Why Los Angeles Multifamily is Still a Top Investment Pick

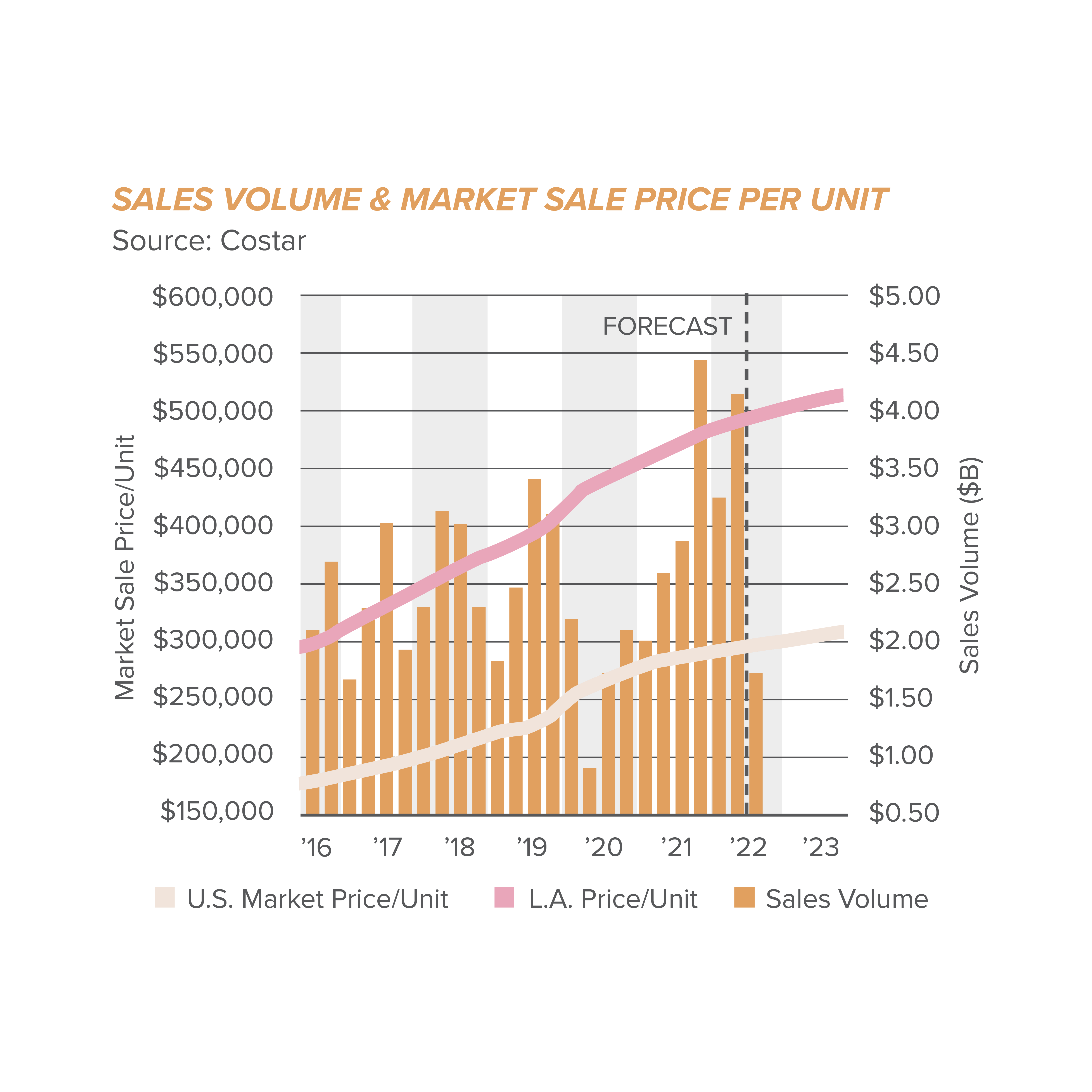

Los Angeles has been painted in a bad light for a couple of years – from the eviction moratorium to continuous COVID-19 restrictions, homelessness issues, development costs, California exodus, and more recently, the “Mansion Tax“, the market has received its fair share of bad press. Despite the news, Los Angeles continues to attract investors seeking opportunities. To illustrate this, the Los Angeles multifamily market achieved $14.4 billion in sales in the last 12 months; this compares to $3.7 billion in Austin, $4.6 billion in San Diego, and $5.4 billion in Las Vegas. The most comparable market is Phoenix which recorded a whopping $16.9 billion in sales over the last 12-month period, but the vacancy rate stands at 7.9 percent, compared to Los Angeles’ 3.4 percent.

