Shopping Center Owners in 2021 are approaching retail leasing cautiously and selectively due to the rent instability that occurred in 2020. Many landlords suffered as collection issues and vacancies rose because of the pandemic. As a result, new construction shopping centers welcome tenants based on their essential nature, income, and pricing transparency.

As consumer shopping patterns change, tenants also have to choose their location carefully. A common trend is a flight to quality centers. Moving forward, tenants are looking for unique outdoor space, safety, and tech infrastructure in both urban and suburban developments.

Although landlords would rather fill space than have space sit vacant on the market, there is a pricing disconnect between landlords and tenants. This gap keeps long-term retail leasing stagnant as more tenants opt to sign short-term leases, and landlords take on the risk, betting on the future of retail.

Shopping centers encapsulate every business from small businesses to nationally recognized big-box tenants. In Texas, 70 percent of shopping center tenants are small businesses, one of the largest percentages nationwide. As such, each tenant holds a different value on what drives their performance in a shopping center. In this article, Matthews™ explores the relationship between landlords and tenants, the leasing trends occurring in the shopping center space, focusing mainly on new construction shopping centers in the Dallas-Fort Worth (DFW) metroplex.

An Overall Update on the Leasing Environment

For shopping center landlords, the goal is to find well-performing tenants that can commit to long-term leases, ensure a steady stream of cash flow, and contribute to the center’s community. However, the COVID-19 pandemic brought some changes to the shopping center space, including the rising trend in short-term leases and a lack of clarity regarding the value of retail properties.

As retail leases come up for renewal, the duration is shrinking to shorter terms. A long-term lease can last anywhere from ten to twenty years, or around four years for an average retail lease. But landlords were succumbed to the pressures brought on during COVID-19, as vacant space increased across the country, and tenants found themselves in a great position of power, signing new agreements with shorter lease terms and searching for space with less square footage.

While short-term leases can pose unpredictable waves of tenants moving in and out, landlords shouldn’t view this lease type as unfavorable. Even just having a tenant boosts occupancy, which can help when other tenants are looking for space. For example, tenants renegotiating their rents will have a challenging time arguing lower rent when the shopping center is full, albeit with some short-term leases. Tenants could also sign short-term leases, and rent could trend higher in the future when the market strengthens.

Tenants are looking for ways to slash costs, stay flexible, and maintain leverage over their landlords. It’s currently a high-stakes game for landlords; however, the risk is a two-way street. In two to three years, shopping center owners can turn the tables on tenants by hiking rents to match the market rent or booting retailers out for other tenants. On the other hand, more short-term deals could also leave

landlords with greater vacancies.

It is not uncommon to see a tenant with a pop-up or short-term lease extend the terms of their lease when the landlord provides flexibility.

There will be a higher threshold on renewing leases in the near term, as stores evaluate their role in the market and the investment required to meet new consumer needs. The way that tenants structure the lease will allow them to pivot as consumer behavior changes. It is anticipated that tenants will continue COVID-related rent negotiations and lease restructuring throughout 2021 and into early 2022, as some retailers will be unable to make balloon payments that were deferred and require additional deferral or abatement.

According to CoStar, roughly 1.5B square feet of retail space in the U.S. is set to expire this year, equating to about 14% of the retail market.

There is a divergence between shopping center assets and markets. Suburban neighborhood and grocery-anchored centers along the Sunbelt and in secondary cities will continue to be the most resilient. Malls and urban-core retail, however, face declines in occupancy, lease term, rent, and valuation. As a result, investors are reluctant to make short-term commitments in urban areas or malls until uncertainties regarding new customer trends are clarified and whether or not the current suburban migration patterns will continue post-pandemic. It is anticipated that the number of distressed properties will also increase throughout the nation.

Case Study: Dallas-Fort Worth

The DFW retail market will begin to recover in 2021, but landlords need to help tenants, experts say. The DFW market ended the year with above 90 percent occupancy in the region’s over 200 million square feet of retail. The shopping centers that lost tenants due to the pandemic will bounce back as retail entrepreneurs and strong chains regain confidence and acquire the space. DFW boasts some of the nation’s best economic fundamentals, with population and job growth exceeding other primary markets, allowing the bounce back to be higher. Absorption will record at about one million square feet in 2021, one of the lowest levels recorded, and new construction will also be down at 1.4 million square feet. Occupancy is expected to end the year at 92.5 percent and climb to 94 percent in 2022. In 2021, new construction will add 1.7 million square feet to the market. DFW reflects a trend throughout Texas and the United States where less new retail construction is underway because anchor tenants aren’t expanding, retailers are looking for smaller square footage, and there is a rise in construction costs impeding timelines. Compared to a decade ago, where the size of a new retail project was 125,000 square feet, that number decreased over 50,000 square feet to an average size of 70,900 square feet in 2020. This drastic decrease, plus population gains, help lower DFW’s leasable retail space per capita, a measure that experts use to illustrate that America is over-stored versus other countries, with DFW being one of the most over-retailed markets in the U.S.

