Decoding the Surge in Commercial Real Estate Insurance Costs

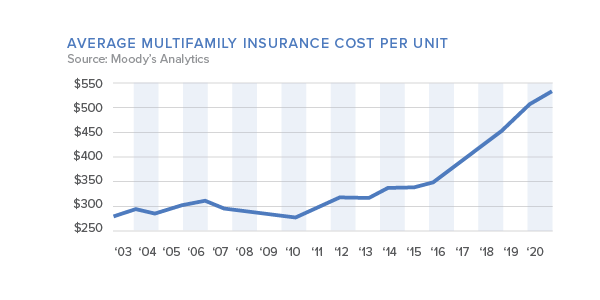

Commercial property owners find themselves in uncharted waters as insurance premiums reach historic highs. Factors such as natural disasters, inflation, and a contracting reinsurance market contribute to this alarming trend. Since 2017, commercial real estate insurance costs have surged by an average of 7.6% annually, according to Moody’s Analytics. This upward trajectory threatens to erode profits, with potential costs wiping away a year’s worth of gains.

What Is Causing the Rise in Insurance Costs?

Natural Disasters:

One of the primary contributors to this phenomenon is the escalating frequency and intensity of natural disasters. Hurricanes, wildfires, and other climate-related events are no longer sporadic occurrences but have evolved into formidable threats, leaving commercial properties vulnerable to substantial damage. As these disasters become more frequent, insurance providers are compelled to recalibrate their risk assessments, inevitably leading to higher premiums for property owners.

Inflationary Pressures:

Inflation, a significant force in this context, is pushing insurance costs to new heights. As the overall prices of goods and services rise, so does the expense of labor, materials, and property reconstruction. For commercial property owners, especially those dealing with the aftermath of incidents, this means grappling not only with the consequences of disasters but also with the increased costs of restoring their assets.

Contracting Reinsurance Market:

The situation worsens for commercial property owners due to a shrinking reinsurance market. Reinsurance is crucial for spreading risk across the insurance industry, acting as a safety net for insurers. However, reinsurers are becoming more cautious as risks evolve, limiting their coverage and raising prices. This reduction in available coverage and the resulting higher costs are directly passed on to property owners, compelling them to face unprecedented financial challenges.

The Impact of Rising Insurance Costs

Multifamily buildings are grappling with substantial cost hikes. Cities like Dallas, Los Angeles, and Houston witness annual insurance cost increases of 14.4%, 13%, and 12.6%, respectively, especially affecting rental apartment buildings.

The surge in insurance costs is significantly impacting property sales, creating a ripple effect in the real estate market. According to CoStar Group, there has been an astonishing 79% decline in deals exceeding $25 million since late 2021. This financial burden, imposed by soaring insurance expenses, is reshaping the dynamics of real estate transactions.

Challenges for Property Owners and Investors

Navigating the storm of escalating insurance costs presents a more formidable challenge than the more predictable waves of interest rate hikes. The annual renewal of insurance policies compels property owners into embracing new policies at elevated costs, adding a layer of financial complexity to their responsibilities.

High insurance costs are also influencing strategic decisions. Some lucrative deals are being shelved, altering the landscape of potential real estate investments.

As commercial property owners navigate this complex terrain, strategies for managing insurance costs become pivotal. The industry’s resilience will be tested as it grapples with an intricate interplay of economic, environmental, and legal factors, reshaping the future of commercial real estate.