The United States economy has been in a near-total shut down for all of April, and many states are remaining in lockdown until the end of May or later. In the past six weeks, widespread business closures have left a lasting impression on the overall market, and initial claims for unemployment insurance have been sky-high with more than 30 million claims. The unemployment rate currently sits at about 17 percent, and gross domestic product shrank by an annualized rate of 4.8 percent in the first quarter. This is the biggest drop since Q1 2014 and the largest contraction since Q4 2008. In the first ten weeks of the year, economic growth has been reversed, and in this report, we will take a look at the long-term impact on commercial real estate and its respective sectors.

The U.S. Economy

In the next several days, U.S. retailers will bring the biggest collective retail reopening since the coronavirus pandemic shuttered thousands of stores. Retailers hope that shoppers are willing to venture out and brave distancing rules, cleaning disruptions, and limited service. While there is no way to tell precisely what the economic damage from COVID-19 will be, there is widespread agreement among economists that it will have a negative impact on the global economy.

Here are the predictions:

- 4% Forecasted Global GDP in 2020

- $76.69B Monetary GDP Loss in Best-Case Scenario

- -2.4% Forecasted GDP Loss in U.S. Global Scenario

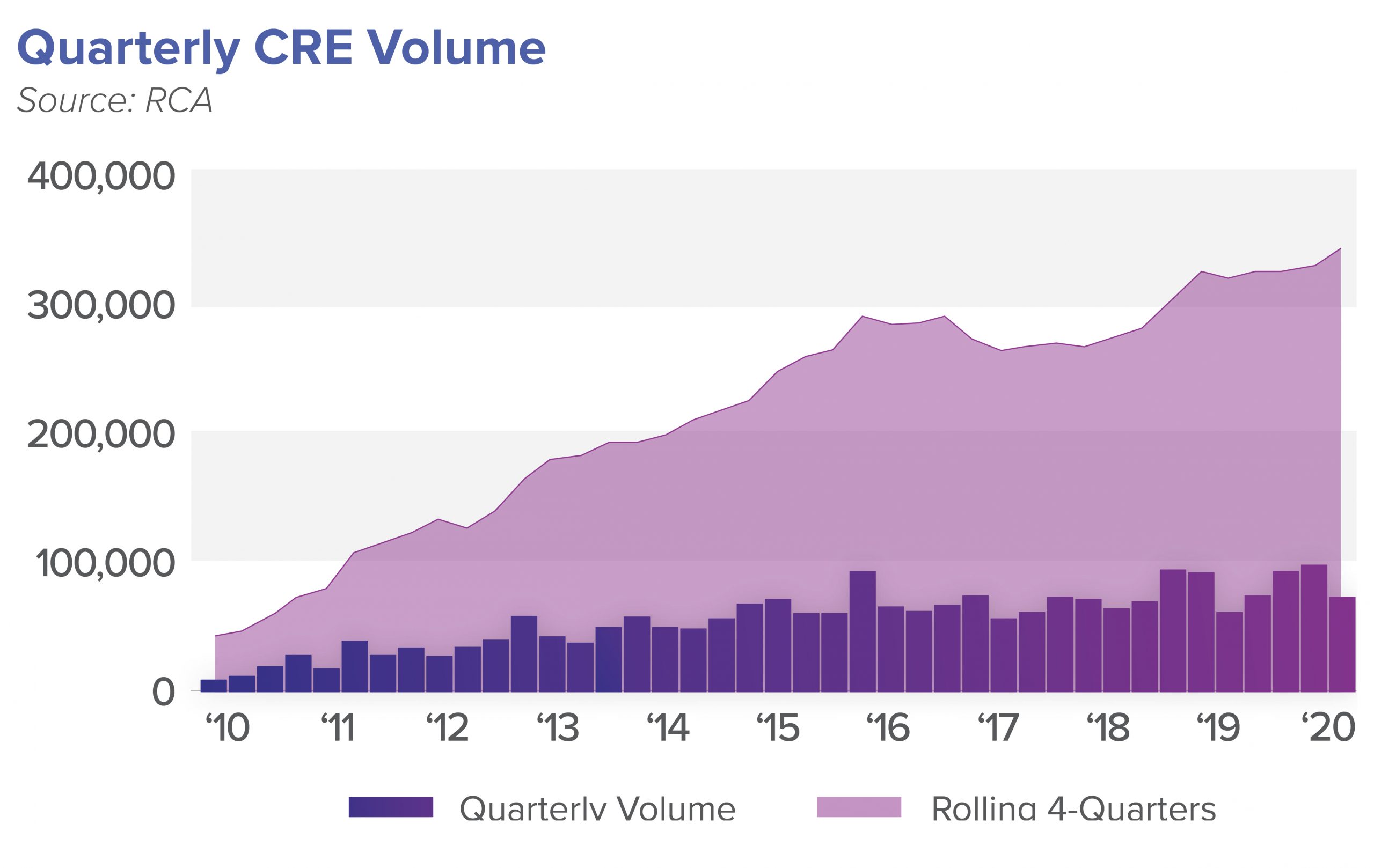

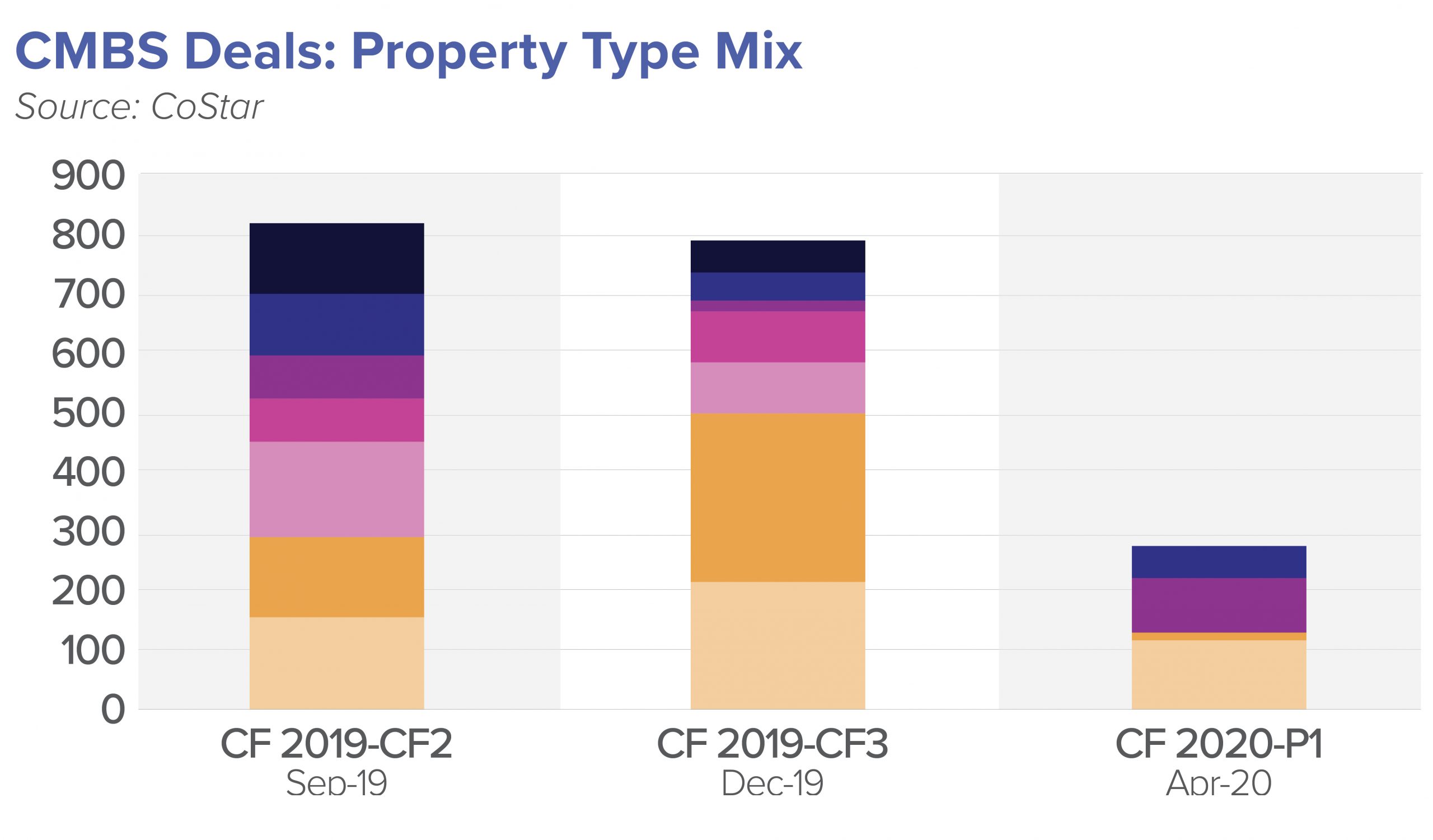

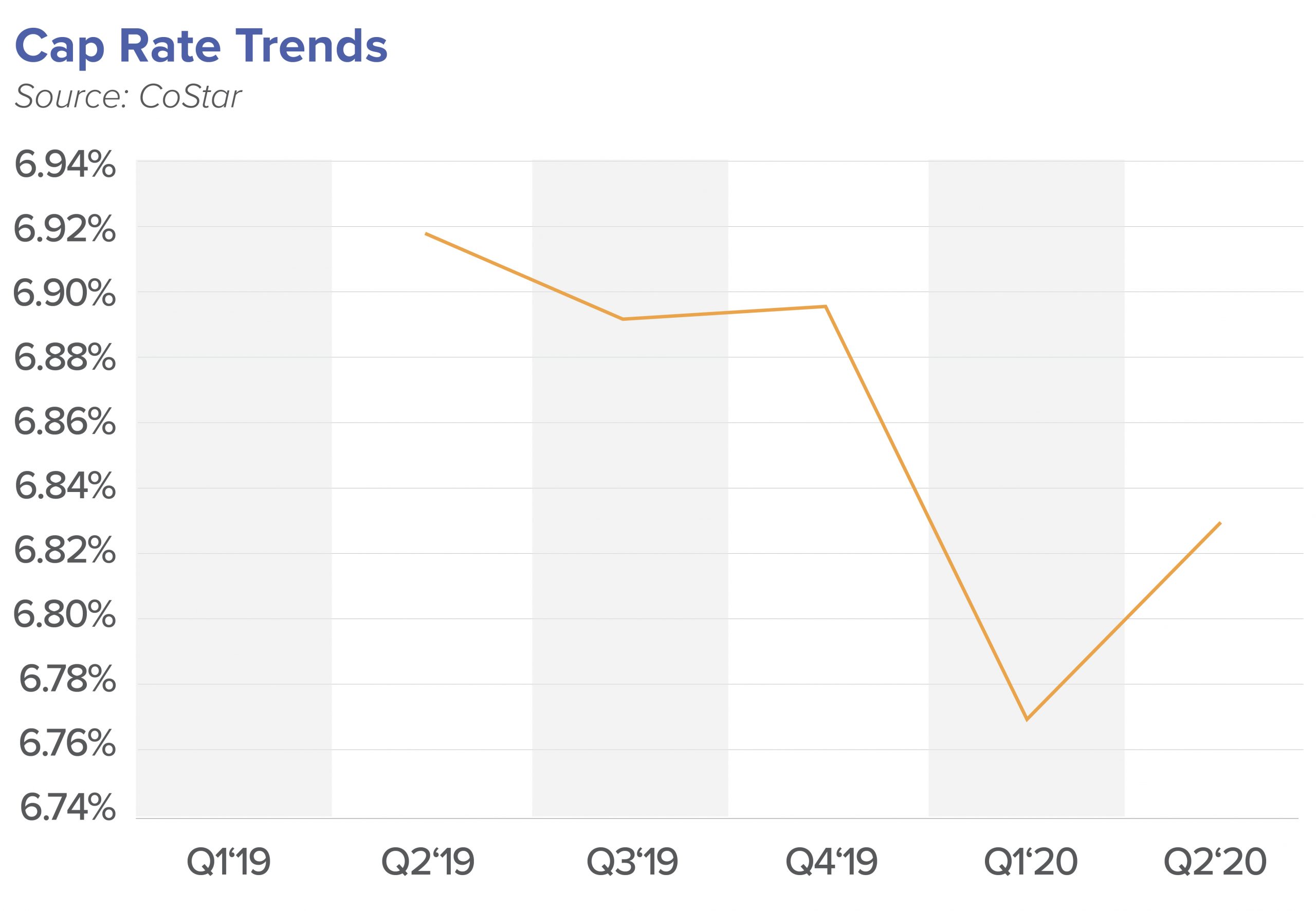

The impact of COVID-19 on CRE will be most evident in a slowdown in deal volume from February and March. According to CoStar, commercial sales activity in these months declined 17 percent as the pandemic hit CRE markets. This was probably because investors held back as the economic environment became more tenuous. Cap rates, however, have been steady amid the market slowdown. The average cap rate has dropped only seven basis points for retail, indicating that the decrease in sales activity is not because of a lack of investor confidence but obstacles to transacting efficiently. For multifamily, the average cap rate dropped to 6.01 percent.

In the near term, investors will mostly focus on second-quarter rent collection. In the long term, despite the reopening, many will focus on occupancy and vacancy concerns as many tenants will see their ability to pay rent impaired. Owners and landlords will need to focus on tenants that have staying power and the ability to adapt to changing customer needs.

