How has the self-storage industry in a post-lockdown world become one of the most desirable asset classes of commercial real estate? Disruptions in housing, elevated migration, lifestyle changes, and office space shifts caused by the global pandemic created a surge in self-storage demand, with institutional investors, private equity firms, and private buyers all taking notice. Once considered an oversaturated market, the self-storage industry is performing better than it has in prior years. With supply-demand fundamentals balancing in most markets, there has been a significant increase in capital chasing these assets. In this article, Matthews™ will outline the current condition of the self-storage market and what to expect from the niche commercial real estate product post-pandemic.

Historic Gains for Self-Storage

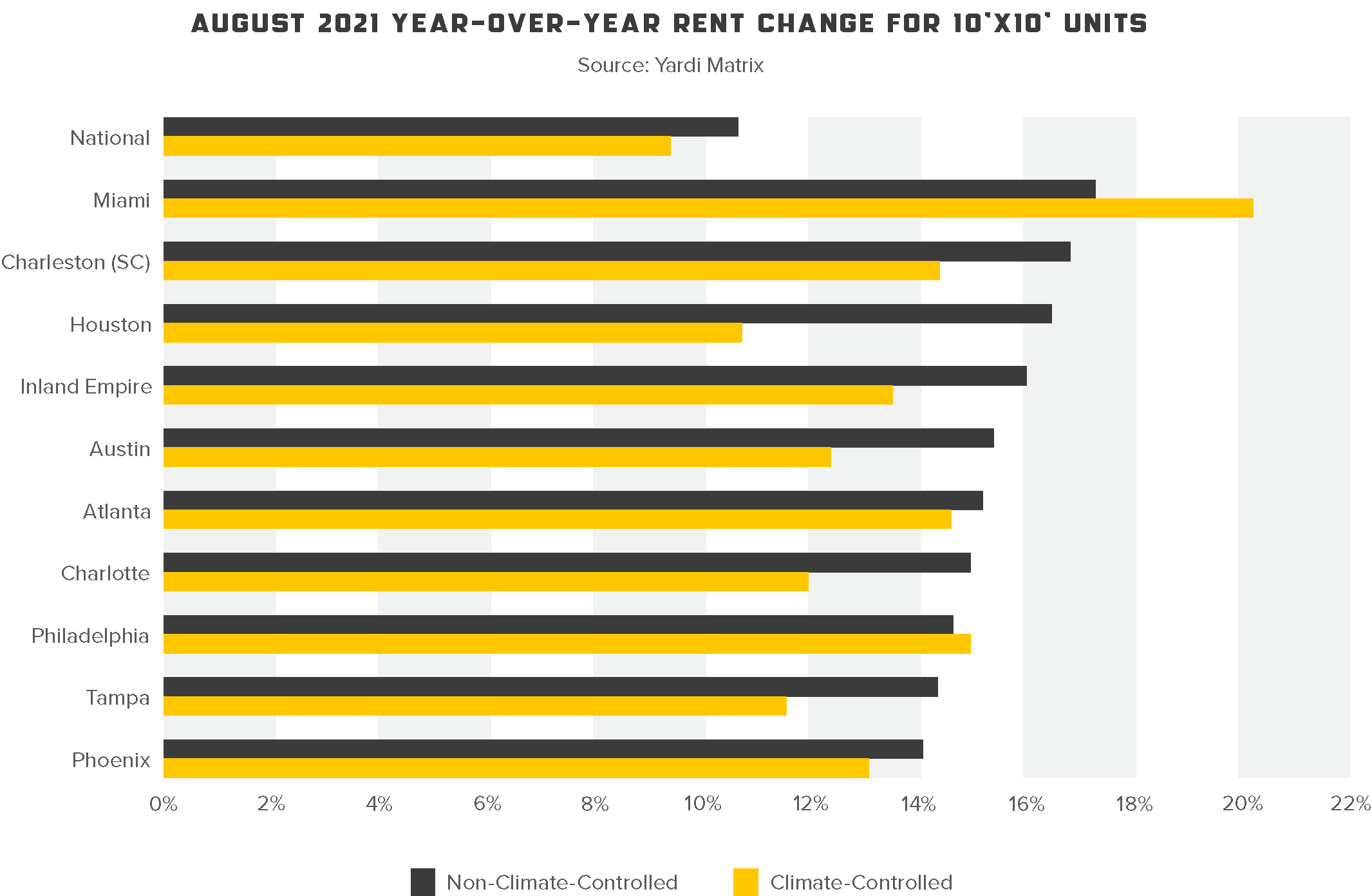

Although self-storage rents took a hit at the start of the pandemic, they returned to normal levels at the beginning of Summer 2020. The positive trajectory continued into the first half of 2021 and beyond, with August reporting some of the best annual rental rate performance in history. As of August 2021, 10×10 non-climate-controlled units averaged $128 per month, the highest for that unit size since 2016, according to Yardi Matrix, while climate-controlled units averaged $146 per month. These historically high rental rates caused a 10.6 percent average year-over-year rent change for climate-controlled units and a 9.4 percent change for non-climate-controlled units. Miami was the hottest market for self-storage rental rates, reporting a staggering 20.2 percent year-over-year increase for non-climate-controlled units and 17.2 percent for climate-controlled units. Charleston, SC, Houston, TX, and the Inland Empire, CA also topped the list.

