Retail Real Estate is Going Strong Headed into the Holiday Season

Retail remains steady despite the recession and inflation concerns. In fact, U.S. retail real estate vacancies are down, rents are up, and more stores are opening than closing. In the last year, more stores opened than closed for the first time since 1995, and several analysts predict that this trend will continue into 2023. Brick-and-mortar store owners are posting some of their best numbers in years and are planning expansions as more Americans venture out to purchase retail items once again. This is extremely promising with the holiday season upon us, and experts predict a healthy and highly profitable season.

Retail Expansion Plans

After several years of overbuilding, new retail construction has drastically declined. Now, most developers prefer to refurbish existing properties instead of creating new ones and solidify the tenant before construction. In addition, more and more e-commerce retails are moving to real estate to attract more customers, accelerate growth, and incorporate an experience into their business. According to the November Monthly Economic Review, real GDP climbed 2.6 percent in the third quarter of 2022, demonstrating a robust economic expansion that sets the tone for the fourth quarter. According to Kleinhenz, a chief economist, consumer spending is the primary driver of this economic growth.

Importance of Omnichannel Retail

Omnichannel is an emerging trend in the retail sector. This experience allows retailers to incorporate several on-ground and online options to increase consumer engagement and experience. Retailers can increase availability, improve sales and traffic, and combine digital touchpoints. Consumers love having a wide array of options because it feels like they have control. By offering an omnichannel experience, retailers can increase their target audience, resulting in higher sales performance.

Holiday Spending Trends

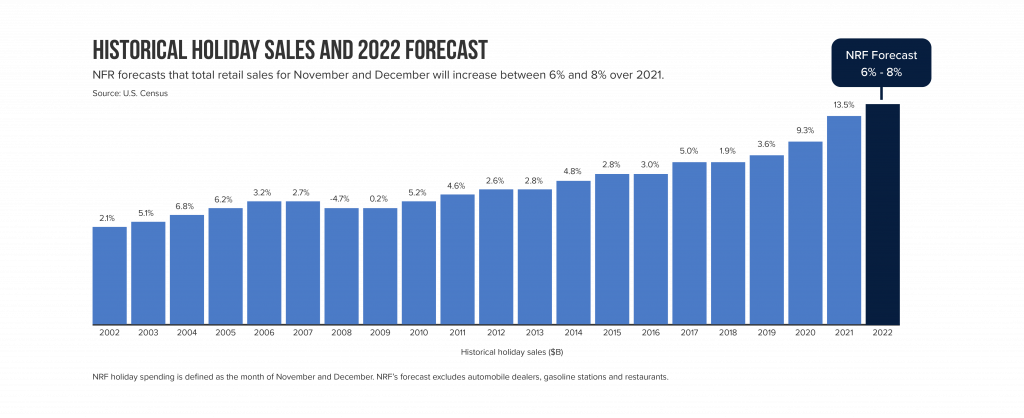

Experts are very confident in the outcome of the 2022 Holiday season. Black Friday in store sales revenue was down five percent at the week ending November 26, 2022. However, Adobe Analytics data showed that online spending on Black Friday this year reached $9.12 billion, up 2.3 percent year-over-year. Overall, consumer spending is up, and inflation is unlikely to have a noticeable effect on consumers’ holiday buying habits. The predicted healthy holiday sales will continue to reinforce this upward trend in economic activity. Recent market data expects holiday retail sales to increase by six to eight percent this year. Along with traditional on-ground retailers, e-commerce sales are included in the Holiday projection and are expected to increase between ten to twelve percent this year.

These trends mean that regardless of the country’s economic state, consumers will continue to celebrate the holidays. Even in the most uncertain economic times, consumers want to give gifts to their loved ones and make the holiday season memorable. Time and time again, retail reminds investors that it is here to stay. Retail real estate has remained steadfast throughout the years and shows no signs of slowing down anytime soon.

Retailers set to outperform

Consumer spending is projected to grow to nearly $1.3 trillion during the 2022 holiday season. Online sales of food and beverages are projected to grow by 22.9 percent, health and personal care sales are expected to increase by 21 percent, and apparel and accessories could see a 10.9 percent increase in overall sales.

Top retail sectors to invest in include electronics, home furnishings, apparel, automotive, big-box retailers that sell a little of everything, and grocery stores.

Discount stores, including Aldi, Marshalls, and T.J. Maxx, are expected to outperform this holiday season. These stores are famous for having quality products at discounted prices, making them an essential stop on your shopping to-do list. T.J. Maxx, Marshalls, and HomeGoods are also hosting a holiday campaign that continues to focus on the people during this season of giving.