A Deep Dive into CRE Capital Markets Complexity

In a complex interplay of factors, CRE capital markets significantly shifted in 2023 compared to the year prior. As interest rates surge, property lending plummets, and a conspicuous disparity emerges in price discovery. The industry now finds itself navigating a challenging terrain. Transactions are experiencing a notable downturn, reflecting the cautious approach of lenders. Notably, Q3 2023 witnessed a substantial decline in lending activities compared to the preceding year, with a 7% decrease in bank lending from Q2 to Q3 2023. The total volume of loans during this period dropped by a staggering 49% compared to Q2 2022, and year-to-date borrowing, as of November 2023, registered a 44% decrease.

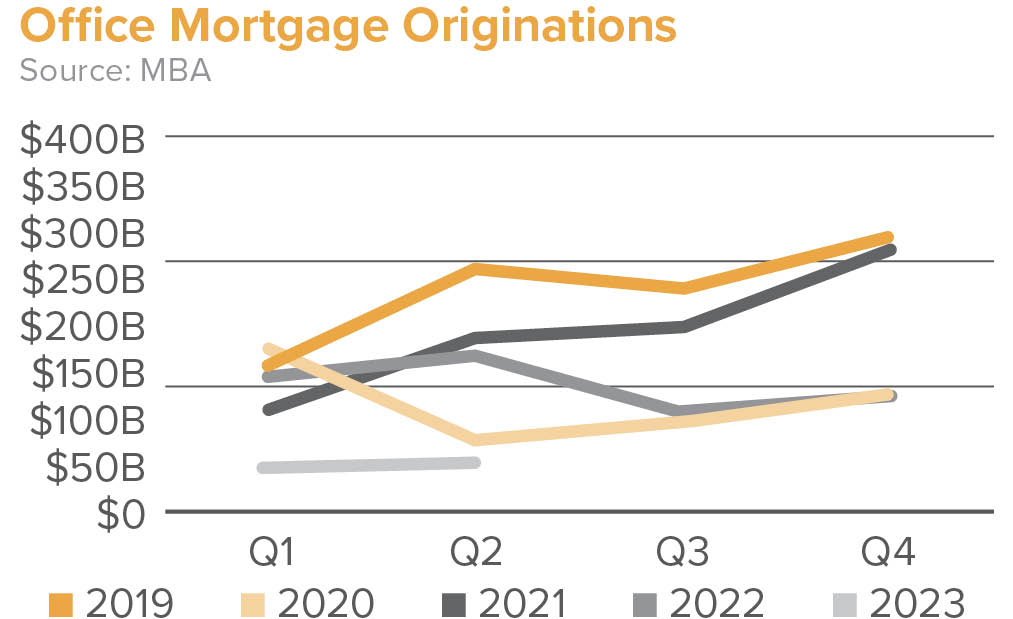

