How To Invest in Life Science and Real Estate

The U.S. is the epicenter of life sciences, holding several established markets in Boston, Cambridge, San Diego, and San Francisco. The industry encompasses various fields, including biotechnology, pharmaceuticals, medical devices, and genetics. Before the pandemic, gene therapies, AI-powered drug discovery and development, consumer wearables, and telemedicine were just some of the drivers transforming the space, according to Deloitte. Before the pandemic, life sciences were dubbed the “hidden giant,” but the rush for the COVID-19 vaccine has resulted in a flood of venture capital exacerbating the development of new facilities, ranking it among the fastest-growing asset classes in commercial real estate.

According to Crunchbase, a service that provides information about public and private companies, commercial real estate investors poured $16.55 billion into the biotech and life sciences sector in the first half of 2020, compared to $13.4 billion during the same period in 2019.

Additionally, the federal government is significantly interested in the sector as well, with California’s life sciences industry receiving $4.95 billion from the National Institutes of Health in 2019. RCA data revealed that from January through November 2021, life sciences/research and development investment sales reached $19.1 billion, a $9 billion increase compared to the same time in 2020.

Types of Life Science Tenants

Biotech and pharma companies take up the most life sciences space, though each tenant has varying real estate requirements. Medical device companies are more of an assembly line with clean rooms (a room with a concentration of controlled airborne particles), while pharmaceutical and biotech companies need laboratories requiring four times as much space as offices per person. In contrast, digital healthcare and genomics companies have much smaller footprints, only needing desk space and computing power, similar to tech companies.

Major tenants in the life sciences sector include:

1. Biotech firms

2. Pharmaceutical companies

3. Medical device manufacturers

4. Medical equipment manufacturers

5. Digital healthcare

6. Genomics

The life sciences industry presents some great opportunities with great returns. Fueled by demographic trends and research, the asset class can stand on its own for a long time. According to Persistence Market Research, sales in the life sciences aggregate spending market were $974.2 million in 2021 and are projected to expand at a CAGR of ten percent from 2022 through 2032. Though development can be costly and lengthy, the highly educated workforce, paired with all-time high venture capital investments in healthcare and biopharma, points toward a high-yielding future.

Fueling Biotech Growth

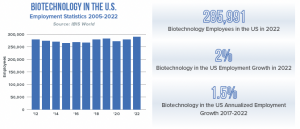

Though it doesn’t represent the entire life sciences workforce, the U.S. biotechnology research and development (R&D) employees are among the most highly educated globally, with the average tenant encompassing 70 percent of employees with doctoral degrees. The employment base in the U.S. biotechnology R&D sector has grown in the last three months at the fastest pace ever. According to IBIS World, the number of people employed in the R&D industry increased 1.5 percent annually between 2017 and 2022 and is expected to continue growing over the next five years.

Where Life Sciences Real Estate is Growing

Boston has long been the leading global hub for life sciences, attracting nearly $20 billion in venture capital investments for life science projects in the last two years, according to Crunchbase. Not far behind are “the birthplaces of biotech,” San Francisco and San Diego, which are competing with established life science sectors in Philadelphia, Raleigh, Northern New Jersey, and Bethesda.

Other rising life sciences markets include:

Los Angeles, Houston, Denver, Seattle, Chicago, and Minneapolis.

Developers are noticing the exponential boom in the life sciences sector, with Houston-based developer Hines recently announcing to invest “billions of dollars” in life sciences projects over the next two years. In fact, some developers are targeting abandoned office properties to convert into lab space. A prominent U.S. life sciences commercial developer announced a $155 million transaction involving a seven-story office building in New York with plans to transform it into a 208,000 square foot life sciences facility.

In the past, life sciences may have experienced relatively slower growth due to being perceived as financially risky. The reason for this is these tenants are typically start ups that have high failure rates for various ideas and can take several years before achieving profitability. Some are credit-grade companies with capital resources, while venture capitalists fund the rest. These types of companies that occupy life science buildings can take a long time to get revenue as they have a lot of equipment needs. However, experts note that the variation throughout the biomedical industry provides a range of leasing and investment opportunities.