Market Overview

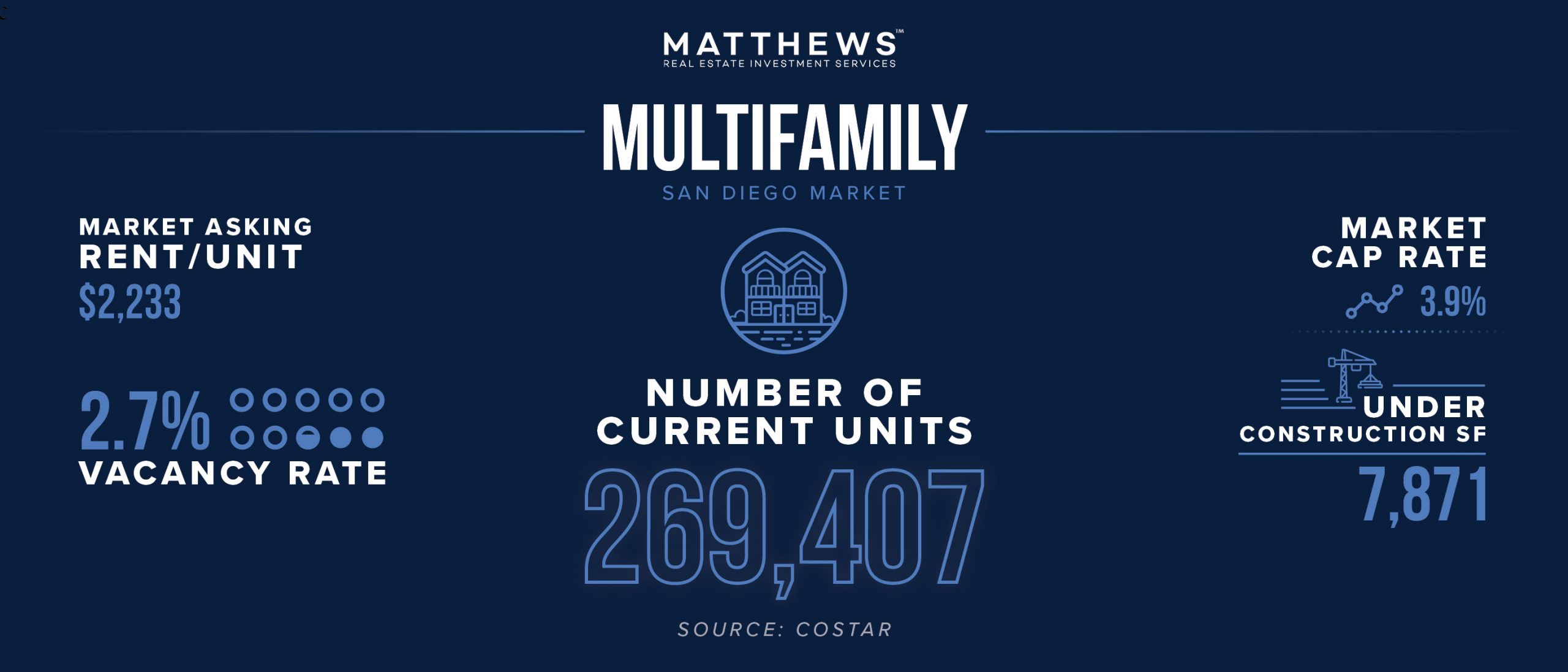

As a firmly positioned top life sciences market, San Diego sees no shortage of demand. These firms, along with defense contractors, biotech firms, healthcare providers, and logistics users, have supported stability for industrial as they expand in the market. Several top universities in the area provide a talent pool of highly educated graduates and collaborative work with firms and research institutions. Businesses are taking different approaches when it comes to utilizing office space, depending on their newly adopted work models, which could affect office vacancies. As a significant Navy hub, over 140,000 active duty and civilian military employees call San Diego home, contributing to apartment demand. San Diego benefits from being a travel destination, providing shoppers year-round, though inflation poses a risk to retailers. The City of San Diego has one of the largest concentrations of millennials in the country, representing 25 percent of the population.

Despite the strong retail leasing activity in San Diego, the metro is no stranger to elevated vacancies. As a result of COVID-19 and the corresponding wave of department store closures, national chain bankruptcies, and the demise of local mom-and-pop shops, large vacant spaces were left behind. The vacancies ranged from 2,000 square feet freestanding retail pads to 15,000 square feet mall anchors. Investors are increasingly converting retail properties into housing, which boosts retail vacancies as the properties are no longer deemed retail. Net absorption is running on the longest streak of positive absorption since 2016, totaling 937,00 square feet in the last 12 months. The most targeted retail properties for redevelopment are big-box spaces, dark anchor space at malls, and in-fill sites along well-trafficked retail corridors. These housing redevelopment trends account for one percent of existing inventory, according to CoStar.

