A Capital Markets Overview

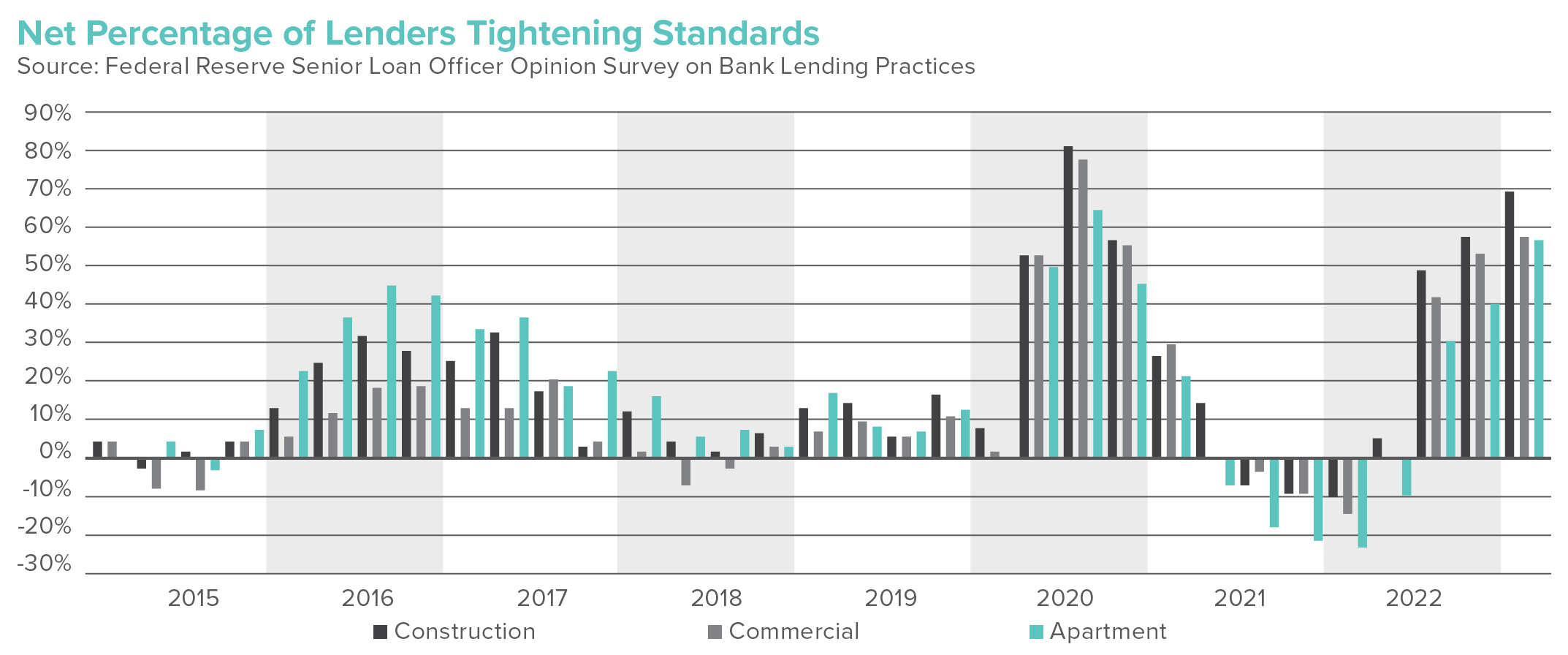

After years of low rates and liquidity, the capital markets sector has entered a constricted lending environment. The rapid increase in the funds rate adjusted the cost and availability of capital as banks tightened their lending standards. In March 2023, major banks declared bankruptcy, with some experts predicting the collapse would cause the Fed to pull back; others insist the Fed will continue increases as previously stated. With so many fluctuating fundamentals and unknown outcomes, how should investors navigate the changing market, and what opportunities lie beneath the surface?

Going Through the Cycle?

