Events are quickly unfolding surrounding the COVID-19 outbreak, with a growing impact across the globe. As coronavirus pressures mount, firms have curtailed travel, schools have closed, and people are practicing social distancing. As a result, consumer spending has decreased as people stay home, thus causing a ripple effect throughout the economy and commercial real estate. This report is intended to provide information and guidance on the developments occurring in the market and the potential implications on the commercial real estate industry.

The U.S. Economy

With the economy unprepared for this pandemic, there have been significant changes in employment, stock markets, and consumer spending.

Employment

- The number of Americans filing for unemployment has skyrocketed to a record-breaking 6.6 million for the week ending on March 27,2020, according to the latest report by the Labor Department. The Previous record was 3.3 million claims filed the week of March 21, 2020.

On March 27th, President Trump signed a massive $2.2 trillion stimulus package (CARES Act) into law. As the largest emergency aid package in history, it will assist impacted businesses, more than 150 million American households, pump billions of funds into unemployment insurance programs, and increase spending on hospitals and more.

- $250 billion in direct emergency assistance would include payments of $1,200 to be sent to every person making $75,000 or less a year.

- Extend unemployment benefits by up to four months for all laid-off workers, including gig employees and freelancers.

- It includes $350 billion in loans to small businesses, more than $100 billion in grants for hospitals and healthcare systems dealing with shortages of medical equipment or protective devices and $150 billion to help state and local governments.

Stock Market

- Though Dow Jones Industrial Average jumped more than 800 points, or 4% on March 27th, 2020, which totaled 12.8% for the week. The S&P 500 gained 3.7% while the Nasdaq Composite advanced 3.2%. Those gains put the Dow and S&P 500 on track for a three-day winning streak.

