The Current State of Shopping Centers

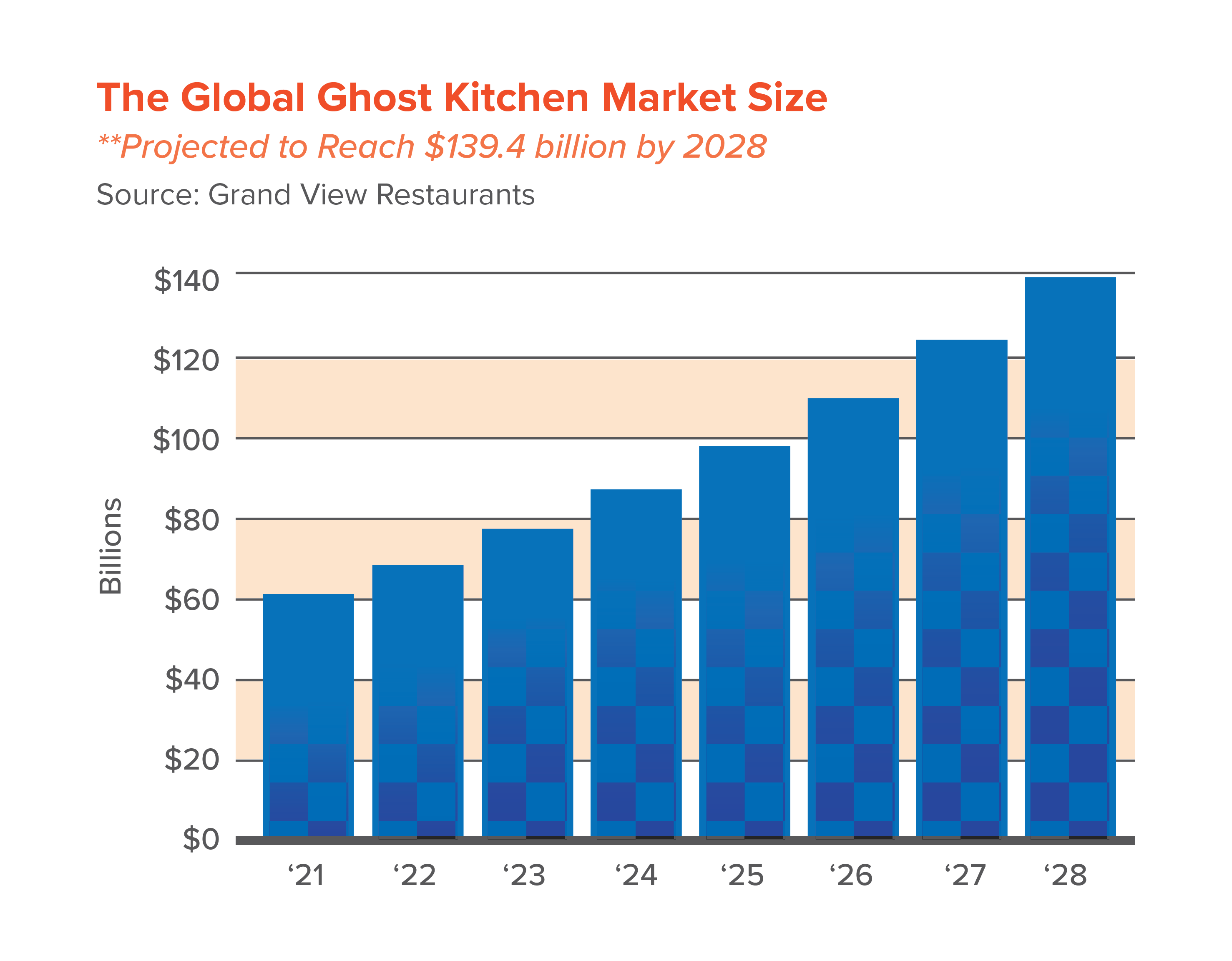

Shopping center landlords are welcoming back customers after the pandemic to a new retail landscape. The latest focus to optimize the customer experience is modern technology, including ghost kitchens. The virtual-only restaurant concept is breathing new life into underused or vacant shopping center spaces. In 2019, the ghost kitchen industry was valued at $43.1 billion and is expected to reach $118.5 billion by 2027, according to ReportLinker. While restaurants are increasingly searching for alternatives to brick-and-mortar locations, shopping center landlords are finding ways to bring customers back to shops. Unable to ignore the growing popularity and success of the concept, shopping center owners are implementing ghost kitchens into their properties.

