2023 End Of Year Healthcare Market Report

Healthcare Market Overview

Constituting approximately 20% of the national gross domestic product (GDP), healthcare stands out as one of the fastest-expanding sectors in the country. The demand for healthcare properties, such as medical offices and urgent care clinics, experienced a significant surge in 2023. The medical office sector possesses compelling investment qualities that consistently attract investors, thanks to long-term leases and stable tenants. This newfound popularity on a national scale is driven by factors such as an aging population and the sector’s resilient response to the challenges posed by the COVID-19 pandemic. Demographic shifts indicate that by 2034, the 65-plus population will surpass the number of children for the first time in U.S. history. Furthermore, projections from the United States Census Bureau suggest that by 2060, nearly one in every four individuals in the U.S. will be 65 years old or older.

Healthcare Highlights

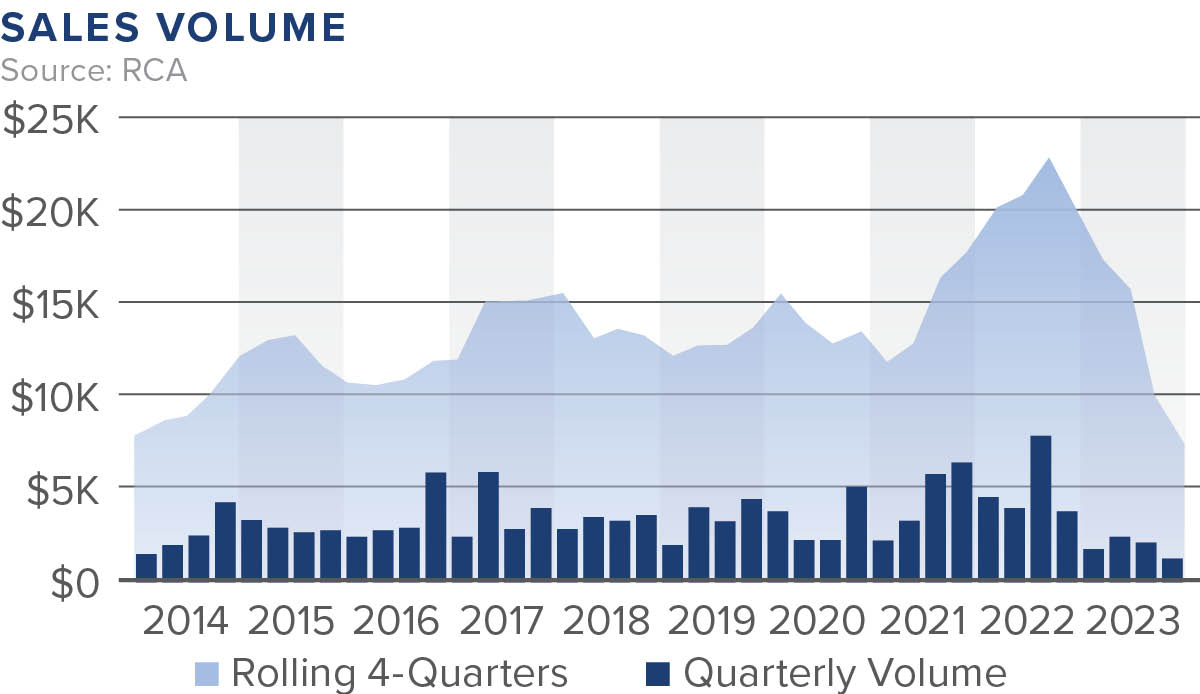

- In 2023, the sales volume for the medical office sector amounted to $7.5 billion, with 977 properties sold.

- The average price per square foot was $298, down 7.9% year-over-year (YOY).

- The average cap rate in 2023 was 6.9%.

- Dallas-Fort Worth saw the most robust construction starts, with 663 projects currently underway.

