Understanding Apartment Financing

Defining the Apartment Financing Market

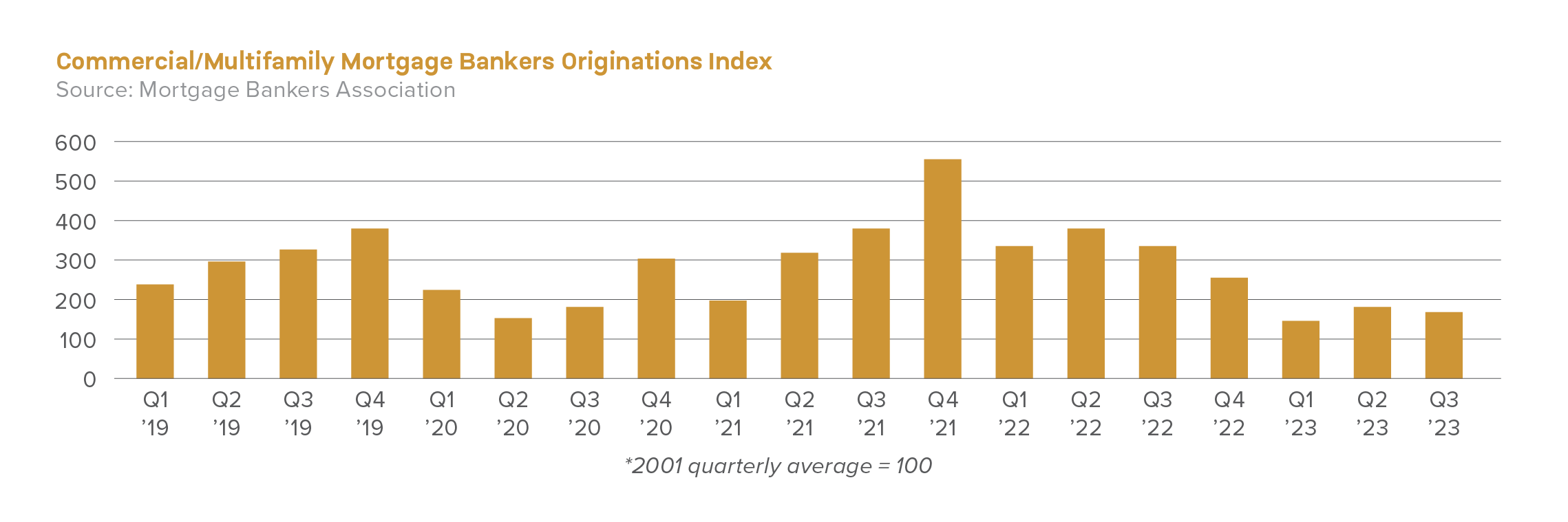

Over the past 12 months, higher market interest rates have affected the apartment financing market with several negative headwinds. The increased cost of capital has inhibited multifamily sales as sellers and buyers find risk-adjusted return price discovery due to increasing leverage costs. Buyers are much more reluctant to acquire assets (unless in a 1031 exchange) below borrowing financing costs or negative leverage.

For example, buying at a 5.50% cap rate and borrowing at a 6.50% to 7.00%+ interest rate, creates negative leverage. As rates stay higher, asset price discovery continues to be adjusted (prices adjust lower), although at a seemingly slow pace. On average, multifamily cap rates have increased 60 to 100 basis points since Q3 2022 as buyers adjust their leveraged rate of return thresholds. Cap rate expansion has directly affected asset sales as the industry works through buyers and sellers settling on executable pricing. There remains plenty of liquidity (although at lower leverage points) as market bid-ask spreads continue to be defined.

