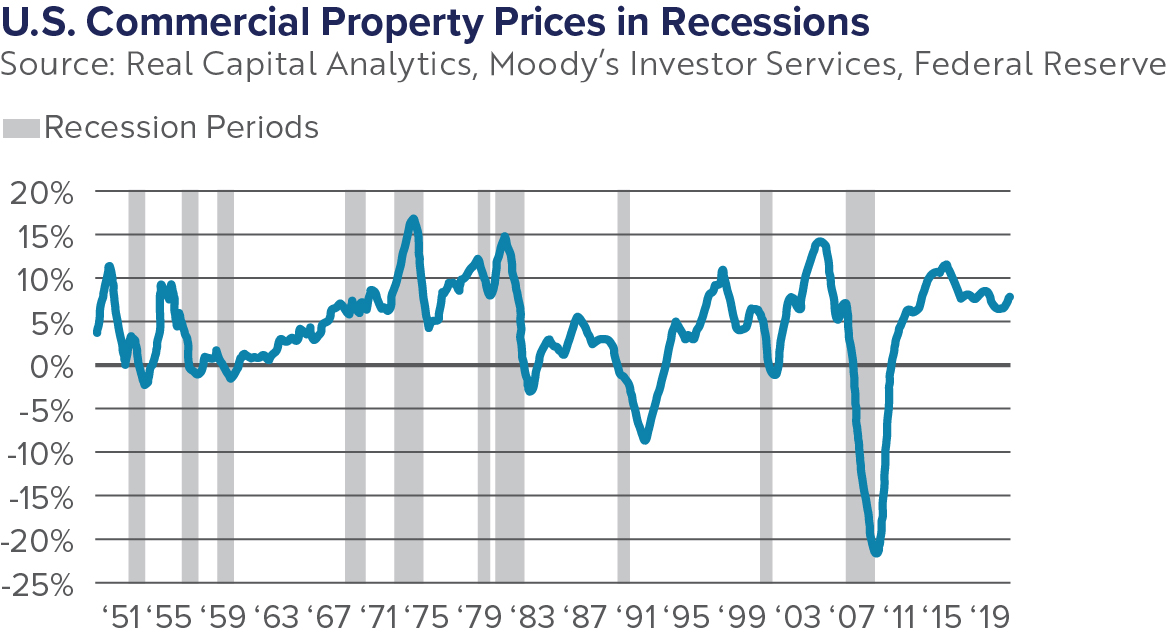

The coronavirus pandemic has upended the commercial real estate economic outlook for 2020 with mass layoffs, decreases in consumption, and a downturn in economic activity. This unique and unprecedented period has the potential for 18 months of disruption, and many leading financial institutions predict a recession. Although many like to compare today’s economic troubles to the financial crisis in 2008, the downturn we are currently facing as a result of a global pandemic is fundamentally different. It is important to note that the health of the market going into this global health crisis was great, and CRE deal activity was strong. This report will compare and contrast the current health crisis to past recessions, with a focus on commercial real estate impacts.

The CRE Outlook—What lessons did we learn from the Great Recession?

The Great Recession was a worldwide phenomenon and the most significant global downturn since the Great Depression. It lasted from December 2007 to June 2009, and the economic contraction resulted in declined U.S. spending for two years. More than ten years later, the COVID-19 pandemic has spread around the world, and the U.S. faces what looks to be another downturn.

Unemployment claims have skyrocketed, and it is uncertain how long this period of reduced economic activity is going to last. Promoting financial stability post-2008 has left the market in better shape to endure this downturn. Banks today have a lot more capital, and the Federal Reserve and other financial regulators have quickly adapted to ensure that credit markets can function smoothly. With available liquidity, low interest rates, the CARES Act, and additional funding have provided the commercial real estate industry with tools to weather the storm.