Here are five fundamentals that drive the Los Angeles multifamily market and why it is still a top market to invest capital in.

1. Renter Demand is Present, and Investors are Chasing this Demand

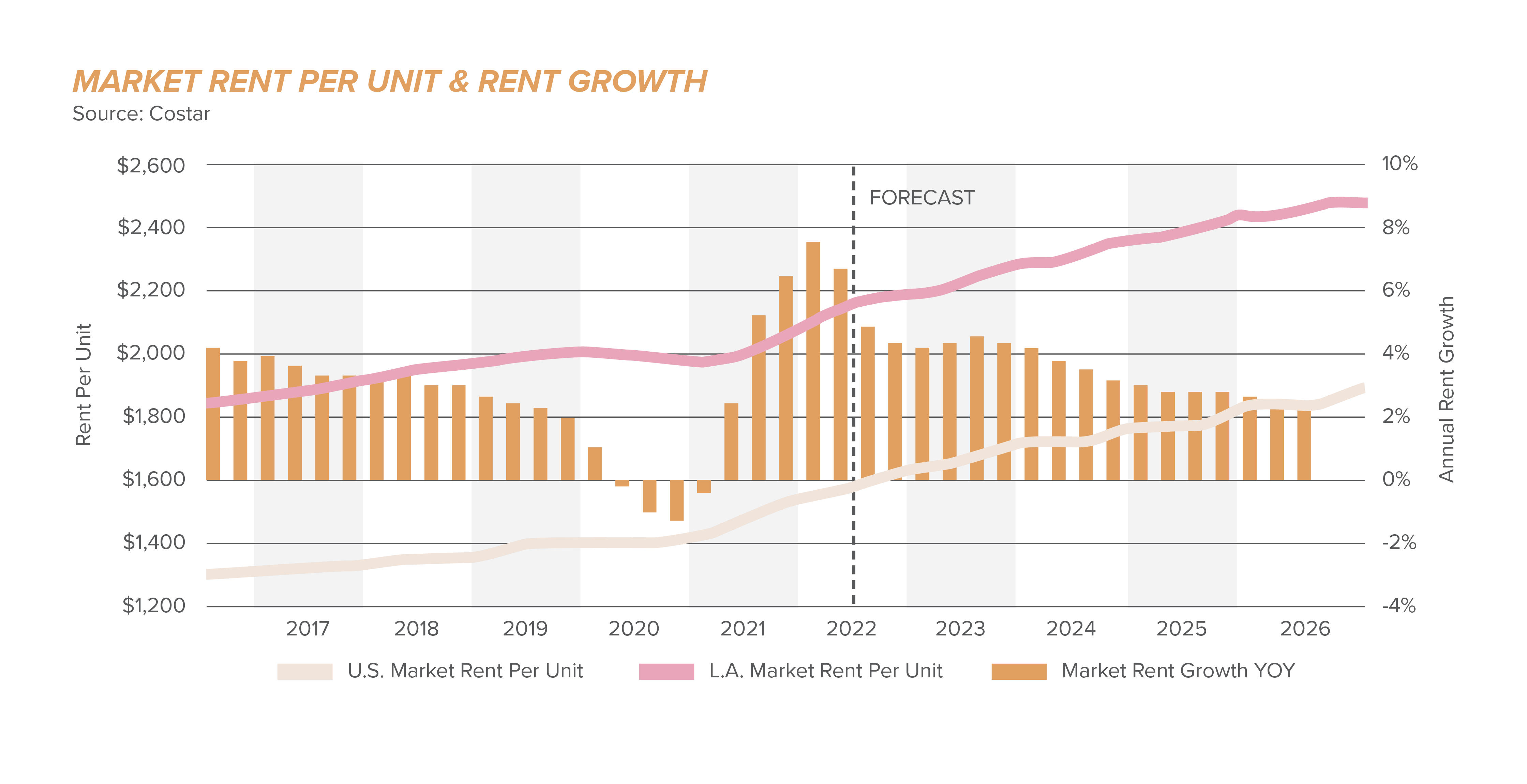

According to Zillow, home buyers are being priced out of the housing market as prices reach, on average, $991,551 (seasonally adjusted and includes only middle-tier priced homes), an 11.8 percent year-over-year increase. This price range is out of the question for many households, resulting in the dependence on multifamily for housing needs. The average asking rent per unit in Los Angeles is $2,187, with an average rent growth of 5.4 percent, and as costly as it is, renting in Los Angeles is still a more accessible option than buying a home in the current market.