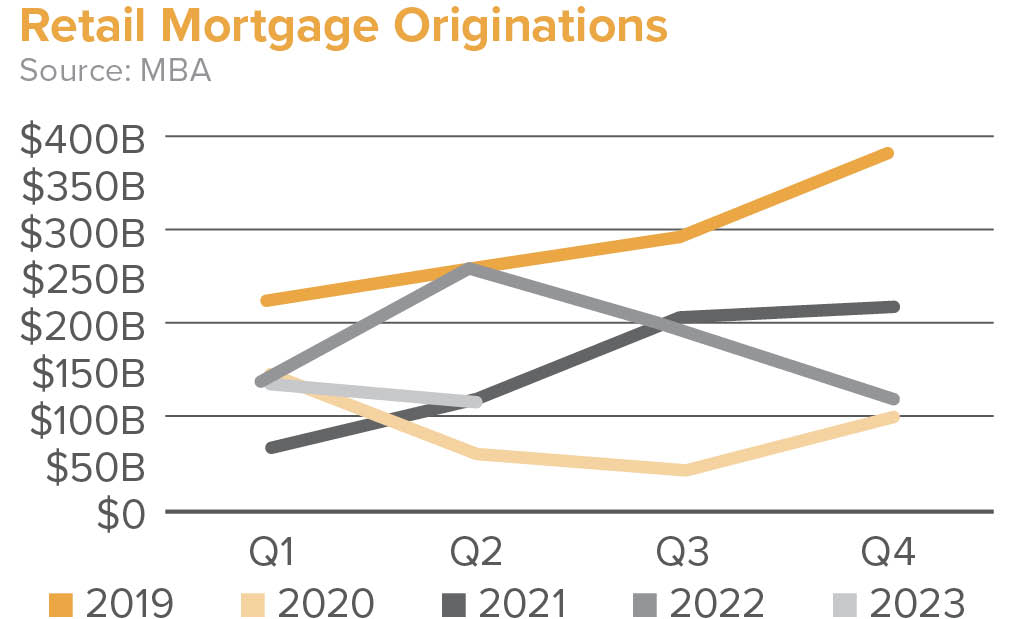

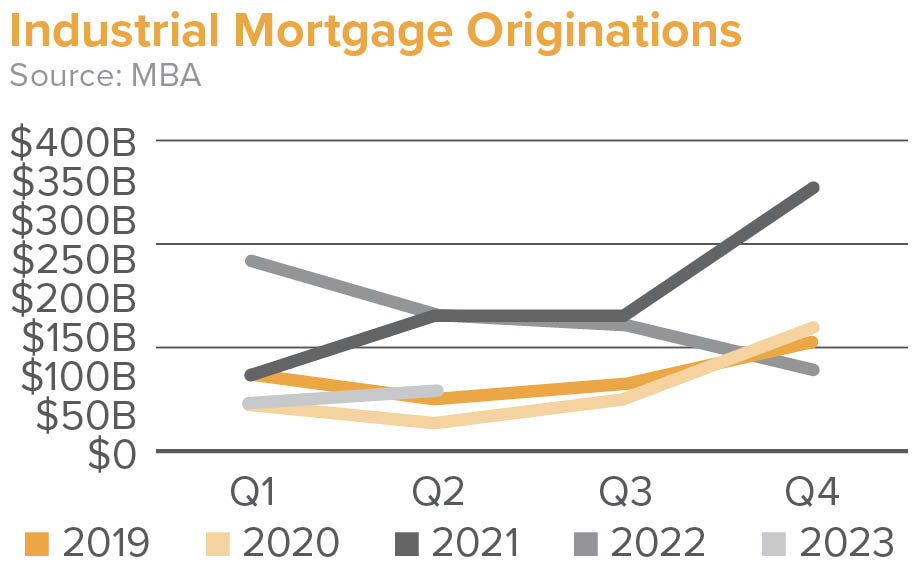

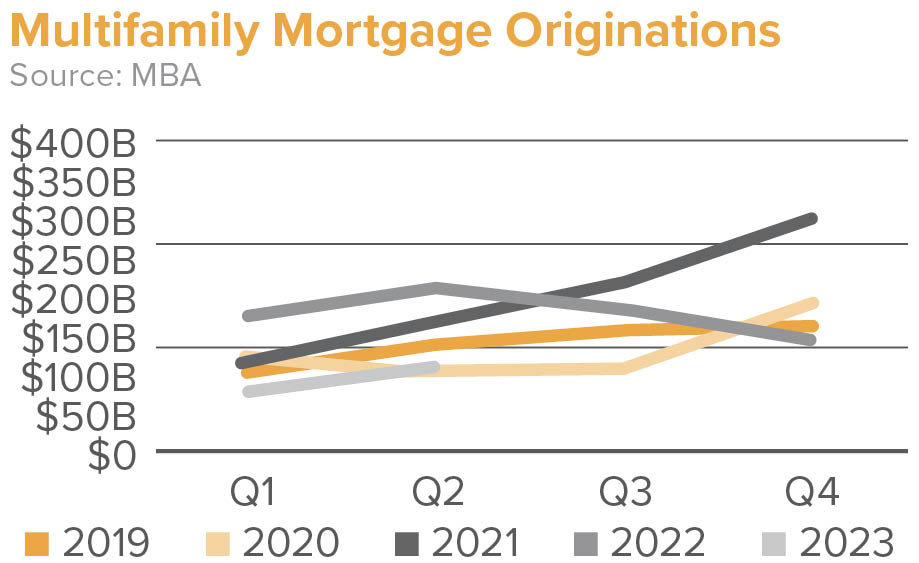

An in-depth examination of statistics from the Mortgage Bankers Association’s (MBA) recent report further underscores the challenging environment, revealing a 26% decline in total lending, down from $816 billion in 2022 to $442 billion in 2023. Multifamily lending, a significant component of the market, is anticipated to experience a substantial 41% drop to $285 billion. Despite these challenges, the industry persists, and deals are still being executed, driven by a combination of creativity and effective communication. In this dynamic environment, stakeholders must adapt and innovate to navigate the evolving landscape successfully.

