Trends Transforming Healthcare

The U.S. has the world’s largest healthcare industry, and the sector’s strength attracts significant market players. With an aging population and the ever-increasing need for accessible healthcare, the industry will only expand. Additionally, the demand for ambulatory centers, cosmetic surgery complexes, freestanding medical office buildings (MOBs), urgent cares, and other unique healthcare facilities, such as medtail, are increasing nationwide, making the healthcare industry one of the strongest commercial real estate asset classes to invest in.

How the Healthcare Industry is Evolving

The changes impacting the healthcare sector cannot be overstated. The demand for healthcare real estate is anticipated to increase tremendously in the upcoming years due to improvements in medical technology and changing healthcare policies. As healthcare providers look for new ways to improve patient care and reduce costs, the real estate industry is poised to play a critical role in meeting their needs.

The healthcare industry is becoming more consumer-centric and shifting from hospital campuses to specialized medical office facilities. Examples include adding specialty clinics, medical office buildings, urgent cares, and ambulatory centers into neighborhood locations to improve patient accessibility, increase outpatient surgeries, and lower healthcare costs. These modern spaces attract new clientele and drive up business.

“Medtail” is a growing nationwide trend where healthcare services are offered in retail settings. Medtail is a result of healthcare tenants shifting away from large hospitals and standalone buildings to provide services that cannot be offered online.

MOBs Movement in the CRE Space

MOBs have been strong performers in healthcare real estate for the past few years, and the trend continues. MOBs are typically multi-tenant properties that house medical practices, clinics, and other healthcare-related businesses intended to improve patient outcomes and enhance the patient experience. As the population ages, the need for MOBs increases; consumers are more health conscious than ever before, contributing to demand.

Investors are increasingly turning to medical office buildings as a stable alternative to suburban office holdings. MOBs boast record high rents, strong deal flow, and demand outpacing supply amid tight vacancy and stable cap rates.

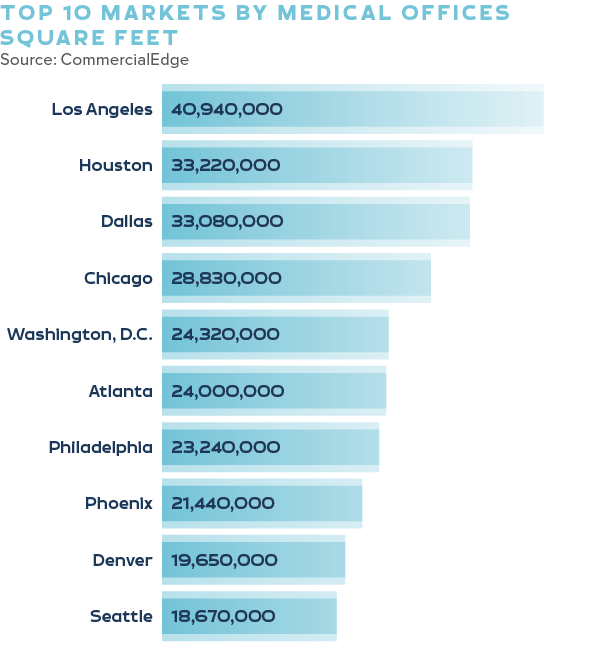

According to Yardi Matrix data, the U.S. now has 1.9 billion square feet of medical office space, 17.6 million square feet under construction, 19.7 million square feet planned, and another 65.6 million square feet are in the prospective phase.

Investors are drawn to the sector mainly because of substantial macroeconomic headwinds, including an aging boomer population and the overwhelming need to provide most healthcare services in person at a physical site. Medical office buildings typically involve long-term leases, less turnover between leases, high occupancy, and better below-the-line capital expenditure performance. Medical professionals are also among the most creditworthy tenants, creating a more durable income stream and a significantly lower risk profile. Despite economic headwinds, MOBs are viewed as a recession-proof or recession-resistant asset class.

Healthcare real estate transaction volume slowed in the latter half of 2022 due to rising borrowing costs and mounting economic uncertainty. Rising interest rates were the most significant concern facing the MOB investment landscape, with large domestic banks slowing lending activity.

Experts predict a promising outlook for healthcare in 2023 with increased absorption and low vacancy rates. The medical office sector has compelling investment qualities that will keep investors returning, namely its long-term leases and stable tenants.

Additional Subsectors Performing Well in Healthcare and Medtail

Cosmetic Surgery Centers

In recent quarters, cosmetic surgery centers have become an increasingly favorable asset. In 2022, private equity firms significantly focused on med spas, aesthetics, and plastic surgery offices, all of which offer a range of revenue streams, including insurance fees and steady cash flow. Successful mergers with dermatology and plastic surgery groups have also been observed, bringing in-house cross-referral and substantial insurance revenues. These two business models align perfectly.