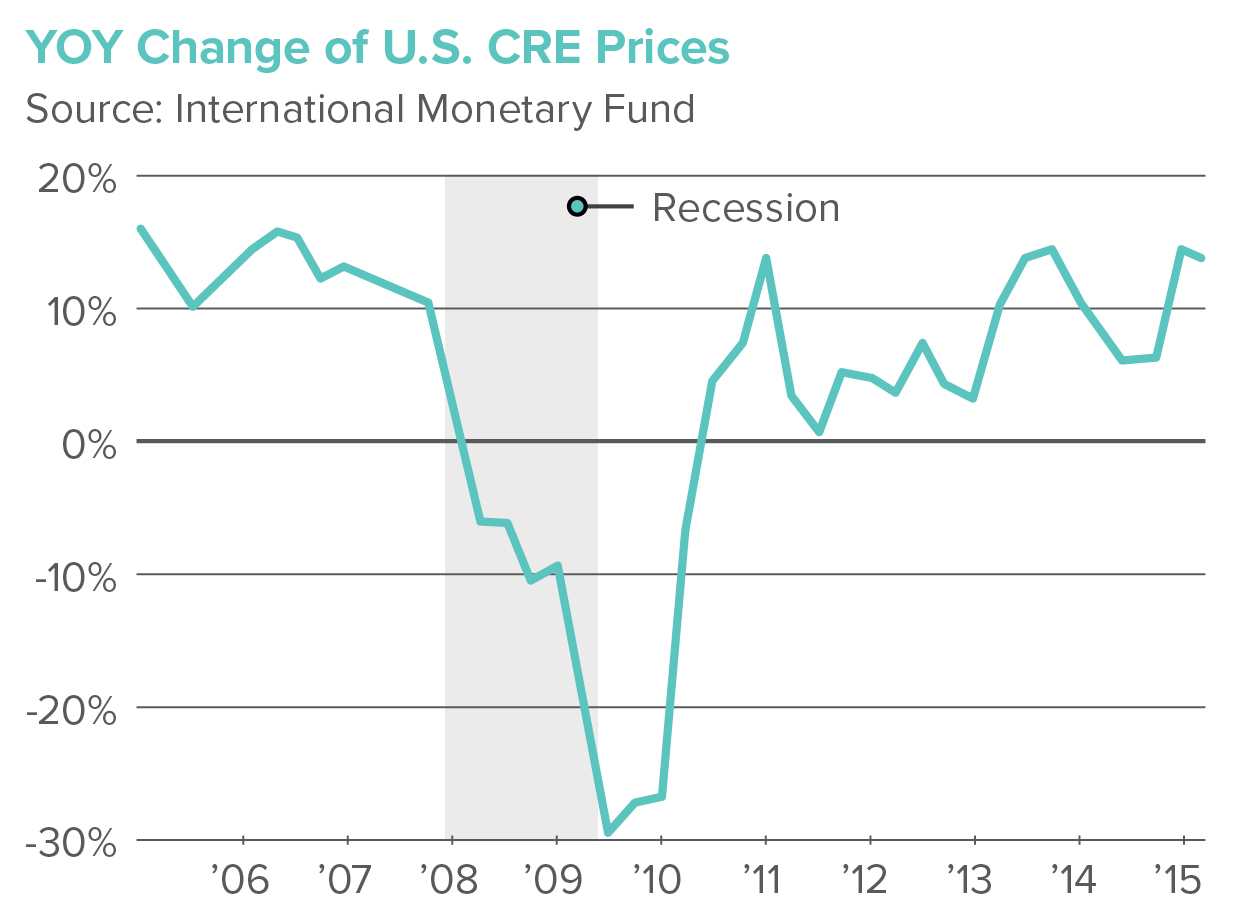

Since the 2008 financial crisis, commercial real estate activity has undergone a number of changes and fluctuations, cycling through the real estate phases seen throughout history — recession, hyper supply, expansion, and recovery.

In the immediate aftermath of the crisis, commercial real estate markets experienced significant property value declines and a sharp reduction in investment activity due to a lack of available financing and liquidity.

However, in the years that followed, the commercial real estate market began to recover, driven in part by lower interest rates to stimulate the economy, which yielded strong economic growth, and increased demand for supply. Investment activity in the commercial real estate market rebounded by 2014, with record levels of capital flowing into the market from both domestic and foreign investors. Commercial real estate expansion also led to increased property values, with many markets seeing significant appreciation in property prices. Between 2014 and 2020, the U.S. was experiencing recovery; it was organic and fundamental — then COVID-19 happened.