San Diego’s concentration of research firms has fed directly into demand for industrial space. Rents have grown ten percent in the last 12 months, a historic high for the market. Development is limited as there are areas of opportunities in San Diego. Raw land sells for $10 per square foot where partially-improved and finished pads are near $15 per square foot. Dallas-based Lincoln Property Co. made headlines with one of the largest industrial trades in the San Diego region amid rising logistics demand in the area. The deal involves an eight-building portfolio totaling approximately 613,000 square feet for $205.5 million, or $335 per square foot. The properties expand across North County suburbs, including Vista, San Marcos, and Carlsbad.

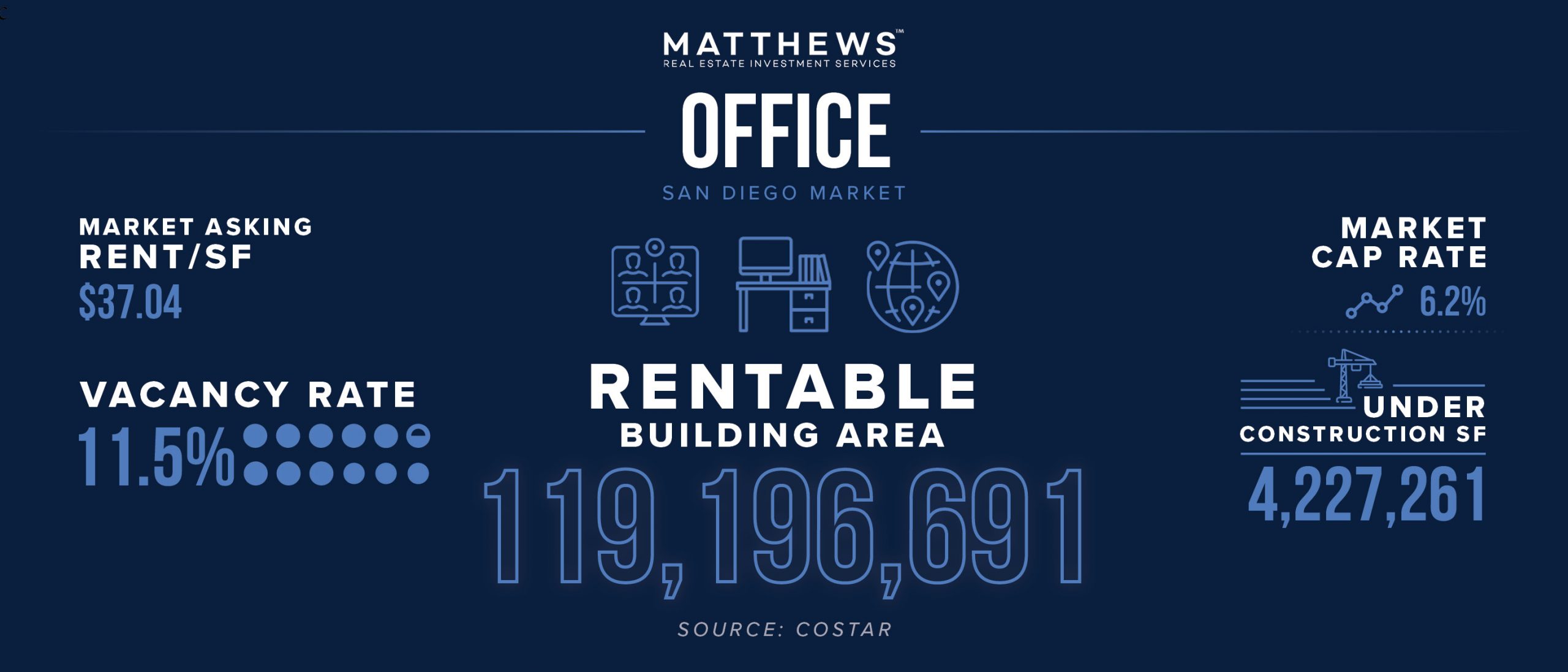

The recent developer’s sale of partial stakes in two office and mixed-use properties, valued at $86 million, indicates the rising property demand in San Diego. The properties are occupied by medical technology firm Alphatec Spine, artificial intelligence software firm Ezoic, sports equipment maker Honma Gold, and cosmetics maker Coola Skincare. Several technology and sports-oriented tenants have been attracted to San Diego in the last few years for comparatively lower rents and property costs. San Diego’s vacancy rate is 11.5 percent, with rent growth posting 2.5 percent in the last 12 months. Office sales reached $3.1 billion during that same time.