Insights

Navigating the Future of Strip Centers | A Roundtable Discussion

Multifamily Market Report | Denver, CO

Multifamily Market Overview Denver, CO This year, Denver’s multifamily sector has seen a shift in dynamics. Following a successful year in 2021, when the market saw excessive demand and skyrocketing rents, fundamentals have visibly cooled. Multifamily is a great inflationary hedge, and although fundamentals have slowed, demand is still very much present, and the sector […]

What Are Delaware Statutory Trusts And Why Should Investors Use Them?

What Are Delaware Statutory Trusts? Rising interest rates, inflation, and worries of a recession have caused a reset in the multifamily market. Sellers are pulling back as buyers are not hitting price expectations, which in turn affects the deal flow and overall activity. In addition, weariness has made the buyer pool more shallow, as rising […]

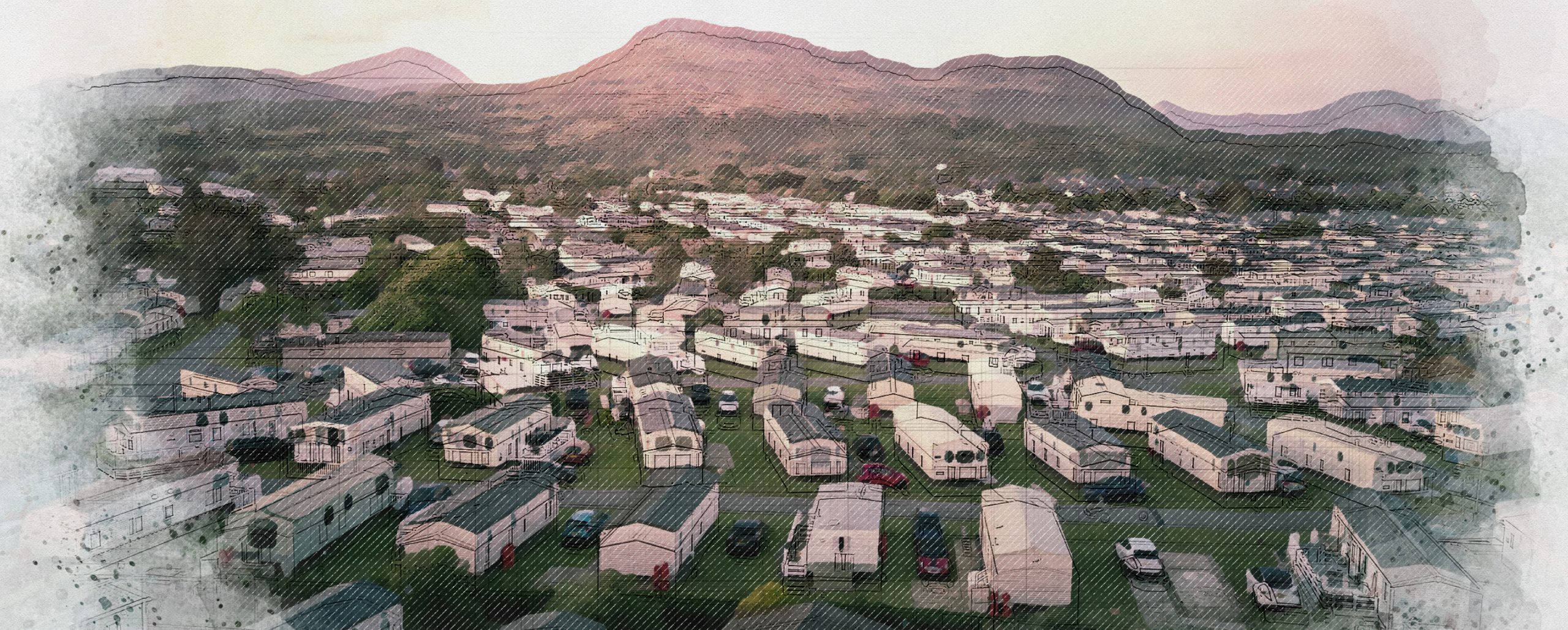

Manufactured Housing: The Fight to Maintain an Affordable Housing Market

Manufactured Housing: The Fight to Maintain an Affordable Housing Market Over the past two years, the median home price has increased 36.5 percent. This significant increase, paired with the average 30-year mortgage rate jumping from 3.3 to nearly seven percent, has caused many Americans to press pause on house hunting, unable to match the income […]

2023 Outlook for Commercial Real Estate Lending

Q&A | Matthews™ Capital Markets Experts As the economy recovered from COVID-19, the demand for commercial loans increased. Multifamily mortgage lending is seeing an increase in demand and record levels of capital. The Mortgage Bankers Association (MBA) projects commercial real estate and multifamily mortgage lending will break $1 trillion for the first time because of […]

Impact of California’s Affordable Housing Crisis on Apartment Owners

California’s Affordable Housing Crisis: What This Means for Multifamily It is not surprising that California is experiencing an affordable housing crisis – from a shortage of suitable low-income homes to an excess of low-income renters and limited land to build, California faces its fair share of challenges. However, the state is well versed in this […]

EVs Electrify the CRE Space

EVs Electrify the CRE Space The popularity of electric vehicles (EVs) continues to gain ubiquity across the country and is pushing many businesses to add property value through EV-integrated solutions. Development in EVs will create multiple opportunities for the real estate sector as multifamily, office, and retail adapt properties to cater to EV users. CRE […]

Ballot Measure Outcomes: What This Means for Commercial Real Estate

Ballot Measure Outcomes California ballots in this year’s election included various propositions, measures, and proposed rules and regulations that touch upon commercial real estate. Los Angeles Mansion Tax Approved The most high-profile of the city’s ballot measures, United to House L.A., also known as the “Mansion Tax” passed by a healthy margin. Now approved, […]

Feeling the Heat: Phoenix CRE Report

Feeling the Heat: Phoenix CRE Report Known as the Valley of the Sun, Phoenix, AZ, is one of commercial real estate’s hottest markets. With a current population of over 4.7 million, a 1.4 percent increase from 2022, the Phoenix metro is packed with abundant job growth, consumer spending, and investment opportunities. Phoenix is the largest […]

How the L.A. “Mansion Tax” Impacts Multifamily

Impact of Measure ULA (Mansion Tax) Passing The most high-profile of the city’s ballot measures, United to House L.A., also known as the “Mansion Tax” passed by a healthy margin. Its aim is to fund affordable housing programs for tenants at risk of homelessness and slap a tax on high-priced real estate sales (4% to […]