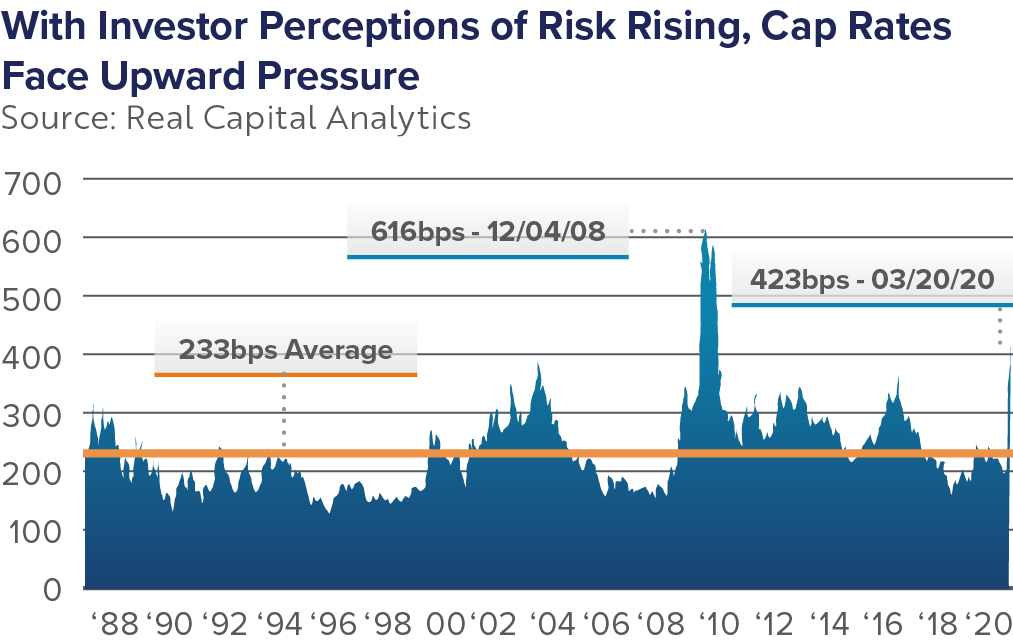

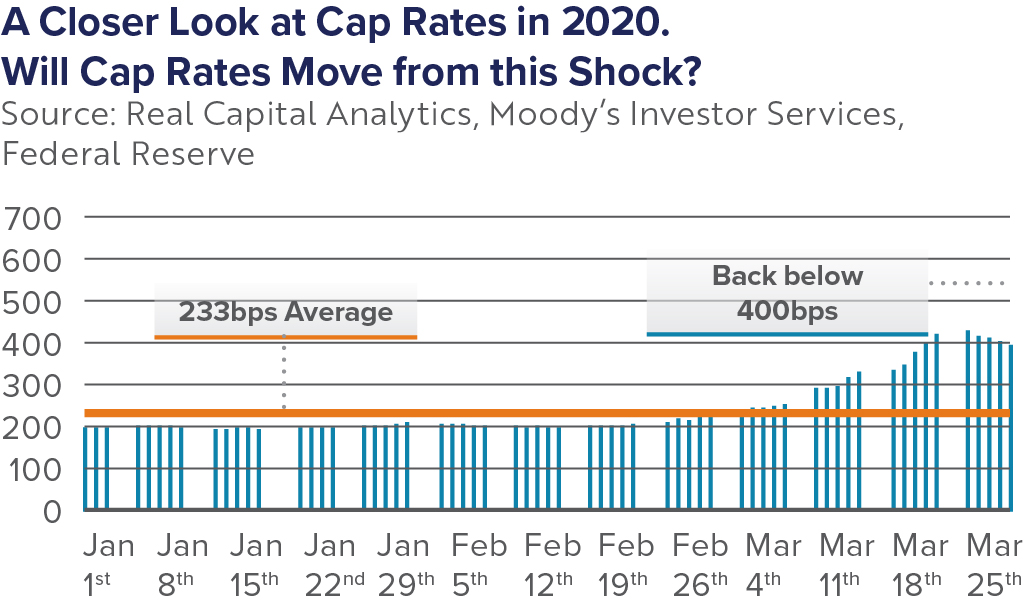

Despite a range of challenges across different industries, investors in commercial real estate are still actively engaged and trying to get deals done, especially in markets and industries that are built to perform under economic pressure. However, CRE isn’t immune from the fallout. Cap rates are facing upward pressure as investor risk perceptions rise, and sectors, such as non-essential retail and hospitality, will unsurprisingly take the brunt of the fallout due to social-distancing orders.

On the other end of the spectrum, the multifamily sector will be less affected as they are considered recession-proof. The downturn is expected to be a lot shorter and shallower than 2008 and is expected to be more V-shaped, showcasing negative growth for a quarter or two, followed by a period of strong growth.

Here’s a look at Present & Past Performance of Top CRE Sectors