Los Angeles’ 2022 reality strongly favors the renter, and investors and landlords know this. According to the 2019 U.S. Census Survey, 54.58 percent of households were renters. That percentage has now increased to 62.20 percent, according to Claritas data. These data points help landlords enact aggressive rent hikes amid a hot real estate market. Although some cities in the Los Angeles metro are rent-controlled, Los Angeles, Santa Monica, Beverly Hills, and West Hollywood, other nearby cities such as Glendale, Burbank, Torrance, Pasadena, and Downey are not. Rent control laws vary by municipality, and generally put a limit on annual rent increases and protect tenants from eviction without cause.

Key points to know for rent-controlled units specific to the City of Los Angeles

- Los Angeles rents are subject to a lower rent cap (8% maximum) than rent-controlled buildings in other parts of the state under most circumstances (5% plus up to 5% inflation).

- Landlords can only raise the rent once every 12 months.

- When the rent increases, the landlord can raise the security deposit by the same amount.

- For every additional tenant (a roommate not on the original lease, for example) that moves in, the landlord can raise the rent 10%. The same amount must be reduced if the tenant moves out.

- The rent can be increased by 1% each year for utilities that the landlord pays.

- At least 30 days’ notice is required for rent increases.

- For “no-fault” evictions (where the tenant did nothing wrong), the landlord must notify the city and pay a relocation assistance payment that varies from $8,500 to $21,200 based on the tenant’s income, length of tenancy, and reason for eviction.

Buildings that are rent controlled have very minimal tenant turnover; although an average rent-controlled tenant pays approximately $3,240 less per year than the average renters’ market rates, vacancy rates are healthy. As such, rent-controlled apartments are often hard to come by for the traditional renter.

As of September 2022, eviction bans, and moratoriums are still in effect within the City of Los Angeles until the COVID-19 emergency period ends. However, it is unclear when that will happen. Once current bans are lifted, though, there will still be restrictions. Landlords may only evict a tenant who fails to make rent payments in the months after the emergency period ends. Compared to New York City, once the city lifted COVID-19 restrictions, rents increased by 15 percent, and it’s anticipated that the same thing will happen in Los Angeles.

2. Is Gen Z Making Los Angeles Trendy?

Sunny weather, expansive mountains and beaches, and an endless trove of career opportunities have always drawn young people to Los Angeles. But members of Gen Z are claiming a growing share of apartments in California compared to other generations. They represent more than one-quarter of active renters in Los Angeles. Many of them seek to live out their Hollywood dreams. In fact, 30 percent of Los Angeles Gen Zers are drawn to online fame. Resources also say that Los Angeles is one of the healthiest cities in America in terms of lifestyle. After two years of a pandemic-related stint in health, Gen Z has made healthy living a top priority, making Los Angeles a prime city for the health-conscious generation.

The roughly 67 million Americans born between 1997 and 2012 just entering the workforce, starting college, or graduating high school – have impacted the market. Experts have predicted that Gen Z will become the economy’s main drivers for budding entrepreneurs, advocates, artists, and tech experts. It’s fair to say the cities to which Gen Z flock will benefit not only from the influx of new residents but also set that city up for long-term success.

A study conducted by Sunclet.com, owned by NestPick Inc, ranked 110 global cities based on 22 indicators spanning four major categories: digital, principles, leisure, and business. Los Angeles was ranked first due to meeting the following needs – government digitization, access to healthcare, right to protest, LGBTQ+ equality, and internationalism. The influence of this generation is vast. According to Rent Café, the year-over-year change in the share of Gen Z renters in Los Angeles was a positive 45 percent between 2020 and 2021.

3. Limited Buildable Land

The biggest Achilles heel for Los Angeles is land availability and, thus, the housing shortage. With the ocean on one side, the desert on the other, and steep hills in between, there isn’t a lot of land left to develop. The land is more valuable than any other market in the United States and is therefore priced at a premium. As of 2021, Los Angeles is ranked as the third hottest market for increasing land values. Even small parcels of land in Los Angeles nowadays cost a pretty penny, according to a recent Realtor.com report which analyzed how underdeveloped property prices have risen since the onset of COVID-19.

