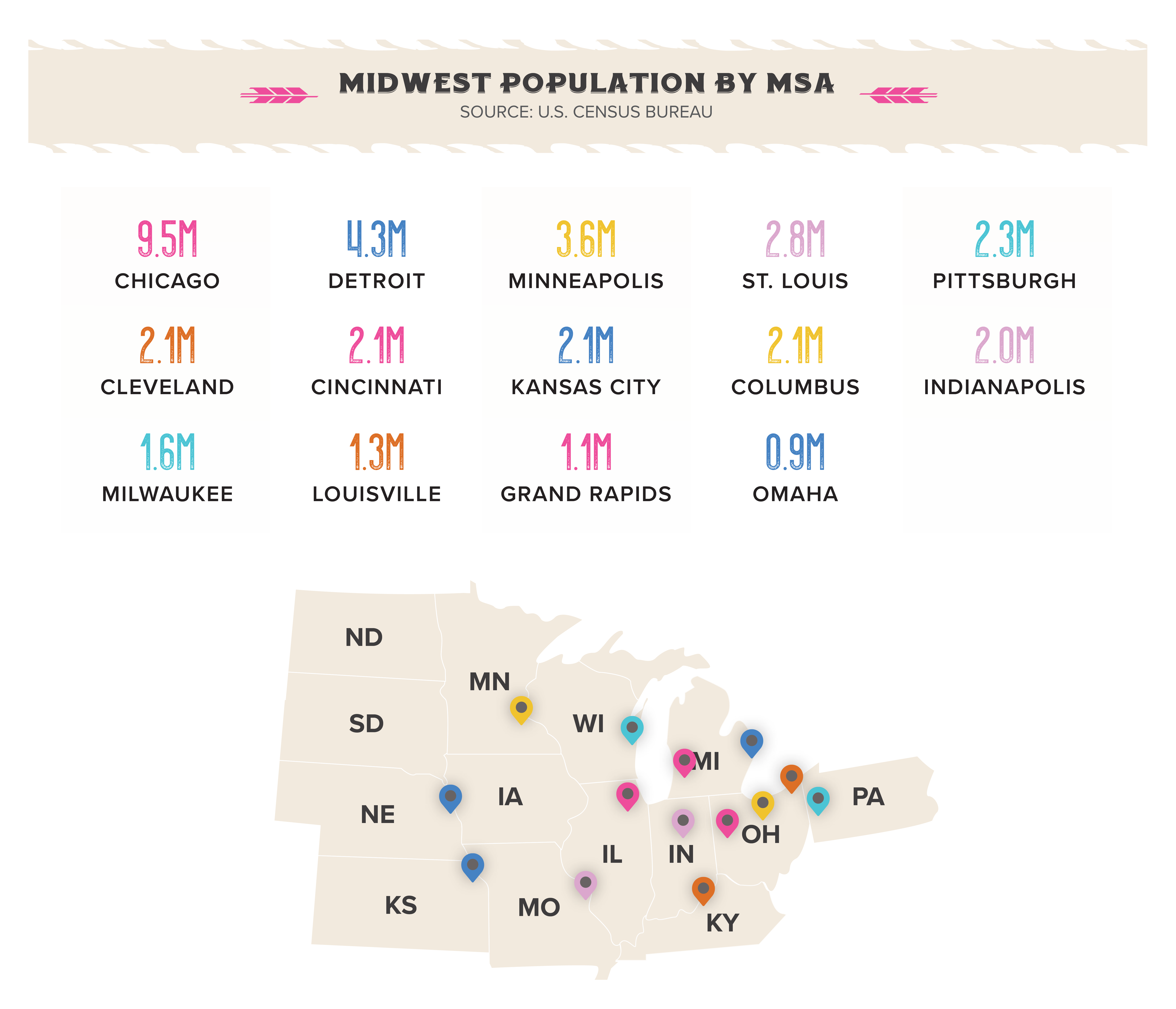

The Midwest boasts some of the largest industries in the nation, with manufacturing and healthcare topping the list. In addition, the region hosts almost ten percent of U.S.-based tech start-ups and houses 139 Fortune 500 Companies. Entailing one of the largest populations in the U.S., about 21 percent of the population, or 68 million people, reside in the region, compared to 56 million in the Northeast and 39 million in California. Coming before Germany, India, the UK, France, Italy, Brazil, and Canada, the Midwest boasts the fourth-largest global annual GDP of $4.2 trillion. New companies and residents are the main contributors to the region’s thriving economy, as they follow the area’s opportunities. In this article, Matthews™ discusses how the Midwest became a target region for investors and the leasing trends dominating the area.