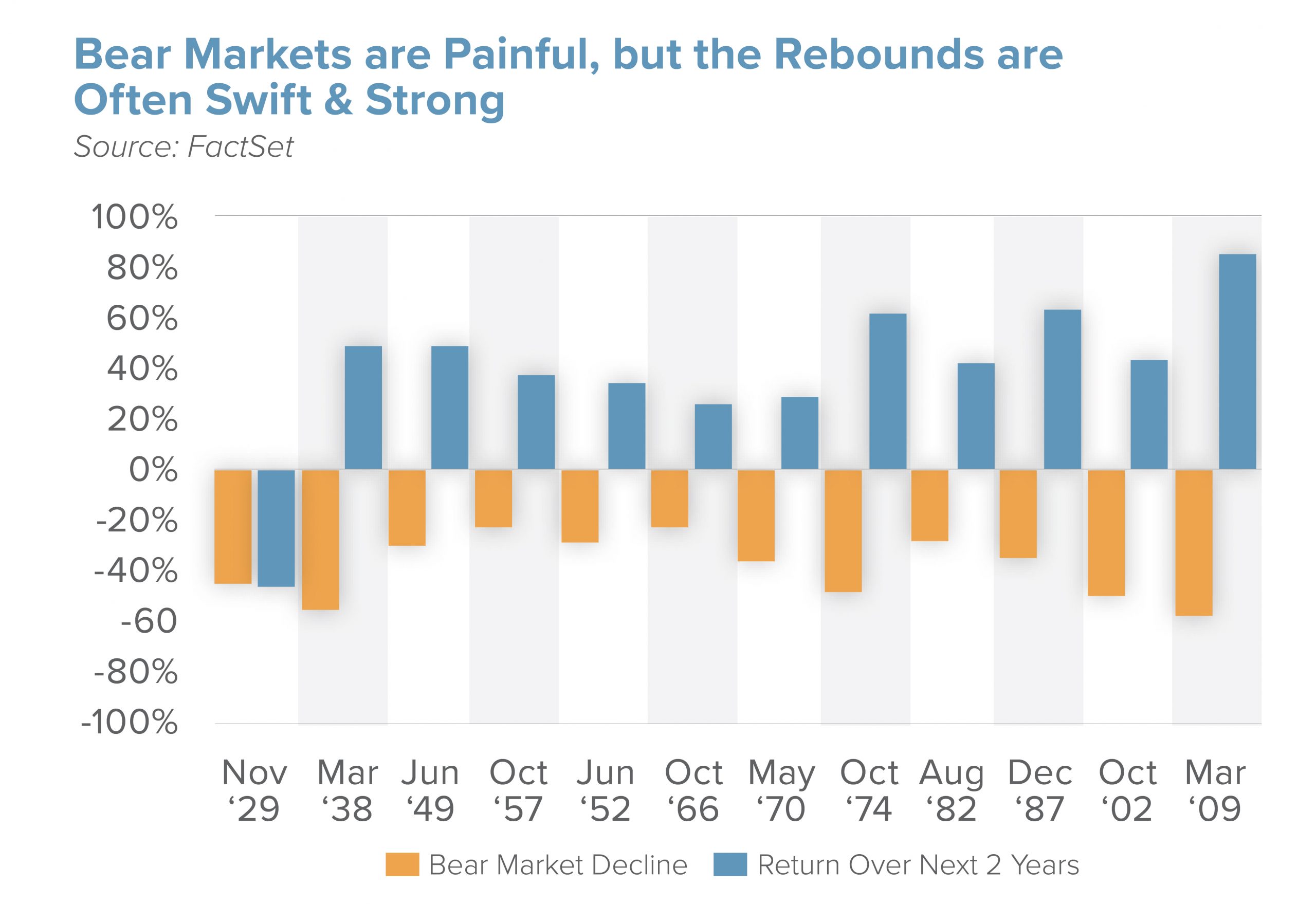

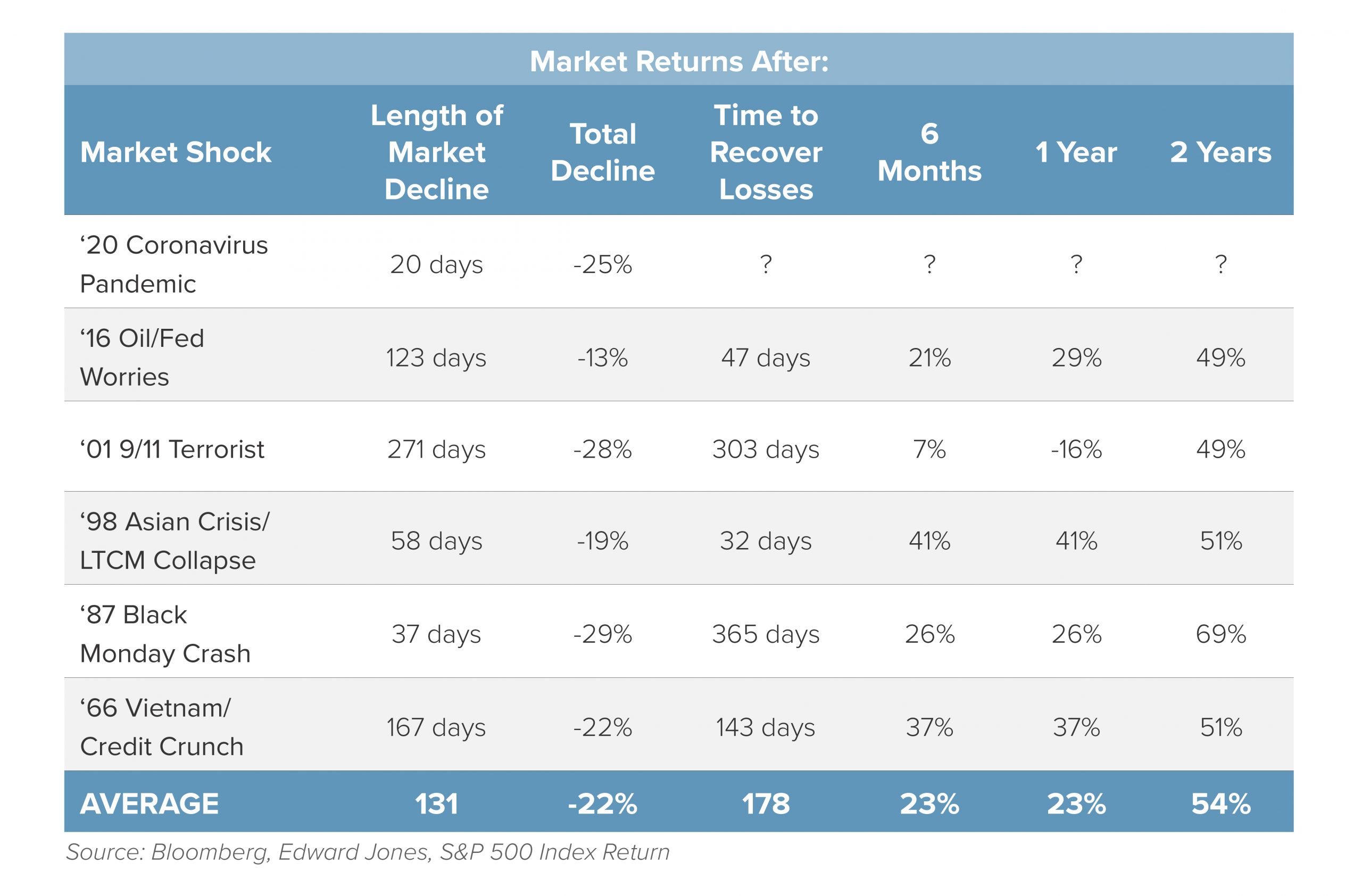

- Though the Dow is still nearly 27% off last month’s record highs and U.S. oil prices sank below $20/barrel on March 29th. On April 2nd, despite the grim unemployment data, stocks rallied alongside surging oil prices, so we know we are going to see some painful moments in the market with strong rebounds shortly after.

Due to the cause of this slowdown, we will face temporary declining changes, with financial and banking sectors are on firm footing. Though the U.S. is experiencing a time of considerable disruption in employment, unemployment will not stay this high, as is the case in traditional recessions and a root cause for a more slowly developing recovery. Even with a sharp decline in GDP in the coming months with the economic foundation coming into this, a recovery in economic activity, investment, and the stock market will be faster and more vigorous than we’ve previously seen.

