Why Invest in Multifamily During Inflationary Periods

Inflation has become a near-constant topic of conversation. Surging gas, food, and rent prices catapulted U.S. inflation to a four-decade high in 2022. Inflation reached a record-breaking 9.1 percent in June, before dropping to 8.3 percent in August. This pressured households and sealed another hefty interest rate hike by the Federal Reserve, with higher borrowing costs following suit. As the stock market is impacted, investors are wondering where the best place is to distribute their money to receive stability as inflation rages and a recession looms. Real estate, especially multifamily, has always been a tried-and-true inflationary hedge. Investors are leaning more towards this asset class to plant capital and stay ahead of financial perils.

Is Cash or Real Estate King During Inflation?

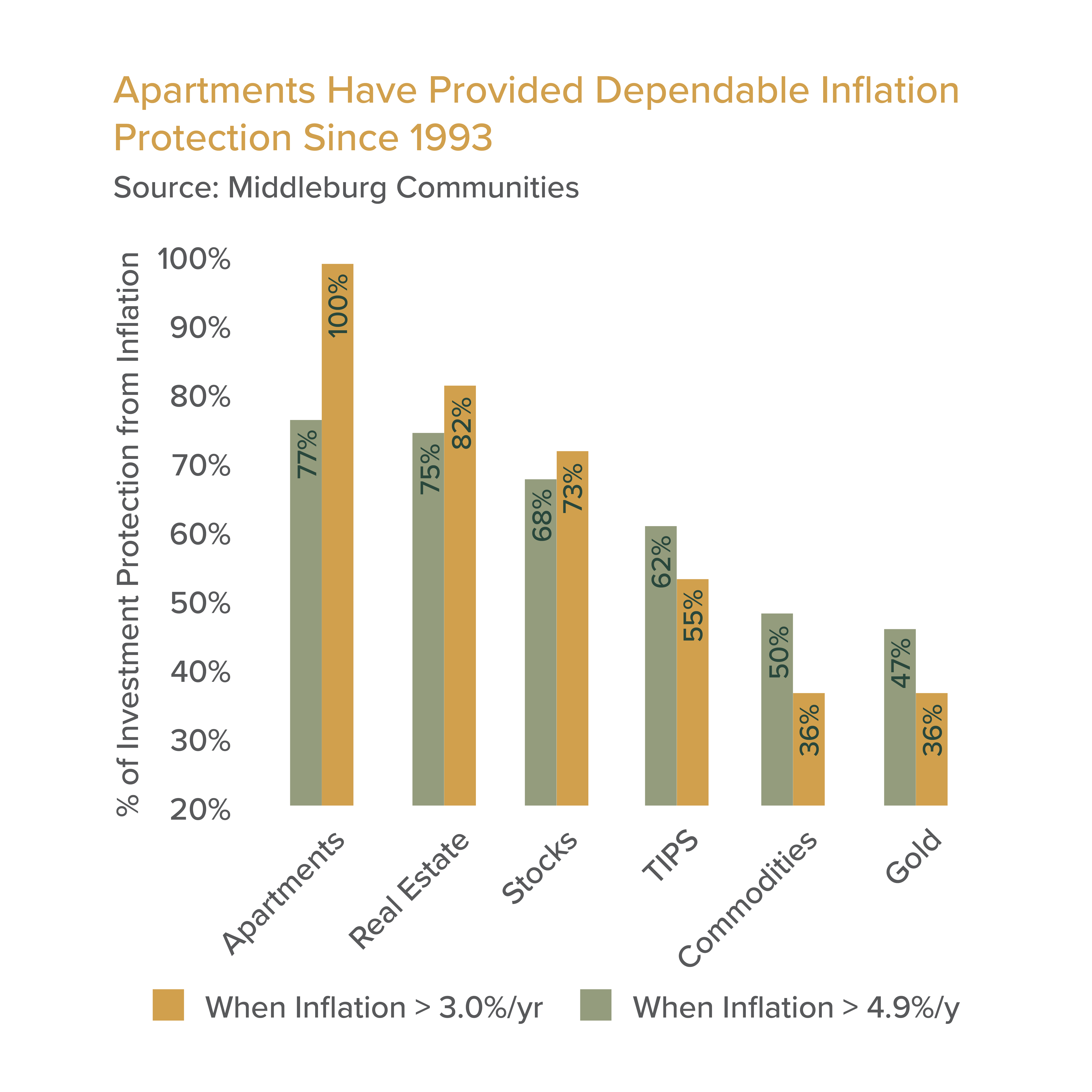

Real estate has long been considered one of the most stable and attractive investment classes. Inflation weakens the purchasing power of consumers, and the value of fixed returns is reduced. Therefore, to hedge against inflationary impacts, investors seek assets that can grow in value, such as real estate, that build a stable path towards cash flow and capital appreciation. Historically, in high inflationary periods multifamily operators see increases in rental rates which has been a great safeguard against inflation.