Active Retailers in the Midwest

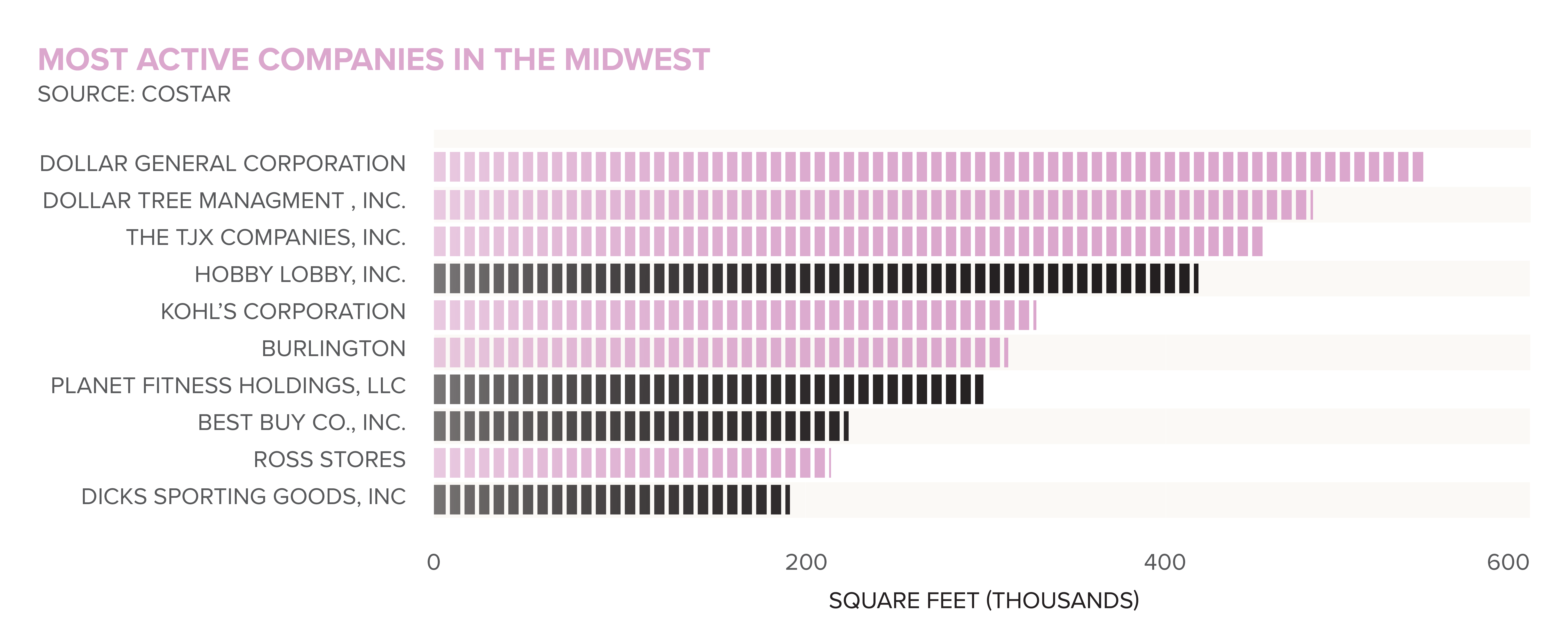

In nearly every major metro in the Midwest, the most active tenants expanding, leasing, or developing involve grocers, discount retailers, fitness centers, home improvement stores, and outdoor activity stores. The majority of activity in the Midwest is reflective of the broader trend in shifting consumer demands, away from wants and more towards needs and services.

Breweries

The craft brewing trade garnered a lot of popularity among a broad adult demographic, especially millennials drawn to experience-based locations. There are currently 8,764 operating craft breweries in the U.S. Recently, nearly half of adults under 30 reported increased craft beer consumption compared to two years ago. Craft breweries have made an incredible impact on local economies, serving as communal areas for locals and travelers seeking a laid-back ambiance and unique experience. The producer of the documentary “Blood, Sweat, and Beer,” Chip Hiden, claims “a brewery can inspire a real sense of community in a place that otherwise might not have it. People like to have them in their town; they like to spend that beer money with people they know.”

