The need for data centers has steadily increased as the internet grows in ability and accessibility. The year 2020 was a landmark year for the product type, and investor momentum continued into 2021. The global pandemic accelerated the demand for cloud services and streaming media as employees worked from home and residences became the new entertainment hubs. According to KPMG, data traffic typically grows 20 percent year-over-year but jumped to 40 percent in 2020. As such, data centers gained value. But after several years of merger and acquisition activity to build scale, the opportunities to invest are fewer, although valuations are on the rise. In this article, Matthews™ examines what features are necessary for a data center, the different asset types, and how traditional investors can enter the unique and growing market.

Put in simple terms, a data center is the “home” for the internet. It is a place to store equipment and computing hardware needed to connect to a network and houses critical applications and data for companies. The physical facility comprises several vital features, including servers, routers, firewalls, storage systems, and application delivery controllers. All these features work together to deliver the internet known in today’s modern world. To enable the smaller products efficiently, all data center properties need three basic components to succeed — power, network connectivity, and cooling.

Data centers are mission-critical, meaning they are expected to always remain operational.

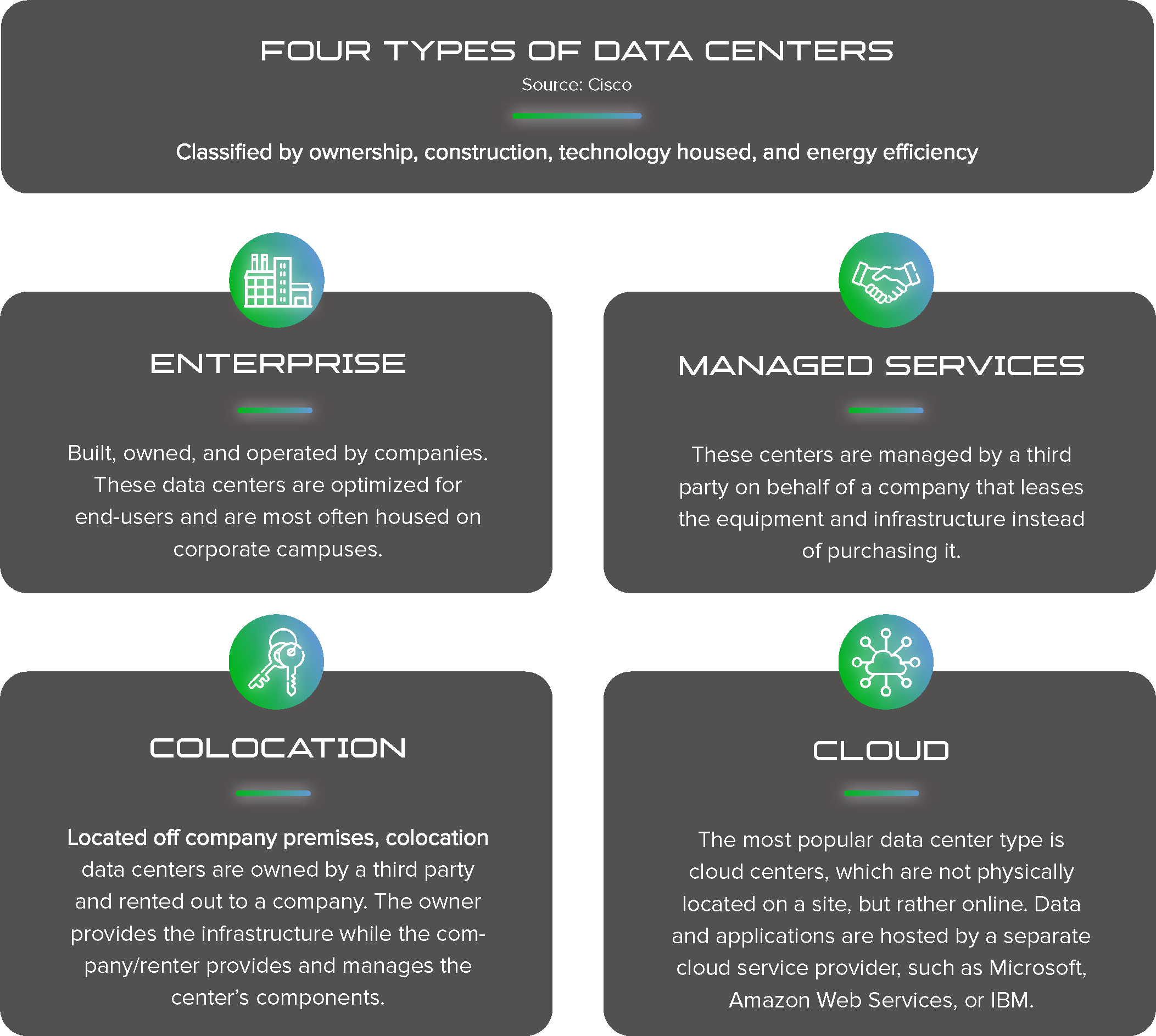

Overall, data centers of all types are used by companies for email and file sharing, customer relationship management, productivity applications, databases, artificial intelligence (AI), machine learning, virtual desktops, collaboration services, and communications.

The Rush to Invest

As COVID-19 aerated internet growth and the speed of digital transformation for companies worldwide, the demand for data centers grew with no plans of slowing down. According to Business Journals, data center construction increased from 611.8 megawatts at the end of 2020 to 680.8 megawatts in the first half of 2021. For reference, one megawatt is equivalent to one million watts, the same amount of power 400 to 900 homes consume in one year, according to the U.S. Nuclear Regulatory Commission. Data centers reached an average market price of $23.2 million in Q3 2021, boasting a 3.7 percent cap rate, a decrease from the 6.9 percent average in 2020.

Along with enhanced office and consumer use, several emerging tech industries increased the demand and value of data centers like autonomous vehicles and the Internet of Things (IoT).

Challenges Facing Data Centers Today