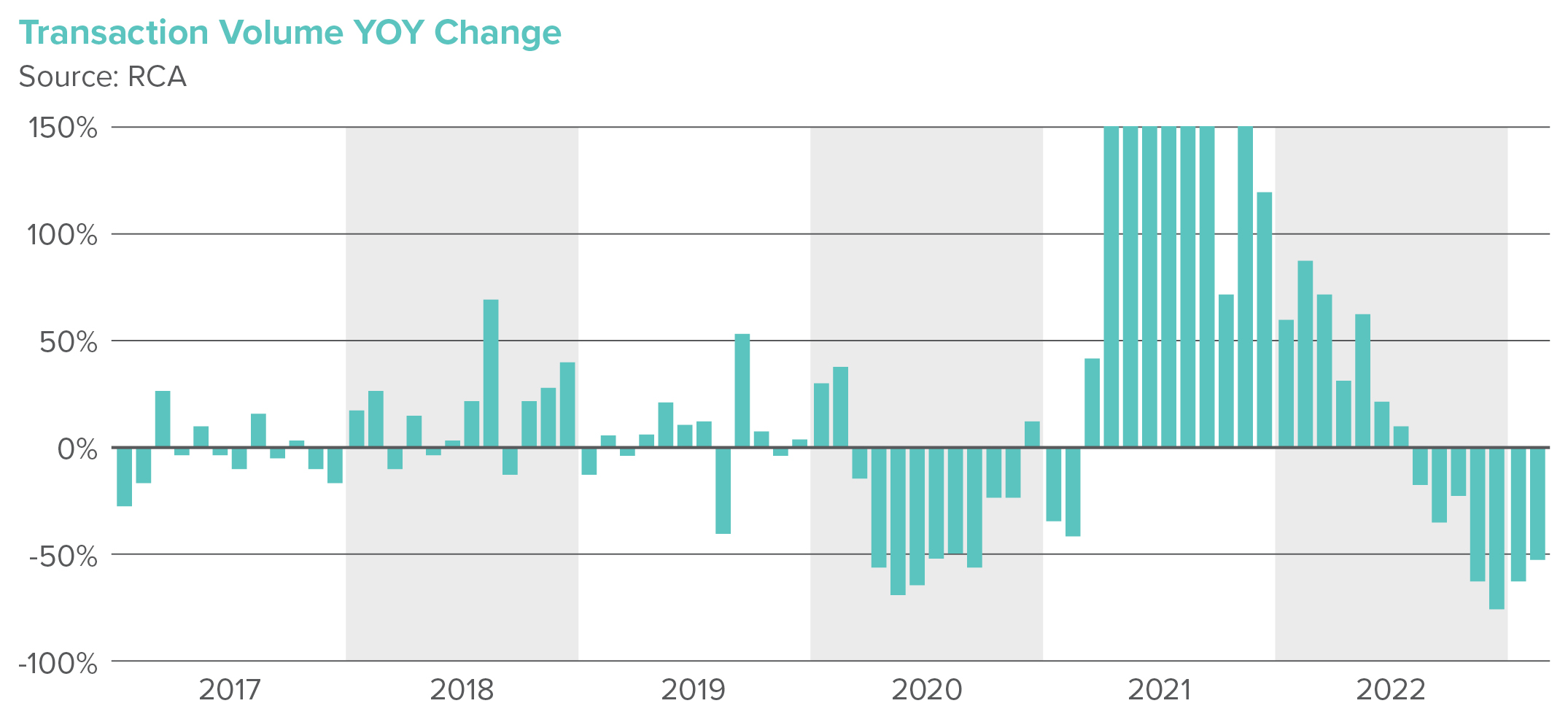

Despite the initial 90 days of lockdown in 2020, which put billions of dollars of transaction pipelines on hold, the U.S. economy’s reaction of cutting rates to zero seemed to be a pragmatic and rational response to inflating the economy while it was in a state of literal lockdown. The lower rates allowed for transaction activity to continue despite higher credit spreads that were attributable to the risk of investing in an uncertain real estate market. The market did not expect these low-rate indexes to catalyze a mass migration of investor funds out of equity markets that were hit hard during the lockdown into more tangible investments like commercial real estate. Almost overnight, it appeared that professionals who had created wealth by investing their salaries into equity markets since 2008 almost cashed out their portfolios and became commercial real estate experts. The novice yet extremely active and motivated investors pooled funds and knowledge together to form groups that turned into national networks.

