NMHC’s January 2024 Survey

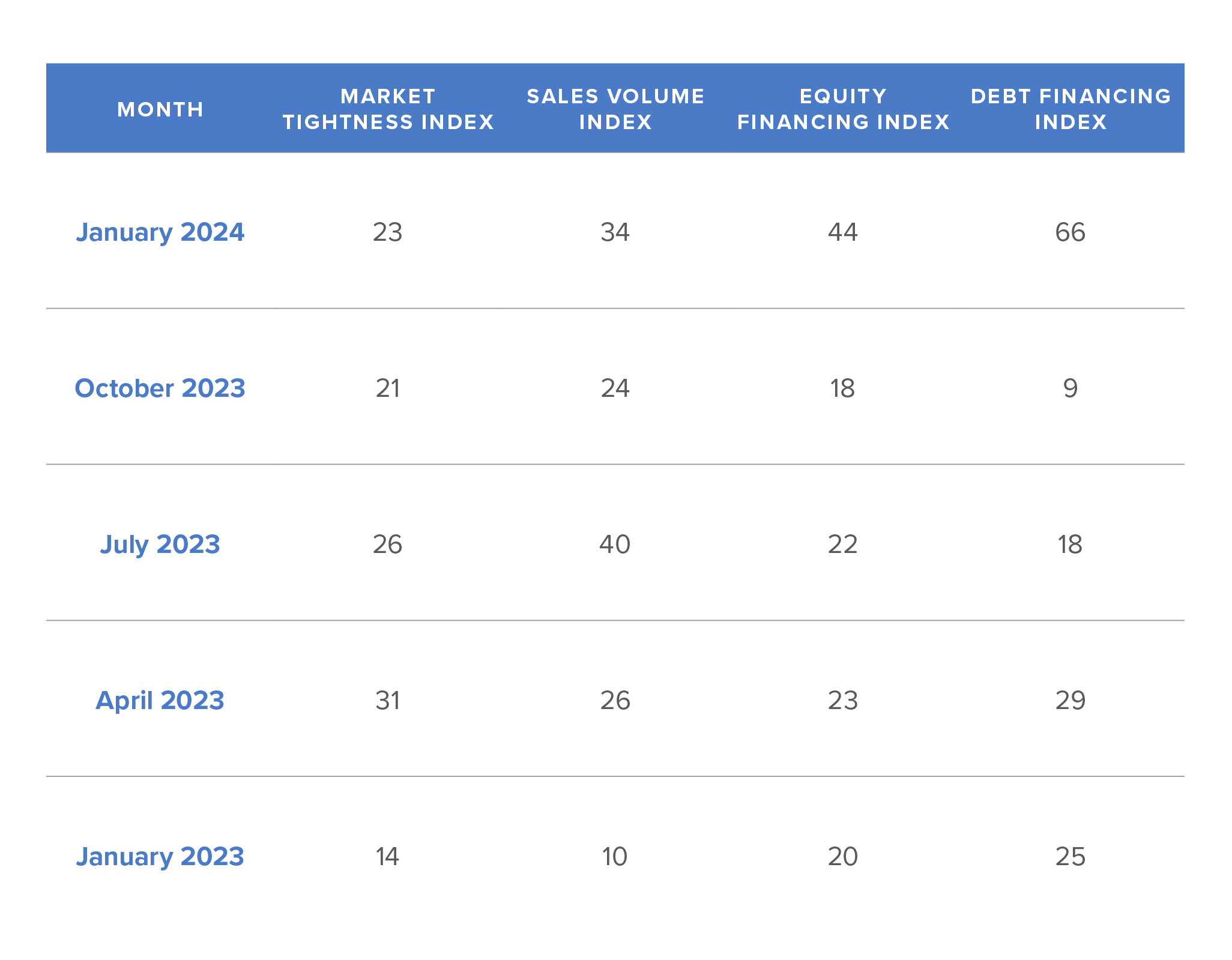

The forecast for multifamily debt financing has become favorable for the first time in over two years. However, the overall conditions in the apartment market showed a decline in the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions for January 2024. While Debt Financing scored 66, the Market Tightness (23), Sales Volume (34), and Equity Financing (44) indexes all registered below the neutral level of 50.

Source: NMHC

Source: NMHC

The Market Tightness Index above 50 indicates increasing overall constraints in apartment markets, while a score below 50 suggests relaxation. A Sales Volume Index above 50 signals a rise in sales, below 50 indicates a decrease, and 50 reflects unchanged conditions. An Equity Financing Index above 50 implies greater availability of equity finance, below 50 suggests reduced accessibility, and 50 denotes unchanged equity financing conditions. A Debt Financing Index above 50 indicates overall improvement in borrowing conditions, below 50 signifies deterioration and a score of 50 means unchanged borrowing conditions.

Reasons Behind Increase in Debt Financing Index

The Debt Financing Index score of 66 marked the first time in 10 quarters that debt financing became more available. In the January 2024 survey, approximately 45% of participants noted improved debt financing conditions, a contrast to the 0% who expressed the same sentiment in October 2023. About 35% believed conditions remained unchanged, while 14% considered the current period less favorable for borrowing compared to three months ago.