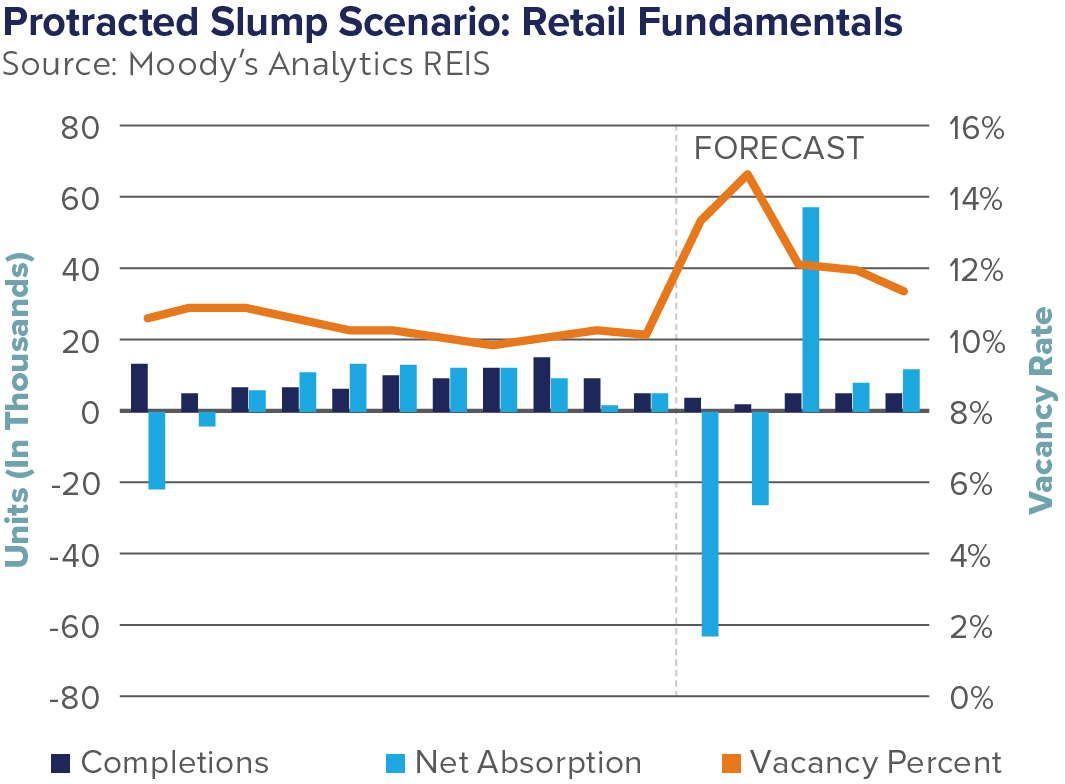

Retail

Although consumption has been pulled away as a result of many retail locations closing, consumers today still have money to spend when compared to previous recession. Markets such as Las Vegas and Austin, which built more retail supply since the last recession, will see rents decline more drastically as tourism and suburban shoppers pull back. The decline in rents, however, is a result of oversupply, not the inability of consumer spend. Vacancies could peak as high as 14.6 percent by the end of 2021, with negative net absorption of retail space peaking at more than 60 million square feet by the end of this year, according to Moody’s Analytics. For neighborhood and community shopping center assets, centers with certain retailers, such as grocery, drug, or mass-market, will respond differently. However, the restaurant subsector will take a hit as the prolonged lockdown prevents operation.

