CLICK HERE TO DOWNLOAD THE ARTICLE

Approximately four million people call Los Angeles home, making it the second-largest city in the United States. When adding together the small cities that make up Los Angeles County, the urban area totals more than ten million people. With the extensive and difficult construction process paired with the considerable demand for housing, one thing is certain, Los Angeles is an expensive place to live and has limited affordable housing. Due to the high cost of single-family homes, more than 63 percent of households in the area were occupied by renters in 2018, according to the Southern California Association of Governments. Coupled with the large renter pool, the gentrifying neighborhoods, value-add deals, and asset appreciation have helped Los Angeles keep a steady stream of investment opportunities over the years. Los Angeles also encompasses several small markets across different cities, which allows investors to do more with less. In this article, Matthews™ dissects the Los Angeles multifamily market and presents the benefits and challenges of owning a property in an ever-growing market.

Why Multifamily Housing is So Expensive

Los Angeles has had its fair share of challenges, but it continues to attract new talent and investment. These challenges include the financial crisis, which shaped the area’s current real estate landscape, the shifting market preferences from urban to suburban locations, several ups and downs regarding multifamily development, and now, COVID-19.

According to the UCR School of Business Center for Economic Forecasting and Development, building multifamily in the City of Los Angeles costs about $100,000 more per unit than in other nearby Southern California cities. Further, land costs account for nearly 17 percent of a multifamily project’s total development cost compared to less than two percent in other cities. Developers also don’t want to commit to building units with the ongoing threat of constant rent control ballot initiatives. The fundamental difference of housing costs in Los Angeles comes down to the value of land. According to Hoyu Chong, lead researcher for the center said, “Los Angeles is an enormous world-famous city, ten times the size of the other locations studied, and that concentration of economic opportunity, industry, and activity means the land comes with a significant cost premium.”

Variables Affecting Los Angeles Multifamily Growth

With so much opportunity, come challenges, including difficulty of building, high-cost of land, and expensive rent. Affordable housing projects are not feasible for development without the cost being distributed among numerous people. Therefore, developers tend to focus on Class A developments where the high rent can turn a profit. Consequently, Los Angeles residents feel the greatest pinch considering the high rent and limited affordable housing. Some of the biggest factors at play affecting multifamily growth in Los Angeles is vacancy decontrol and zoning laws.

High Rent

When COVID-19 was introduced, many renters reevaluated their housing choices. As unemployment skyrocketed at the beginning of the pandemic, renters searched for more affordable housing, with the pandemic to blame for less-favorable, high-density residential living. With renters no longer tethered to their work location, many have moved away from urban markets to suburban neighborhoods. As a result, vacancy and concessions increased in urban markets.

Landlords utilize vacancy decontrol to raise rents to the market rate at the beginning of a new tenancy and serves as the lifeline for private capital owners to increase cash flow. Experts believe that vacancy control would diminish apartments’ value overnight as it takes away the incentive to add property value. Much like rent control, landlords would be extremely challenged to keep up with costs, which according to a National Apartment Association study, increased recently by seven to eight percent. In New York, the state eliminated vacancy decontrol in 2019, and as a result, property values plunged, building upgrades and maintenance were cut back, and multifamily sales declined drastically.

Local Ordinances/Zoning Laws or Restrictions

Boasting one of the highest populations in the country, Los Angeles has experienced sprawling development over the past century. In conjunction, the market has also endured a housing shortage and some of the highest costs of living in the world. Development continues in Los Angeles, but zoning limits the type, density, and height of developments, while also creating setbacks. Ultimately, zoning laws limit the potential and growth in some neighborhoods.

In 1978, Los Angeles passed Proposition 13, which protected privately-owned land with the same property tax limitations as residential. This means large corporations within California, such as Facebook, have only paid one percent of their property’s value in taxes for the last four decades. Proposition 15 was an ordinance on the 2020 ballot that did not pass. Prop 15 proposed to divide millions of acres of land into residential and commercial, allowing for a projected $12.5 billion in property taxes from corporations, according to LA Times. The proposition promised to target businesses valued at $3 million or more. Supporting this is a University of Southern California study, which found that 80 percent of the state’s commercial properties are worth $3 million or less.

Los Angeles is nearly completely dominated by single-family housing, particularly on the Westside, in the Valley and in Northeast Los Angeles. These areas are where the battle over development and displacement primarily occur. While compromising a majority of the city’s land, these neighborhoods have nearly zero rent-stabilized housing, and have played a disproportionate role in exacerbating the housing crisis. On the other hand, the City of Los Angeles is dominated by Class B and C multifamily, which is in some major need of upgrades. Other markets, like downtown Los Angeles, are an ‘entertainment powerhouse’ and boast mid- and high-rise luxury developments.

The path to solving the housing crisis starts with massive changes in zoning regulations. Development of multifamily housing is expensive, even for affordable housing. Therefore, public officials need to support changes to zoning and land in order to reduce housing unit costs and increase affordability for Los Angeles renters.