With the region hailing some of the most popular drafts in the U.S., such as Budweiser, Pabst Blue Ribbon, and Miller Lite, it makes sense that breweries are popular in the Midwest. The region hosts annual beer festivals and consistently invents new brews, evidencing that craft beer is a local passion, spurring brewery development and leasing in the area.

What possibly stands out the most from an investment perspective is a brewery’s ability to transform a once distressed area. Abandoned neighborhoods and small towns are prime candidates for breweries. Tenants have targeted industrial warehouses due to their cheaper real estate and sizeable space to house large and expensive machinery and equipment. Depending on the type of brewery, square footage can range anywhere between 500 to 3,000, compared to the average retail chain ranging between 1,000 to 10,000+ square feet.

In many cases, breweries serve as assets that have resurrected and enhanced communities, attracting tourists, thus bringing money to the economy. Zoning laws largely determine where breweries can be located, but these neglected areas can support a brewery installation.

In Petersburg, IL, a small taproom brewery, Hand of Fate Brewing, has brought good fortune to the small town. Once a dollar store, the owner took over the lease to create a community hub, where customers can find a sense of local identity and pride. The taproom encourages surrounding businesses to stay open later after drawing visitors from all over the Midwest and accounts for economic development to the area.

Healthcare

Healthcare is met with incredible opportunities, and equally, challenges with expanding tenancy to other geographical areas. Mature secondary markets in the Midwest can benefit healthcare real estate tenants, as the markets already house large specialized medical office buildings. The asset class attracts local, regional, and institutional investors, opening opportunities to work with and represent various healthcare tenants with differentiating objectives. The Midwest region holds some of the best health systems in the U.S. and accounts for a large portion of employers. However, challenges ranging from market competition to brand unfamiliarity are top of mind for healthcare tenants as they work to solidify a new patient roster in the area.

The demand for medical services is reaching an all-time high with a growing senior citizen population and expanding healthcare coverage. Beyond putting elective surgeries on hold, healthcare facilities saw a positive performance overall during the pandemic. In markets across the region, the healthcare industry was among the most active in leasing, development, and employment growth. Various healthcare systems have announced expansions and new job listings.

Healthcare is penetrating the shopping center space, as indicated by the increasing presence of healthcare clinics, urgent cares, and specialty-care facilities in a retail setting. Investors are keen on adding the resilient product type to their thought-out tenant mix, as they provide long-term stability through economic disruptions. Midwest markets are less volatile during downturns, further stabilizing shopping centers with healthcare tenants. For some developments, medical offices are a key amenity, making healthcare accessible and convenient to shoppers. Now, customers are no longer just patients as they come to shopping centers for convenience, looking to accomplish their daily tasks, including routine check-ups and grocery shopping for dinner items.

Cleveland has a reputation as a healthcare powerhouse, being one of the largest industries in the market. Since 2010, healthcare technology has multiplied in the market, thanks to initiatives such as the Health-Tech Corridor. After acknowledging the lack of space to accommodate the growing health-tech business, a community-wide collaboration encouraged development in the Health-Tech Corridor in MidTown, Cleveland.

Healthcare Tenants in the Midwest

Ohio

- Healthcare accounts for 4 of the top 11 employers in Columbus

- OhioHealth is the most extensive health system with 11 hospitals and health services and 20,000 employees

- Mount Carmel, the second-largest health system with 9,000 employees, opened a $361 million hospital in Grove City

- Nationwide Children’s Hospital ranks in the top 10 best children’s hospitals in the nation

- Cincinnati Children’s is the nation’s leading pediatric hospital with 15,000 workers and is developing a new $600 million tower

Missouri

- Kansas City holds the nation’s largest animal health cluster, KC Animal Health Corridor, representing 75 percent of the world’s animal health, diagnostics, and pet food sales

- IQVIA, a health information technology and clinical research firm, leased a 235,000 square foot space in Overland Park

- PRA Health Sciences, a biotech firm, takes up 100,000 square feet in Lenexa

- Children’s Mercy is growing its research facility by 375,000 square feet with Children’s Research Institute

After the Health-Tech Corridor initiative launched, a significant number of developers and financial support have flocked to the cause. The Health-Tech Corridor entails two major hospital campuses and the two largest employers in the metro: the Cleveland Clinic and University Hospitals. Cleveland Clinic has consistently ranked among the best hospitals in the world by U.S. News & World Report. It has ranked first for 26 consecutive years in cardiology & heart surgery and second for 22 straight years in the top five overall rankings. Further, several health-tech companies reside in the metro.