Multifamily

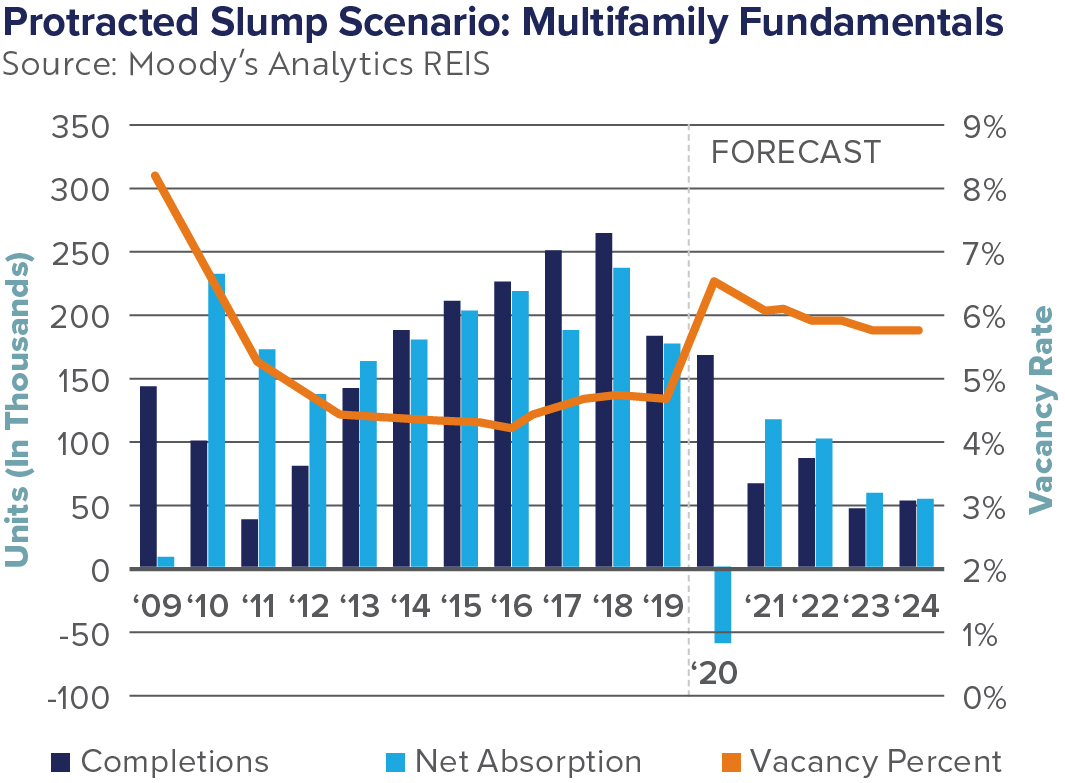

In the last recession, apartments outperformed almost every sector, and the question remains, will they outperform during this downturn as well? In 2008, there was backdoor demand for apartment units because many people could no longer afford to stay in their homes. During the COVID-19 pandemic, there isn’t that same underlying economic condition. People are still paying their rent, and as of April 19th, 89 percent of renters had made full or partial rent payment, and with the stimulus provided by the CARES Act beginning to roll out, many renters have a cushion in place. Further, renters are working with multifamily property owners and operators on rent deferral programs to help eliminate defaults. Multifamily looks to be the safest and strongest asset class, with vacancies this year peaking at only 6.6 percent and rents falling only 2.8 percent this year, and 3.9 percent next year. These numbers already outperform those from the last recession, mainly due to pullback on new construction and strong performance in the multifamily sector since 2010.

