The Fast-Evolving Self-Storage Market

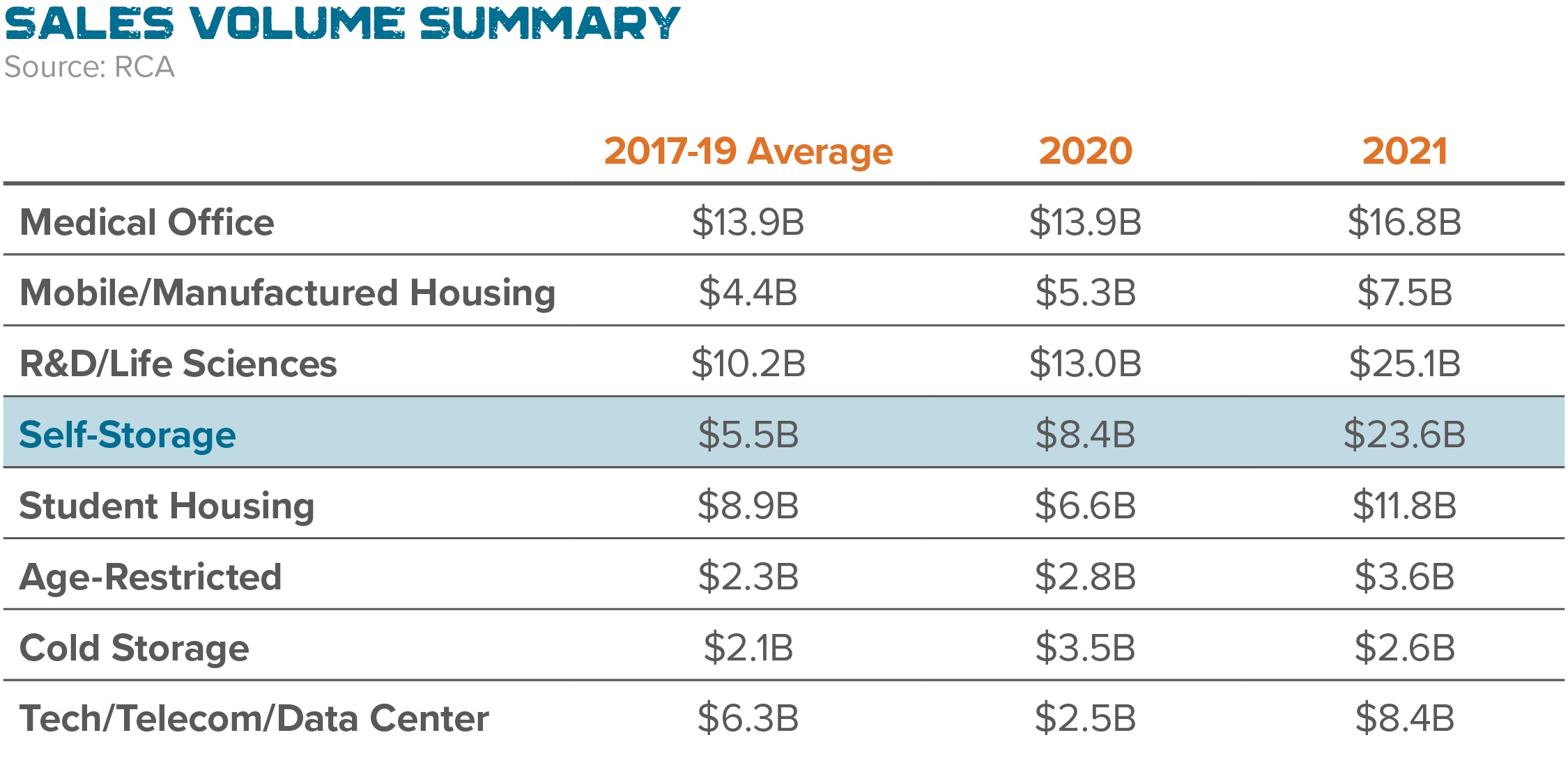

Self-storage outperformed again in 2021, with sales volume increasing 180 percent from $8.4 billion in 2020 to $23.6 billion in 2021, according to Real Capital Analytics data. The industry has experienced steady growth in the past 30 years, benefitting from both long and short-term societal trends. In recent years, more Americans have become increasingly comfortable with up and moving across the country, which was accelerated by the COVID-19 pandemic. This has increased the demand for more storage. Today, 10.6 percent of households rent a self-storage unit, according to SpareFoot. With the majority of the workforce shifting to remote, this has allowed people to move to different cities or required them to make more space to work from home. Along with people’s evolving relationship with their living space, the increased cost of housing and accelerated trends in net migration have built up the demand for storage in growing markets throughout the country. With appealing long-term dynamics and proven resiliency through economic cycles, self-storage is performing at an all-time high and is projected to continue on this trajectory in the coming months.

Public Storage CEO claims COVID-19 has added a fifth “D” to self-storage demand:

- Divorce

- Death

- Dislocation

- Disasters

- Decluttering

Self-storage arguably outperformed all sectors during the pandemic, with REITs posting a 70.4 percent return from the start of the pandemic through November 2021. According to the National Association of Real Estate Investment Trusts, self-storage outpaced industrial, retail, office, healthcare, and all other REITs. The sector posted the most vigorous sales growth in 2021 in terms of dollar value, with activity up $15.2 billion from 2020. Portfolio and entity-level sales drove most of the growth, with bulk-portfolio dispositions totaling $9.4 billion in Q4 2021 alone.

