Click Here to Download the Report

The presumptive Democratic presidential nominee and former Vice President Joe Biden has outlined his 2020 tax plan in this 110-page economic policy document. His plan lays out what taxes could look like under his presidency for individuals and corporations, should he win the election and obtain congressional approval.

Key Findings

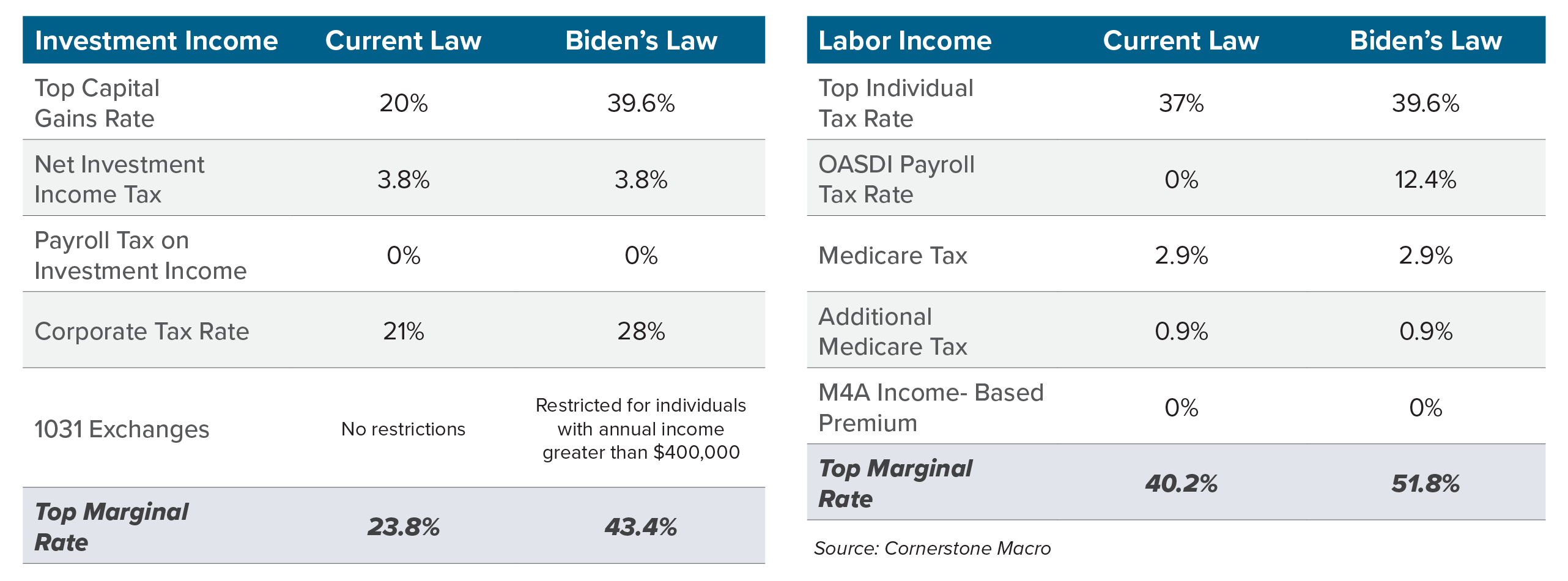

Raising Taxes on Work

Federal top marginal tax rates on labor and investment income.

Summary of Tax Plan

- 1031 Exchanges would be prohibited for individuals with annual income over $400,000.

- The top individual income tax rate for taxable incomes above $400,000 would revert from 37% under the current law to the pre-Tax Cuts and Jobs Act of 39.6%.

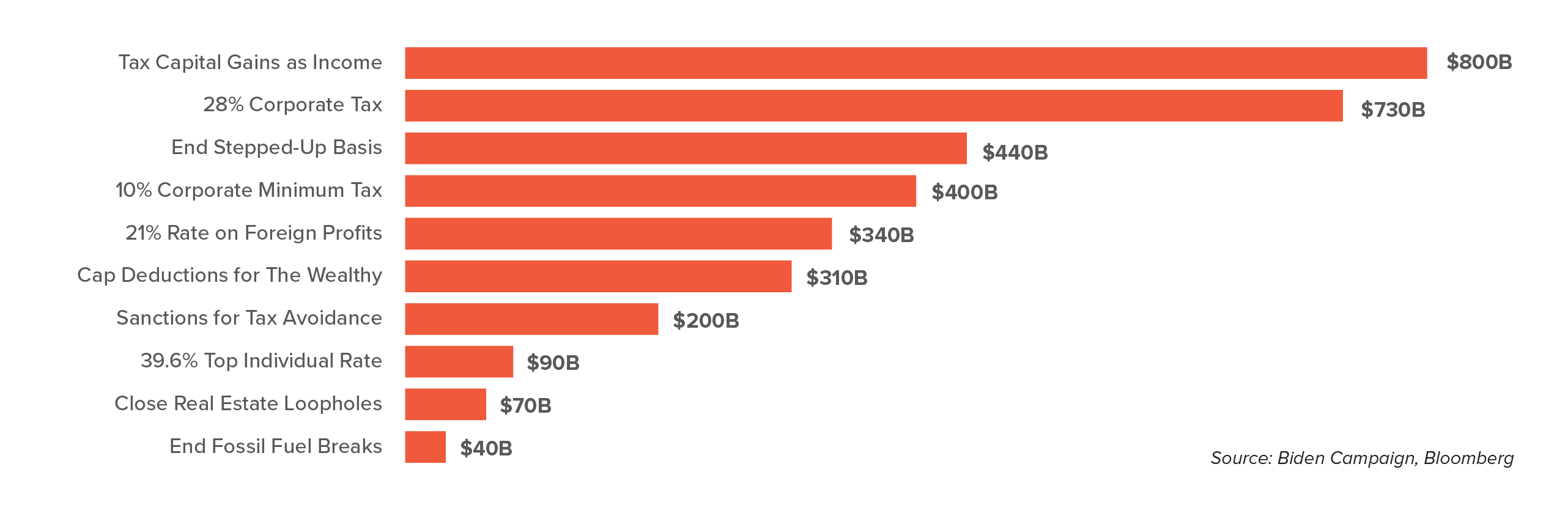

- Long-term capital gains would be taxed at the same rate as ordinary income for households earning more than $1 million.

- Repeals the Tax Cuts and Jobs Act components for high-income filters.

- For wages above $400,000, a 12.4% social security payroll tax would be imposed, split evenly between employers and employees. The current wage cap is $137,700.

- Increases the corporate income tax rate to 28%, up from 21%.

- Doubles the tax rate on Global Intangible Low Tax Income (GILTI) earned by foreign subsidiaries of U.S. firms from 10.5% to 21%.

- Establishes a corporate minimum tax on corporations with book profits of $100 million or higher. The minimum tax is structured as an alternative where corporations will pay the greater of their regular corporate income tax or the 15% minimum tax on profits reported to investors, while still allowing for net operating loss (NOL) and foreign tax credits. In effect, anything companies did to drive their tax rates below the 15% level would be taken back.

- Reduce global domestic product (GDP) by 1.51% over the long term.

How Biden’s Tax Plan Stacks Up

Biden’s 2020 Tax proposal could encourage companies to manage financial-statement income differently, changing the information investors use to judge business prospects. For more information on Biden’s 2020 Tax Plan, please contact a Matthews™ specialized agent.