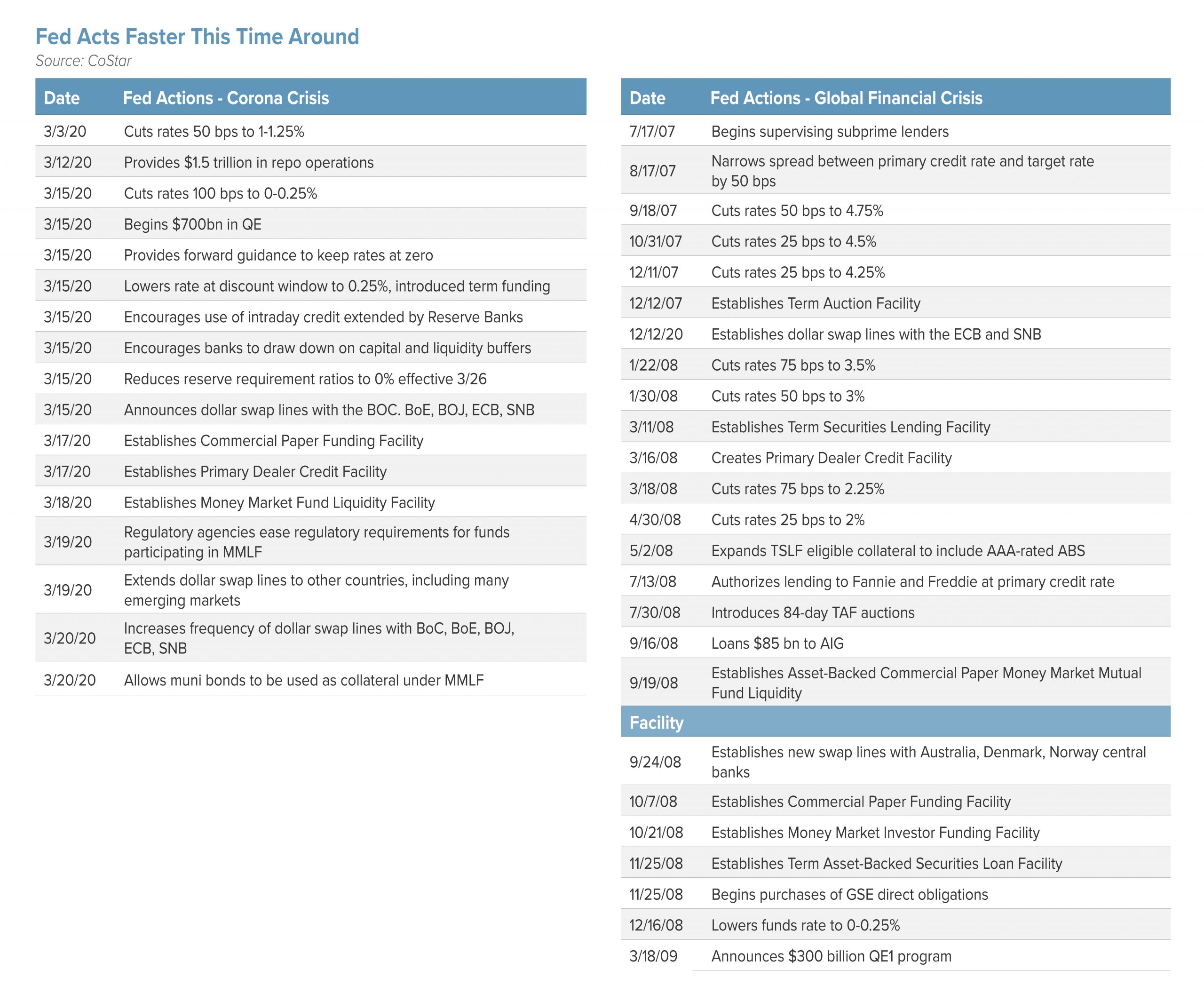

The Fed

On March 15th, the Fed’s policy decision was historic as rates were cut to zero, restarted $700 billion in quantitative easing, and committed to other actions to provide banks with more liquidity. The Fed also set up unique facilities to fund commercial paper, provide more accessible credit to primary dealers, and give liquidity to money market funds.