According to Foursquare location data, people are ready to return to normal, and as officials begin the process of relaxing some business restrictions, various regions are starting to see upticks in foot traffic.

- Fast food and gas station visits have returned to pre-COVID-19 levels in the Midwest and rural areas across the nation.

- Even casual dining restaurants are starting to show upticks, likely driven by new delivery and curbside options. In the West, South, and Northeast, visits are down only 4-8%.

- Home improvement stores are up nearly 20%, versus 6% in the period prior.

- Gas station visits have increased since mid-April, down only 6% nationally versus 8-11% in the weeks prior.

- Grocery store foot traffic has subsided and returned to pre-COVID-19 levels, up 8% in rural areas.

- Liquor store traffic remains above pre-COVID-19 levels, up 10% as of April 24th.

What Lies Ahead for CRE?

The eventual impact of the pandemic and economic fallout on commercial real estate market fundamentals and pricing is currently unclear. While lockdowns and social-distancing measures became the norm late into the first quarter, the full impact of the pandemic on property pricing has yet to unfold. According to predictions, the outlook is relatively grim during the recovery phase over the next couple of years for all retail formats. Mall anchors, full-priced apparel, and small businesses located in strip centers are particularly concerning. More people will rely on e-commerce as the adoption rate has grown tremendously, and will probably never retreat to pre-COVID-19 levels. Multifamily and healthcare will adjust fairly quickly to the new normal and will bounce back. It is within the realm of possibility that the abrupt slowdown in economic activity from customers pausing normal routines will be reversed rapidly, once treatment plans are in place and a retail reopening protocol is made available for each state.

From the Matthews™ investor outlook COVID-19 survey conducted in April, investors are planning to be active and see strong corporate guaranteed single-tenant net lease properties as the best opportunity in the market. Here are the other results:

- 41%- Strong Corporate Guaranteed Single Tenant Net lease (office, industrial, or retail)

- 66%- Multifamily Properties

- 97%- Multi-Tenant Commercial (shopping centers and office buildings)

- 95%- Non-Corporate Credit or Franchisees Single Tenant Net Lease (office, industrial, or retail)

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.