are likely with no solution. During the last major debt ceiling crisis in 2011, the S&P 500 plunged by 15 percent, and sectors with close revenue ties to U.S. government funding, health care and defense dropped by 25 percent.

Impact on Commercial Real Estate

The ongoing issue of debt creates stress for capital markets. A major concern is that without the debt ceiling expansion, the government risks defaulting on its Treasury obligations. A move like this could cause creditors to demand higher interest rates from the U.S. Treasury to provide capital. If this occurs, it could cause subsequent rate increases for other types of debt, including mortgages, consumer borrowing, and business capitalization.

“While the debt ceiling potentially raises issues for the bond market, investors may also become concerned with the level of debt that continues to emerge in the current federal spending environment.”

– Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

Investors Prepare for Potential Default

Past forecasts suggest a default could push the county into a deep recession. As the U.S. already faces high inflation, such a result can cause financial markets to crash, credit markets to freeze, massive job layoffs, and plummeting asset values, including commercial real estate.