Industrial

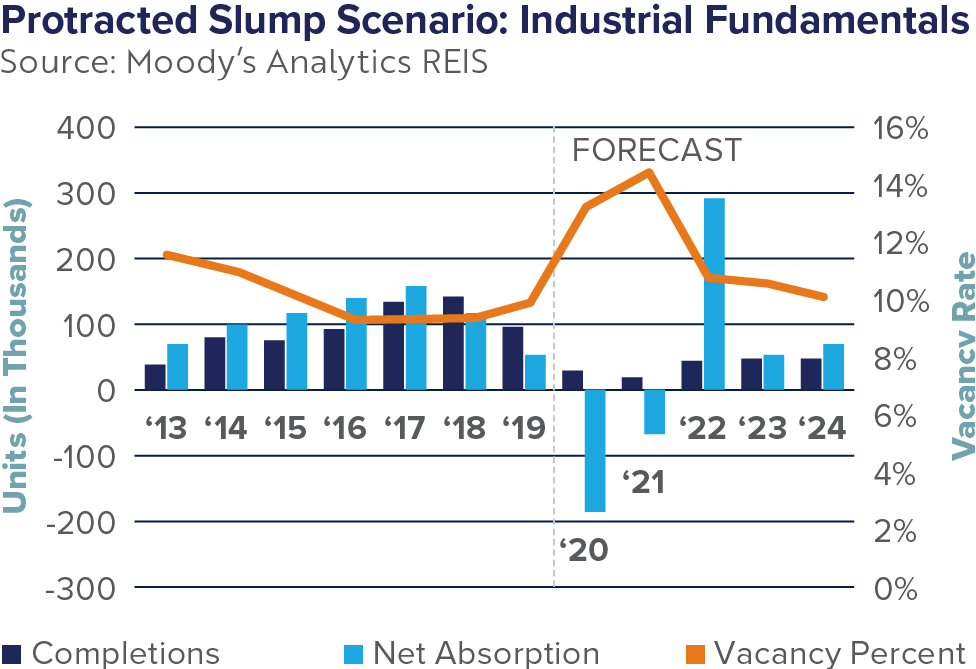

Industrial has been increasing in popularity since the growth of e-commerce fulfillment. As a result, despite the new supply in the market, vacancies haven’t increased. From 2010 to 2017, even as construction increased, vacancies declined by only two percent. Moody’s Analytics predicted that vacancies would change with new supply, leading to a bump in vacancies from 2017, low 9 percent to a high of 14.3 percent in 2021. This is slightly higher than the 14 percent high during the Great Recession. These vacancies, however, will snap back quickly as the economy recovers, and people become even more reliant on e-commerce, placing industrial and logistic properties in high demand.

Healthcare

Many healthcare practices are considered recession-resilient due to the importance of people needing to stay updated on their health. Despite temporary non-essential medical office closures, the sector is poised for a quick recovery. In 2019, this robust property type had low vacancy rates and over six million square feet absorbed. With a growing aging population combined with expanding medical insurance coverage and new treatment options, this equates to an increasing demand for medical office space and is considered a defensive industry.