The Shift of Capital Markets

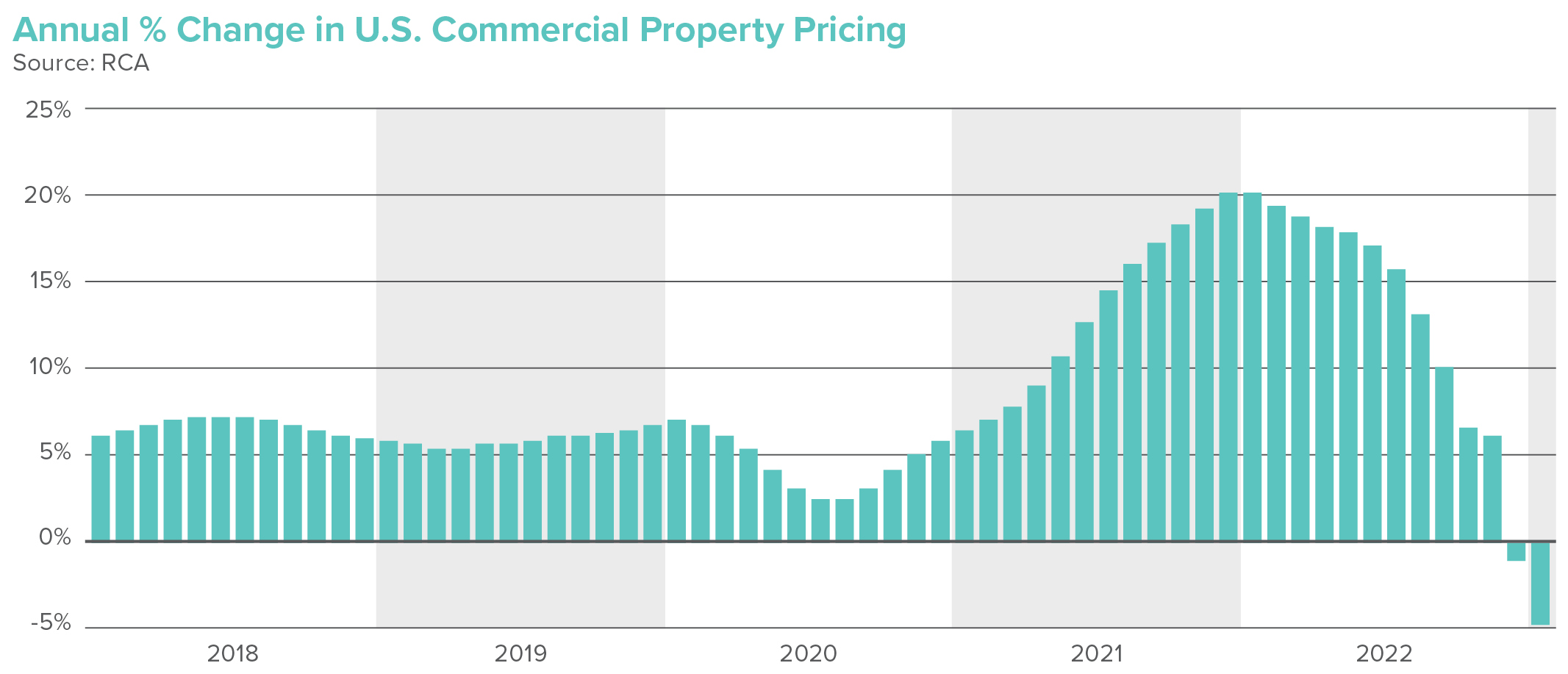

The syndication model is a vital component of the current price correction experienced throughout the market today. Years of low rates, paired with pooled investor capital and $5 billion of treasury funds injected into the general population, allowed for a prolonged period of higher leverage, lower costs of debt, and the ability to grow and achieve higher rents in 2021, and early 2022. In turn, cap rates compressed, and property values increased. Between Q3 2020 and Q2 2022, nearly 50 percent of the nation’s commercial real estate assets traded hands, and many of those assets exchanged hands more than once, sometimes three or four times in six quarters.