Industry Trends in CRE Capital Markets

The Federal Reserve’s influence on the current state of commercial real estate lending is palpable, with a vigilant eye on potential credit deterioration in the sector. The November 2023 Supervision and Regulation Report provides a comprehensive overview of the regulatory landscape, revealing increased pressure on lenders to curtail activity for economic cooling. The report highlights credit rating downgrades for banks, attributing them to elevated interest rates and substantial exposure. Larger banks are strategically bolstering their cash-to-asset rations, while smaller banks, although actively lending, face vulnerabilities.

To navigate these challenges, the commercial real estate market is utilizing creative lending strategies, including the growing popularity of owner financing. These nonbank lenders are stepping in to fill the void left by traditional banks, with private investors and funds injecting capital into the market. However, concerns have been raised by the Federal Reserve regarding a lack of transparency in these financial maneuvers in CRE capital markets.

Commercial Mortgage Debt Outstanding

Over the past two quarters, there has been a significant surge in U.S. Treasury debt issuance — $1.9 trillion, triple the 10-year average. Simultaneously, there has been a reduction in demand for U.S. Treasuries as China downsizes its holdings and the Federal Reserve tightens its holdings by $843 billion. Amidst this, the potential impact of a federal budget resolution on interest rates looms, underscoring the intricate web of financial dynamics shaping commercial real estate lending. Of the $4.6 trillion of commercial mortgage debt outstanding, roughly $2 trillion is backed by multifamily, $750 billion by office, $420 billion by retail, $360 billion by industrial, and $300 billion by hospitality, with the remainder in healthcare, self-storage, mixed-use, and other CRE properties, according to MBA.

