Insights

Navigating the Future of Strip Centers | A Roundtable Discussion

2022 Multifamily Market Report | Koreatown, CA

Koreatown Market Overview Multifamily Koreatown has been a hotspot for apartment developers during the past several years, as the neighborhood has witnessed an ongoing evolution into a dense, dynamic neighborhood in the center of Los Angeles. It is one of the five largest apartment submarkets composed of Koreatown at the northern end, and Arlington Heights […]

Colorado’s MHPA Legislative Timeline- Good or Bad for Landlords?

Colorado’s MHPA Legislative Timeline- Good or Bad for Landlords? Colorado’s mobile and manufactured housing market is the state’s largest source of unsubsidized affordable housing, accounting for nearly 900 parks and communities statewide. Although these homes offer cost-effective alternatives to rising mortgage costs and interest rates, tenants have historically been subject to the rates and regulations […]

Understanding Inflation: The Pros & Cons for Commercial Real Estate

How is Inflation Impacting Commercial Real Estate? Inflation remains elevated due to many factors, mainly a result of the COVID-19 pandemic, including increases in household demand, stubborn supply chain bottlenecks, energy shortages, geopolitical affairs, and rising commodity costs. In the U.S., the sticky components of inflation continue to accelerate, including rents and wages. Given […]

Los Angeles Apartment Investors Step to the Sidelines

Los Angeles Apartment Investors The year 2022 has proven sobering for apartment investors. After more than a decade of cheap debt, the party has finally come to an end. This year, the Federal Open Market Committee has increased interest rates five times. By September, the prime rate reached a range of 3% to 3.25%, the highest […]

Multifamily Miami Market Report

Miami Market Overview Multifamily Report Apartment rents in the Miami market rose at a 9.8 percent annual rate in the fourth quarter of 2022 after increasing by 7.8 percent over the previous three years. There are currently 23,000 units under construction, representing the largest pipeline in over three years. Additionally, 21,000 units have been delivered […]

Reasons to Sell in the Hospitality Market

Reasons to Sell in the Hospitality Market Recession fears have now shifted from a “what if” to a “how deep” mindset for hotel owners across the country. The hotel industry is in the middle of an upswing of rent rate growth while the broader economy is preparing for the onset of a recession. This unique […]

Reasons to Buy in the Hospitality Market

Why is it a Great Time to Buy in the Hospitality Industry? The hospitality market has made a comeback following the pandemic. Leisure and business travel demands have increased exponentially since 2020, and as such, booking rates have multiplied. This growth pattern makes it a great time to invest in the hospitality industry. The real […]

Is Now the Time to Re-Invest in Shopping Centers?

Over the last ten years, numerous profound shifts in retail shopping habits have been attributed to the significant rise of e-commerce. Because of these shifts, retailers are now hyper-fixated on buying habits and their bottom line. Now, amid a looming recession, retail investors wonder when the best time is to re-invest in shopping centers. […]

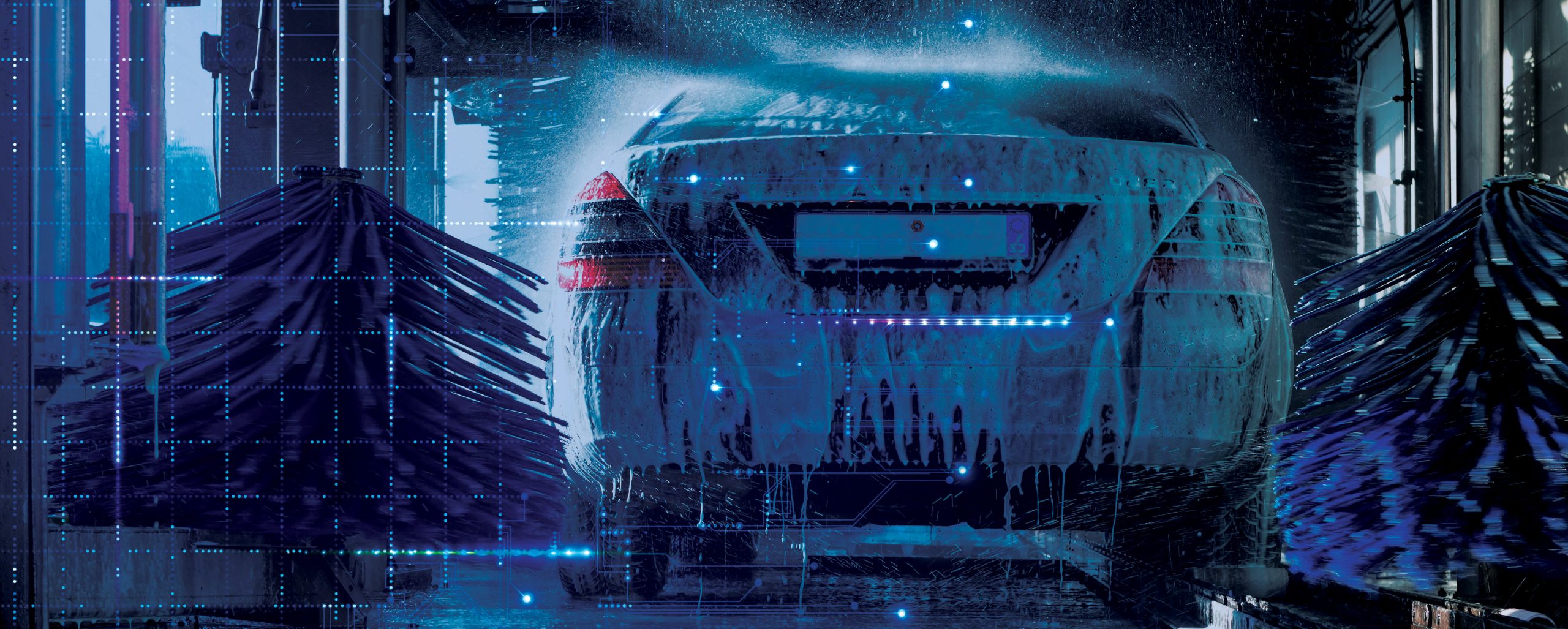

Are Car Washes a Sound Real Estate Investment?

Are Car Washes a Sound Real Estate Investment? Car washes are a technology-driven, high-demand industry that thousands of Americans use daily. According to the U.S. Department of Transportation Federal Highway Administration, more than 90 percent of U.S. households have at least one vehicle and 66 percent of Americans get their cars washed about 13 […]