–

Following the economic crisis experienced in 2020, the overarching logic would have been that COVID-19 crippled the car wash industry – however, that wasn’t the case. According to experts, the industry grew in 2020 and has continued to grow in 2021. Consumers looking to the service-based retailer as a much-needed form of entertainment, normalcy, and distraction during the height of lockdowns, and investors took notice. Investors saw the car wash industry as an investment beacon. The product type was deemed an essential business in several markets across the country, while also being recognized for its e-commerce resiliency.

The Industry

The car wash industry is experiencing a period of massive growth in the commercial real estate space. According to an industry report by Grand View Research, from 2013 to 2018, the industry achieved a 3.6 percent compound annual growth rate (CAGR) in revenue and projected to increase by an additional 3.2 percent through 2025. This trajectory has piqued private investors’ interest, resulting in the car wash sector becoming one of the hottest acquisition property types. In 2020 alone, the top 20 car wash chains were owned or backed by private investors.

Consumer Trends

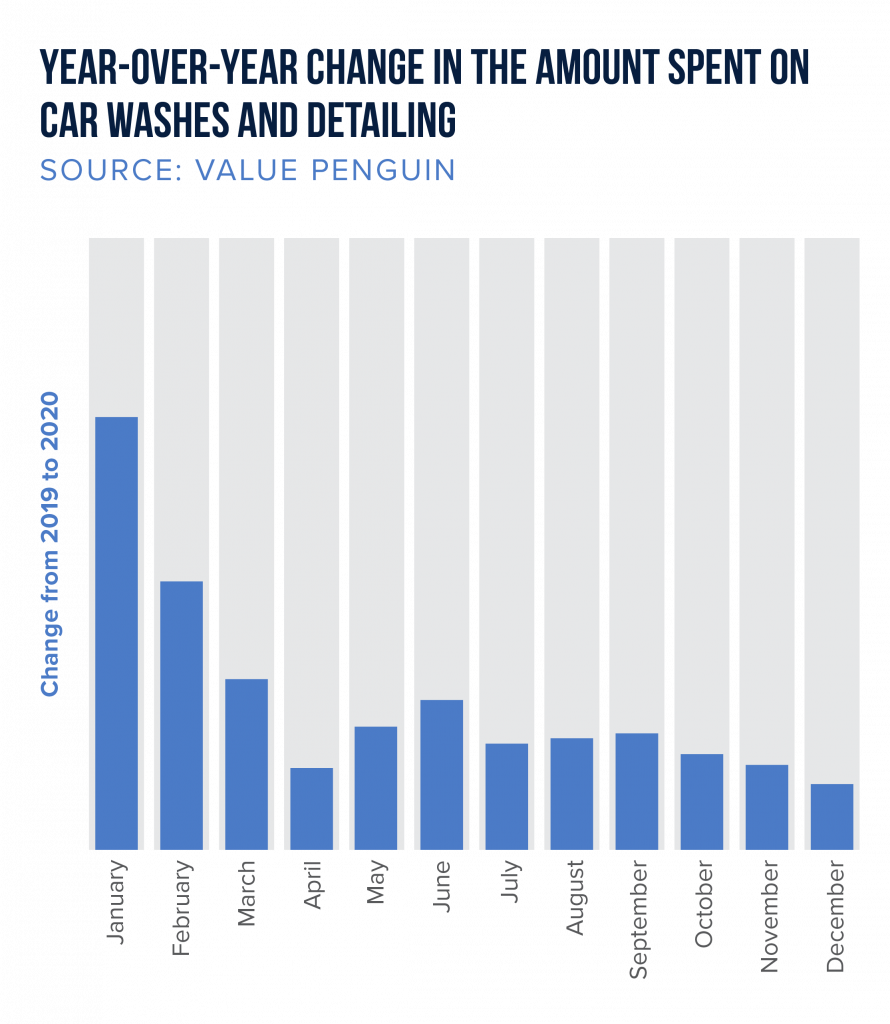

Of course, this growth and investor interest are driven by consumer demand. As a service-based industry, car washes are proven to be e-commerce-resistant. Further, consumers are turning more and more towards convenience and speed of service, therefore many are forgoing the option to hand-wash their cars. In 2019, 77 percent of drivers frequently washed their vehicle at a professional car wash, up from 48 percent in 1994. As the number of drivers increases, the growth in the car wash industry will continue at an estimated growth rate of 1.7 percent per year, according to Equity Multiple. In 2020, Americans spent 117 percent more on car washes and detailing than in the year prior.

