For years, c-stores have been essential in providing access to food, beverage, fuel, and other household essentials at an affordable price for their respective communities. With the onset of COVID-19, retailers of all sorts were forced to improve their accessibility and convenience for the consumers that were no longer able to enter their doors. C-stores are introducing new concepts to compete with changing business models and off solutions to evolving consumer habits. In this article, Matthews™ will examine the different ways c-stores are adapting their services and integrating technology moving into the future.

The Current State of C-Stores

According to the National Association of Convenience Stores, the current c-store count in the U.S. is 150,274, with 7-Eleven leading the pack. Although the industry faced obstacles throughout the pandemic, their overall in-store sales performance improved, increasing 3.3 percent in 2020, the best percentage growth since 2016, according to CS News. As vaccines are dispersed across the United States paired with more relaxed safety regulations and a rise in consumer confidence, revenue is expected to grow 8.2 percent in 2021, according to IBISWorld. Merchandise such as groceries and household products were the most profitable instore sales, as food service fell for the first time in five years in 2020. This loss prompted stores to reevaluate their food and beverage offerings going into 2021.

Convenience stores saw a substantial increase in the average sales price and compression in cap rates in late 2021, indicating more security for investors. CoStar’s c-store average price per square foot was $651 in Q1 2021 compared to $766 in Q3 2021, a 17.66 percent increase. Cap rates averaged 5.66 percent in Q1 2021 compared to 5.32 percent in Q3 2021.

Convenience is Key

Convenience is more important to consumers than ever. Amid the pandemic, people began to spend more time in their cars and on their phones and less time in shops. C-stores firmly positioned themselves as a one-stop-shop providing all the same offerings as a coffee shop, quick-service restaurant, grocer, and gas station all in one place. Consumers’ focus shifted from a “quick stop along the way” to a “destination for essentials.”

Patrons have evolved their shopping habits, dramatically affecting the c-store industry. Before, consumers would normally run into c-stores for grab-and-go and immediate consumption items. Now, consumers have grown dependent on their local c-store, and the average basket size has increased as they shop for frozen foods, milk, and paper towels. This shift in behavior has not gone unnoticed. C-stores have begun to increase their square footage footprints to accommodate these consumer shifts, while also remaining more simplistic than their larger retail counterparts. Since last year, c-stores were at the forefront of the retail evolution by expanding their product mix, and further expediting reimagined services like partnering with delivery apps.

Bigger, Better Options

From the widespread adoption of electric-powered vehicles to changing consumer sentiments regarding what they want from a convenience store, the most prominent players in the industry had to shift their long-term strategies to stay relevant. Given the competition in today’s industry, brands find ways to differentiate themselves to win over consumer loyalty, beginning with the retail process and where they are positioned in respective markets. Visibility and ease of access are two of the most significant factors that subconsciously drive a consumer to stop at that specific store. When looking at most new construction, 7-Eleven, Wawa, Kum & Go, Circle K, and other c-store tenants are positioned at highly trafficked signalized intersections sitting on large lots with broad points of ingress and egress.

While it appears inevitable that electric vehicles will be the norm in the next two decades, it will require a shift of c-stores with fuel stations to rely less on gasoline sales and incorporate electric charging stations to magnetize customers. As of right now, the average time to fill up a fuel tank is around three to five minutes, while the average time a Tesla Supercharger takes to charge a battery fully is roughly 20 minutes. Given the longer wait times, the demand for c-stores to offer more than basic snacks and drinks increased.

Customers have expressed they want higher quality items, such as bean-to-cup fresh coffee and made-to-order hot food. C-stores are catering to these demands with initiatives such as 7-Eleven’s

Laredo Taco Company & Raise the Roost, Wawa’s made-to-order deli, Kum & Go’s “The Fresh Market,” and many more.

Consequently, consumers will want more grocery store items to purchase while waiting for their vehicle to charge or making a quick stop on their way home, such as fresh produce, milk and eggs, and an assortment of other goods to avoid going to multiple stores. From a retail perspective, this means store square footage will increase to accommodate these new offerings and amenities.