Multifamily Fundamentals

Development

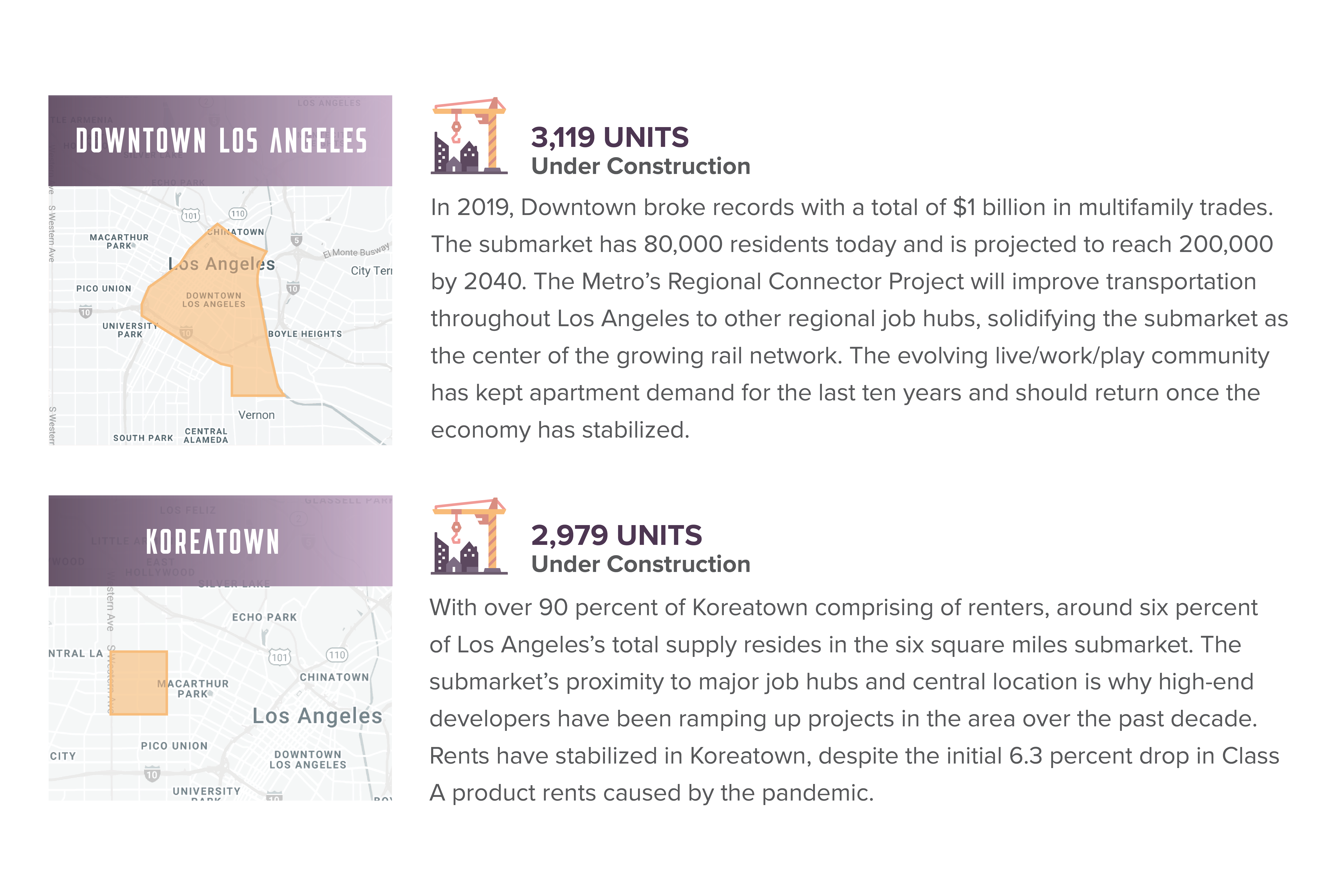

There are currently 28,000 units under construction in various submarkets throughout Los Angeles. This new supply will increase competition in the area and cause older buildings to lower rents. However, in places like Inglewood, where the NBA is building a new arena for the Clippers just south of the new $5 billion SoFi Stadium, more development projects are underway to meet the steady and healthy demand for housing. Centrally located submarkets, such as Koreatown and Hollywood, positioned along the transit lines, also see heightened construction.

The Los Angeles metro has boasted a four percent vacancy rate over the last decade. Although COVID-19 has brought major disruptions, the pause on development, lengthy entitlement process, and fierce apartment competition could help supply constraints. Overall, the demand for new product is relatively low and should keep occupancy afloat.

Sales Activity

Los Angeles remains a primary investment option, even though transaction volume has slowed due to the gap in buyer and seller expectations. Around $900 million traded in Q2 2020, and $1.7 billion in Q3 2020. A private institutional investor recently sold a 12-property portfolio, with assets located in Mid-Wilshire, Pasadena, and Calabasas, for $2.4 billion. Given Los Angeles’s rising job market and strong housing demand, the multifamily market is projected to stay strong.

The Los Angeles Market & Submarkets

Los Angeles had a strong multifamily track record before the outbreak, with $11 billion in multifamily trades for both 2018 and 2019. The metro’s diverse economy, consistently expanding population, and wealthy residents alludes to a quick rebound post-COVID-19. Domestic and international capital was pouring into the apartment market, boosting the average sale price to $300,000 per unit. With one of the highest percentages of renters than any other major U.S. city, Los Angeles notoriously unaffordable apartment market will rectify and stabilize.

While the world is in uncharted territory with the pandemic, one thing remains certain: a strong multifamily property with a promising location will survive and thrive post-COVID-19. Owners should continue to monitor the various aspects of their property to ensure continual success, but once the market stabilizes, demand will return for these centrally-located assets near transit lines, major job hubs, and entertainment options. For more information, please contact a Matthews™ specialized agent.