The Growing Virtual Kitchen Concept

Ghost kitchens, or dark kitchens, are virtual-only restaurants that operate out of a single location and prepare multiple food concepts. These kitchens can serve an assortment of menus from different brands but only offer pick-up or delivery options. Investors love the low costs of operating dark kitchens, and customers love the ability to order various food items in one app. Additionally, ghost kitchens allowed restauranters (without drive-thru or delivery capabilities) to continue sales through pandemic-induced lockdowns. Food brand operators were left with bleak choices during COVID-19, as dine-in areas were shut down or open at severely limited capacities. Ghost kitchens offered a solution as they allowed orders to continue. Some spaces even used third-party delivery platforms to bring food home to customers. For some, the ghost kitchen business model is here to stay. With tech companies and large national food chains entering the market, ghost kitchens are exploding in growth and demand.

How Ghost Kitchens are Resurrecting Retail Centers

With all eyes on ghost kitchens, an array of investors took notice, including shopping center landlords. The lockdowns during the pandemic affected businesses that relied on foot traffic for sales, such as shopping center restaurant tenants. Mall food courts struggled to produce high revenue, especially during difficult times and shifting trends, which caused rapid turnovers. Landlords started utilizing underused kitchens in the food court to provide various food options for customers in-person or at home. Ghost kitchens put the focus back on operations and pivot the weight of foot traffic and customer retention on stores. With consumer shopping habits changing during the pandemic, ghost kitchens optimized retail space in non-conventional ways.

C3 Partnership

Simon Property Group is leading the ghost kitchen initiative in shopping centers. The shopping mall giant has made several partnerships to inject new life into food courts, including a collaboration with Brookfield Asset Management. Both companies have invested in a food-tech platform, Creating Culinary Communities (C3). Currently, C3 consists of 40+ limited-service culinary brands and over 800 digital brand outposts throughout the nation, where customers can order food brands at digital kiosks in-person or online for delivery or pick-up. C3 is bolstering its digital reach through such partnerships and expanding into brick-and-mortar locations, focusing on Simon and Brookfield shopping centers across the U.S.

Kitchen United Partnership

Simon Property Group initiated another collaboration for virtual kitchen implementation, “Grab Go Eat,” with ghost kitchen industry leader Kitchen United. The Grab Go Eat platform allows customers to deliver food directly to their table in the food court or any store within the shopping center. Rather than waiting in various lines, customers and mall staff can skip the lines altogether by picking up food directly from the restaurant, all while ordering from multiple restaurants under one ticket.

How Ghost Kitchens Elevate the Shopping Experience

1. Opportunity to Enhance Revenues

For shopping center landlords, optimizing food ordering capabilities, paired with the ownership of multiple food brands in one location, will help fuel new experiences and offer tenants the ability to enhance revenues. With the introduction of ghost kitchens, food brands can focus on back-of-house operations.

2. Utilizing the Underused

Ghost kitchens offer the opportunity for shopping center operators to utilize kitchen staff during downtime periods when there are fewer shoppers. Maximizing profits and efficiency, shopping center operators can serve beyond their food halls and explore off-premises delivery. With that in mind, dark kitchens can draw in a broader customer base, as customers may come for the food but stay for the shops.

3. Testing New Concepts

Moreover, shopping centers with ghost kitchens are going to be preferred by aspiring restauranters given the low initial setup cost and the ability to test out customer response to their menu. In turn, customers will be given a new culinary experience at affordable prices. Taking it a step further, customers can be notified of any new entries to the ghost kitchen to bring back customers.

4. Cater to New Customer Behavior

With e-commerce as the main competitor for customers, ghost kitchens can help with revenue growth by reeling in sales from the kitchen. Ghost kitchens also effectively target new audience segments, specifically those who wouldn’t usually venture to their local mall. Not only do they cater to guests who are shopping, but also to those who want their food brought to them at home.

What ’s Next?

Putting the customer’s experience at the forefront, shopping center operators aren’t stopping at ghost kitchens to provide lifestyle experiences. In fact, the embrace of ghost kitchens has inspired shopping center landlords to evolve omnichannel services to further cater to customer convenience. Some are partnering with platforms that provide in-store or on-site returns of online purchases for immediate refunds or credit. Shopping centers will be able to continually offer new food experiences with ghost kitchens, given the capability to provide various food items in one location and test out new offerings without fear of failure. Shopping centers are transforming from a one-stop location with an array of shops into a town square destination where customers can shop, eat, and play. This transformation will continue to unfold as shopping center landlords embrace the changes that modern technology brings.