Debt Market

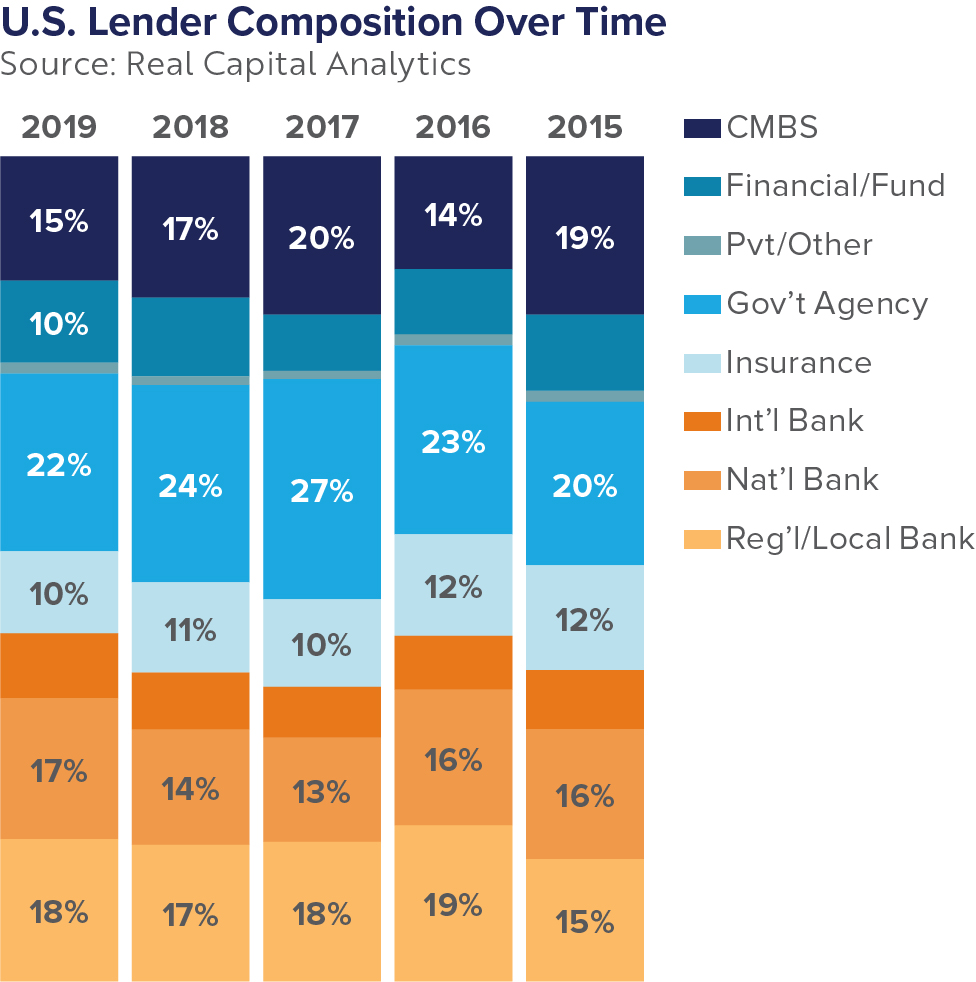

In contrast to the 2008 financial crisis, where lenders were afraid to provide loans because property prices were falling, today, lenders have aggressive loan momentum. By comparing the lending composition today to that of 2008, there are several different lenders in the market currently, meaning there are various sources of capital, all of which have more than 10 percent of market share. Before the 2008 financial crisis, CMBS controlled most of the market, and in the early 80s and 90s before the great recession, the lending market was controlled mostly by banks. This monoculture of debt translates to a failed market. Still today, even if we lose one lending group, others are available and ready to take on the market share with more diversity in debt capital and market stability.

Guidance From our Agents

No two economic downturns or recessions are the same, but a rebound always occurs. During this time, it is essential to look at your best and worst-case scenarios, plan for the road ahead and communicate with others to get as much information, insights, and feedback as possible.

- Scenario Planning– Look at best-case and worst-case scenarios and the range of potential outcomes to decide the next steps for your investment. Do you see any consistent themes?

- Communicate With Brokers, Fellow Investors, and Tenants– With numerous conferences and meetings cancelled, take the time to get input on what other investors are doing, as well as your broker’s thoughts on next steps. Also, communicate with your tenant, look at their revenue sheet, and decided what relief, if any, is necessary.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.