Capital Markets | Multifamily Market Report

Market Overview

The Effective Federal Funds Rate currently stands at 5.08 percent as of June 12, 2023. This comes after 10 consecutive rate hikes, beginning in March 2022 and the most recent on May 3, 2023, up by 25 basis points. As a result of these hikes, lending has taken several hits, and there have been a few major bank failures making lenders react by avoiding riskier loan types.

Despite a decrease in transaction activity, multifamily properties remain the most sought-after asset type as of H2 2023 but at a much slower rate compared to earlier years. Sales began decreasing in the latter half of 2022 to $227 billion; however, it was still the second-best year on record following a record-breaking 2021, according to CoStar Group.

Multifamily, By the Numbers

- Asset Value: $5T

- 12-Month Sales Volume: $145.3B

- Market Cap Rate: 5.3%

- Market Sale Price Per Unit YOY Change: -5.7%

Rising Rates

Investors are adjusting their business plans to adapt to a new interest rate environment and increasing pricing pressures. Initially, strong rent growth helped offset the effects of higher interest rates, but this counterbalance is now diminishing. Furthermore, as the macroeconomic landscape changes, investors are revising their estimates about rent growth and raising their yield requirements.

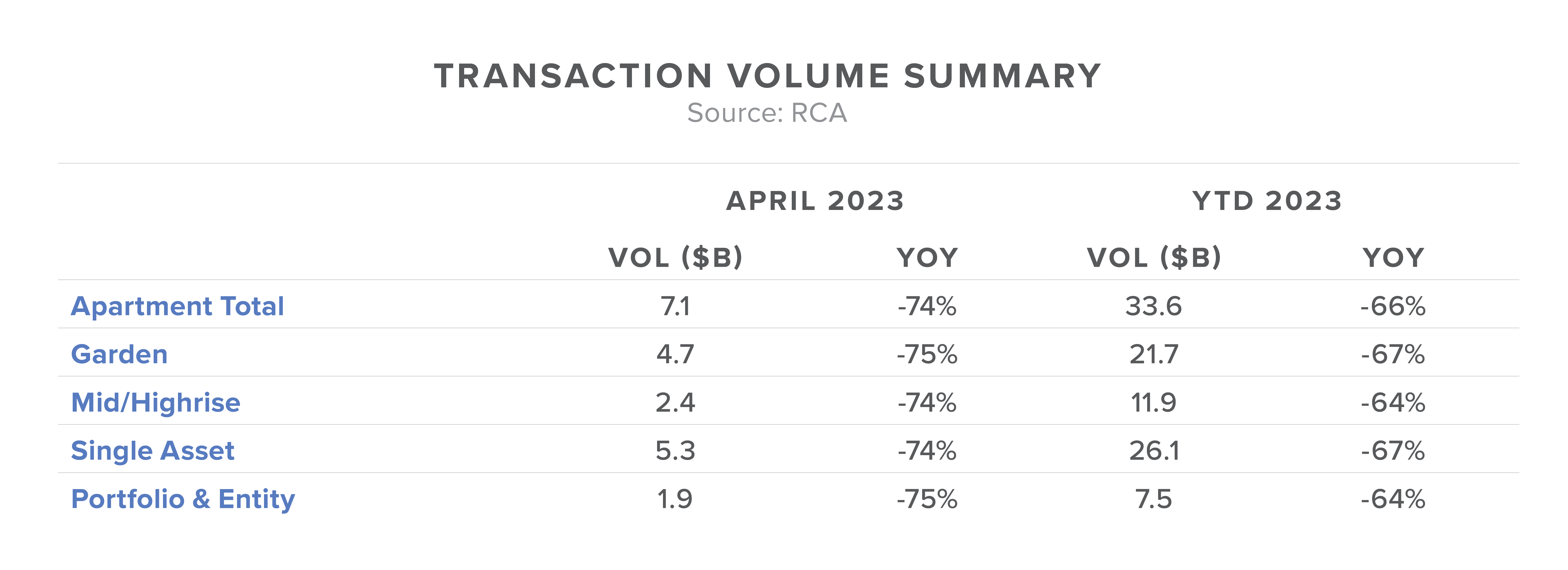

According to Multihousing News, multifamily investment activity has experienced a substantial decrease due to the rate increases implemented by the Fed. Multifamily sales volume was down by 64 percent at the end of Q1 2023 compared to Q1 2022. The primary factor for this fall – rising cap rates. The rise in cap rates has resulted in a loss of value ranging from 12 percent to 18 percent, prompting sellers to hold onto their assets until the value recovers. It’s not only the sales volume affected by increasing interest rates. The development activity has also been significantly impacted, making it harder to secure funding for projects.

