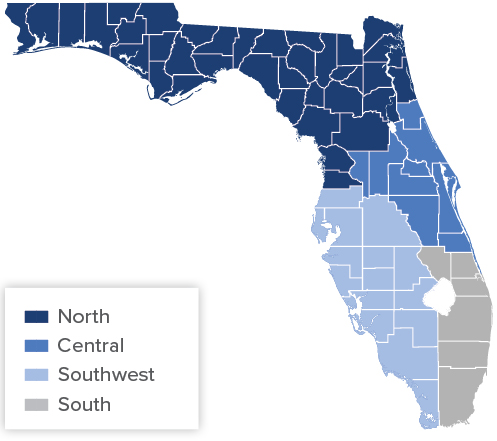

Florida Medical Office Market Overview

Market Overview

Florida is a vibrant and diverse state located in the southeastern region of the U.S. Renowned for its stunning beaches, including the famous Miami Beach and the Gulf Coast’s white sands, Florida attracts millions of visitors yearly. Among the state’s numerous commercial real estate assets, healthcare continues to be one of the most sought-after.

Several positive factors contribute to this high demand for healthcare real estate. First, the state’s aging population is significant, with approximately nine million residents (42% of the total state population) aged 50 or older. This demographic has historically comprised the majority of healthcare services consumers, increasing the demand for outpatient healthcare facilities to cater to the growing aging population. Additionally, healthcare in the state ranks as the third-largest employer and the second-largest contributor to GDP, playing a substantial role in the overall economy. The high demand for services and the large number of patients relying on access to healthcare facilities provide investors with a high level of security in healthcare real estate.

North Florida Market Overview

Includes -Pensacola • Fort Walton Beach • Panama City • Tallahassee • Jacksonville • Gainesville

In North Florida, the market rent stands at $24.05 per square foot, and has increased on average 3.17% over the last 10 years. The total sales volume for both investment and owner-user sales has reached an impressive $146 million, with an average sales price of $2 million, and an average cap rate of 6.9%. The region’s medical office inventory is substantial, totaling 30.5 million square feet, and the current construction of 382,000 square feet indicates a commitment to meeting the growing demand for healthcare services. The 12-month net absorption stands at 153,000 square feet, indicating a positive trend of occupied spaces.

By The Numbers | Last 12 Months | Source: CoStar Group

- Average Sales Price: $2M

- Average Cap Rate: 6.9%

- Sale Price Per SF: $236

- Total Inventory: 30.5M SF

- Under Construction: 382K SF

- Vacancy Rate: 6.5%

Central Florida & East Coast Market Overview

Includes – Kissimmee • Orlando • Daytona Beach • Titusville • Melbourne • Ocala

Central Florida and the East Coast’s market rent is $26.51 per square foot, and has increased on average 3.3% over the past decade. The total sales volume for both investment and owner-user sales is $243 million, with an average sale price of $2.1 million and an average cap rate of 6.7%. The region’s medical office inventory is substantial, totaling 34.3 million square feet, with 471,000 square feet under construction. The 12-month net absorption stands at 414,000 square feet, and the vacancy rate for the area is 7%.

By The Numbers | Last 12 Months | Source: CoStar Group

- Average Sales Price: $2.1M

- Average Cap Rate: 6.7%

- Sale Price Per SF: $273

- Total Inventory: 34.3M SF

- Under Construction: 471K SF

- Vacancy Rate: 7.0%

West & Southwest Florida Market Overview

Includes – St. Petersburg • Lakeland • Bradenton • Sarasota • P O R T Charlotte • Fort Myers

Southwest Florida’s market rent is $26.68 per square foot, and has increased on average 4% over the past decade. The total sales volume for both investment and owner-user sales is $355 million, with an average sale price of $1.9 million and an average cap rate of 6.6%. The region has 47.5 million square feet of medical office inventory and 376,000 square feet under construction. The 12-month net absorption is low at 4,300 square feet, with a vacancy rate of 5.4%.

By The Numbers | Last 12 Months | Source: CoStar Group

- Average Sales Price: $1.9M

- Average Cap Rate: 6.6%

- Sale Price Per SF: $258

- Total Inventory: 47.5M SF

- Under Construction: 376K SF

- Vacancy Rate: 5.4%

South Florida Market Overview

Includes – West Palm Beach • Fort Lauderdale • Miami • Key Largo • Key West

South Florida’s market rent is $40.59 per square foot, and has increased on average 5.1% over the last 12 years. The total sales volume for both investment and owner-user sales is $322 million, with an average sale price of $2.4 million and an average cap rate of 6.3%. The region has 47.9 million square feet of medical office inventory and 663,000 square feet under construction. The 12-month net absorption stands at 79,600 square feet, with a vacancy rate of 6.5%.

By The Numbers | Last 12 Months | Source: CoStar Group

- Average Sales Price: $2.4M

- Average Cap Rate: 6.3%

- Sale Price Per SF: $137

- Total Inventory: 47.9M SF

- Under Construction: 663K SF

- Vacancy Rate: 6.5%

Major Operators & Tenants

Among all the outpatient healthcare facilities within the state, several key operators are spread across numerous locations, meeting the needs of patients in multiple cities throughout each of the four distinct markets.

Download the full report today to get a full list of major operators and tenants.