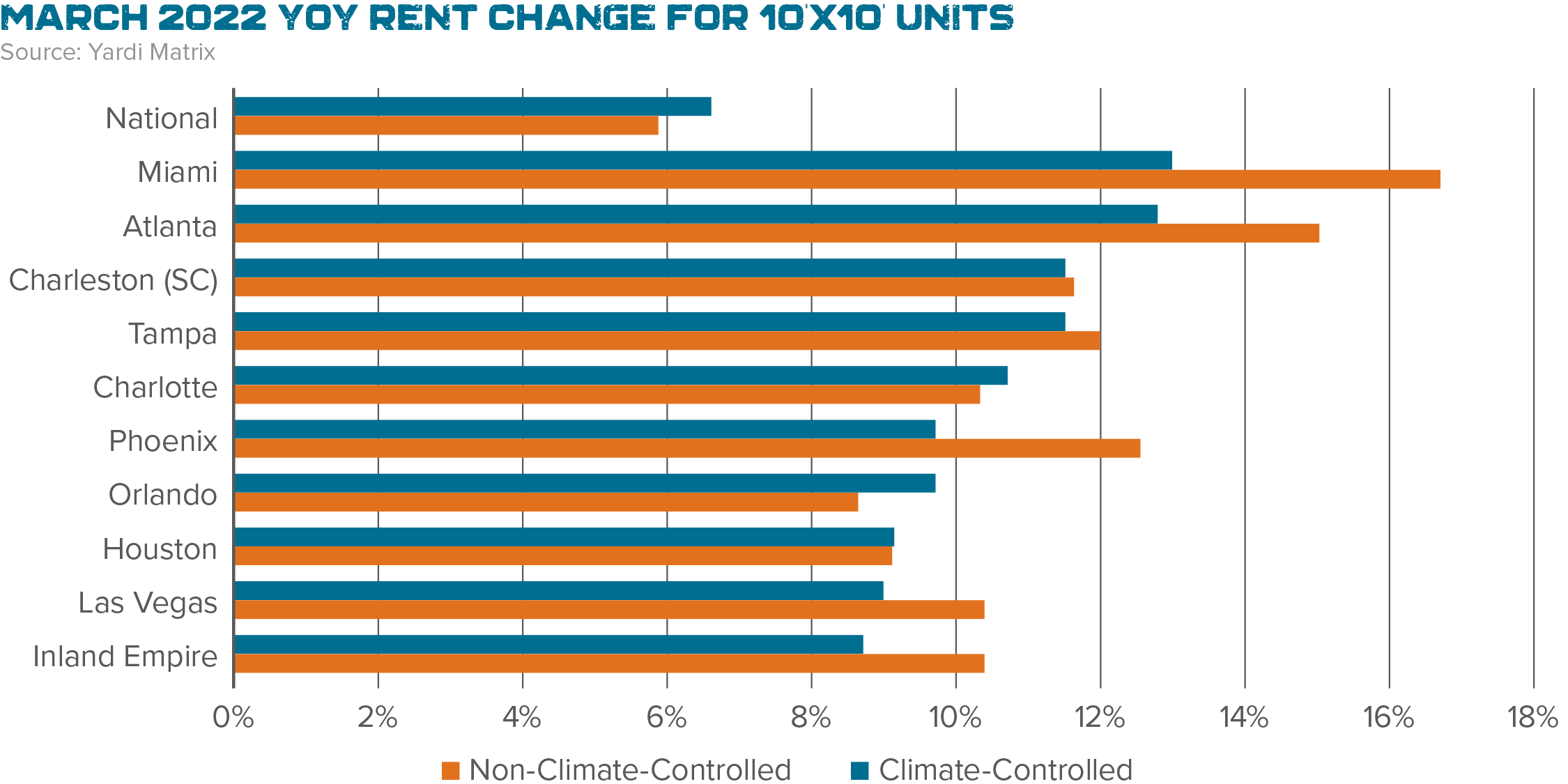

With apartment rents in major markets surging 14.2 percent in 2021 and single-family home prices rising 15 percent, people are moving into smaller living spaces and leasing more affordable storage units. Overall, rents remain well above average on a year-over-year basis, reflective of positive trends in the industry. National rates for 10×10 non-climate-controlled (non-CC) units increased 5.8 percent year-over-year in March 2022 and climate-controlled (CC) rents grew 6.6 percent during that same time, according to Yardi Matrix. Currently, street rates for non-CC units sit at $128 per month, while CC units command $146 monthly on average.

Rent growth was positive in all major metros, with 25 percent of the top 31 MSAs recording rent growth at or above ten percent and 22 of the top 31 metros at five percent growth or more for non-CC units. For CC units, five of the top 31 metros had ten percent rent growth, and 12 metros recording five percent growth or less year-over-year. The strongest-performing markets are high-growth metros in the South and West, led by Miami (16.7 percent), Atlanta (15 percent), Phoenix (12.5 percent), and Tampa (11.9 percent). So long as fundamentals remain robust, self-storage rents are projected to increase in Q2 and Q3 2022, specifically in cities like Los Angeles, where caps were placed on rent increases in late 2021.

New Development Activity

Over 3,300 self-storage properties have been built in the U.S. since 2010, with over half of them completed since 2018, according to CoStar. There are 3,992 self-storage facilities in various stages of development currently; 726 of which are under construction, 1,410 in planning, and 554 are prospective developments. However, given the rising material costs for construction, competition for labor, and slow municipal approval processes, development competition may be deterred. The total number of self-storage properties in the U.S. stands at over 50,000, according to Storage Cafe. The self-storage market was valued at $48.02 billion in 2020 and is projected to reach $64.71 billion by 2026 with a compound annual growth rate of 5.45 percent. These metrics are impressive from any investment standpoint, and the concerns surrounding oversupply are less apparent as demand has largely absorbed new products. Emerging markets with considerable population growth, and large gateway cities, will continue to give new development opportunities.

Self-Storage Outlook

The self-storage industry is less sensitive to economic shifts as demand for storage exists both during economic downturns (as people downsize in housing or move in with family) and when the economy is strong (more disposable income and heightened demand for commercial users). As such, self-storage facilities hold value better and recover quicker during weak periods.