Key Tenants Backfilling Space

- Food Halls

- Restaurants with Outdoor Patios

- Quick-Serve Drink, Dessert, and Snack Restaurants

- Grocery Stores

- Pet Specialty Stores

Where are Tenants Looking for Space?

It is no surprise that tenants are looking for space in new developments that feature open-air shopping experiences. Developers are placing greater value on creating unique outdoor spaces for social and alternative shopping environments. Further, many retail centers now cater to mixed-use, meaning there is additional traffic from residents or office workers.

As shoppers gravitate towards these types of spaces, so do tenants as they deliver higher traffic volumes.

Gone are the days when tenants searched for space in urban malls. Today, suburban locations lend significant opportunities. However, it is essential to note that urban developers are taking more precautions as far as health standards by investing in high-quality air filtration HVAC systems and implementing technology for more connectivity with consumers.

Aside from new developments, tenants also seek second-generation shopping center space opportunities as these centers are already established and consumer-friendly. The landlord is also familiar with what tenants work within the neighborhood, space, and complement other tenants in the center.

Considerations for New Construction Space

Finding the Right Tenant Mix

Tenant placement is vital in influencing shopper circulation. There is a spatial relationship between the anchor and non-anchor tenants and low impulse and high impulse retailers in tenant placement strategies. High impulse retailers should be placed in areas with more pedestrian flow because better locations help sustain their business models. In conjunction, the higher impulse retailers and non-anchors would be allocated on lower levels, whereas lower impulse shops and anchors are on upper levels. Thus, shops on lower stories would be smaller in size, and shops on upper stories would be larger.