The Commercial Real Estate Industry

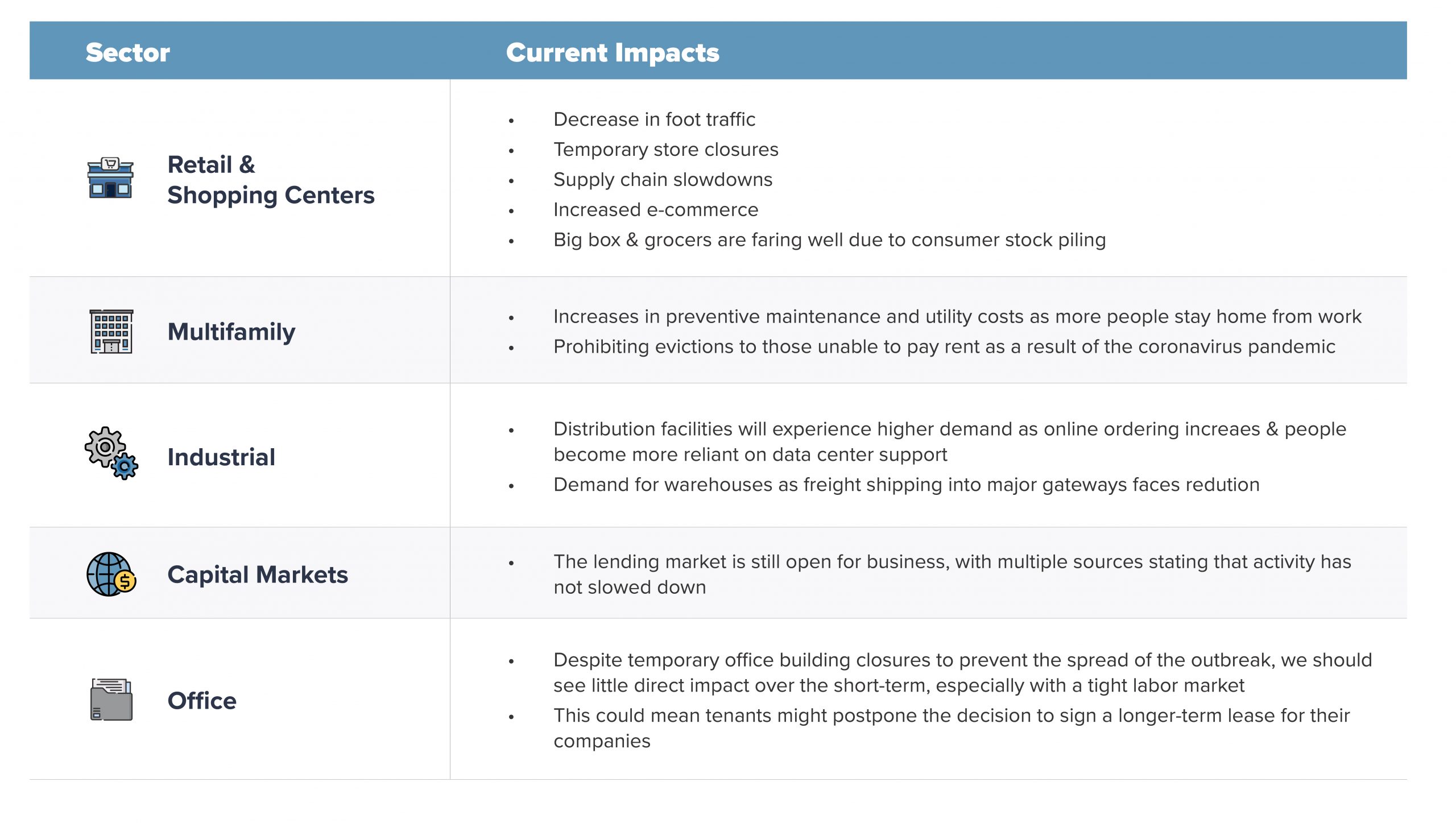

With the U.S. being a safe haven for capital, long-term investments are less volatile and can handle short-term market instability. Though we will see a short-term slowdown in CRE, especially in the retail and hospitality industries, the fundamentals of many of these properties can withstand a pandemic. The effect on the office sector is less clear as uncertainty still remains on how long employees will need to telecommute and practice social distancing. But landlords of movie theaters, hospitality centers, and stores facing temporary closures in the face of virus concerns will now experience some relief with the CARES Act. The asset classes with the most upside are industrial, specifically warehouses and data centers, and apartments.

Here we will take a look at how COVID-19 is impacting the commercial real estate sectors and the capital market:

Navigating Changes in the CRE Market

What Lies Ahead for CRE?

Just as many in CRE have described retail as “dying” in the past, the truth is we are going through a transformation in CRE and as a nation. The effects on commercial real estate will vary by sector and market, and the extent of the effects will depend upon the duration of the economic challenges we are facing. We do not foresee an extended recession, but rather a slowing of growth. With sector and market challenges springing up daily, Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.