The Launch of Opportunity Zones

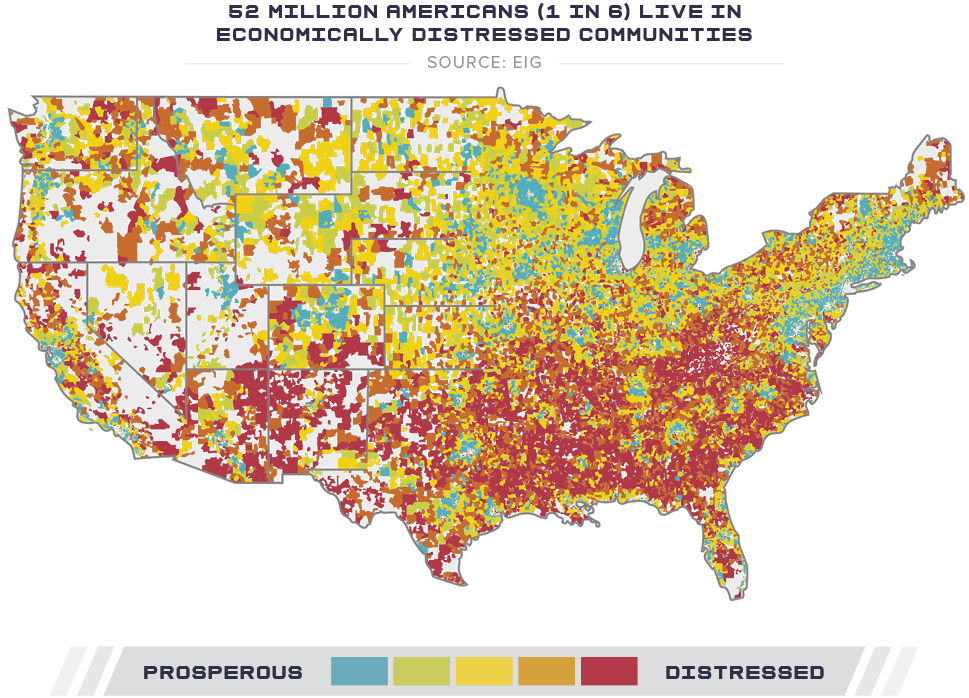

As part of the Tax Cuts and Jobs Act, the opportunity zone provision is designed to encourage investment and economic growth in specific low-income communities, in turn offering federal tax incentives to the taxpayer who invests in a business located in one of these zones. The final regulations were released in December 2019 and provided some much-needed clarity to investors.

These final regulations tie together many loose ends that remained after the two previous regulations were released in October 2018 and in May 2019. Before this, many investors were concerned with the confusing rules, the lengthly required holding period, and the inability to enjoy losses or take the distribution in the early years. Further, developers also expressed trouble finding deals that made financial sense due to the high cost of land in many zones. Until recently, only a handful of investors were willing to learn the parameters of the opportunity zone program.

The volatility during the pandemic led many to pull money out of the stock markets and invest in real estate instead. Many have chosen opportunity zone funds, leading to a surge in fundraising. This article provides insight into the final regulations and how investors can maximize the benefits of opportunity zones in 2020.