Syndicators were not the only ones staying active in this market. Naturally, other players, even institutions, saw dramatic equity increases in their property values as cap rates seemed to compress by 25 basis points every six months as the cost of funds could be as low as 2.50 percent. At some point, the music had to stop, although clearly, nobody wanted to admit it. Over the last two years, many investors’ lives changed forever, and syndicator models established themselves as respected professional networks rather than think-tank forums.

This mass of active investment liquidity, paired with the lowest rate environment witnessed in the U.S. in nearly a decade synthesized the modern day syndication model investors are familiar with.

The Next Phase

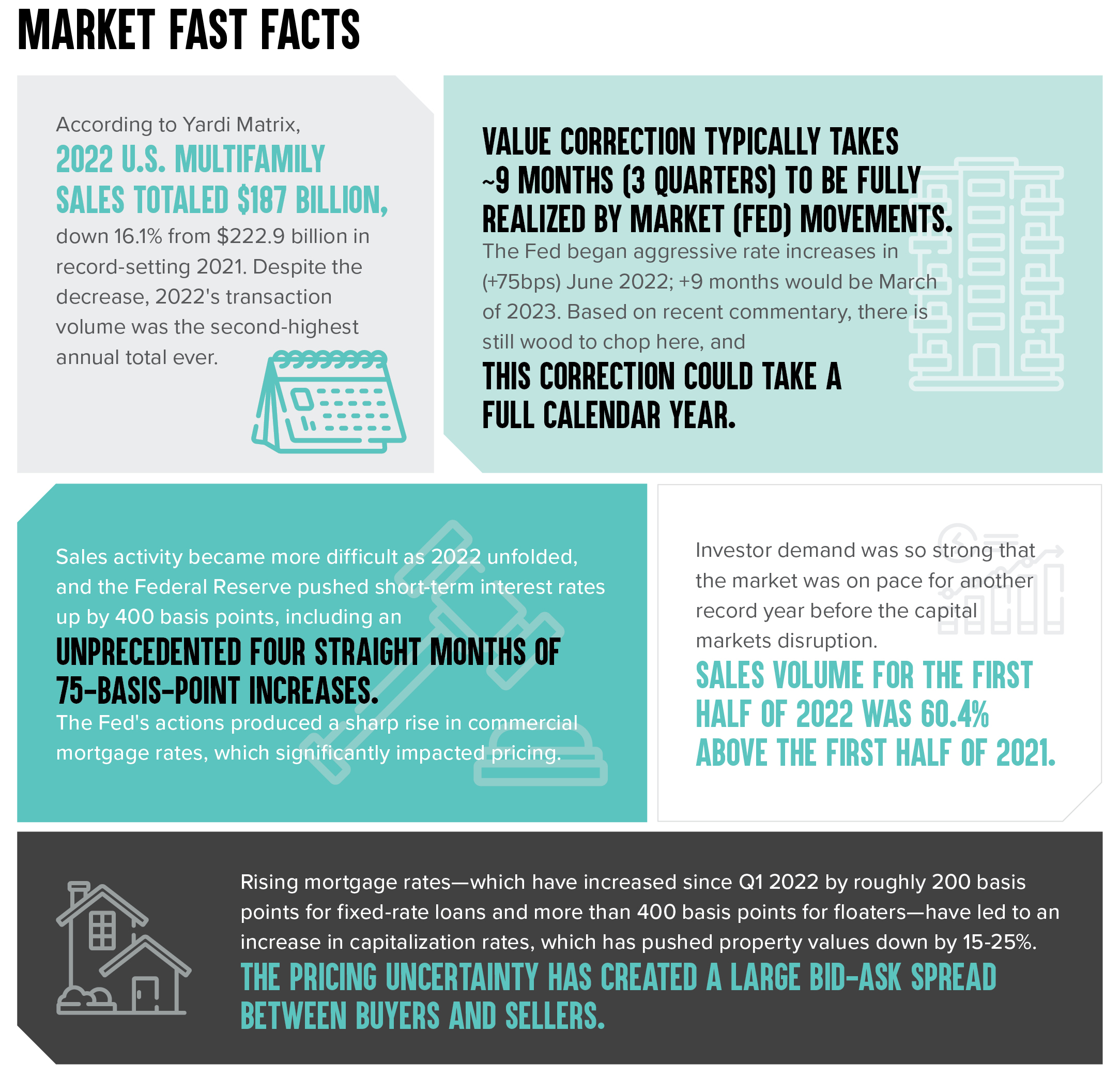

Welcome to the Summer of 2022! In reaction to inflation soaring up to over nine percent, a rate not seen in decades and admittedly fueled primarily by the surge in housing costs – the Federal Government moved to increase rates over time and manipulate the market to stop it in its tracks aggressively. The question now is, has this been successful? Did the Federal Reserve step up to save the American economy from its greed and ultimately create an unfixable bubble, or did it attempt to muffle a white-hot U.S. economy and potentially a new golden era of the United States? It’s unfortunate that the definition of inflation is integral to raising property values, which increases the cost of capital and creates downward pressure on rent growth, all of which is occurring in today’s market.

The recent economic activity is pressuring people to compare today’s market to the 2008 housing bubble, but no bubble has been found. The U.S. is in a housing undersupply period met by the high demand of an increased population. The increased values witnessed seem to be in perfect flux with the laws of supply and demand. Despite this, the U.S. economy has increased the federal funds rate by 525 basis points since March 2022.

How to Navigate 2023

The facts shown state the market is experiencing more of an inconvenient grounding than a longstanding depression. 2023 is expected to be a successful year if the Fed discontinues rapid increases at the correct time.

Advice from a Capital Markets Expert – Clark Finney

-

Stick with what you know.

Invest in the markets and relationships you know and have confidence in. While working with a neighborhood and legacy lender is preferred, many banks are in a liquidity crunch. Their required ratios of deposits/loans outstanding are currently upside down due to the roaring activity in the last two years. Many investors withdrew deposit funds to invest and used loans as a vehicle to execute; many bank lenders are in a period where they cannot originate as much as preferred.

-

Follow the capital.