Underwriting-Types of Deals/Price of Deals?

Underwriting assists investors in evaluating a property’s viability and prospective returns by evaluating its income potential, expenses, cash flow estimates, market conditions, and numerous risk considerations. This process helps stakeholders make informed decisions about financing, investment opportunities, pricing, and overall risk management in the multifamily real estate sector.

According to RCA, throughout 2023, prices in the multifamily market have been experiencing year-over-year declines every month, but the actual downward trend began in 2022. The RCA CPPI (Commercial Property Price Index) for apartments reached its highest point in July 2022 and has been steadily decreasing since then. In April of 2023, the index was down by 12.1 percent compared to the previous month. However, compared to March, prices showed a steeper decline of 17.1 percent when annualized.

Nonetheless, this 17.1 percent decline can be seen as an improvement. The most significant price drops occurred between November 2022 and January of this year, with the average annualized pace of price decreases during those months reaching 25 percent.

Investment Opportunity

The major sentiment is a lag in sellers’ expectations (ask), who are holding onto prior pricing, and buyers (bidders) who are capital constrained. The bid/ask disconnect is improving based on the decrease in multifamily valuations. In addition, some distressed assets are hitting the market. Opportune investors are coming into complete projects or working with lenders on upcoming loan maturities.

The newly released Freddie Mac Multifamily Apartment Investment Market Index (AIMI) climbed by 5.3 percent quarter-over-quarter in the first quarter of 2023, indicating an increasingly favorable environment for multifamily investment opportunities. In a reversal from the decline seen in the fourth quarter of 2022, AIMI increased in all 25 metropolitan markets monitored by Freddie Mac. If investors possess available funds or can secure financing from the currently tight lending market, this is an opportune moment to engage in the acquisition of apartment properties.

Market Sales Trends, Last 12 Months

The markets experiencing some of the highest sales volume and transactions in the nation over the last 12 months, according to Costar Group, include:

- New York, NY: $10.1B

- Los Angeles, CA: 7.9B

- Atlanta, GA: $7.3B

- Phoenix, AZ: $6.9B

- Washington, D.C.: $5.2B

Recent Significant Sales

333 Park Plaza Drive, Westlake Village

Westlake Village Apartments is a 47-acre seaside development with apartment houses that include quaint cottages and spacious townhomes. This multifamily portfolio comprising 3,105 units located in Daly City, California, was sold in January 2023 for $925 million.

1000 W 8th St, Thea at Metropolis

According to Costar Group, the THEA at Metropolis sold for $504M or $735,766 per unit on November 8, 2022. At the time of the sale, the property had a 91 percent occupancy rate. Through their Northland Fund VIII, Northland funded the purchase of this property using a fixed-rate debt with a term of 10 years. Northland obtained most of the funding for this acquisition through the sale of the Hilands, a multifamily property of 826 units in Tucson, AZ.

19 Dutch St

The multifamily property consisting of 483 units located at 19 Dutch St in New York, NY 10038, was sold on September 23, 2022, for a total of $487,500,000. This sale translates to a price per unit of $1,009,317.

221 Massachusetts Ave, Church Park Apartments

The apartment building located at 221 Massachusetts Ave. in Boston, MA, consisting of 208 units, was sold on April 28, 2023. The sale was conducted by a joint venture between Boston Residential Group and Boyd/ Smith Inc, and the buyer was Brookfield Properties Multifamily LLC. The purchase price for this transaction amounted to $439,000,000, equivalent to an approximate value of $864,173 per unit.

160 Riverside Blvd

On July 15, 2022, a multifamily property located at 160 Riverside Blvd in New York, comprising 455 units, was sold for a total of $415 million. The property, which had an occupancy rate of over 99 percent, was constructed in 2001 and features ground-floor retail space.

What Does the Future Entail?

Though multifamily investments have slowed, the sector’s fundamentals remain intact. Although rising interest rates can negatively affect multifamily property owners and investors, there are also potential advantages. Higher interest rates may discourage potential homebuyers from entering the single-family housing market, increasing demand for rental properties. Inflation and rising costs can contribute to higher rents for existing properties. Multifamily property owners and investors with strong financial positions can take advantage of the current economic conditions by expanding their portfolios at a lower cost.