Discount Retailers

It comes as no surprise that discount retailers rose in popularity among shoppers during economic uncertainty, and this trend is very apparent in the Midwest. Discount chains offer merchandise or products for a fraction of the price compared to full-price retailers. With consumer spending focusing on value through the wake of the economic recovery, new frugal shopping habits are likely to carry into the rest of the year and beyond. As a result, investors will continue to favor these secure, income-producing assets.

The Midwest includes secondary and tertiary markets, boasting cheaper real estate, more robust growth due to the affordable cost of living, and stable economies. While discount retailers offer the best value in their products, they equally search for the best value in their real estate. Their expansion goals align closely with their financial goals; therefore, they target the Midwest, where deals are not overvalued and produce higher return rates.

Discount-oriented retailers dominated Ohio’s leasing activity, ranking among the top leases signed in the state, including Big Lots, Burkes Outlet, and Kohl’s. In Cleveland, discount retailers accounted for the most move-ins and top leases. Detroit saw heightened activity from deep discount chains, Dollar Tree Inc. and Dollar General signed 12 leases collectively. Dollar Tree signed a total of 78,000 square feet through six leases, Family Dollar signed three leases totaling 22,000 square feet, and Dollar General signed three leases totaling 27,000 square feet.

Discount grocers like Aldi, SuperValu, and Hy-Vee have found their footing in the Midwest. The discount grocer segment is among the fastest businesses to recover from the pandemic, and their essential-retailer status helped retain consistent sales throughout 2020. There is no shortage of customers seeking good deals on produce. A new German discount grocery chain, Lidl, has entered the already tight grocer competition with expansion plans to penetrate the Midwest, starting with Minnesota. In a region that boasts affordability, discount grocers and retailers will outperform.