“Higher For Longer”

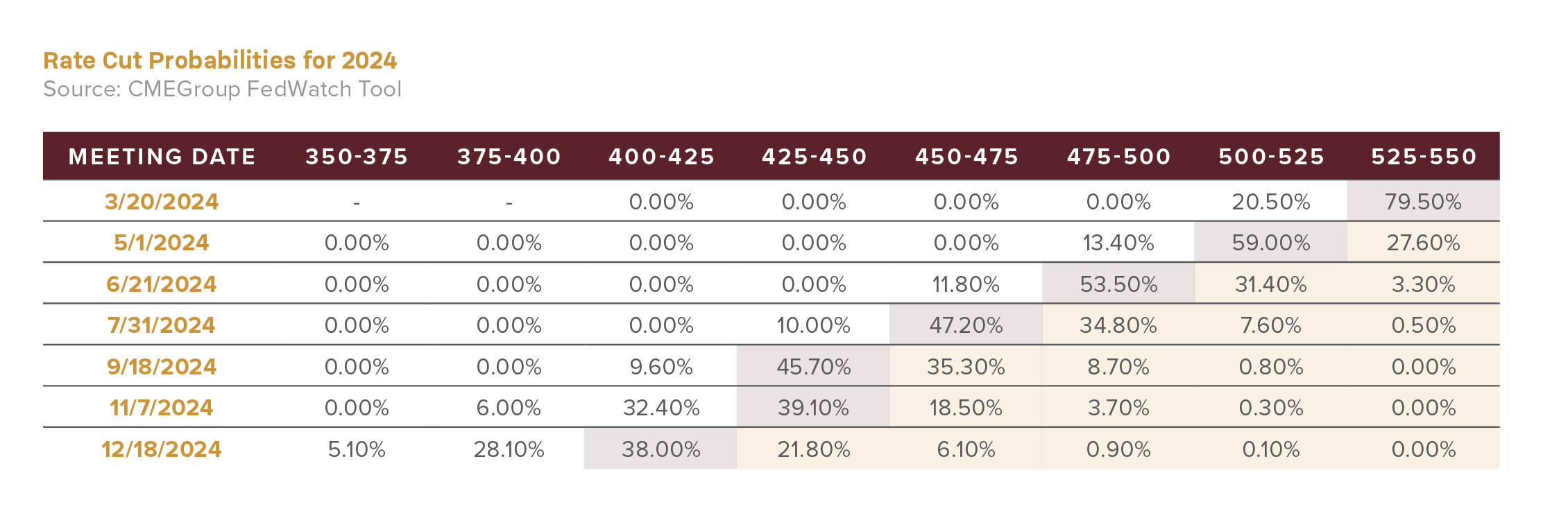

As this market cycle evolves, investors await stabilization (which we are finally seeing as of Q1 2024). Although the Fed has kept rates higher, they announced in the December meeting that cuts are likely in the latter half of 2024. Regardless, apartment financing is directly indexed to Treasury yields, Treasury swaps, and/or SOFR for floating rate loans, plus a spread premium. These indexes are “influenced” by Fed policy but not necessarily directly correlated. What we do see from investors is patience. Market uncertainty has led to a “risk off” investor mindset thus affecting transaction values across all asset classes. As the new year starts, we see higher volumes of assets for sale as sellers and buyers re-enter the marketplace with the hopes of future rate cuts. Since this is an election year, the probability of future rate cuts increases based on historical evidence.

Selectivity in the Debt Market

With market participants waiting on the sidelines, investment capital is being highly selective, for debt transactions and equity investments. The new development segment has seen the greatest impact.

Equity investors have been reluctant to deploy development capital due to several factors:

- Rising Construction Costs

- High Cost of Construction Apartment Financing

- Achieving the Appropriate Risk-Adjusted Returns Over a 3,5, or 7-Year Hold Period

Apartment financing for existing cash-flowing assets has tightened considerably due to increasing rates. As lenders solve for a 1.25x or better debt service coverage ratio, higher rates have diluted the calculus. This has resulted in the loan constant to increase by 150 to 200 basis points over the past nine months. A loan that originated in the 5% range over the past two years would have garnered 20% in loan proceeds. A loan originated today is in the 7% range, using a 1.25x debt service coverage ratio. As leverage decreases with increasing rates, investment economics have become difficult to pencil.

