The Shopping Center Must-Have

Given the whirlwind of events the past three years, retailers are reconsidering their locations and space needs, indicating a change is on the horizon. Now that retailers understand their business model after re-examining shopping behavior through online habits, a new generation of shopping centers is anticipated to emerge. One highly sought-after asset class is multi-tenant net lease retail pad sites because it offers attractive financing options, drive-thru capabilities, and healthy foot traffic. These types of centers also often include essential retailers, which quickly grew in demand following a year that involved temporary and permanent store closures. Retail centers will become more balanced and diverse, with the addition of drugstores, restaurants, discount retailers, and even healthcare facilities. In this article, Matthews™ will discuss the nature of retail pad sites, the tenants they attract, and how they evolve the shopping center landscape.

The Current State of Shopping Centers

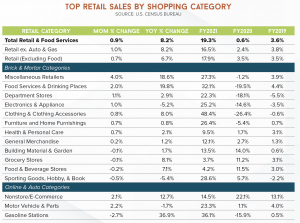

Throughout 2020, investors were given the opportunity to monitor which retailers survived and thrived in light of COVID-19. Among those retailers include grocery stores, drugstores, quick-service restaurants with drive-thrus, convenience stores, home improvement stores, auto part and service retailers, and healthcare. These properties saw substantial demand as other non-essential net lease assets were forced to close for a period of time in 2020. Experts witnessed these well-performing tenants achieve consistent investor interest throughout 2021, and so far into 2022.

Retail centers with the highest demand:

- Grocery-anchored centers

- Jewel box retail pads

- Drugstore-anchored centers with limited shop space

Some variables could affect shopping center recovery, including of the property, location, and operations.

Heightened Demand for Retail Centers

While retail-focused institutional buyers focus on off-market multi-tenant centers, this has presented more on-market opportunities for private buyers. Pricing among stable assets has become competitive as availability is deficient, and investors have extensively hunted for essential use investment-grade retailers. The limited retail supply has compressed cap rates, especially among the more popular essential tenants, like quick-service restaurants and coffee-oriented businesses. 1031 Exchange buyers contributed to the cap rate compression as they searched for higher yield options while remaining cautious. Retail centers encompassing investment-grade and essential tenants offered a safe space for capital. At the same time, non-essential property owners have held onto their assets to ride out the storm, playing into the stabilized pricing.

Retail pad assets often feature annual rent increases due to the nature of their triple net leases. For the most part, freestanding retail is highly desired for its location, prominent visibility, and foot traffic from anchor shops. National investment-grade tenants commonly chase these spaces, such as banks, convenience stores, and quick-service restaurants. Therefore, tenants that already had online order fulfillment processes in place either held value or are worth more than they were a year ago.

Parcelization Trends

Multi-tenant retail owners and buyers are re-evaluating their investment strategies, including parcelization, a break-up sale strategy impacting the market. By dividing the shopping center into multiple parcels, sellers

can list at better prices, more aggressive cap rates, and expand the buyer pool to new and unseasoned investors. In some cases, selling off parts of the center unlocks more value than if it were sold as one asset, and financing is no longer an issue once the property becomes a smaller price point. Additionally, selling off a parcel will help lower an investor’s basis, making this trend very attractive today. A shopping center in San Francisco finalized its fourth and final transaction in April 2021, totaling $11.4 million, thanks to this parcelization strategy. The four sales entailed a 54,000 square foot anchored center, a 4,144 square foot retail pad with two tenants, a 6,755 square foot pad with five tenants, and a 26,520 square foot vacant retail building. The seller achieved approximately $2.5 million more than if they were to have sold the property altogether.

Shopping Centers Optimize Parking Lots

Another trend dominating multi-tenant pad sites is landlords selling a portion of land in front of a big-box, often unused space in the parking lots, to convert into an outparcel. This opens the opportunity to optimize sales, profits, and revenue by developing a property on a plot of land that was otherwise unused. Often, outparcels are standalone sites located near the main road that shares a parking lot with a shopping center or are redeveloped from a retail center’s parking lot. With their store frontage facing the main road, these multi-tenant pads benefit from vehicle traffic driving by or into the shopping center. By adding essential and national tenants to the tenant mix, landlords will increase their net operating income, thus increasing their property’s value. Additionally, landlords of distressed multi-tenant centers can pay down debt or focus on other strategies by selling their outparcels.

Demand for multi-tenant net lease pads can be attributed to the higher yield options for investors. Shopping center owners are presented the opportunity to monetize a valuable piece of land that draws in more customers and maximizes profits. By executing a ground lease with a tenant or developer, an owner can reap the monetary benefits without the risk of developing the site.

Creative ways to make the most of versatile parking spaces can help retailers differentiate themselves and thrive during uncertain times. Source: Retail TouchPoints

The Evolution of Shopping Centers

Although online shopping bolstered in 2020 and 2021, it still hasn’t completely replaced brick-and-mortar retail. Now that consumers feel safe to resume their everyday routines, in-store shopping has normalized to pre-pandemic levels. The shopping center real estate environment is currently undergoing a critical transformation. Outparcels will likely become more common in multi-tenant real estate as they further enhance the open-air shopping format, optimize store visibility, and lure in shoppers.