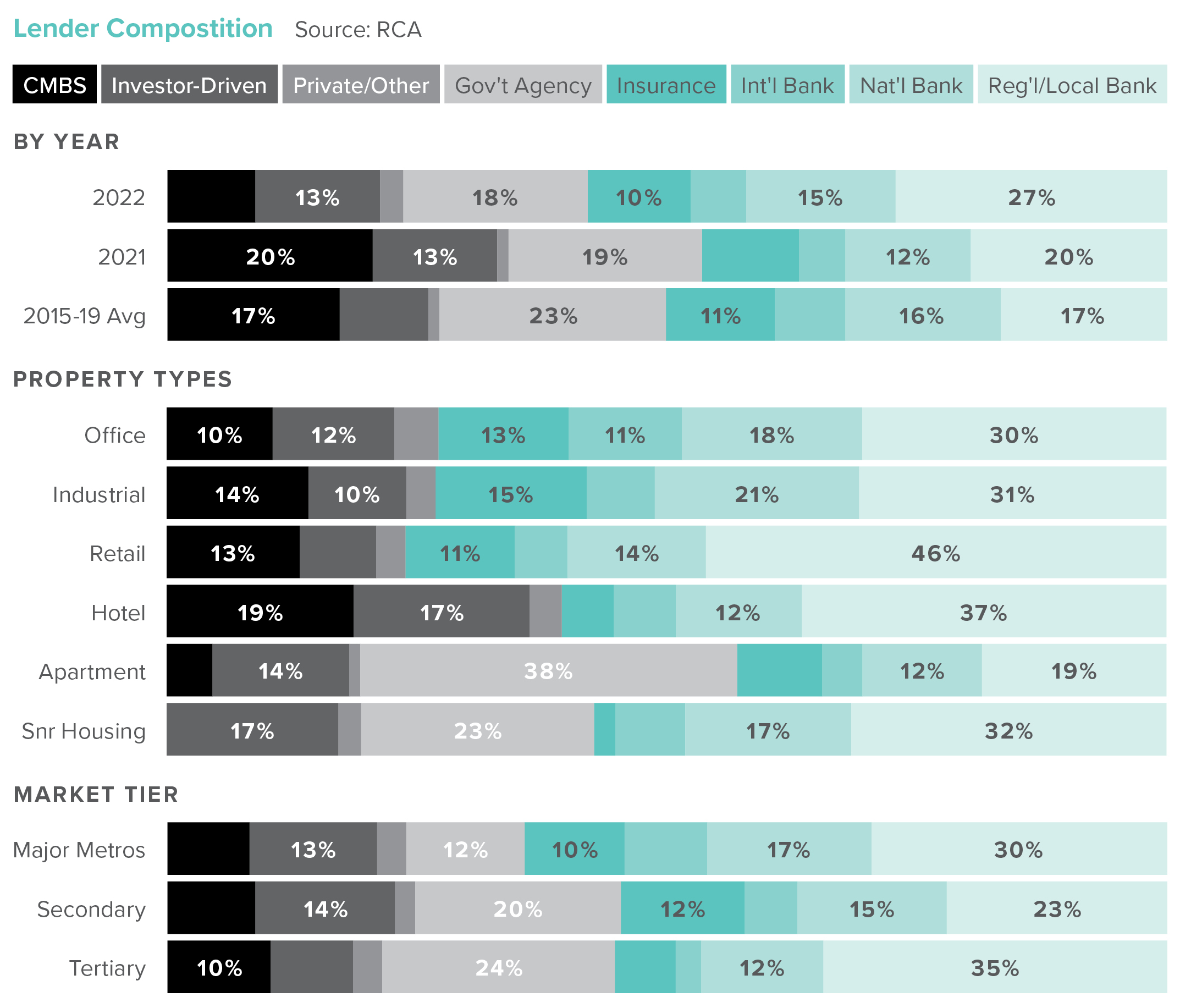

What are the major institutional investment funds doing? Where are they investing? How are they investing? What financing products are they using to invest? For example, many groups that used bridge financing to acquire value-add assets are now straying away from floating rate products citing the increased costs of cap rate purchases. Instead, they are structuring the capital stack with a blended rate of fixed agency and mezzanine financing to solve for cheaper and safer leverage.

-

Keep negative leverage and its effect on your returns in check.

Negative leverage is the relationship between your cost of capital and purchase cap rate. This ratio is integral to quickly assess investment opportunities and find yield in a higher interest rate environment. You want your purchase cap rate to be higher than your interest, based on the fact that your purchase cap rate is often a way to determine the return of your investment.

-

Stay active and understand that time kills deals in a volatile environment.

Be cognizant of your rate lock expirations and the spread risk during a closing process. The market movement within a few days could add 50+ basis points to your rate, even affecting your final proceeds. Do not wait and stay idle once you are under application.

-

Keep the focus on the small items before they become large problems.

Is the American Land Title Association survey current and approved by the title? Have you engaged your insurance broker to begin their respective quoting process? Have you created your LLC yet? Does the lender/title require a zoning report? If engaged too late in the process, all of these items can take up to two to three weeks to deliver and could potentially delay your transaction and provide problems.

-

Focus on key dates for economic reports and meetings.

They will have a dynamic effect on the market, and they could have an impact on your real estate investment.

Takeaways

In all, the economy’s foundation is looking strong, despite the current recessionary period. Prices are receiving pressure based on the increased cost of capital rather than an oversaturation of supply paired with a lack of demand. Yes, rents and the prospect of rent growth face downward pressure, but market vacancies are still stabilized in significant markets. Lender rates will continue to increase through the majority of 2023. During this time, many investors create generational wealth even with a higher cost of capital. This wealth was created by understanding that some capital events are short-term solutions to long-term investments and acquiring assets in solid markets at a competitive cost basis.