Refinancing

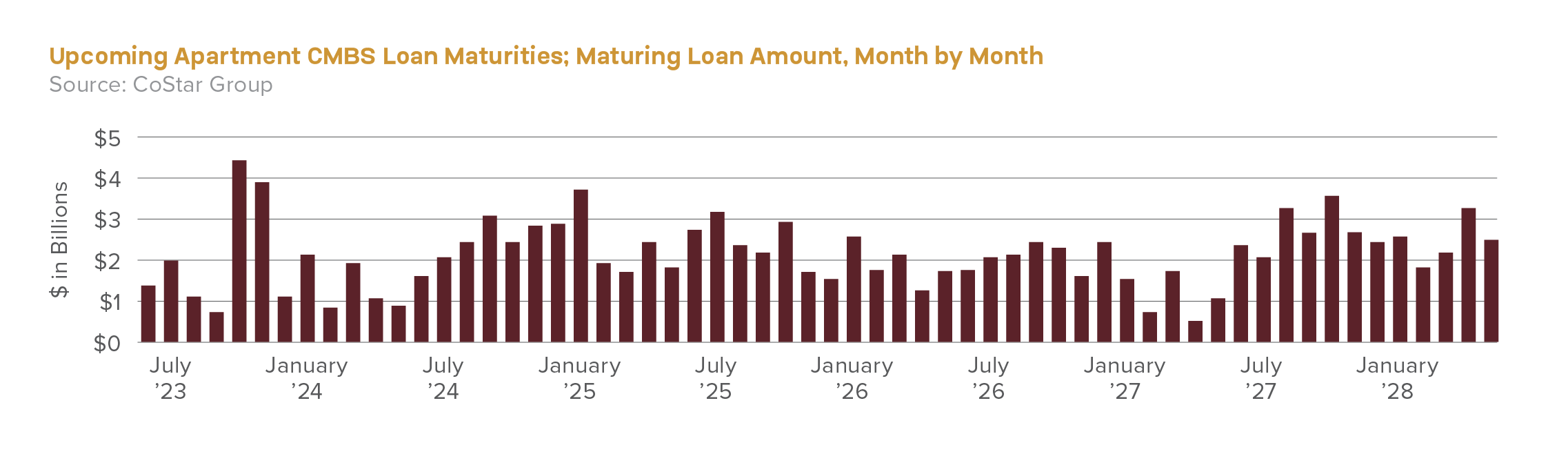

Due to apartment financing economics, borrowers who have loans coming up for refinancing have had to solve for several issues. These issues include lower available loan proceeds, higher rates, and less mainstream capital market players offering financing options (mainly local, regional, and money center banks). Borrowers have found it challenging to locate lending sources that offer acceptable term. Thus approaching alternative financing strategies to achieve higher debt leverage. The strategies include but are not limited to short-term bridge financing structures, mezzanine financing, and/or preferred equity capital sources. All three options have various capital structures, time frames, requirements, and investment hurdles.

Borrowers are engaging with these private capital sources rather than adding capital to the investment to pay down the loan amount coming due. There remains a bevy of private capital sources within the bridge, mezzanine, and preferred equity capital for multifamily as a wave of loan maturities hit the market over the next 12 to 18 months. New capital sources seem to be entering the market weekly as demand far outweighs supply.

Rate Buydowns

We have also seen borrowers utilize “rate buydowns” to achieve higher leverage to refinance their fixed or floating rate loans. Rate buys-downs range between 1% to 4% of the loan, lowering the spread premium and increasing loan proceeds for loan pay off. Most agencies (Freddie Mac and Fannie Mae), life insurance companies, and CMBS lenders allow for rate buy-downs, using them frequently over the past couple months. Additionally, borrowers are more apt to secure a shorter-term loan in the hopes of refinancing if and when rates subside. A large majority of borrowers are securing apartment financing with two- to five-year loan terms for this purpose.

Macro Fundamentals for Apartment Financing Remain Strong

The persistent housing shortage, affecting the availability of affordable housing units and multifamily renters entering the homeownership marketplace. Families transitioning from multifamily into single-family are finding it incredibly costly. With interest rates at decade highs, would-be homeowners simply cannot afford the monthly debt service payments and have delayed purchases.