In Los Angeles, the average price-per-square-foot soared 67 percent year-over-year, most notably in the city’s outer regions, which were once considered relatively affordable. The current price per square foot of a multifamily building in Los Angeles is $457.42. Faced with a severe housing shortage and geography challenges, land value in Los Angeles isn’t expected to fall. Land costs account for nearly 17 percent of a multifamily development, compared to two percent in other markets. As Mark Twain once said, “buy land; they’re not making it anymore.”

Despite these obstacles, the development pipeline in Los Angeles is robust as developers target infill locations and redevelopment opportunities. The percentage of properties under construction represents 2.6 percent of existing inventory as of September 2022. Looking at construction levels, Downtown Los Angeles, Burbank, Greater Inglewood, and Woodland Hills have the most apartment units under construction. Multifamily construction projects are typically Class A properties as they are the only developments that pencil out in current market conditions. Developers find it increasingly hard to build in Los Angeles due to high costs of land, expensive rent, the ongoing threat of rent control, eviction moratoriums, local zoning ordinances and restrictions, and difficulty acquiring permits, labor, and materials.

The lack of adequate land has led to the chronic housing shortage, and investors are drawn to the increasingly valuable opportunities in the market.

4. High population, High Income, and High Desirability

Approximately four million people call Los Angeles home, making it the second-largest city in the United States. When adding together the small surrounding cities that makeup Los Angeles County, the urban area totals more than ten million people. Approximately five million people (62.2 percent of LA residents) identify as renters in the Los Angeles multifamily market. Coupled with the large renter pool, the gentrifying neighborhoods, value-add deals, and asset appreciation have helped Los Angeles keep a steady stream of investment opportunities for years.

“Los Angeles is an enormous world-famous city, 10 times the size of a traditional city, and that concentration of economic opportunity, industry, and activity mean the land comes with a significant cost premium,” – Hoyu Chong, lead researcher for the UCR School of Business Center for Economic Forecasting and Development.

The good news, Los Angeles has one of the highest-ranking average and median incomes in the United States. The average household income in Los Angeles is $101,066, a positive 4.8 percent year-over-year change, and the median household income is $65,290, a positive 5.1 percent year-over-year change. Despite reports of a departure from California and population decline in the metro, apartment rental demand is seeing an all-time high, with net absorption of units running at its highest level in decades. The vacancy is at a low of 3.4 percent, lower than the pre-COVID-19 level of 4.4 percent. Fortunately, Los Angeles is a lifestyle metro that has lured more higher wage earners than it has lost over the last few years.

5. Resilience is King

Cities like Los Angeles have a history of overcoming various challenges and reinventing themselves, so the market contains some of the country’s best and safest rental properties. The demand for apartments has translated to strong recent price appreciation in 2022. The average market pricing records $420,00 per unit, well above the national average of $260,000 per unit. The average market cap rate is 3.9 percent, well below the U.S. average of 5.0 percent.

A multifamily seller in 2021 and 2022 witnessed resale values of value-add deals multiply in some cases after a short three-to-five-year hold period. Investors in Los Angeles are willing to stomach some of the highest prices in the nation to take advantage of the low cap rates and price appreciation. Key drivers of the market’s elevated prices include the metro’s position as the second-largest metro in the nation, diverse economic drivers, land-constrained coastal location, and of course, the market’s resilience to challenges.

It’s advised not to wait for prices to drop as they did in 2008 and 2009. If the past indicates where Los Angeles multifamily is heading, invest in the market now before interest rates and inflation take their toll.

These five fundamentals highlight the opportunity available for multifamily performance in Los Angeles. Although investors are seen exiting the market and moving capital to markets such as Arizona and Texas. The reasons mainly include regulatory and legislative challenges – investors aren’t exiting Los Angeles due to better returns and opportunities. From rent control policies restricting price appreciation to the recent eviction moratorium that prevents landlords from rectifying unpaid rent and continues COVID-19 protocols, apartment owners feel they have few options to improve their investment positions in California. However, buyers are still purchasing in Los Angeles due to the wealth preservation and limited land availability, giving investors an advantage.