Senior Housing Boom

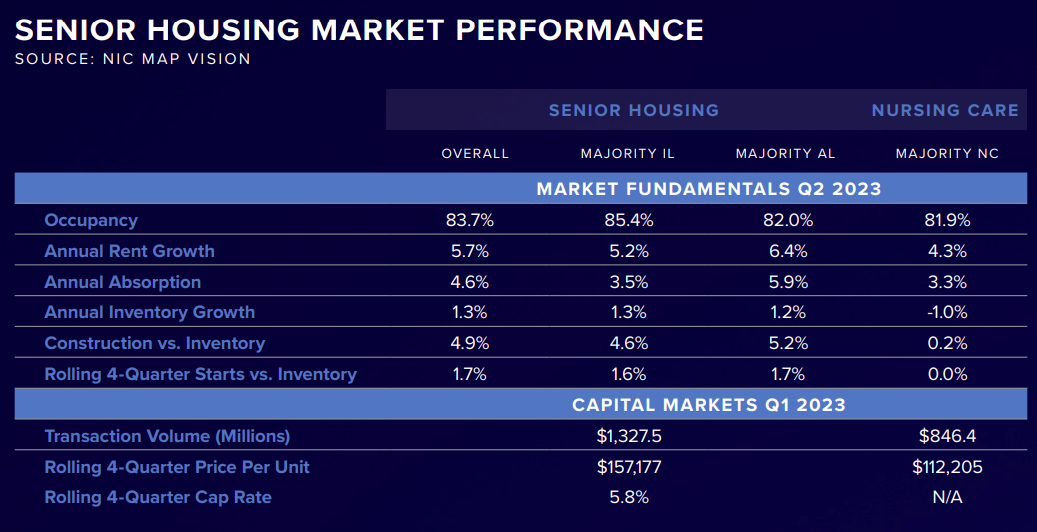

The senior housing sector is experiencing an unprecedented boom. The average occupancy rate rose to 83.7% in Q2 2023, reaching an all-time high of 900,000, according to a recent report by the National Investment Center for Senior Housing & Care and NIC MAP. This surge represents a 0.6% increase over the year’s first quarter and marks the eighth consecutive quarter of positive growth – the longest trend ever observed in this industry.

Market Performance

Although the most recent occupancy data shows a significant improvement compared to the industry’s low occupancy of 77.8% during the same period two years ago due to the pandemic, there is still a considerable challenge ahead. Caroline Clapp, NIC’s senior principal of research and analytics, points out that the industry still has quite a hill to climb to reach the 87.1% occupancy rate recorded in Q1 2020.

“Continued solid demand for senior housing, paired with relatively slow growth in inventory, has contributed to the current occupancy recovery,” said Caroline Clapp. “This is the longest period of occupancy rate gains NIC has ever observed, yet occupancy is still below where it was at the start of the pandemic.”

The NIC MAP monitors 31 major metropolitan areas; of those 31, the top three cities with the highest occupancy rates in Q2 2023 were Boston, where the average occupancy was 89.0%, followed by Baltimore at 87.5%, and Portland, Oregon at 86.9%. On the other hand, the cities with the lowest current occupancy levels were Houston at 78.7%, Cleveland at 80.8%, and Atlanta at 80.9%.

With the demand for senior housing units steadily on the rise, around 25,000 to 40,000 additional housing units will be required annually from now until 2030 to accommodate the increasing demand as the Baby Boomer generation continues to age. This clearly indicates that senior housing is fast becoming a thriving sector in the real estate industry.

But what is driving this remarkable growth, and what does the future hold for this market? One word can sum it up: demographics.

Census data reveals that the number of Americans aged 65 and older reached a staggering 55.8 million in 2020, making up 16.8% of the nation’s population. This surge in the aging population is the primary driver behind the increased demand for senior housing. As more individuals enter their golden years, the need for specialized housing and care services has never been greater.

Its unique position as a bridge between traditional multifamily housing and specialized senior care facilities sets senior housing apart from other real estate sectors. These communities offer a range of services and amenities tailored to the needs of older adults, from independent living to assisted living and memory care. Due to this specialized nature, senior housing can command rent rates that are 10% to 30% higher than traditional multifamily properties.

Beyond higher rents, senior housing properties often enjoy lower operating expenses and longer lengths of stays by residents. This combination of factors can lead to impressive profit margins, with some senior housing providers achieving margins as high as 55% to 65%. This makes senior housing an attractive investment opportunity for individuals and institutions alike.

As an increasing number of retirement communities become more financially secure, with occupancy rates nearing 90% and the rate at which new occupants are filling vacant units left by the COVID-19 pandemic multiplying, investors are driving up the prices for these strategically located assets that are resilient even in economic downturns. Institutional investors are taking note of this lucrative market and are entering the space at an increasing rate. As they deploy their financial resources into senior housing, property values are being pushed even higher, driving further growth in the sector. This influx of institutional investment has the potential to reshape the senior housing landscape in the coming years.

This trend is expected to drive more capital into the sector, leading to improved quality of care, innovation in services and technology, and an expansion of senior housing options. With increased competition, consumers may benefit from better value and more tailored offerings while providers adapt to the evolving needs of an aging population. Overall, this development promises a positive transformation in senior housing, enhancing the quality of life for seniors and their families.

The Road Ahead

The National Investment Center for Senior Housing & Care report’s findings emphasize that the sector is poised for continued expansion. In order to meet the growing demand, it is estimated that more than 800,000 additional units of senior housing will need to be added in the U.S. by 2030. As the aging population continues to swell, the senior housing market presents a unique opportunity for investors, developers, and operators to contribute to the well-being and quality of life of older adults while enjoying the benefits of a thriving market.