Single-family sales have dropped precipitously. The sellers who locked in long-term interest rates in the 2% to 4% ranges, are reluctant to sell and take on new mortgage debt in the 8% range. This creates a substantive lack of single-family supply in many markets. The single-family home has become more unaffordable today than at any time in recent history, delaying renters’ ambitions of homeownership. As such, existing multifamily housing, including build-to-rent (BTR) communities, continue to enjoy solid lease-up, occupancy, and moderate rent growth. However, the velocity of rent growth has subsided in many major markets recently compared to the past 36 months.

Some of this is directly attributed to the implementation of municipal rent control in many markets, as renters and politicians lobby for stricter caps on rental housing increases. These measures will eventually lead to less housing; as units become more functionally obsolescent, landlords will have less capital to re-invest in property and unit improvements.

Even with the new inventory coming online in many markets, demand will ultimately outstrip supply. This adds supply side pressure as multifamily projects have been delayed or mothballed with rising construction costs and apartment financing.

What Apartment Financing Projects Are Getting Done Today?

These segments can be broken down into several categories:

- Stabilized Assets

- Acquisition/Rehab

- Bridge Financing

- Construction Financing

Stabilized Assets

Stabilized cash-flowing assets continue to be an attractive asset class for most lending sources. Liquidity is readily available via agencies, life insurance companies, banks (even though many have shut down origination departments), CMBS, credit unions, and private debt funds. Underwriting for stabilized multifamily projects within primary and secondary MSA locations are typically underwritten to a 1.25x debt-service coverage ratio (DSCR), 30- year amortization (based on asset age and quality), with debt yield metrics between 8.00% to 9.50%, with all in rates between 6.40% to 7.50%. Due to rate increases that affect higher debt constants and adjusted cap rates actual loan to values have dropped as a result.

We are seeing actual loan-to-costs come in between 55% to 70% due to the current underwriting calculus. Pending the lending source and sponsor credit quality (global cash flow analysis and sponsor liquidity), loans are non-recourse with carveout guarantees or come with recourse provisions based on loan risk and sponsor credit.

Within the stabilized cash-flowing asset class, affordable or “mission-based” multifamily assets can achieve much lower interest rates from the agencies (by 15 to 40 basis points) and longer amortization schedules (35 to 40 years) pending the level of rents to area median income (AMI) levels within the submarket. The agencies have large affordable housing mandates to achieve annually, which do not affect their overall market rate lending caps.

Acquisition/Rehab

Capital for the multifamily acquisition/rehab segment of the market remains robust, with private debt funds, banks, agencies (pending if the project falls into the affordable category), and certain CMBS shops. Private debt funds and CMBS shops who have the capacity to lend “on book” can underwrite “acquisition with light rehab” loans for borrowers whose business plan is to renovate units and mark rents to market upon lease-up. These loans are underwritten to a stabilized net operating income for agency or CMBS take out. However, current market dynamics have prevented most “value-add” deals from penciling as the gap between seller and buyer valuations, cap rates, and high renovation costs remain a challenge.

For those projects that pencil, typical underwriting structures can include debt service coverages below 1.0x with a built-in interest reserve for capital improvements, loan-to-costs of approximately 70% and short-term interest rates in the 7% to 9% range. Most lending sources will underwrite to an exit debt yield of 9%. This assures the rehab loan can be refinanced upon stabilization. Due to the inverted yield curve, short-term rates remain 100 to 200 basis points higher than fixed-rate options, including spread premium.

Bridge Financing

Bridge financing for multifamily has been highly sought after for assets that either need more time for stabilization or cannot underwrite to a conventional fixed rate option; either the property has not obtained stabilization post construction (remains within the lease-up phase) or the property has a high variable rate loan coming due, and the borrower needs more time to either stabilized the asset or is anticipating rates to come down over time.

There are many “bridge-to-bridge” financing structures for existing assets today. The typical bridge structure consists of short-term 12- to 36-month loan terms, typically priced as a variable rate product (although there are some fixed options in the marketplace), between 8% to 10%, interest only, with some form of recourse guarantees.