The ridesharing trend has also created a whole new customer base for car washes. These drivers wash their cars multiple times a week to maintain customer satisfaction.

The Fundamentals

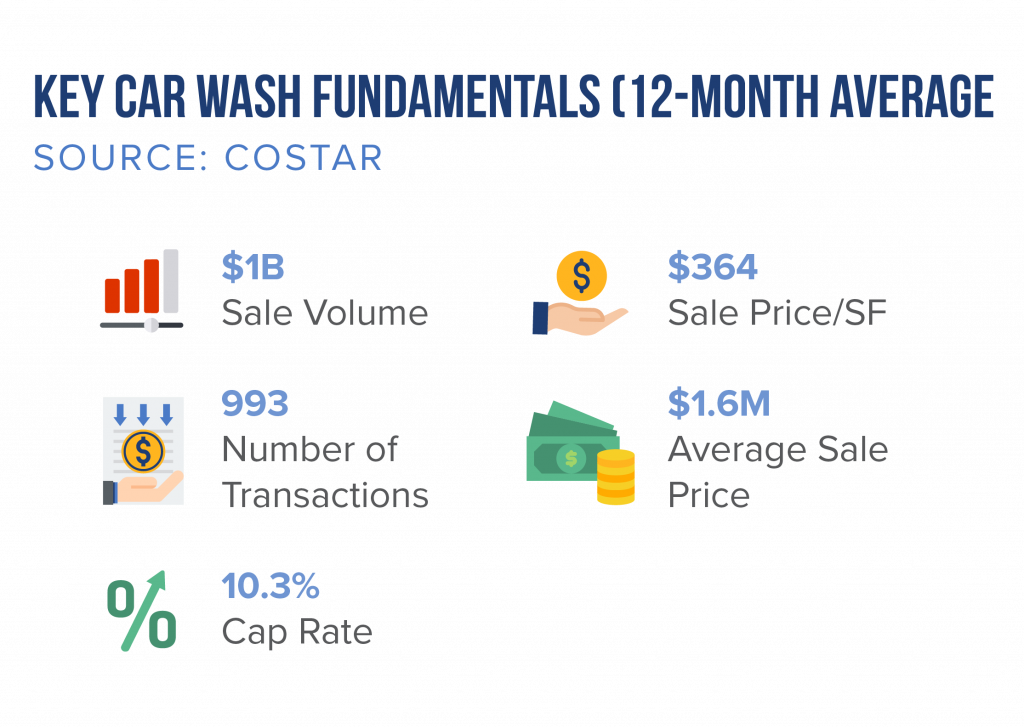

In the past, car washes were typically either sold with the business to owners/users looking to start their own business or in a net lease portfolio in an investment trust. Today, private investors enter the space and operate the property under a long-term lease (10 and 20-year initial term) with fixed increases and strong guarantees. This has resulted in a viable investment alternative for private investors, accompanied by an approximate 100 basis point premium over traditional net lease investments.

Net lease car washes sold on the market are usually express conveyor style washes or full-service, and investors spend about $2-$4 million in capital to acquire the property. The underlying residual value of the car wash location has also become increasingly attractive. Car washes are well-located in proximity to major retail destinations, and with dense surrounding populations, this position further increases the attractiveness of the investment. The location can also be the crux of the investment, as traffic patterns and counts determine the property’s ability to generate adequate cash flow. However, it’s important to note that operating costs for a car wash facility hover around 30-35 percent, lower than typical operating expenses.

Industry Trends

Technology-Enabled Solutions

The industry is pivoting to adjust to new consumer expectations by utilizing technology to boost profitability. Car washes are also modernizing themselves by implementing innovative consumer processing systems and smarter equipment. This not only maximizes consumer experience but also helps cut back on chemical and water waste.

Additional Offerings

Some full-service locations offer gasoline or fuel, convenience stores, and in some cases, a quick-service dining option. To compete, owners are adding high-margin, high-perishable consumer goods to their service offering. Many of the full-service car wash facilities have multiple sources of revenue

and income in addition to the car wash operations. Collectively, the additional income generators strengthen an operator’s EBITDA.

Increased Usage of Incentives

A growing trend is expanding monthly subscription models, bundled pricing, and brand loyalty programs, which incentivized more frequent customer visits and further stimulated the revenue stream.

These characteristics help car wash facilities grow in popularity and compete with traditional net lease retail investments. Demand is anticipated to increase as investors continue to seek well-located, recession-, pandemic-, and e-commerce-proof service-based assets with long-term leases.