A one percent increase in inflation indicates a 1.2% upswing in private commercial real estate excess returns. Yet, during the same period, a one percent increase in the inflation rate can reduce bond prices by 1.5% and a drop in stock prices by 4.2%. Source: Global Financial Crisis

There are four core differences between real estate, specifically multifamily investments, and other investments, such as stocks or bonds. First, real estate is a physical asset with intrinsic value. As a tangible asset, it derives its value from the physical property and improvements. Second, multifamily investments generate returns in the form of rent and appreciation of value, which helps fend off the erosion of current value from inflation. Third, the inflationary pressures can be passed on to the tenant in the form of increased rents, thus income. Finally, through cost segregation, an investor can allocate the asset’s cost over its useful life to account for declines in value over time. Investors can use some tax incentives to write off depreciation, mortgage interest, property taxes, operating expenses, and invested capital to repair or maintain the property.

Core Reasons to Invest in Real Estate

- Intrinsic Value

- Appreciating Value

- Increase in Income/Rents

- Depreciating Debt

Multifamily properties also show an impressively higher result for average risk-adjusted returns compared to stocks and bonds.

Multifamily Performance During High Inflation

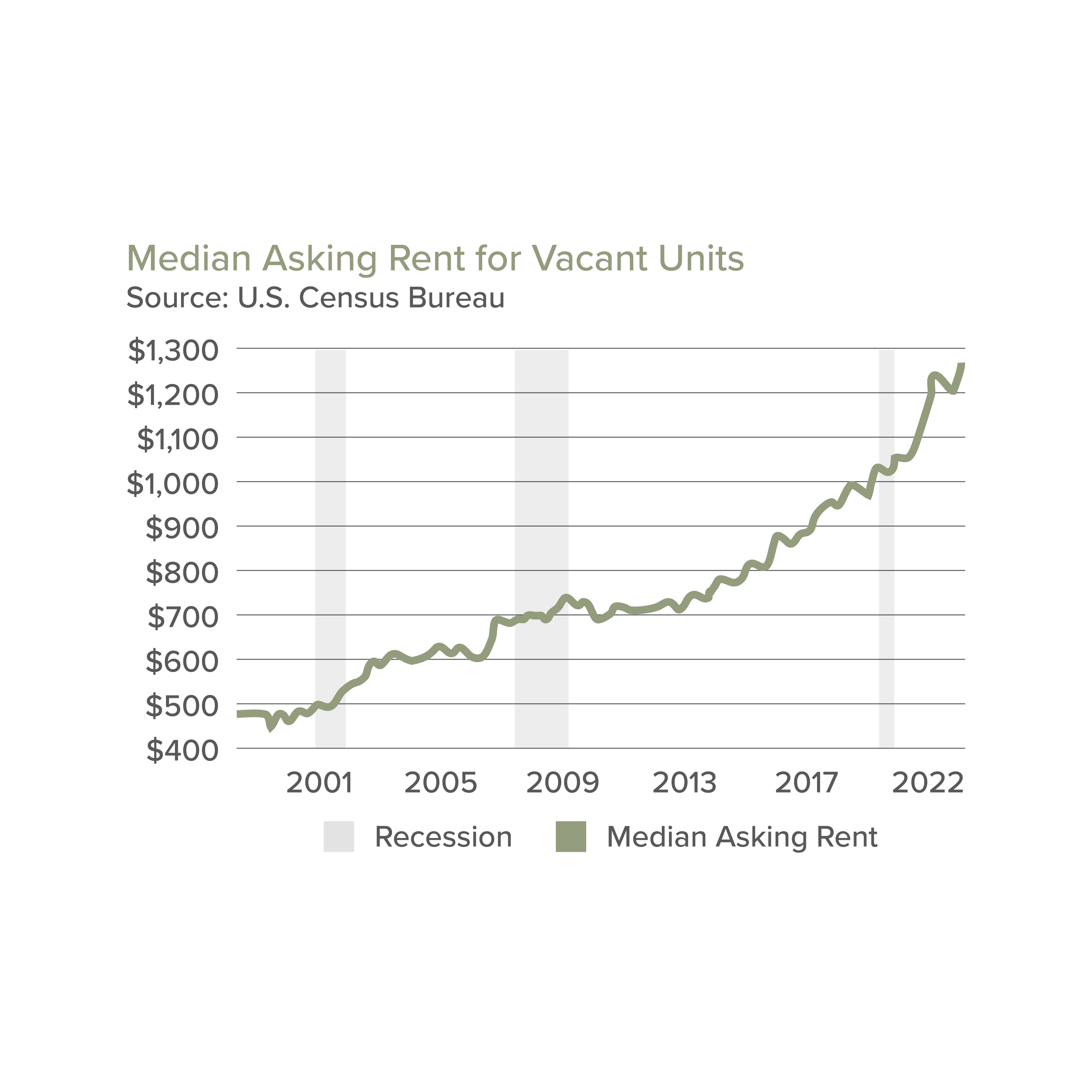

The most important thing to remember about multifamily is the resilience related to rental demand; even during an extreme recession or financial turbulence, people will always need a place to live. Additionally, when interest rates increase along with the prices of goods and services, fewer people can afford to purchase a home, which leads to elevated rental demand. As the demand for rental units rises, multifamily owners can increase asking rents to adjust for inflation and match local market rates. Also, compared to retail or industrial real estate, these leases are much shorter, allowing the owner to adjust rents more frequently. Naturally, rent is expected to increase by two to three percent year-over-year to match inflation, but with current increases in rental income it would likely exceed the inflationary growth in building operating costs and expenses.

Within certain municipalities, multifamily owners can rewrite leases to align with the Consumer Price Index (CPI). These revisions highlight that annual rent raises will be equal to or higher than the annual adjustment to the CPI.

Additionally, multifamily properties are often financed with fixed-rate, long-term loans for as long as 10 years, keeping debt payments stable during rising inflation. These building owners borrow as much as 60 to 70 percent of the property’s value which serves as an inflationary hedge. When a period of high inflation occurs and the owner has a long-term loan with fixed monthly interest, they are not impacted by rapid interest rate spikes and can take advantage of rent and property value growth. On the other hand, any owner that has a property loan with variable rates is at greater risk of interest rate hikes during times of inflation. Multifamily offers investors an incredible opportunity for faster portfolio growth, significantly higher potential to profit from economies of scale, excellent cash flow and appreciation value potential, and stable control over income and asset value.