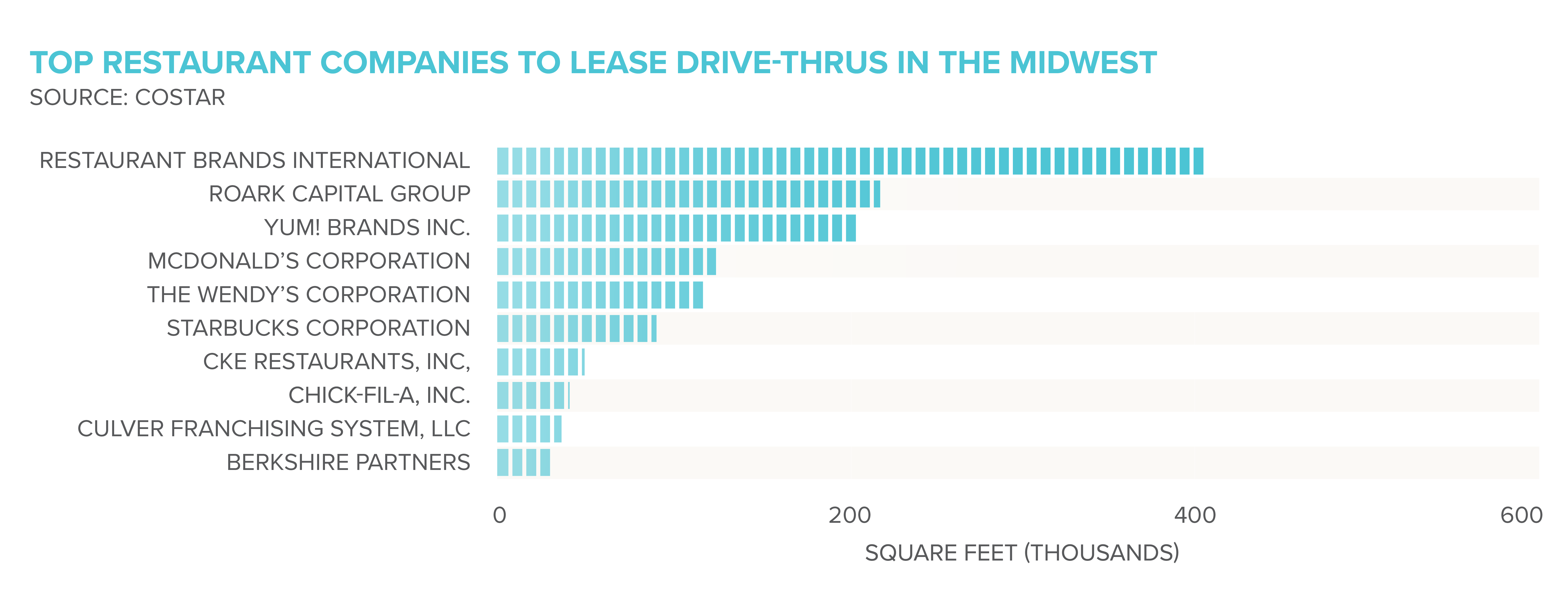

Drive-Thru Rollout

Drive-thrus helped quick-service restaurants and drugstores continue to serve customers through the pandemic while other retailers were forced to close their doors and focus on their online presence. Because of this, drive-thrus grew in demand last year among investors, developers, and franchisers. Restaurant or fast-food chains that originally functioned without a drive-thru are taking action to stay in the game. According to the National Restaurant Association’s State of the Restaurant Industry Report, 53 percent of adults claim purchasing takeout or delivery food is essential in their daily lives. Even companies outside of the food industry are considering drive-thru implementation after seeing the role they played during a crisis.

After seeing the intense demand for properties with drive-thrus and the decreased store sales due to the threat of capacity limits from COVID-19, restaurant owners are rethinking their business model. Drive-thrus served as the lifeline to several fast-casual restaurants throughout the pandemic, and some experts even claim that drive-thrus are an absolute necessity for store growth. Even after restaurants began reopening phases in Q3 2020, drive-thrus still accounted for 13 percent of all restaurant visits. Thus, drive-thrus evolved from a convenient source of revenue to a defense mechanism during a crisis.