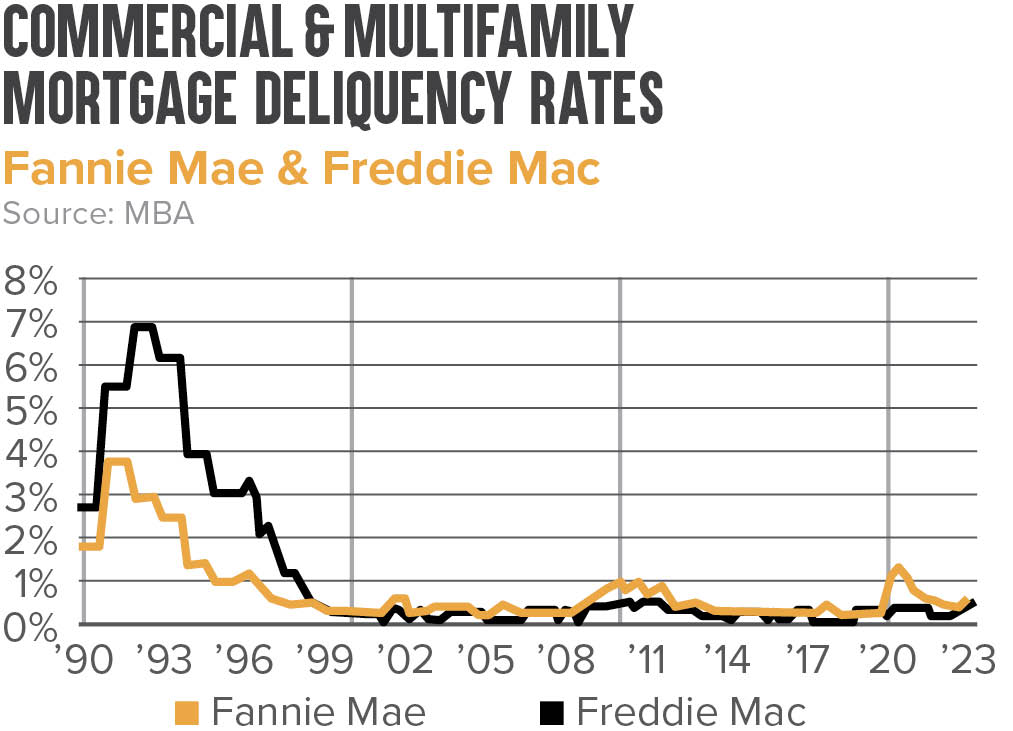

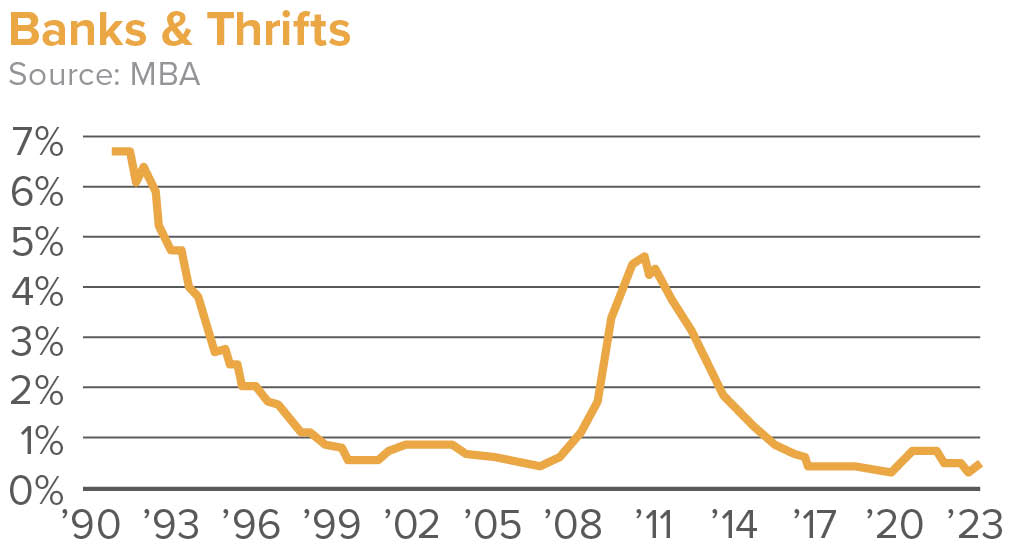

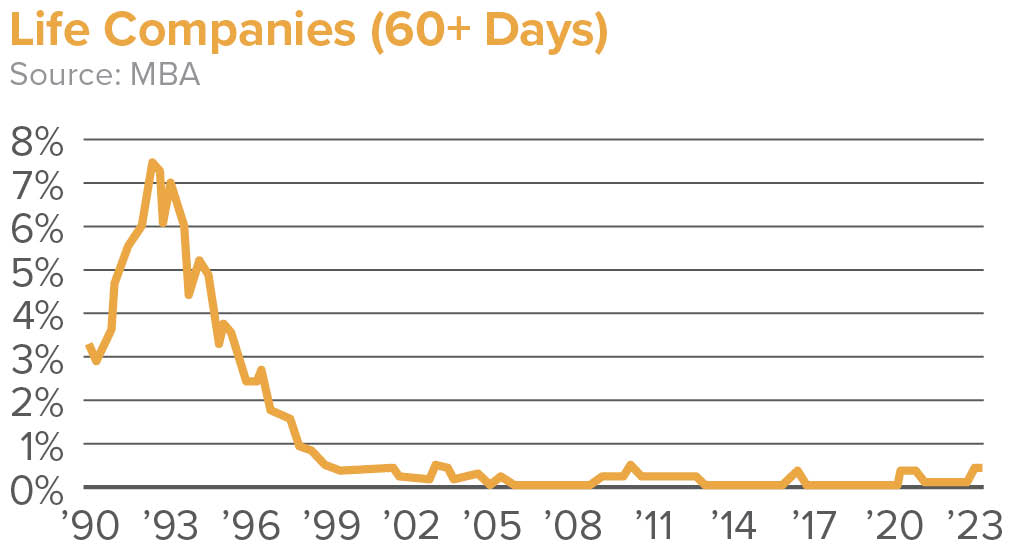

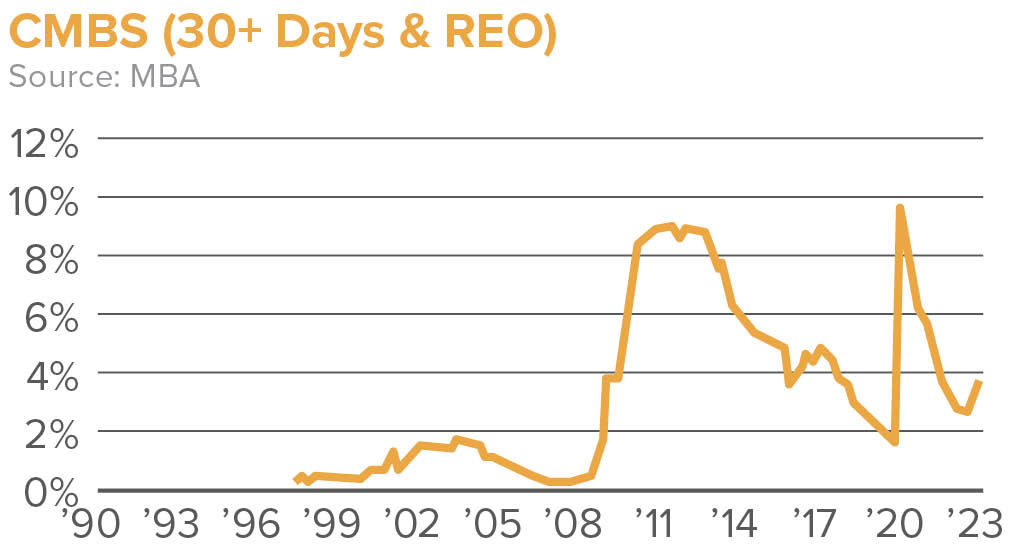

Growth in Delinquency Rates

Examining delinquency rates reveals a concerning trajectory, with rates for CRE loans hitting a decade high. This surge in delinquencies, particularly in the office space, raises apprehensions regarding property valuations and the stability of existing loans. Compounding these challenges is the looming “wall of maturities,” encompassing a staggering $1.4 trillion in commercial loans set to mature. The consequence of this influx is a logjam characterized by banks hesitant to write off loans and a potential reluctance to acknowledge losses. This dilemma contributes to declining demand for new mortgages and challenges establishing accurate property prices. As the industry grapples with these intricacies, the impact on property values and the overall help of the market remains a critical focal point for stakeholders navigating the complex landscape.

Plummeting Property Sales

Commercial property sales have witnessed a sharp decline in 2023, with transactions plummeting by 68% compared to a year ago. This downturn is not confined to specific property types, as retail property sales are down 48%, industrial down 73%, office down 55%, and apartments down 72%. The reduced transaction activity has created challenges in assessing property values, with various indexes providing conflicting narratives. Cap rates, a key measure of investment yield, have seen marginal adjustments despite the changing market conditions. According to MBA, retail cap rates rose by 20 basis points, multifamily rose by 30 basis points, industrial rose by 40 basis points, and office by 50 basis points. These adjustments occurred against risk-free yields, which increased by 350 basis points over the last three years. The

implication is that property value metrics may lag behind actual market dynamics, and a more accurate picture will emerge as transaction activity resumes and is recorded.

However, it is crucial to point out that these changes in property values are occurring after a period of remarkable growth and a good majority of properties exchanging hands in 2022. The accumulated equity in many parts of the market, especially with longer hold periods, serves as a buffer against potential price declines, providing resilience for CRE capital markets in the face of current market conditions.

Short-Term Financing Dominates CRE Capital Markets

Short-term financing dominates the current scene, with strong indications that rates may decrease in the near future. However, the potential for volatility necessitates a nuanced consideration of each client’s risk tolerance. Approximately 75% of the CRE pipeline comprises bridge to-bridge finance requests, with limited partner (LP) equity in short supply, posing challenges in meeting capital calls. Notably, clauses such as “no prepay” are merging as crucial tools for borrowers. These clauses offer resilience in harsh economic conditions and providing flexibility to refinance or sell properties when market conditions become more favorable. These adaptive strategies underscore the industry’s resilience in the face of evolving financial landscapes and highlight the importance of tailored approaches to mitigate risk.