Benefits of Investing in Multifamily

- Inherent Value, Income-Generating Asset

- Increase in Demand for Apartments, Increase Occupancy

- Ability to Adjust Rent Rate More Frequently Appreciation Along with CPI

- More Control Over the Investment

- Long-Term, Fixed-Rate Loans

- Low Supply and High Demand

Like all investments, not all provide the same returns. Each investment carries different opportunities and challenges.

Risks of Investing in Multifamily

- Tenants May Fall Behind on Rent

- An Upswing in Construction Costs & Decrease in Inventory

- Maintenance Cost Increase (Note, that during high inflationary periods, owners can renegotiate existing contracts with vendors to lock in prices for one to three years, and sometimes more)

Real Estate Investing Strategies

Perform Due Diligence

Choosing a market with a strong MSA, high demand, and strong fundamentals (low vacancy and market rate rent) proves beneficial to investors. It’s essential to perform due diligence on the economy and rental patterns of any local market in which there’s interest in making property investment or development. It’s recommended to locate assets with cash flow and current tenant leases that can be adjusted in alignment with inflation.

Consider Property Renovations

Property renovations are important and not only increase the overall property value and create future potential capital gains but serve as an excellent hedge against rising prices by outpacing the rising inflation.

Look into Value-Add Opportunities & 1031 Exchanges

With rising real estate property prices in primary markets across the U.S., secondary and tertiary markets have grown in popularity among investors looking to maximize their returns. These markets present excellent value-add opportunities for attractive returns and often receive less bidding competition.

Take Away

Multifamily provides a unique combination of benefits to real estate investors, encompassing passive income, scalability, appreciation, leverage, and incredible tax benefits. To put this into perspective, net demand for market-rate apartments in 2021 reached record highs at 673,000 units; this was the highest in three decades and blew away the previous record from 2000 by 66 percent. In addition, nearly 360,000 market-rate apartment units were completed in 2021. That milestone has been the highest addition in over three decades on the supply side. Another 682,000 units are under construction, and roughly 426,000 are scheduled to be completed by the end of 2022. This is the first-time supply deliveries will reach the 400,000-unit market since 1987. However, the U.S. still needs 4.3 million new apartment units between now (2022) and 2035 in order to mitigate issues related to apartment demand and the shrinking supply of affordable priced housing, according to research commissioned by the National Multifamily Housing Council and National Apartment Association. These favorable fundamentals, combined with shifting market preferences, have led to an explosion in multifamily demand, presenting investors with additional cash flow and capital appreciation despite the short-term