Bridge lenders will typically underwrite to a 9% exit debt yield. Depending on the lending source, borrowers can purchase a rate cap if desired, while some sources do not require caps. Most bridge financing comes with some form of recourse guarantee unless the sponsor has a substantial equity position in the asset.

Construction Financing

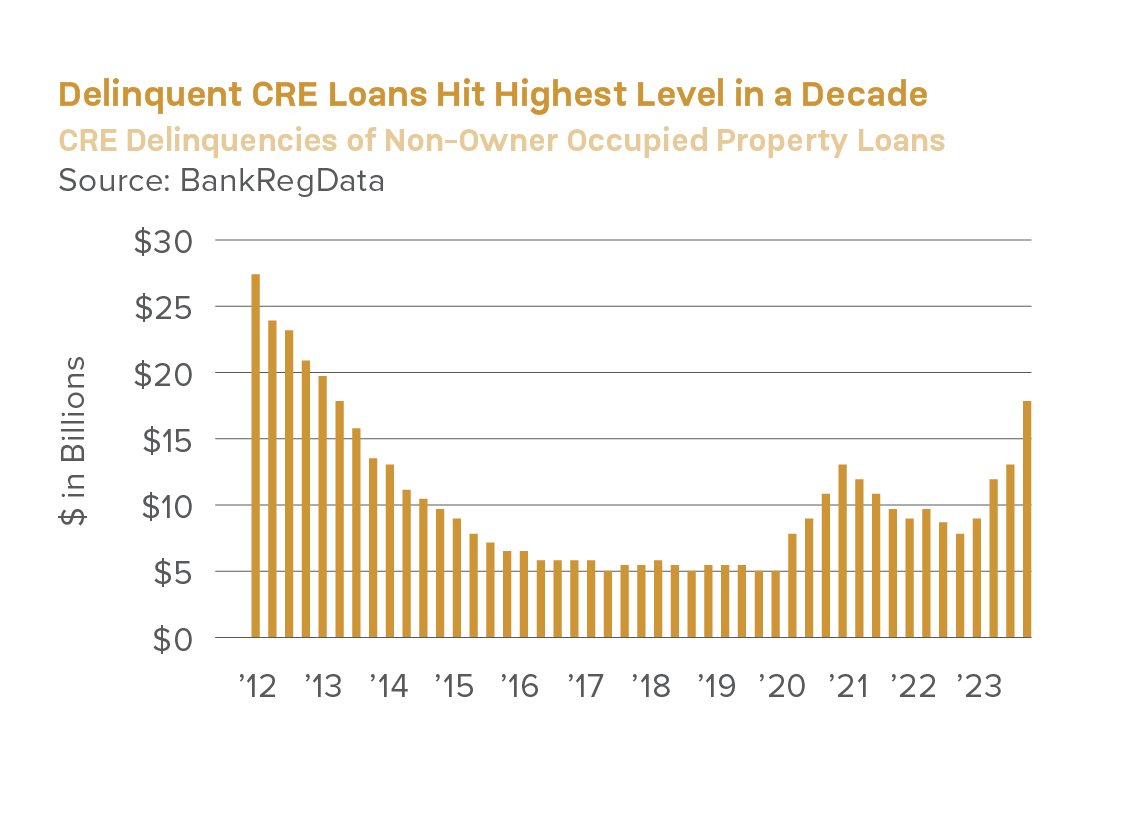

Construction financing has been extremely difficult to obtain within this market cycle. Local and regional banks are typically the “go-to” lending sources for multifamily construction needs. Federal regulators have approached most local and regional banks over the past nine months, requiring them to “scale back” on credit, short up deposits, and ensure that sponsors with outstanding current loans have solid global cash flow, stable credit, and ample liquidity. The absence of construction credit has led many developers to approach “private” capital sources. For those construction lenders who remain in the marketplace, underwriting has certainly been constrained for market-rate multifamily projects.

Most banks require 10% to 15% of the construction loan amount in deposits as a starter, with loan-to-costs ranging between 55% to 65%, variable rate pricing (either prime or SOFR indices) in the 8.50% to 10% ranges, plus personal or corporate recourse to the sponsor/developer. Many banks are also requiring GMAX contracts from the general contractor as the cost for lumber, labor, concrete, steel, glass, and fixtures remain volatile.