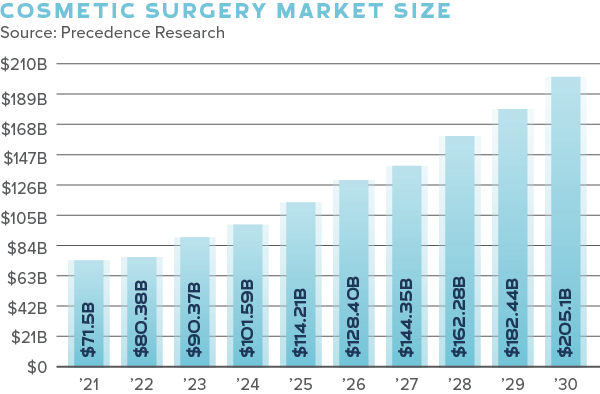

According to Precedence Research, the size of the global cosmetic surgery market is anticipated to increase at a compound annual growth rate (CAGR) of 12.42 percent from 2022 to 2030. The estimated value in 2022 was $80.38 billion and will reach $205.1 billion by 2030. North America saw a market value of nearly $17 billion in 2022.

Urgent Care Facilities

Urgent care centers nationwide are converting to medtail spaces. This trend is in response to consumers’ growing preference for accessible health and wellness services.

Specialty Clinics

According to Report Linker, the specialty clinics market in North America is expected to grow at a CAGR of five percent from $95.67 billion in 2018 to $119.89 billion by 2025. The increase is due to technological advancements in diagnostic medicine, leading to more specialty clinics. A rise in chronic diseases and the number of older adults are also responsible for this market growth.

The U.S. is expected to lead the adoption of specialty clinics in North America, with private hospitals being the preferred choice for patients due to the amenities and better treatment offered.

The increasing competition and improvement in healthcare services are driving the growth of private, specialty hospitals, and ambulatory surgical centers.

Dentists

Market analysis estimates the demand for dental care treatment will increase significantly in the coming decade. The growing prevalence of oral care for adults and children is expected to fuel this future market growth. These offices are being seen in retail locations nationwide more and more.

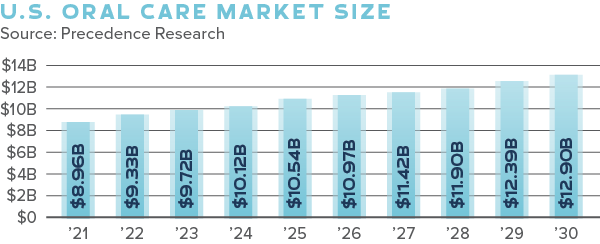

The U.S. oral care market was valued at $9.3 billion in 2022 and is projected to hit around $12.9 billion by 2030, poised to grow at a CAGR of 4.13 percent from 2022 to 2030, according to Precedence Research.

Freestanding Emergency Rooms

The U.S. freestanding emergency department market is expected to grow at a CAGR of 4.9 percent between 2022 and 2027, according to Mordor Intelligence. Freestanding emergency rooms can be excellent investments due to high demand, faster care, higher reimbursements, lower overhead costs, and market growth. As the number of insured Americans continues to grow, this will enable more Americans to afford convenient medical care. Freestanding emergency rooms differ from urgent cares by providing emergency medical care for patients who require immediate attention. In contrast, urgent care centers offer non-emergency care for minor illnesses and injuries.

The West Journal of Emergency Medicine published a study which found the number of freestanding emergency departments (FSED) is increasing rapidly in the United States. Supporters of FSEDs argue that they can offer advantages such as shorter wait times and reduced travel distance for necessary emergency care. As a result, the growing number of FSEDs is anticipated to contribute to market growth during the forecast period.

Ambulatory Centers

Ambulatory centers, also known as outpatient centers, are medical facilities that provide nonemergency medical care and procedures, such as surgeries, diagnostic tests, and rehabilitation services. They are usually located outside of a hospital setting and offer patients a more convenient and cost-effective alternative to hospital-based care.

Global Market Insights reports that in 2022, the market size of ambulatory centers was greater than $87.5 billion, and it is anticipated to experience a CAGR of over 4.5 percent from 2023 to 2032.

Dialysis Centers

Dialysis centers can be a promising investment due to the growing demand for dialysis treatment and the potential for long-term lease agreements with stable tenants. Despite challenges such as high costs and a shortage of qualified healthcare professionals, technological advancements and medical treatments have improved the quality of care within the sector.

Takeaways

Investors who are looking for opportunities in the commercial real estate market should consider investing in healthcare real estate, especially medtail. The demand for accessible and affordable healthcare is constantly growing, making it a promising sector for investment. The healthcare real estate industry is changing, with new subsectors emerging and new models such as specialty clinics and freestanding emergency departments gaining popularity. Healthcare real estate is an up-and-coming asset class that has not been fully realized yet in the CRE space. With this in mind, now is the time for investors to get on board and take advantage of the sector’s stable income, and long-term leases.