The increase in demand stems from evolving consumer habits accelerated by the onset of COVID-19. As people began to work from home and were no longer tied to a physical office, they moved to more suburban areas or different states. While migration increased, so did the need for renters or homeowners to store their belongings while they waited to find a new residence. The work from home trend also created the need for more space, as workers looked to compose a home office with limited square footage. This incentivized people to find storage facilities for excess furniture or decor in order to make room for office equipment.

In addition to residential shifts caused by nationwide lockdowns, the disruptions faced by retail and restaurant spaces forced small businesses to reconfigure their storefronts. Owners and operators looked to self-storage to house the business’ belongings until safety regulations were lifted.

The need for storage increased occupancy rates, which in turn led to increased rental rates – yielding higher returns for investors. As a result, investors began to show more interest in the self-storage market with the potential for large gains in a secure asset class. Capital began flowing in from institutional investment companies, private equity funds, as well as local and regional investors, which created a level of competition never seen before. This demand led to significant cap rate compression for Class A facilities located in primary markets, all the way to Class C facilities in tertiary markets.

Building to Meet Demand

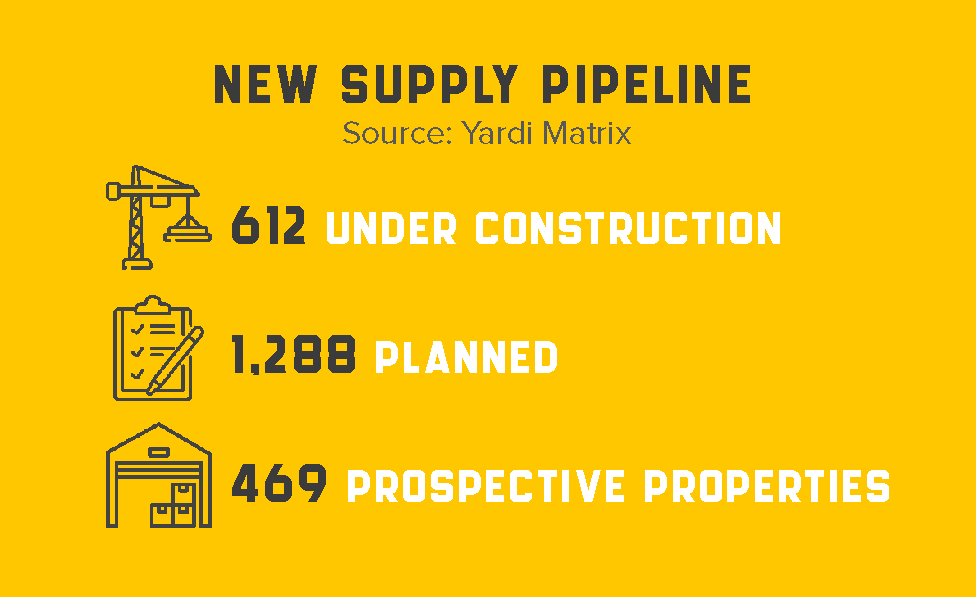

After three years of record completions and many markets being considered over-supplied, the development pipeline slowed in 2020. This pattern began to regress at the start of 2021, into the first half of the year, and beyond. According to Yardi Matrix, August 2021 saw 8.6 percent of self-storage properties nationwide under construction or in the planning stage. This marked a 20 basis point increase from July 2021. In total, Yardi Matrix reported 2,369 properties in various stages of development.

Among top markets, Columbus, OH saw the most growth in development, witnessing a one percent month-over-month increase. Although developing at a rapid monthly rate, Columbus is not listed as a top ten metro for the total number of self-storage facilities under construction or planned in the U.S. Building activity is often correlated to the in-migration and out-migration of markets. For example, New York reported a loss of over 333,000 residents at the start of the pandemic, according to CBS New York. The need to move from the large metro quickly sparked many residents’ need to store their possessions, resulting in high demand for storage space around the city. On the contrary, Las Vegas needs more self-storage supply for those moving into the state. The Nevada metro saw a population increase of 2.2 percent in 2020 and is expected to grow by 40 percent in the next four decades, according to the Center for Biologics Evaluation and Research.

Will Self-Storage Continue to Thrive?

With increased interest and the potential for elevated returns, new institutional investors are entering the market. The effect these buyers will have on the industry has yet to be fully seen as small owners and operators still dominate the sector in terms of ownership percentages. However, as more investors enter the market, the amount of competition to acquire these facilities will continue to increase, which could negatively impact small owners’ buying power.

Similar to other commercial real estate property types, self-storage owners and property managers will have to adjust standard practices to match consumer expectations. By living vicariously through their digital devices, consumers will be more apt to rent a storage unit from facilities that offer modern technology, like a mobile app they can use to lock and unlock the unit remotely or video surveillance. With supply levels and rents stabilizing, the self-storage industry is poised for strong performance and growth in 2022. The sector is predicted to see continued transaction activity and development, as a large influx of people enter markets across the top ten U.S. metros. Lastly, with interest rates at historic lows, cap rates should remain compressed, if not compress even more, due to an increased amount of capital chasing all kinds of storage opportunities.