Tenant Improvement Allowance

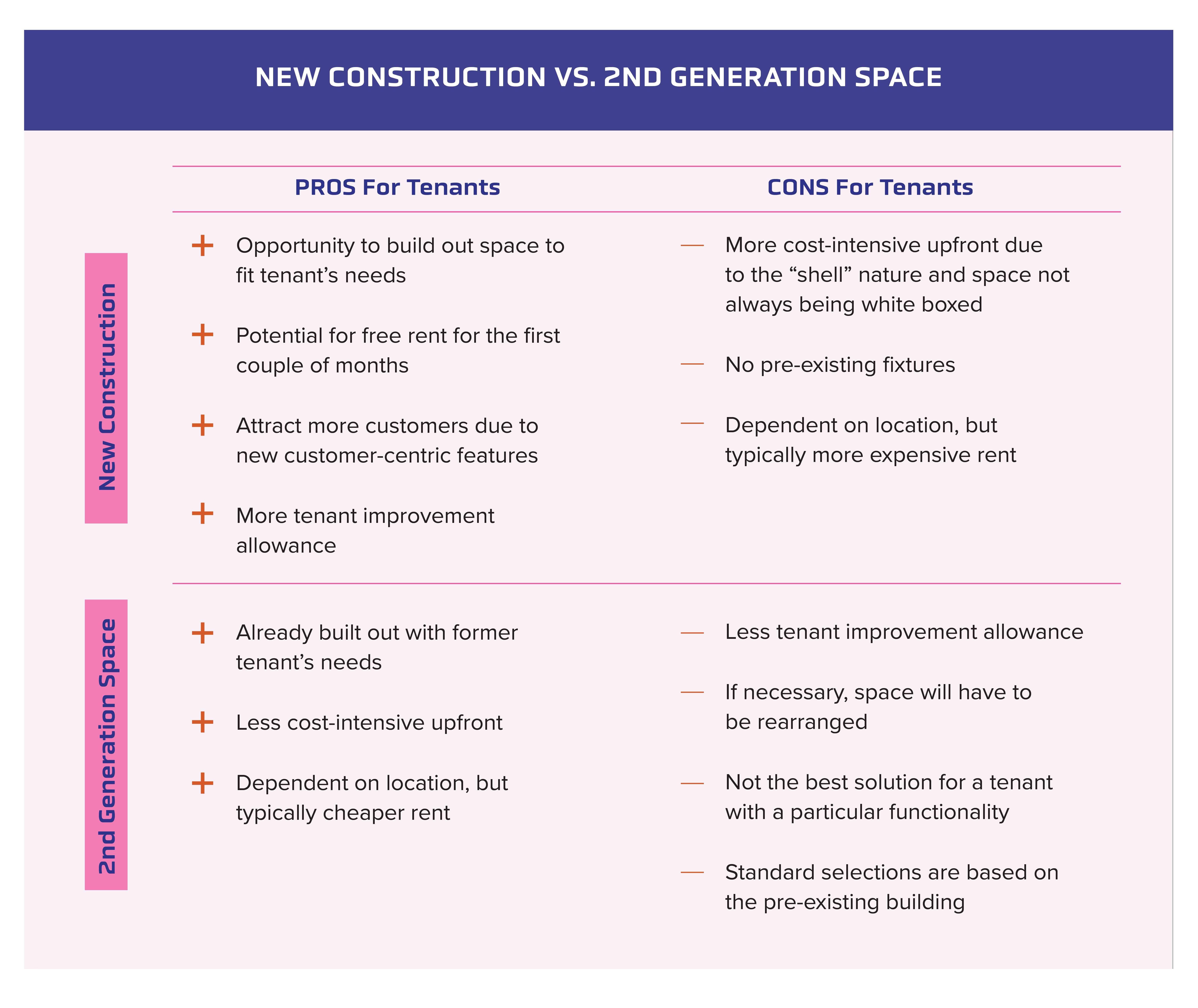

The most significant difference between brand new construction and 2nd generation space is the tenant improvement allowance (TIA). This allowance is typically calculated by a cost per square foot basis of the space. For example, a tenant leases a 5,000 square foot store-front with a $20 per square foot improvement allowance, which amounts to $100,000 for the tenant to put towards build-out expenses. The tenant is responsible for these costs upfront and most leases will require proof of completion before the landlord reimburses the tenant for their work.

To offset build-out costs and get tenants pre-leased for new construction, landlords sometimes offer tenants a rent abatement period or the deferral of rental payments until space is built out. Other incentives include white boxing space in leu of TIA. A white box finish signifies a tenant space that includes exterior walls, windows and doors, roofing, standard lighting and electrical, basic heating, ventilation and HVAC, concrete floors, restrooms, etc. Although this may seem like a bare-minimum construction project, all the above components are built to code and ready for tenant improvements (TIs) to be implemented on the interior – and in some cases, even the exterior. Keep in mind, having a consistent look from the outside is paramount to maintaining a professional commercial property.

Trends in the Market

Preparing a newly built property for a new commercial tenant can be time-consuming for landlords/developers, especially when they don’t want a massive gap between completing a project and getting a lease signed. As such, landlords and developers have become creative and are working alongside tenants for solutions.

- Shift in Tenants: An explosion of non-retail and quasi-retail uses are backfilling open space – including healthcare, education services, fitness, and entertainment. In addition, smaller retailers are taking advantage of new construction, leading to a rise in entrepreneurial retail concepts. They have always been priced out of Class A malls and have never been able to get the foot traffic necessary; however, new construction in the current environment provides opportunities to move into affordable high-quality space.

- Coworking – Mixed-use: As the economy begins to recover from COVID-19, more freelancers are becoming part of the gig economy. With both remote and traveling employees looking for a temporary workspace, coworking tenants are higher in demand. These types of tenants also create more daytime foot traffic that can attract new retail tenants. It is expected that coworking spaces worldwide are projected to reach almost 20,000 this year and will pass 40,000 by 2024. The Global Coworking Growth Study 2020 suggests that although growth in 2020 was slow, it is expected to rebound and develop even more rapidly from 2021 onwards, with a yearly growth rate of 21.3 percent. Almost five million people will be working from coworking spaces by 2023, increasing 148 percent compared to 2020, despite the COVID-19 pandemic shifting working trends.

- Helping Tenants with Online Presence: Landlords provide more than just a retail location. New shopping centers are helping tenants with their digital presence. This includes providing space for buy-online and pick-up in-store capabilities (BOPIS), curbside pick-up, and drive-thru optimization. More and more new construction shopping centers are implementing technology to enhance the consumer shopping experience.

- Community Focused: According to ICSC, shopping centers are evolving from simple retail properties into shopping, dining, and entertainment centers that are central to and fully integrated with their communities.

Please reach out to a specialized agent for more information.