How Are Net Lease Investors Devising New Formulas for Success?

The arrival of COVID-19 caused retail deal activity to come to a grinding halt, and extended closures resulted in some of the nation’s top retail tenants’ inability to make rent payments. Once people saw the news headlines covering permanent store closures and bankruptcies, many assumed COVID-19 was the nail in the coffin for retail brands struggling with the rise and dominance of e-commerce. Despite this, the net lease retail sector has held up relatively well, with essential businesses and tenants pivoting to new consumer needs. As a result, investors are devising new formulas for success. The demand for essential retailers with long-term leases and corporate-guaranteed tenants has increased dramatically, but the supply is limited. The following article reviews today’s market conditions and why now is the best time to sell.

In 2020, e-commerce surpassed levels not expected until 2025, bringing in over $861.12 billion in sales, and representing 21.3 percent of total retail sales for the year, according to Digital Commerce 360.

Rebuilding the Retail Landscape

The retail sector tends to be painted with the same broad brush. In 2020, over 80 brands closed a total of 15,542 stores, and 30 retailers declared bankruptcy, according to data released by Forbes. However, other retail brands fared better and even benefitted from the pandemic, including convenience stores, drugstores, grocery stores, dollar stores, and home improvement stores. As 2020 progressed, investors shifted investment profiles, paying attention to the tenants deemed essential and cautiously approaching the acquisition and underwriting process. After the lull in 2020’s second quarter, national retail volume surged to $18.7 billion by the year’s final three-month period, according to CoStar. Despite national volume plateauing by year-end 2020, the increase reflected 62 percent of the sales volume averaged over the past three years. In 2021, there has been robust interest in net lease properties and increased 1031 Exchange activity. Furthermore, according to a recent interview, five net lease REITs have gone public and are looking to place capital.

The Lack of Construction

The COVID-19 pandemic further slowed investment in retail construction. Since 2016, retailers have tentatively halted footprint expansion, focusing more so on updating and improving existing facilities to remain competitive. With e-commerce making further inroads, the long-lasting effects of COVID-19 could mean further deterioration in retail construction starts in the coming years.

The United States has almost four to five times the amount of retail square footage compared to Europe. Over the next 10, 15, or 20 years the square footage in the U.S. will be similar to Europe.

An analysis of the top ten retail chains that spend the most on construction shows that seven experienced a decline in construction spending in the first nine months of 2020, compared to the first nine months of 2019. Only three of the ten tenants have increased construction spending, according to Dodge Data and Analytics 2021 Construction Outlook. In 2019, the top 20 U.S. retail chains broke ground on roughly $3 billion worth of construction, a decrease of ten percent from a year earlier. In 2020, retail starts among all brands dropped another 25 percent to $12 billion, and square footage was slashed 28 percent to just 55 million square feet, almost one-third below levels of the Great Recession. With many projects delayed

in 2020, COVID-19’s impact on the retail industry has caused the renovation share of construction to grow, increasing to a record 51 percent of total retail starts in the first nine months of 2020. Thus far in 2021, construction loan activity has picked up, compared to the last five months in 2020. Net lease developers are soliciting construction loans, but supply isn’t anticipated for another 12 months.

Shift in Demand

As 2020 progressed, investors sorted out their investment approach for 2021, zeroing in on tenants deemed essential – with grocers, drugstores, home improvement, and dollar stores at the top of the list. As a result of their essential businesses, these retailers have maintained a significantly stronger financial position throughout the pandemic compared to non-essential businesses; thus, attracting investors. Beyond their ability to thrive during the height of the pandemic, single-tenant net lease properties typically have much longer lease structures with terms beyond 15 years and a corporate guaranteed lease. This makes the product type extremely attractive for investors due to resilient income streams and time-tested confidence in rent collection.

The cap rate, which investors use to gauge the profitability and return potential on a commercial real estate asset, is a subtle but crucial demand indicator. Higher cap rates typically involve more risk, while the lower rates are associated with more stability and capture a higher sale price, which reflects strong, often competitive, investor interest. This demand has sent the property type’s annual yield to a historic low of 6.75 percent, a 25 to 35 basis point drop on active deals. By comparison, cap rates between 2018 and 2019 only fell by four basis points. Commercial real estate professionals predict further cap rate compression in the market, although it will depend on the sector, location, and tenant quality. The pressure is now on buyers who are forced to accept lower returns in the form of lower cap rates to secure a pandemic-resilient net lease asset. In combination, the low interest rate environment and economic recovery will drive up the value of net lease retail. During economic dislocation and uncertainty, property owners typically hold on to investments, further driving a gap between buyers and sellers. For example, there aren’t many buyers for OfficeMax or Staples these days, so sellers aren’t putting them on the market. Further, institutional sellers aren’t selling in an effort to keep shareholders happy and maintain well-performing portfolios. The low interest rate environment has also added pressure to the short supply as corporate sellers choose to refinance loans and hold on to properties they might have otherwise sold. Combined with the lack of construction, this shift tells an essential story about the current retail landscape and the disconnect between buyers and sellers.