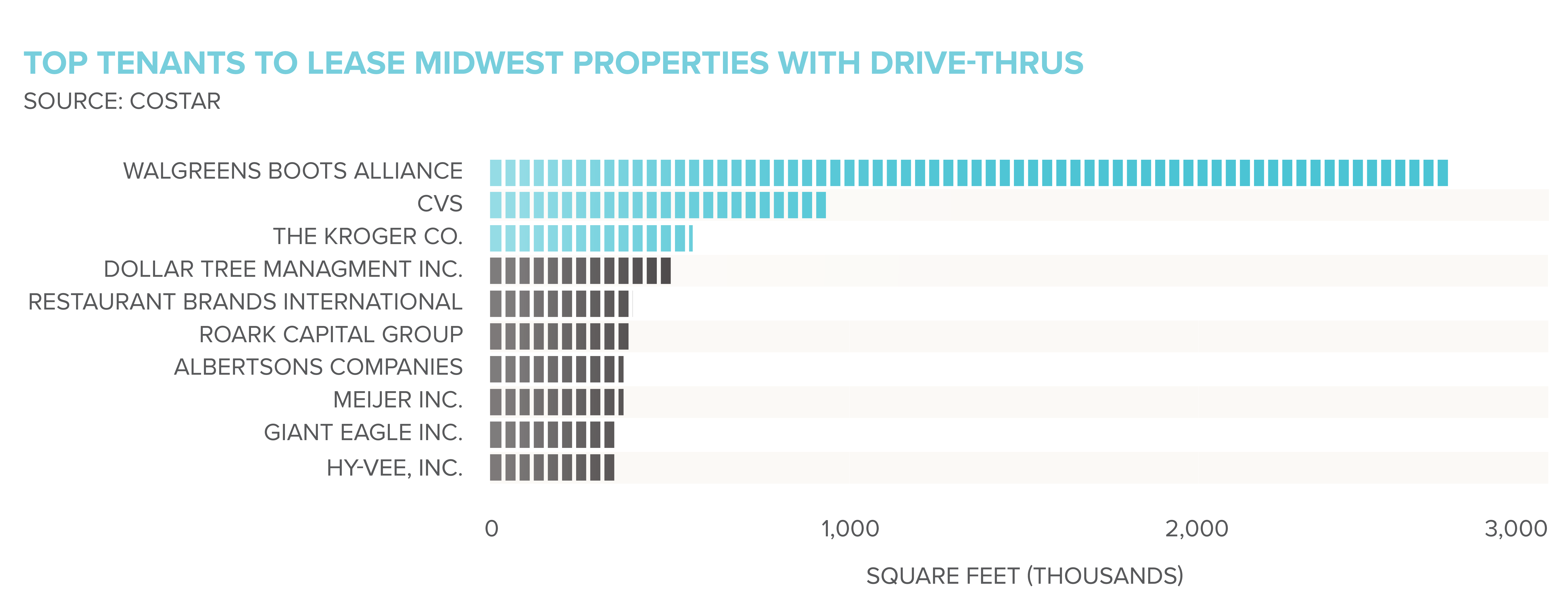

However, restaurants aren’t the only industry confined to drive-thrus for sales. Several companies realize the importance of a drive-thru, including drugstores, banks, convenience stores, and grocery stores. In fact, drugstores were the most active in leasing drive-thrus in the Midwest, according to CoStar. Tom Custer, Vice President of FRNCH Nelson, an architect firm, predicts grocery stores to implement high-volume drive-thru pick-up areas on the sides of grocery stores as online order trends continue to accelerate.

Convenience stores (C-stores) are adding to the ongoing demand for drive-thru space, such as 7-Eleven and Wawa. Both C-store giants have announced drive-thru additions to their locations to enforce contactless shopping. By offering convenience to drivers on the go, C-stores could have the up-leg with the potential to increase basket size by enticing customers with additional convenience.

Development Ventures

Retail and office closures were widespread at the peak of the pandemic, and some never reopened. Shopping mall tenants were among the first to permanently close as foot traffic plummeted, adding a surplus of unused or vacant square footage. With the Midwest holding several shopping experiences, including the largest shopping mall in the U.S., Mall of America, the square footage is abundant. Savvy investors have taken this as an opportunity to shop the graveyard for adaptative reuse opportunities.

Some Midwest markets have targeted their central business districts for redevelopment opportunities to add mixed-use or adaptive reuse projects. These assets draw in renters and shoppers; thus, retailers continue to lease space in the area. The larger markets attract capital due to their diverse economies, educated workforce, and lower cost of living. These factors make the Midwest the perfect opportunity for landlords or tenants looking for the best value in real estate.

Driven by e-commerce, retailers are seeking to lease additional warehouse space to fulfill online orders. In 2020, online shopping became the new normal, with e-commerce sales rising 44.4 percent in Q2 2020. Now that frequently purchased items are readily available, retailers look to stock up on merchandise and seek additional warehouse space to house the excess inventory. Even with vaccines rolled out, online shopping is still popular among consumers for its convenience. Retailers who had omnichannel strategies in place saw first-hand the supply and delivery issues. They had to compete with e-commerce giants, like Amazon, which offers free or two-day delivery for members.

One vastly popular trend in the Midwest for abandoned shopping centers or offices is converting them into warehouses or fulfillment centers. Milwaukee saw the most prominent redevelopment activity, with various projects being repurposed for varying businesses. Cincinnati has seen heightened conversion projects over the years. Since 2010, the downtown Cincinnati market has seen three million square feet of office space converted or removed, most of which are turned into hotels or upscale apartments. The last remaining department store in Minneapolis, Macy’s, was renovated into a massive mixed-use project, adding new tenants ranging from craft breweries and restaurants to a police investigation unit.

As businesses and the general population seek more affordable homes following a year of uncertainty and economic hardship, the Midwest will continue to see growth and investment activity. PWC’s Emerging Trends in Real Estate noted that the Midwestern states are continually evolving their economy to a more sustainable mix entailing education, healthcare, and technology. So long as these markets remain active and strive towards a balanced economic base, innovation and capital are sure to stay in the Midwest.

For more information on leasing activity and trends, please contact a Matthews™ specialized agent.