Growing Their Digital Reach

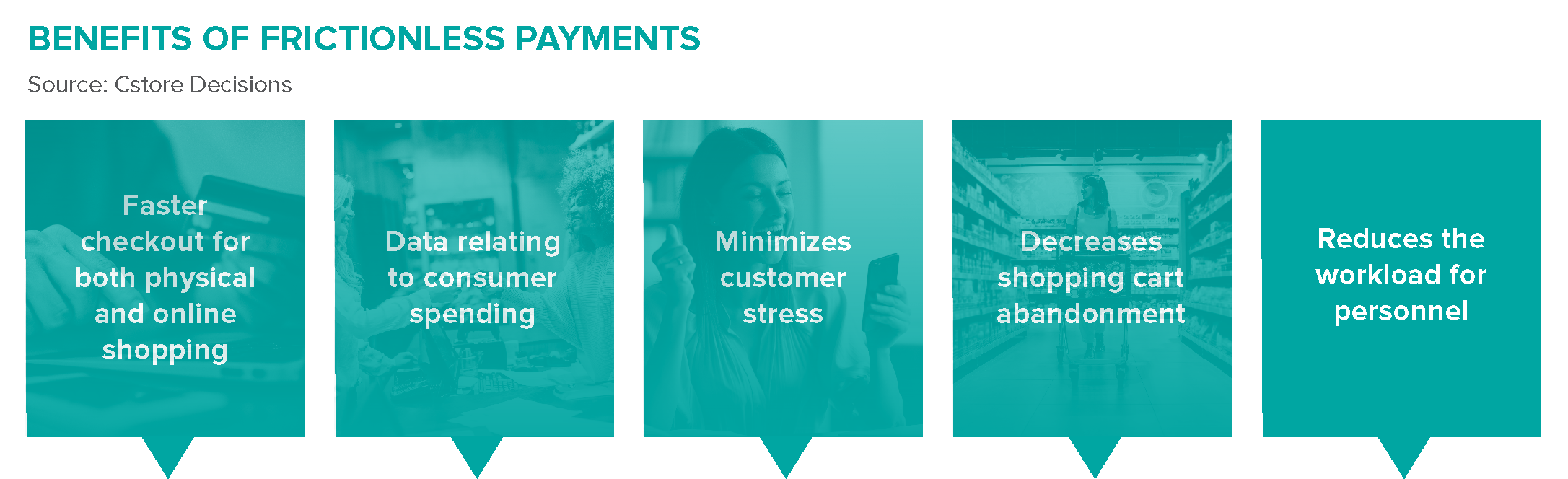

As many consumers look for faster and more efficient shopping methods, their phone has become their shopping cart. This has made mobile and online ordering necessary options for retail businesses. Convenience stores are no different, integrating technology and frictionless payment tools across their locations. Frictionless payments, defined as payment methods using data from devices, apps, and websites to make buying opportunities as seamless as possible, are expected to grow significantly in the next few years, specifically across retail channels. Although c-stores receive cash payments on a higher-than-average basis compared to other industries, contactless payment could greatly benefit owners, operators, and customers.

Mobile ordering is another must-have for c-stores serving new generations. The ability to order ahead, prepay, and set a pick-up time allows for a personalized shopping experience and a better customer service experience due to low wait times and minimal contact. Mobile ordering and frictionless payments can be especially effective for those offering a loyalty program. Oftentimes, customers are not willing to sign up for rewards because they don’t want to remember a program ID or carry a loyalty card. With a mobile app or wallet, these challenges become obsolete, erasing the need for a shopper to keep track of extra knowledge or belongings.

The future of c-stores is reliant on their ability to challenge standard practices and serve the modern consumer. Developing locations with drive-thru capabilities, EV charging stations, and more lot space for curbside pick-up are all applicable strategies, but utilizing technology is key to future c-store success. Mobile ordering, touchless payment, and much more allow customized shopping, increase employees’ productivity, and provide a better customer experience from start to finish. Overall, eliminating wait times and unnecessary contact is paramount for businesses to be competitive in today’s environment and investors looking to invest capital in a thriving and stable product.