Has the Bond Bull Run Come to an End?

In the world of commercial real estate, the age-old Wall Street adage about bull and bear markets still holds true. Bull markets take the stairs up, and bear markets take the elevator down. Unlike the dramatic crash of Black Monday, the current market decline is unfolding subtly and real estate isn’t the leading cause, like in other recessions. Investors and developers in the commercial real estate market experience a seepage of difficulty in the sector. However, there’s one market that is never really considered in the realm of commercial real estate – the bond market.

Navigating the Unpredictable

The outlook for commercial real estate indicates there may be challenges ahead. Advancements in financial markets have simplified the process of assessing investments for individuals and corporations, helping to understand the exact value of most investments. However, commercial real estate presents complexities that technology struggles to capture in real-time market corrections. If the real estate market was more like the stock market, there might have been coined days, much like the historic Black Monday, describing and predicting the unprecedented asset value drop in 2023.

Typically, bear markets stem from a distinct catalyst or black swan event that investors can pinpoint, a trend mirrored today as the Federal Reserve works to tame inflation caused by significant government spending from the pandemic. Though reasons for the spending might be different, the pattern is familiar. History does, in fact, repeat itself as market cycles are cyclical and human behavior remains predictable. As creatures of habit, people seek safety in times of fear and acquire more risk when they are carefree. For investors, this means they often turn to bonds for safety, a secure, long-term investment funnel, valuing its stability.

The Bond Bull Market’s Impact on Commercial Real Estate

The 10-year U.S. Treasury yield is a crucial benchmark for the commercial real estate industry. During the COVID-19 pandemic, there was a flight to quality and perceived safer assets, such as bonds, which led to record low yields. However, volatility created by the hawkish tone of the Federal Reserve made lenders apply more cautious underwriting measures and reduce the leverage provided to developers.

From the lender’s perspective, as rates started to rise in conjunction with runaway inflation, this created a need to shift strategies. Banks and institutions are afforded the ability to make more money from their deposits and the rising overnight rate. Rising rates created more options of investment and steered banks away from making loans on commercial real estate deals that only had marginally better returns, with significantly more risk. This has lead to a major drop in deal flow as banks have pulled back. The average price of the bonds dropped to around 75 cents on the dollar from roughly 89 cents a year ago.

Challenges in CMBS Pricing

For more than a year, a specific segment of the U.S. bond market, CMBS, has been facing significant challenges. Investors should closely monitor CMBS pricing because it provides insight into a broader view of commercial real estate loans and the true value of assets. Economists have warned that challenges at regional banks are likely to reduce overall lending and drag on economic growth. What

most investors don’t realize is that as interest rates go up, the price of the underlying bond goes down. It’s an inverse relationship that can be costly if the bondholder is exposed to long durations. As an example, the price of a single bond will typically fluctuate by the interest rate increase multiplied by the duration. If market rates go up 1% and you’re holding a bond that has a 20-year duration, the price of your bond is down 20%. In all, bond markets and interest rates are intricately connected, and as bond yields fluctuate, mortgage rates follow suit and it trickles down throughout commercial real estate.

The Simplest Investment Advice Isn’t Always the Easiest

Buy low and sell high – the investment strategy that’s often repeated as a rule of thumb but is hard to predict. It would be simple if economists could predict where the market peaks or how to identify rock-bottom prices. To formulate a strategy for the next couple of years, a three-step approach is necessary.

Investors must ask:

- Why are rates rising?

- What is the timeline of impact?

- How should I position myself for the best opportunity to survive & thrive?

Deep Dive: Why Are Rates Rising?