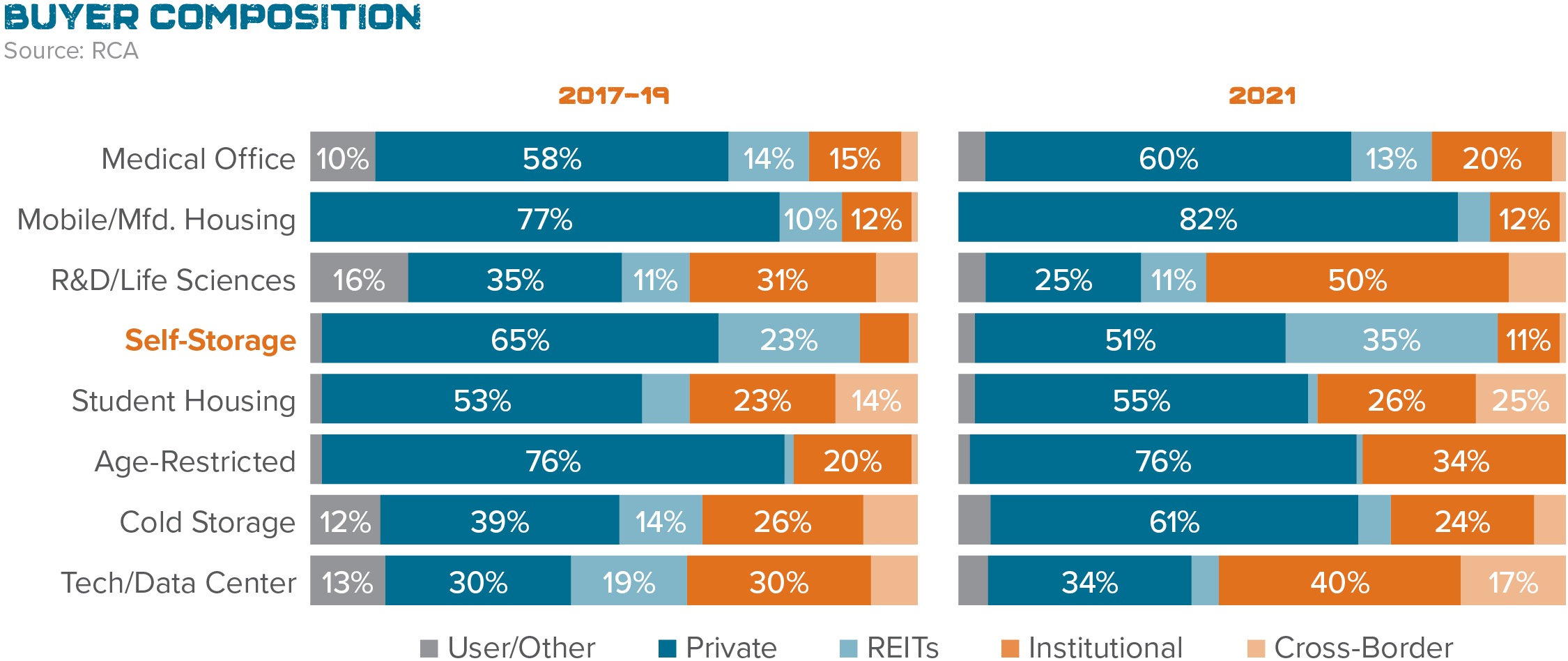

There is now more capital than ever chasing these deals, with institutional funds and private equity groups entering the space with hundreds of millions of dollars to place. Although interest rates are set to rise in 2022, cap rates should see little to no change in institutional quality investment opportunities.

With exceptionally high occupancy rates in place, most operators will start spring leasing with pricing power to increase rates and bring current leases up to market rates. It’s unlikely rent growth will match that of 2021’s 8.5 percent, but Yardi Matrix analysts anticipate strong overall growth in 2022. Despite the difficulty of matching a year like 2021, the self-storage industry is poised to continue to outperform other asset classes and attract investors from every commercial real estate sector.