Like other commercial real estate sectors, data centers face a shortage of building materials and labor, causing a strain on development. A shortage of semiconductor chips is the leading disruptor for data center development, along with a deficiency in fibers. These two materials are instrumental in facility infrastructure. The supply constraint adds to the already fierce competition the sector sees between investors, making it difficult to find profitable deals. These shortages may accelerate the push toward cloud services, as they don’t require a tangible building. Another challenge many investors aren’t aware of is the in-depth knowledge of the technology needed to properly invest in data centers. New investors wanting to enter the space are excited by the asset’s opportunities but are often not experienced in the technology field, leading to various obstacles in the production and management of the space. Any investor new to tech real estate needs to learn the jargon and services that accompany data centers. Lastly, as the internet gains power, so does its susceptibility to security threats. Data center owners and property managers need to be aware of the different ways they can protect the location and network from theft, ransomware, and hackers.

Emerging Trends

Recently, developers introduced a more modern data center, portable edge data centers. These assets focus on off-premise computing, relying on virtual servers that support workloads across groups of physical locations and into a multi-cloud environment. Much smaller and customizable, mobile data centers allow for temporary connectivity wherever needed. As data centers are always expected to stay online, a portable and easily integrated system could be the answer in several situations.

Cooling technology, required to keep data centers at an ideal temperature and ensure critical infrastructure doesn’t overheat, is experiencing the biggest push for innovation in the space. Air cooling is typically used to regulate the temperature within the center, but as centers increase in density and size, air cooling is no longer capable of working fast enough. Liquid cooling, bringing liquid throughout the system racks to cool down the equipment, is the next generation of cooling technology and is expected to be inevitable as data center development and advancement continues. Primarily, data center development has been focused in Silicon Valley due to its tech-focused economy, and Northern Virginia, for its low-income living and vast rural areas. Companies are now looking at smaller metros to invest in data centers. Although Northern Virginia accounts for more than half of the current data center development, there is a new push to expand to secondary markets and regional hubs such as Dallas, Chicago, Phoenix, New York Tri-State, and Atlanta. These markets offer better tax policies, lower power costs, and a lower risk for network disruption due to natural disasters. These factors are more prevalent than ever before as managers and investors look to cut costs to combat high material pricing.