Case Study: Drugstores

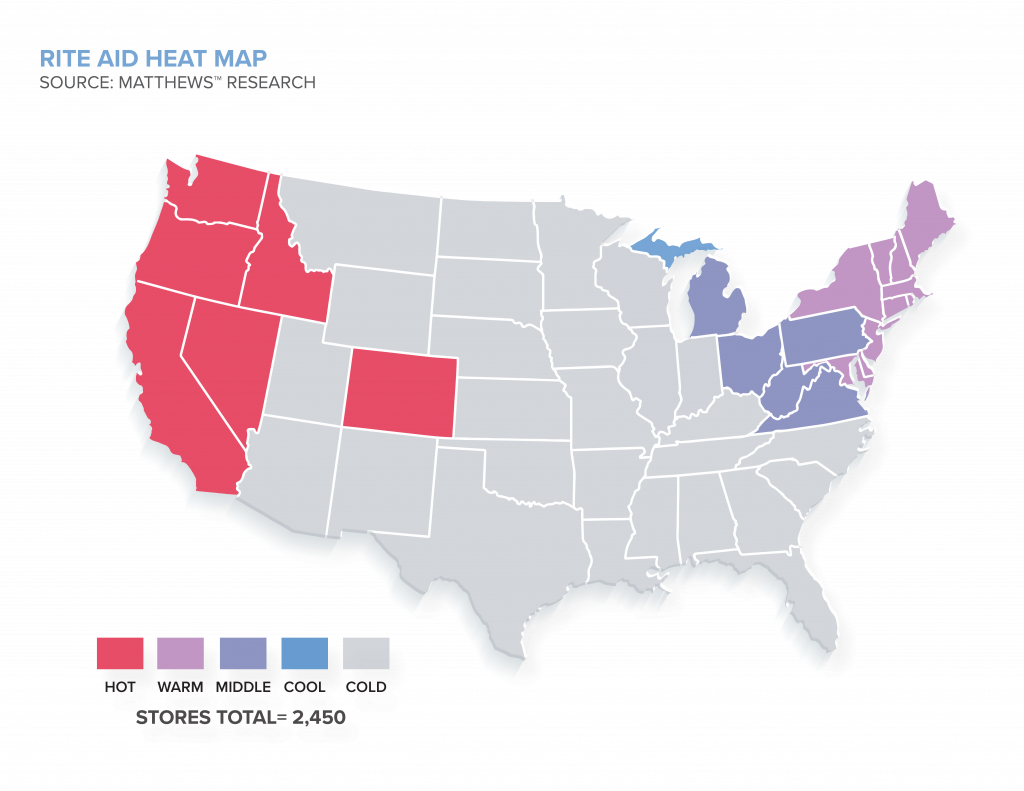

Drugstores have very little competition amongst established players in the market as three companies dominate the drugstore sector – CVS Health, Walgreens, and Rite Aid. Walgreens recently acquired 2,000 Rite Aid locations; Rite Aid currently has around 2,500 locations. This makes the threat of a new competitor or concept slim; pair this with health being at the forefront of consumer minds, drugstores will continue to farewell. Recently, Amazon announced its online pharmacy, where customers can place online orders for medication and prescription refills to be delivered to their homes. However, CVS Pharmacy and Walgreens both have a loyal customer base and already have delivery services in place. CVS Pharmacy and Walgreens also utilize local pharmacists that provide on-the-spot medical information and COVID-19 drive-thru testing.

Before the pandemic, drugstores were already making strides to improve customer experience through partnerships and technology investments. CVS has remodeled locations to focus on health services through HealthHUBs and has expanded and stepped up protocols through MinuteClinic. Walgreens recently partnered with VillageMD, a national provider of primary care, and PWNHealth, a national clinician network that provides safe and easy access to diagnostic testing.

Further, both brands have incorporated free prescription delivery as part of their services. Recently, federal health officials have reached an agreement with pharmacies across the U.S. to distribute free coronavirus vaccines. With these continued improvements, it is evident that drugstores will remain recession and pandemic-resilient.

A Seller’s Market

Buying competition and pricing have curated an environment that favors sellers. These days, it’s a seller’s market for net lease properties for several reasons. For one, net lease investments are easier for investors to manage than multifamily, where maintenance is required. Therefore, many investors are exiting the apartment space. Second, they provide long-term stable income streams. Single-tenant net lease properties have longer lease structures with terms that can go beyond 15 years. From a rent collections standpoint, this provides investors with much-needed stability and assurance. Third, demand for net lease properties outstrips supply.

—

The substantial buyer demand for net lease properties will help convince more owners to sell, which will point the industry towards recovery. Investors anticipate an active acquisition year in 2021, with corporate-guaranteed leases as one of the most popular avenues, especially for 1031 Exchanges.

1031 Exchanges and sale leasebacks are poised to play a significant role in transaction activity in 2021. As the future of 1031 Exchanges remains unclear, 2021 is anticipated to be a strong year for tax-deferred exchange transactional activity. The pandemic has created an unprecedented need to repurpose and renovate existing real estate to meet post-pandemic business models. 1031 Exchanges provide an incentive for owners who are not in a position to make significant building modifications. This strategy transfers properties into the hands of buyers willing and able to invest fresh capital and optimize these properties for future tenant needs.

Today’s environment is also an opportune time to consider a sale leaseback transaction. The frequency of sale leasebacks is increasing as a means to generate equity value. JCPenney is a prime example of a high-profile company utilizing sale leasebacks to unlock liquidity during tough times. Other examples include Bed Bath & Beyond and Big Lots.

The COVID-19 pandemic accelerated the inevitable digital distribution of e-commerce and has caused a significant consolidation of retailers, fundamentally altering the competitive market. Investors look for investment-grade tenants with a history of longevity and a proven track record of staying profitable in all economic climates. This is an opportune time to take advantage of the opportunities available in the market.