The Coveted Drive-Thru

Restaurants with drive-thrus experienced a monumental performance in 2020 and 2021. It’s become an essential selling point for retail developers to incorporate drive-thrus to maximize value in their new investments. For example, in Willis, Texas, an HEB-anchored center will be accompanied by outparcels, all equipped with drive-thrus. Developers are eyeing existing retail locations to add drive-thru capabilities due to substantial demand. Additionally, strong national tenants, such as Starbucks and Chipotle, are looking to move out of inline strip centers to end cap locations where they can have a drive-thru component. Tenants are downsizing and reducing their footprints to accommodate consumer needs post-COVID-19 and focusing on gaining drive-thru exposure. In summary, drive-thrus bring in more customers to the shopping centers they accompany, boosting sales and foot traffic to the neighboring stores.

Successful shopping center tenants, like grocery stores and dollar stores, are expanding to accommodate the demand while boosting sales of other non-essential items.

Drive-Thru Activity

- Prioritizing accessibility, chipotle is making headlines with plans to implement drive-thrus, or “chipotlanes,” to 70 percent of its new locations. already, “chipotlanes” are proving successful through higher store sales.

- In Boardman, Ohio, a 179,000 square foot shopping center was purchased for $16.5 million, with four accompanying outparcels occupied by quick-service tenants, such as Chick-fil-A, McDonald’s, and Panera Bread.

Tenants Expanding or Right-Sizing

According to PWC’s Emerging Trends in Real Estate, the vast majority of shoppers still purchase products and services in-store. Therefore, successful shopping center tenants, like grocery stores and dollar stores, are expanding to accommodate the demand while boosting sales of other non-essential items. Some non-essential retailers, like apparel stores, are finding that online sales are soaring compared to in-store sales and are reacting appropriately by right-sizing and increasing online ordering efficiency. Right-sizing is when a business reconsiders its real estate footprint and determines to reduce store size to optimize profit. In the case of the Container Store, with an average store size of 25,000 square feet, e-commerce sales grew 109.5 percent with the help of curbside pickup.

Despite this, the storage and organization company has made plans to open 100 small-format stores in major markets in 2022 and plans to roll out 76 small format stores over the next six years. Savvy investors will monitor the activity of non-essential tenants for potential future value, particularly those located in non-credit big-box properties with underlying solid real estate or below-market rents.

The Doctor is In

Multi-tenant center landlords have extended their reach beyond traditional retailers and look to businesses, such as healthcare-oriented tenants, to add to their retail centers. Similarly, healthcare tenants have changed their outlook on clients, targeting shopping centers with high foot traffic to expand their market share. The most common example of a healthcare tenant moving into an outparceled pad is urgent care facilities, which are looking to maximize visibility. Urgent care clinics are easier to access than hospitals because of their ground floor locations and same-day appointment scheduling options. Urgent care properties in shopping centers maximize accessibility as they are closer to neighborhoods and their patients’ homes.

Further, urgent care patients pay less for a visit than hospital patients, a study by Annals of Emergency Medicine revealed. The average cost for an urgent care visit is $168, compared to $2,259 to $2,199 for hospital emergency department visits. By prioritizing the customer and optimizing accessibility and affordability, an urgent care is an excellent option for outparcel tenants.

Discount Retailers Find Their Place

While off-price retailers rely solely on foot traffic due to the lack of online presence, the sector still witnessed a healthy recovery in both foot traffic and reported revenue. Shoppers have a new mentality that is mission-driven and necessity-focused, pushing discounters as top contenders among shopping options. Dick’s Sporting Goods is following the lead with a new off-price concept, Going, Going, Gone!, which will offer deep discounts on footwear and apparel brands sold at the store. Placer.ai found consumers have prioritized a store’s proximity to home, and suburban shopping centers with large discounters have profited from their familiarity with routine shoppers. Discount chains positioned in outparcel pad sites can bolster the overall consumer base for a shopping center.

California Owners Look Out of State for Opportunities

Although California offers an abundance of well-located and highly sought-after retail, available outparcel and multi-tenant pads are scarce. The lack of developable land, paired with the exceptional demand for freestanding retail, has enabled landlords to hike up sale prices and rental rates in the last few years. Further, the strict zoning laws in California have made it difficult to create optimal outparcels equipped with a drive-thru. San Luis Obispo, Santa Monica, Santa Barbara, and Corte Madera all have varying restrictions on drive-thrus, some of which involve a new construction ban ranging from six months to 40 years.

These reasons, and more, are why California investors are fleeing the state to search for better deals. Specifically targeting states with no income tax, California buyers have found higher yields outside of California. In cities like car-dependent Houston, Texas, the low tax environment and relatively affordable real estate have drawn investors from across the nation. Additionally, the city boasts a population of 2.3 million in the span of 600 square miles.

Multi-tenant pad sites have been a coveted retail asset for some time now, but their smaller footprint, drive-thru optimization, and underlying fundamentals have pushed them to the spotlight. With retail sales expected to grow six to eight percent in 2022 and reaching $4.86 trillion, according to The National Retail Federation, there is no better time to invest in retail. Experts anticipate the upcoming years to play out as a transitional period for retail. The combination of adaptation and increased retail spending alludes to a favorable outlook for multi-tenant net lease pads. For more information, please speak with a Matthews™ specialized agent today.

For more information, please speak with a Matthews™ specialized agent today.