Construction lenders have been caught with insufficient contingency reserves over the past 36 months, as input cost inflation has led to major cost overruns and construction delays. Construction lenders are underwriting to a 9% to 10% exit debt yield upon stabilization. This in turn impedes overall loan to cost, forcing many developers to increase their equity requirement for the project.

What we Face in 2024 for Apartment Financing

Over the past eight to 10 years, available apartment financing has been cheap, relative to historical standards. This is because the Federal Reserve kept the overnight lending rate to a minimum, artificially keeping interest rates low for an extended period of time. Lower debt costs allowed investors to borrow at very low rates and acquire assets with positive leverage (borrowing costs below the purchase price cap rate). During this period, apartments experienced increasing rent growth and new development, as strong demand fundamentals outweighed oversupply in most markets.

The Loan Maturities Wall and Available Options

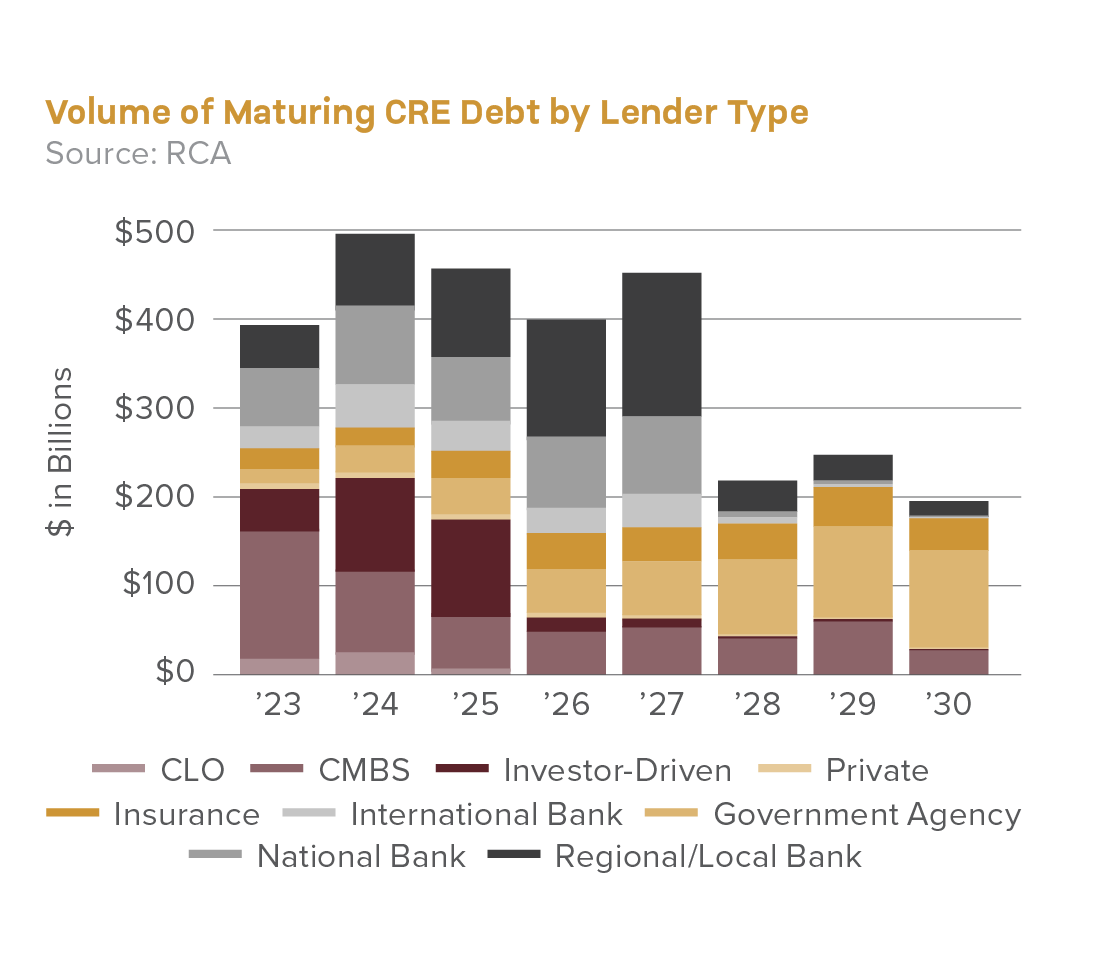

Looking forward, there is a sizable volume of loan maturities coming due within an interest rate environment that is much higher than the past five to 10 years (assuming average loan terms). Below are the actual statistics over the next 48 months.