Rents | Vacancy | Construction

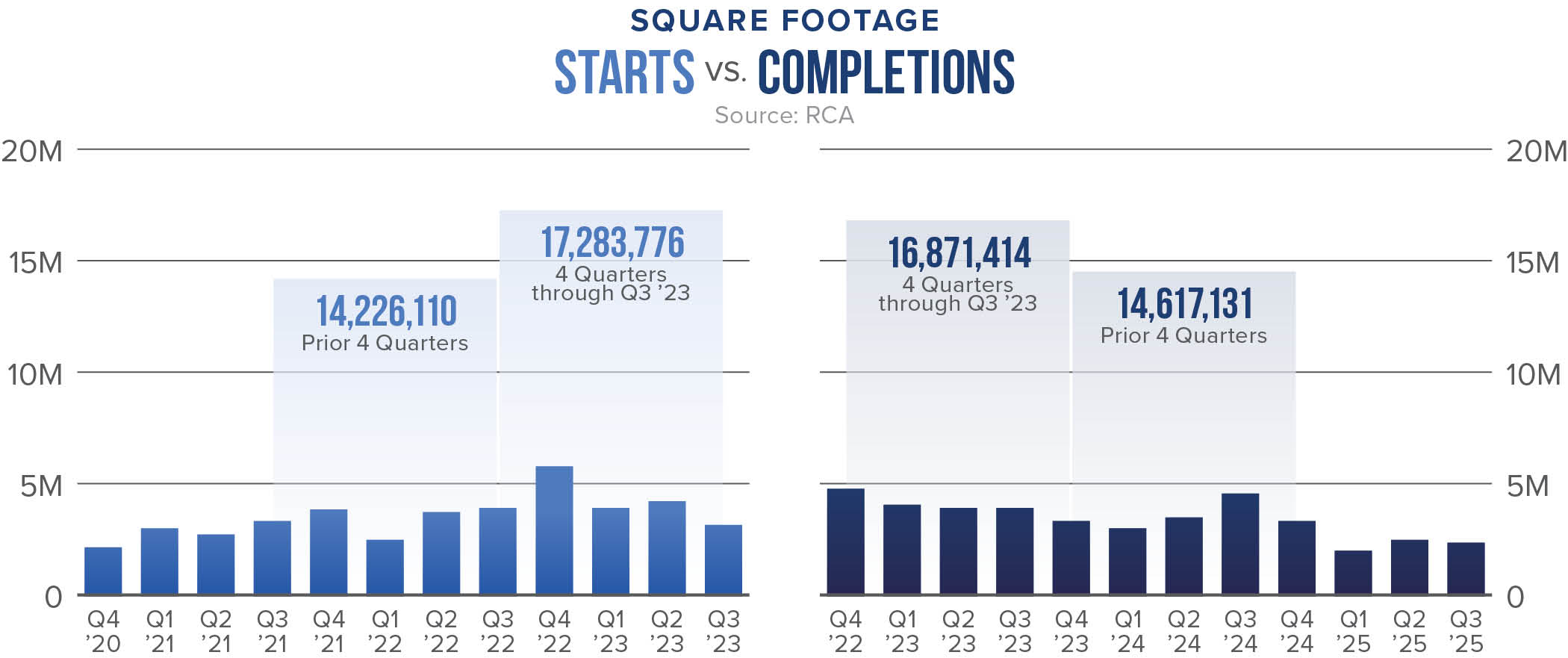

The market asking rent per square foot ended 2023 at $26.65 and is expected to experience a slight decline in 2024. Market asking rent growth declined throughout 2023, beginning Q1 at 3.4% and ending the year at 1.7%. The medical office sector experienced a notable decline in vacancies in 2023, from 14.6% in Q1 to 10.2% in Q4. Construction activity comprised about 17.3 million square feet of starts and about 16.9 million square feet of completions. At the close of the year, overall fundamentals are strong, with increased occupancies nationwide.

Sales

Total sales volume in the medical office sector hit $7.5 billion in 2023. Q2 2023 had the highest sales volume of the year at $2.4 billion. The average price per square foot decreased by 7.9% YOY, currently at $298. Washington, DC, experienced the highest sales volume, ending the year at $390 million, closely followed by Phoenix ($389 million), Los Angeles ($328 million), and Atlanta ($307 million).

To read the 2022 End-of-Year Healthcare Report, please click here.