Breakdown of CRE Lending

Looking back to 2022, loans were made by just looking at the deal size. For example, in 2022, more than one-third of the multifamily loans made last year were $1 million or less. The average size of multifamily loans made for a bank portfolio was $3.9 million in 2022, compared to averages of $38 million for life companies and CMBS, $19 million for FHA, and $18 million for Fannie Mae or Freddie Mac. According to MBA, bank lending accounted for 77% of the loans but 42% of the dollar volume in 2022. In 2023, each loan is driven by the property’s subtype, market, age, deal age, size, income, and more.

Navigating the diverse landscape of CRE lending involves a meticulous breakdown of lending practices across various property types. In this market, relationships are paramount, and aligning the right lenders with borrowers is crucial. Recognizing the unique approval processes and understanding the credit boxes of different institutions is fundamental, with the upfront due diligence process playing a pivotal role in setting realistic expectations, whether dealing with a seasoned investor or a first-time participant, challenges abound.

Office

Office properties are undergoing the most intense scrutiny as the landscape of office work undergoes significant changes. These changes were prompted by the adoption of flexible work schedules and questions surrounding how companies will navigate work-from-home and hybrid models. According to CoStar Group, the overall U.S. office vacancy rate has reached a 30-year high at 13.5%. It also reports a negative net absorption of 7.3 million square feet, accompanied by a 1% decrease in rental rates. However, trophy properties with the finest amenities in top CBDs have experienced an 11.6% increase in rental growth. With these challenges lenders have been reluctant to lend on this property type.

Retail

Three years ago, retail properties faced significant challenges and were widely perceived as one of the most vulnerable CRE sectors. Since then, investors and lenders have been drawn to the sector. According to Moody’s Analytics, there’s a positive trend in retail performance, with vacancies decreasing from 10.4% in Q1 2022 to 10.2%. Average asking rents have experienced a 0.7% increase over the last year. These numbers indicate a nuanced landscape within the retail sector. Certain subtypes demonstrate resilience and even growth, reflecting a more refined understanding among industry participants regarding retail dynamics. As such, credit unions addressing the gaps left by traditional banks, offering advantages such as the absence of prepayment penalties.

Examining lending terms reveals nuances in secondary and tertiary markets. This includes interest rates and amortization periods and major markets featuring five-year deals, spreads, and amortization periods. Notably, non-recourse financing dominates in this space, with CMBS taking precedence. This type of financing is characterized by interest only payments and sizing based on property income. Meanwhile, life insurance companies contribute to the landscape with desirable features such as tighter spread and higher amortization rates.

Industrial

Industrial property performance has been remarkably strong lately – with high demand driving vacancies lower and rents higher. The slowdown highlights the lingering impacts of rising interest rates and the commensurate uncertainty around asset pricing. However,

private capital remains at the forefront of buying actively. Institutional and public REIT investors persist in their pace of acquisitions,

homing in on first-class developments and prime locations. For industrial, the preference leans towards agency financing, driven by factors like predictability and bridging the leverage gap.

Multifamily

Multifamily has been defined by a significant mismatch between supply and demand of space. This imbalance resulted in record-low vacancy rates and rapid rent increases. In response to this demand, developers increased the issuance of permits, initiating new construction projects. The consequence of these efforts has resulted in nearly one million multifamily units currently in the development pipeline. This is uptick has caused vacancy rates to increase and a moderation in rent growth.

Economic Outlook & Risks for CRE Capital Markets

CRE Capital Markets is at a critical juncture with sustained 5%+ 10-year Treasury yields impact cap rates and capital values. The prospect of such yields has raised questions about the resilience of CRE in the face of increased borrowing costs. BlackRock’s prediction of a long-term borrowing cost of 5.5% further adds to the cautious sentiment. Further hinting at challenges in the financing landscape.

The economic landscape will experience lowered growth expectations for investment rate volumes in 2024. This suggests a need for stakeholders to recalibrate strategies in response to evolving market conditions. On the lending front, projections indicate that CRE lending will reach $559 billion in 2024. Multifamily lending is anticipated to constitute a significant portion, projected at $339 billion. These forecasts underscore the dynamic nature of the CRE market, prompting industry participants to carefully navigate the economic landscape. Investors must adapt strategies to mitigate potential risks and capitalize on emerging opportunities.