Between 2023 and 2027, $980.7 billion in multifamily debt is coming due.

Approximately $1.99 trillion of multifamily mortgage debt outstanding through 2028.

These loan maturities consist of a mixed bag of short-term variable rate debt (construction financing/bridge loans). They tend to carry two- to three-year terms, in addition to five- to 10-year fixed-rate loans coming up for maturity. Borrowers who cannot find adequate refinancing proceeds, existing lenders are offering short-term loan extensions to many borrowers. However, these extensions typically include some form of loan paydown if the minimum debt service coverage ratio is not met at the new higher market rates.

Borrowers face difficult decisions as they decide how to handle heavier, unforeseen monthly debt service payments due to increased rates. In addition, borrowers with variable rate loans are required to replace their interest rate caps. This adds additional cash flow constraints. Borrowers have had to run the calculations between paying down the loan to refinance with a fixed-rate lender or finding a suitable bridge lender that will provide enough proceeds to cover the refinance. This allows the borrower more time to execute their business plans at higher interest rates. So, in this context, below are some creative approaches available in the market today.

Extensions

By utilizing extension options, borrowers can extend their loan for a year or two. This approach comes with risks, including the assumption that interest rates will decrease in the near future, the need for additional equity injection to reduce the lenders’ loan exposure, and efforts to align the loan with the loan-to-value or debt service coverage requirements, potentially requiring additional loan guarantees.

Refinance

Refinancing at current rates with the most competitive financing available is certainly the best option. However, property cash flows (not necessarily value) are the determining factor here. The unfortunate reality is that rates are higher and property values are lower. So, either borrowers are adding additional equity or utilizing rate buy-downs to cover maturing debt.

Loan Restructuring

This includes modifying loan terms, extending maturities, or temporarily reducing rates. However, this is only available if the property is performing and the sponsor maintains creditworthiness by lender standards.

Rescue Capital as Apartment Financing

Some investors have turned to the preferred equity, allowing the property owner to inject new capital via equity recapitalization. A preferred equity investor pays down outstanding debt and buys additional terms without the borrower investing out-of-pocket capital.

They are structured as a secured interest of the borrowing entity and include a preferred return of 8% to 10%. The overall return ranges between 13% to 18%, depending on the project metrics. Investment terms vary from 24 to 60 months. The exit (preferred equity payoff) is typically a sale unless the property can be refinanced in the future to generate the preferred equity partner returns.

Full/Partial Sale

For borrowers facing insurmountable debt with impending maturities, selling the asset (even at a loss) can be the best option.

Apartment Financing Outlook

The long-term viability of multifamily and the build-to-rent sector as an asset class remains positive, as demand for housing continues. Assets in strong primary and secondary locations retain considerable value compared to other asset classes with moderate rent growth. Liquidity will be readily available, although less robust than in the past, and at higher rates. Moving forward, the market should see rates stabilize (with the Federal Reserve slowing or ceasing to raise rates further). This will allow for price discovery, cap rate adjustment, and fresh capital to enter the market.

There are silver linings that come with all real estate cycles. Investors entering the market for the first time, have a contrarian investment outlook, or are redeploying fresh capital, there’s plenty of investment opportunities. Over the next 12 to 24 months investors can acquire assets at much lower basis levels, as banks and bridge lending sources start to unload non-performing assets.

The timing of these sales will likely occur at the beginning of Q2 2024. Market volatility often brings opportunity for the opportunistic investor with a three- to 10-year investment horizon. Accumulating assets over the next 12 to 24 months might be excellent timing for long-term cash flow and appreciation.