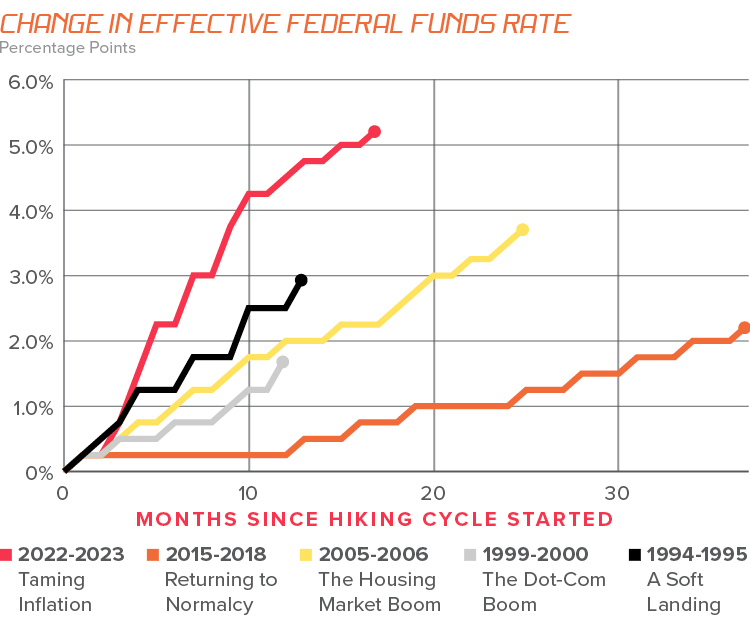

The Federal Reserve has raised rates in one of the steepest climbs in history, aiming to counter the adverse effects of rampant inflation. Despite the positive momentum in the U.S. economy brought on by the resilient consumer base, the prolonged COVID-19 shutdowns led to widespread ripple effects. The government’s mass injection of government spending created an unprecedented situation. People kept their jobs when historically they would have been lost, and people were able to save disposable income because many retailers and restaurants were closed. The mix of pent-up disposable income created an avenue that accelerated inflation beyond anyone’s prediction.

The work-from-home movement shifted focus to moving where climates are warmer and more time could be spent outside. It also put more focus on the home as more time was spent there, escalating housing prices and related costs. The measure of CPI (inflation) is made up of almost 40% housing related items. In addition to a strong consumer, supply chain disruptions and increased demand further elevated prices, exacerbated by historically low interest rates.

As a result, investors found themselves in an unsustainable growth pattern. This prompted Jerome Powell to adopt a reactive approach, taking a page out of Volcker’s book and aiming to reset the market by applying hawkish and tough strategies. While this might have caused short-term challenges, historical patterns indicate economic resilience and eventual recovery. Volcker created short-term pain that reset the market and set the stage for one of the greatest periods of a bond bull market for forty years. There have been short times of fluctuation, such as 1994, where it can be costly in the short term, but the economy has historically bounced back.

What is the Timeline of Impact?

Once again, revisiting the COVID-19 pandemic – the pivotal factor that reshaped daily lifestyles and work dynamics. The office sector has borne the brunt, a trend likely to persist as the return-to-office movement is slow. Other sectors, such as build-to-rent (BTR) and multifamily, saw a massive initial surge. However, they were met with steepening construction costs, borrowing costs, leverage reductions, and cap rate expansions that followed the 10-year Treasury yield increase. Sales within the retail and single-family sector have thrived due to a robust consumer, pent-up demand, and the implications of interest rates rising. This has turned a larger percentage of homeowners into landlords. Mortgages below 3%-4% attract attention, particularly when faced with the prospect of doubled interest rates and diminished purchasing power.

Office and rental markets are starting to find stability due to shifting consumer demands and needs. However, the U.S. faces a shortage of approximately two million homes. As such, investors and developers must remain vigilant and cautious and not try to “catch the falling knife.” Chasing reduced pricing might not yield profits, akin to the misconception following the 2009 recession. During this period every investment seemed profitable.

How should I position myself for the best opportunity to survive & thrive?

By taking the lessons learned for the past, developers and investors can strategize for survival and growth. Remember, bull markets take the stairs up, and bear markets ride the elevator down. Investors are riding the elevator down, and what does a person do in an elevator? They stand still and let it carry them.

In this market pause, crafting a buying strategy is crucial. However, investors can’t buy if they don’t have cash or access to capital. Unless the Federal Reserve changes its targeted inflation number, it’s hard to suggest they will start cutting rates. Plotting plans of investments and creating an “if/then” scenario is paramount. For example, ask what you would do if residential mortgages become assumable or if rates go up another 100bps?

Crafting this “if/then” investment strategy will help when the market is at a tipping point. The 40-year drop in rates is resetting, moving toward the average. If rates continue to rise, a generational shift will occur. The baby boomers will see a risk-free rate of return higher than it’s been for years. This will start the move of large amounts of investable dollars into treasuries and securities with high coupons. Millennials are facing increased mortgage rates, are likely to lend another shift into rental housing. Given this generations’ inclination toward experiences and rental-based lifestyles, the demand for multifamily and BTR will grow.

The bond bull run has come to an end, but that doesn’t mean investment returns are going to decline. It’s important to remain vigilant and consistent with allocations in sectors. Focusing on strategies that have historically performed during rate accelerations enables investors to capitalize on the resilient economy. Moreover, this period of market fluctuation presents numerous short-term opportunities.